Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed the trading session on a record-high note on September 23. The BSE Sensex rose 340 points or 0.40% to finish the day’s trading at 84,886. The NSE Nifty 50 closed 138 points or 0.53% higher at 25,928. The Bank Nifty closed the day’s trading 0.51% higher at 54,069. The Nifty Midcap 100 closed the session 464.75 points or 0.77% higher at 60,674.

The NSE Nifty 50 closed 0.53% higher at 25,928.75, while the BSE Sensex closed 0.40% higher at 84,886.09.

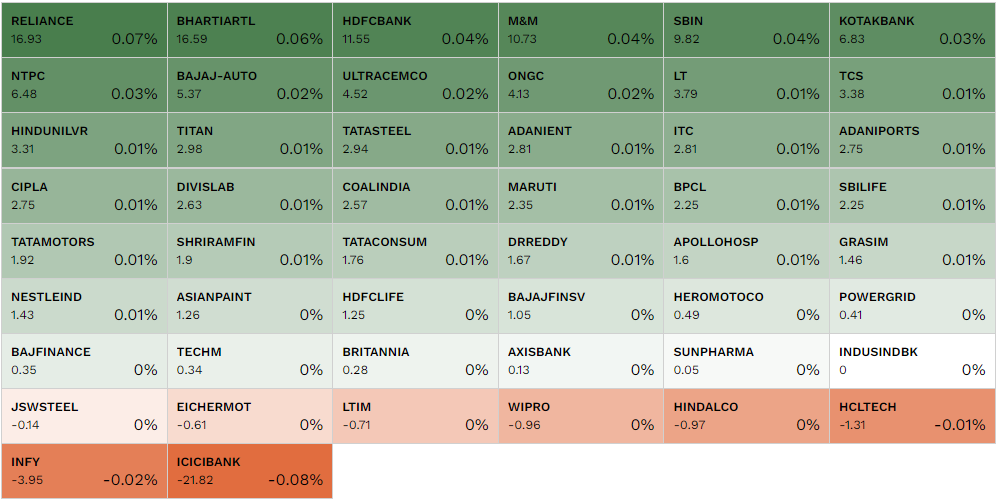

M&M, Bajaj Auto, ONGC, Hero MotoCorp, and SBI were the top gainers in the Nifty 50. Meanwhile, Eicher Motors, Divi's Laboratories, ICICI Bank, IndusInd Bank, and Tech Mahindra were the major losers in the Nifty 50 on September 23.

Courtesy: NSE

"The Indian Rupee appreciated on Monday amid positive domestic markets with domestic equities hitting fresh all-time highs. However, Rupee lost initial gains on a strong American currency (US Dollar) and firm crude oil prices. India's Services PMI fell to 58.9 in August VS 60.9 in July. We expect the Indian Rupee to trade with a slight positive bias on positive global equities and fresh FII inflows. However, a recovery in the greenback and elevated crude oil prices may cap a sharp upside. Investors may watch out for US GDP, consumer confidence and core PCE price index data from the US this week," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

"The Sensex and Nifty reached record highs on Monday, driven by expectations of increased foreign inflows following last week’s Federal Reserve rate cut, which has boosted risk-on sentiment among investors. Key gains came from the energy, banking, and auto sectors, while IT stocks underperformed. The Nifty now seems set to target 26,000, with momentum likely led by major banking stocks," said StoxKart in a note.

HFCL shares gained 1.63% on the NSE, trading at ₹164.25, following the company’s announcement of a strategic partnership with General Atomics Aeronautical Systems Incorporated (GA-ASI). This collaboration is expected to enhance HFCL's capabilities in the aerospace sector.

In today's trading session, Canara Bank led the gains among Nifty PSU Bank stocks, rising by 3.26%. Indian Bank followed closely with an increase of 3.25%, while Bank of Maharashtra and Bank of Baroda both saw gains of 2.59%. Central Bank of India rose by 2.51%, and State Bank of India (SBI) increased by 2.16%.

PSP Projects has received work orders totaling Rs 554.92 crore, including the construction of the Gold Stone Hotel and Commercial Towers in Bangalore, valued at Rs 389.29 crore (excluding GST). These projects are expected to be completed within 22 and 16 months, respectively. Additionally, the company will construct residential towers in Ahmedabad for Rs 165.04 crore. Following this announcement, PSP Projects' shares surged 4.71% on the NSE, trading at Rs 705.15.

Surana Solar has received a Letter of Award as a Solar Power Developer (SPD) for photovoltaic power stations with a total capacity of 54 MW (AC) under the Mukhyamantri Saur Krushi Vahini Yojna 2.0. This initiative, aimed at feeder-level solarisation, is part of the PM-KUSUM Scheme and is backed by the Maharashtra State Electricity Distribution Co. Ltd. The estimated project cost is Rs 189 crore, and the stock is currently trading at its upper circuit on the NSE at Rs 46.48, up 4.99%.

On September 23, 2024, out of 4,085 stocks traded on the BSE, 2,332 advanced, while 1,592 declined, and 161 remained unchanged. Notably, 294 stocks hit a 52-week high, and 33 reached a 52-week low. Additionally, 355 stocks traded in the upper circuit, and 225 in the lower circuit.

At 12 noon, ONGC led the gainers on the NSE with a rise of 3%, followed by M&M (up 2.82%), SBI (up 2.75%), BPCL (up 1.99%), and Bajaj Auto (up 1.92%). On the losing side, ICICI Bank slipped 1.96%, while Eicher Motors fell 1.76%, IndusInd Bank declined by 1.32%, HCL Tech dropped 1.32%, and Tech Mahindra was down 1.18%.

