Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed on a lower note on October 15. The BSE Sensex fell 135 points or 0.17% to close at 81,838. The NSE Nifty 50 closed 62 points or 0.25% to settle at 25,066. The Bank Nifty closed the day’s trading 0.25% higher at 51,945. The Nifty Midcap 100 closed the session 121 points or 0.20% higher at 59,587.

The NSE Nifty 50 closed 0.25% lower at 25,066.15, while the BSE Sensex closed 0.17% lower at 81,837.76.

Prestige Estate, DLF, Brigade Enterprises, Phoenix, and Godrej Properties were the top contributors to the upside of the sectoral index Nifty Realty on October 15.

Courtesy: NSE

"Indian Rupee is, however, near all-time lows on strong Dollar and weak Asian currencies. Weak tone in the domestic equities and surge in inflation also weighed on the rupee. India’s CPI inflation rose to a nine-month high of 5.49% YoY in September vs forecast of 5% and 3.65% in August on rising food prices. However, a decline in crude oil prices capped sharp gains. We expect Rupee to trade with a negative bias on FII outflows and risk aversion in global markets amid geopolitical uncertainty in the Middle East. Overall strength in the US Dollar may further pressure the Rupee. Any intervention by the RBI may also support the local currency," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

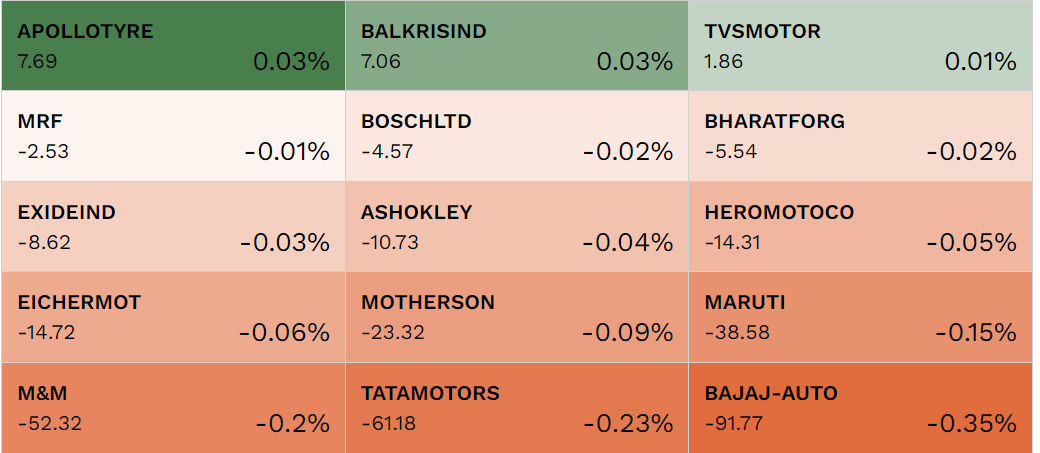

Bajaj Auto, Tata Motors, M&M, Maruti Suzuki, and Samvardhan Motherson were the major contributors to the fall of Nifty Auto on October 15.

Courtesy: NSE

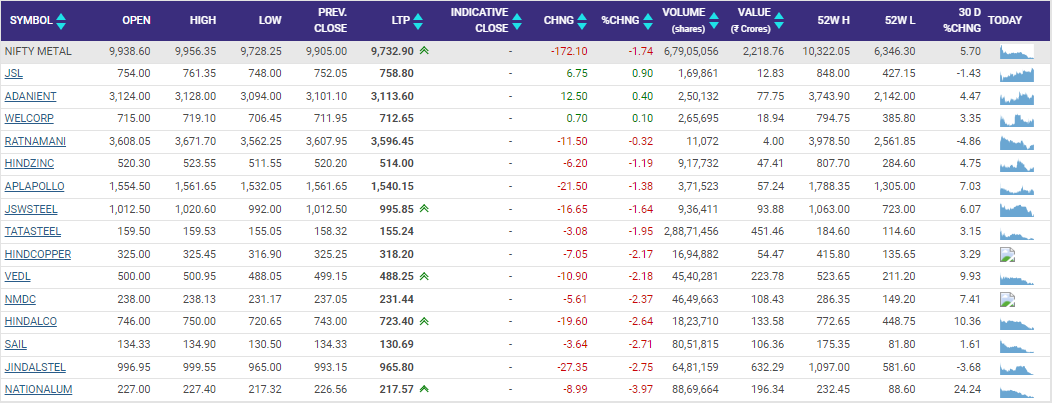

Share market today live updates : Nifty Metal gainers and losers

NALCO, Jindal Steel, SAIL, Hindalco, and NMDC were the major losers to see deep cuts in the Nifty Metal on October 15.

Courtesy: NSE

Foreign portfolio investors (FPIs) continued their selling trend in the Indian stock market, recording an outflow of Rs 3,731.60 crore during Monday's trading session. This marks the 11th consecutive day of selling, reflecting a sustained bearish sentiment among international investors towards Indian equities.

Over the past 11 days, FPIs have withdrawn a total of Rs 73,123 crore, with Rs 62,124 crore withdrawn in October alone. The most significant sell-off occurred on October 3, when FPIs offloaded Rs 15,506 crore worth of stocks. FPIs last engaged in net buying on September 26, acquiring stocks valued at Rs 630 crore, according to data.

Exide Industries Limited has announced that its wholly-owned subsidiary, Exide Energy Solutions Limited, has executed agreements to acquire a 26% equity stake in Clean Max Beta Private Limited as part of its solar power initiative. Following the announcement, Exide's stock traded at Rs 522.30 on the NSE, reflecting a decline of 1.52%.

The initial public offering (IPO) of Hyundai Motor India has seen a subscription rate of 13% on its first day, as of 1:24 PM, according to BSE data. The retail investor segment has performed well, achieving a 20% subscription, while the non-institutional investors' quota was subscribed at 9%. The portion allocated for qualified institutional buyers (QIBs) recorded a mere 1% subscription. In contrast, the employee segment showed strong interest, with a subscription rate of 58%.

Jefferies has maintained a "Buy" rating on HDFC Bank with a target price of Rs1,890. The bank aims to reduce its Loan-to-Deposit Ratio (LDR) to 85-90% over the next three years, which it plans to achieve through a 15% CAGR in deposits while moderating loan growth to 11%. The ramp-up of branches is expected to enhance deposit market share, although loan growth is anticipated to remain at or below sector levels.

Additionally, HDFC Bank has room to lower its funding costs, which could improve its Net Interest Margin (NIM). The impact of Priority Sector Lending (PSL) compliance on profits is expected to be minimal, and slower growth in unsecured loans may help keep credit costs manageable. Jefferies has trimmed its earnings estimates by 4-6% to reflect the anticipated slower loan growth.

By 12 pm, Hyundai Motor India’s Rs 27,870.16-crore IPO had received bids for 95,60,628 shares, representing 10% of the total issue size of 9,97,69,810 shares. On Monday, the company raised Rs 8,315 crore from anchor investors, ahead of the public offering.

EditDelete

Commenting on the gold outlook Renisha Chainani, Head Research - Augmont - Gold For All said that Several factors have combined to push the price of precious metals downward during the past two days. The recent spike in US Treasury bond rates has been attributed to traders' lack of expectation of another massive interest rate decrease by the Federal Reserve in November. Secondly, despite increased acceptance of a less aggressive policy easing by the Federal Reserve and predictions for a regular 25 basis point interest rate cut in November.

Chainani also added that the US dollar surged above the 103 mark on Monday (the highest level since August 8). In reaction to Hezbollah's drone attack on its army installation on Sunday, which left four soldiers dead and seven critically injured, Israel promised to respond forcefully, increasing the possibility of a further escalation of geopolitical tensions and supporting precious metals prices. Due to mixed fundamentals, gold is expected to trade in a confined range of $2645 (~Rs 75500) and $2685 (~Rs 76500). Silver has been trading in the range of $30(~Rs 88000) to $32.5(~Rs 93500) for the past month due to mixed fundamentals.

As of 12:40 noon on October 15, 2024, stocks on the BSE showed positive momentum, with 1,929 stocks advancing compared to 1,843 declining, while 145 remained unchanged. A total of 3,917 stocks were traded during the session. Notably, 222 stocks hit their 52-week highs, while 31 stocks touched 52-week lows. Additionally, 292 stocks traded in the upper circuit, and 182 stocks were in the lower circuit.