Shares of Bikaji Foods International Limited (BFIL) jumped 4.20% on Monday, reaching a fresh all-time high of Rs 987.95 on the stock exchanges. The surge came after the snack manufacturer announced that it had received approval from the Ministry of Corporate Affairs (MCA) to incorporate a wholly-owned subsidiary, Bikaji Foods Retail Limited (BFRL).

Shares of Adani Total Gas rallied more than 8% to an intraday high of Rs 855 after its joint venture got funding worth $375 million financing package from global lenders. This marks the largest global funding initiative in the city gas distribution (CGD) sector.

Shares of HDFC Bank were up 0.86% to an intraday high of Rs 1,756.20 after the banking company announced listing its subsidiary HDB Financial Services. On September 20, the company announced that it would seek approval from the board of directors and regulators to proceed with an initial public offering of HDB Financial Services, said the company in an exchange filing.

"The Bank Nifty index has broken out above the key resistance level of 53,357, indicating strong bullish momentum. With a robust closing today, the immediate support now stands at 53,000. If the momentum continues, we could potentially see targets of 54,500 and 55,000 in the coming sessions. The RSI remains strong at 74, signaling bullish strength, and suggests that the current trend may persist. Traders should consider buying on dips with proper risk management, as the overall outlook remains positive," said Riyank Arora Technical Analyst.

Shares of Anil Ambani-owned Reliance Power have been on an upward trajectory since the company announced its board meeting to consider a fundraising proposal. The board meeting is scheduled for today, September 23, 2024. Ahead of the meeting, Reliance Power’s share price surged, opening higher and hitting an intraday high of Rs 38.15 per share on the National Stock Exchange (NSE). During early trading, the stock touched the 5% upper circuit.

SpiceJet’s share price jumps over 6% to intraday high of Rs 70.50 on NSE following the announcement that its board has approved the issuance and allotment of approximately 48.71 crore equity shares to eligible qualified institutional buyers.

Aimed at raising Rs 3,000 crore at an issue price of Rs 61.60 per share. This issue price includes a premium of Rs 51.60 per unit and a discount of Rs 3.19 from the floor price.

Shares of debt-ridden Vodafone Idea soared by 10%, reaching a day's high of Rs 11.94 on the Bombay Stock Exchange (BSE) after the company announced on Sunday that it has signed agreements worth $3.6 billion (Rs 30,000 crore) with Nokia, Ericsson, and Samsung to source telecom equipment over three years for 4G network expansion and 5G rollouts.

Courtesy: NSE

Divi's Laboratories, Bharti Airtel, M&M, SBI, and Adani Enterprises were the top gainers in the Nifty 50. While, ICICI Bank, Hindalco, Eicher Motors, HCL Technologies, and LTIMindtree were the major losers in the Nifty 50 on September 23.

The NSE Nifty 50 opened 0.25% higher at 25,856.05, while the BSE Sensex opened 0.18% higher at 84,692.94.

"Domestic benchmark indices are likely to mirror gains in the SGX Nifty index and see a firm opening. However, subdued trading in other Asian indices could limit the gains going ahead as investors would wait for cues from European indices in afternoon trades for further direction. While all bullish eyes will aim at the Nifty 26,000 mark with an interweek perspective, aggressive bulls may prefer to take a breather following last week’s Fed-fueled rally. Key US data during the week like the GDP growth numbers for the second quarter and Federal Reserve Chair Jerome Powell's Speech this Thursday, followed by US PCE inflation on Friday will be in focus," said Prashanth Tapse, Senior Vice President of Research at Mehta Equities.

The city gas joint venture between Adani Group and France’s Total Energies has secured a $375 million financing package from global lenders. This marks the largest global funding initiative in the city gas distribution (CGD) sector.

Shares in the Asia-Pacific region are trading in positive territory on Monday morning. The Asia Dow is trading up by 0.33%, where as the Hong Kong’s Hang Seng is trading in green, up by 0.68%, South Korea’s KOSPI index is traded higher by 0.04% and the benchmark Chinese index Shanghai Composite trading in green, up by 0.19%.

The airline’s board has approved the issuance and allotment of 48.7 crore equity shares to qualified institutional buyers at Rs 61.60 per share, which includes a premium of Rs 51.60 and a discount of Rs 3.19 per share to the floor price. The total amount raised from the issue will be Rs 2,999.99 crore.

Catch Live Updates : SpiceJet Share Price Today Live Updates, 23 Sep, 2024: SpiceJet on the radar

WTI crude prices are trading at $71.49 up by 0.69%, while Brent crude prices are trading at $74.96 up by 0.63%, on Monday morning.

The debt-ridden telecom operator has secured a $3.6 billion (Rs 30,000 crore) deal with Nokia, Ericsson, and Samsung for the supply of network equipment over the next three years. This agreement represents the initial phase of the company’s transformative capital expenditure plan, which is valued at $6.6 billion (Rs 55,000 crore).

Catch Live Updates : Vodafone Idea Share Price Today Live Updates, 23 Sep, 2024: Vodafone Idea on the radar

Foreign institutional investors (FII) mopped shares worth Rs 14,064.05 crore, while domestic institutional investors (DII) offloaded shares worth Rs 4,427.08 crore on September 21, 2024, according to the provisional data available on the NSE.

The US Dollar Index (DXY), which measures the value of the dollar against a basket of six foreign currencies, traded up by 0.08% at 100.81.