CLSA has maintained an "Outperform" rating on Reliance Industries with a target price of Rs 3,300. The company’s Q2 consolidated EBITDA came in 2% below forecasts, primarily due to weakness in the Oil-to-Chemicals (O2C) segment and Reliance Retail, while Reliance Jio and the upstream business performed better. Despite this, lower depreciation and higher other income led to a 7% consolidated PAT beat.

Following a more than 15% decline, Reliance Industries is now approaching CLSA's conservative valuation. Key triggers over the next 12-15 months include a potential rise in Airfiber subscribers, the launch of new energy projects, and the anticipated IPO of Jio.

Jefferies has reiterated its 'Hold' rating on HCL Technologies, setting a target price of Rs 1,770. The brokerage noted that the company's operating performance in the second quarter exceeded expectations, with positive surprises in both its services and product businesses.

Additionally, HCL Tech raised the lower end of its growth guidance for FY25 by 50 basis points, reflecting a more optimistic outlook. The stock is currently trading at 28 times its one-year forward earnings, suggesting limited scope for re-rating in the near term.

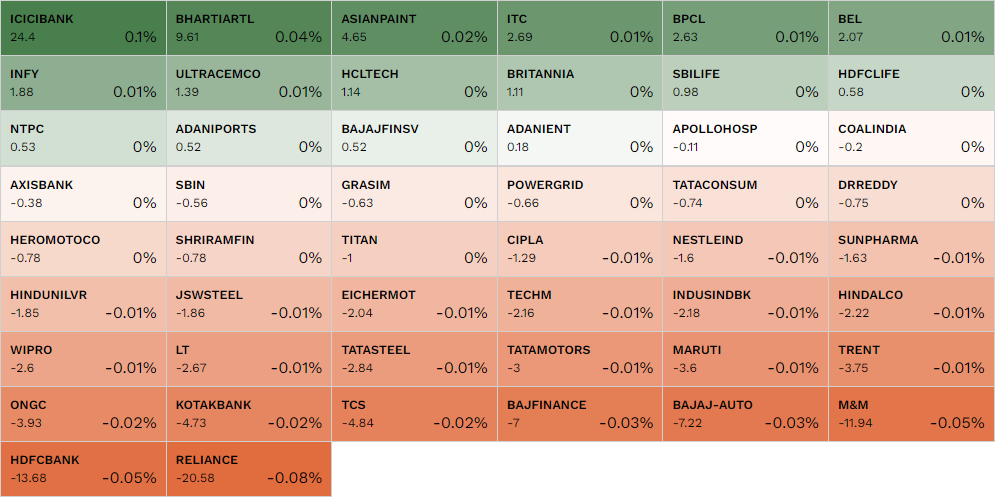

At noon trade, BPCL led the top gainers on the NSE, rising 2.38%, followed by Asian Paints and ICICI Bank, both up 1.64%, Bharti Airtel gaining 1.61%, and Britannia advancing 0.95%.

On the losing side, Bajaj Auto was the biggest laggard, down 2.78%, followed by Wipro (-2.60%), Bajaj Finance (-1.73%), M&M (-1.52%), and Tech Mahindra (-1.51%).

At noon trade, BPCL led the top gainers on the NSE, rising 2.38%, followed by Asian Paints and ICICI Bank, both up 1.64%, Bharti Airtel gaining 1.61%, and Britannia advancing 0.95%.

On the losing side, Bajaj Auto was the biggest laggard, down 2.78%, followed by Wipro (-2.60%), Bajaj Finance (-1.73%), M&M (-1.52%), and Tech Mahindra (-1.51%).

Reliance Industries Ltd (RIL) shares fell nearly 1% in Tuesday's trading as investors reacted to the company's second consecutive quarter of disappointing results. The standalone figures were affected by weaker refining and petrochemical spreads, while Reliance Retail reported weak revenue but improved margins. Additionally, RJio's tariff hikes were countered by increased subscriber churn, leading several brokerages to lower their target prices for the stock.

Seamec announced that its vessel, SEAMEC III, has been hired by Supreme Hydro Engineering Pvt Ltd effective October 14, 2024. The vessel will operate in the Mumbai High Offshore Fields to conduct underwater inspections of FPSOs. Following the announcement, Seamec shares traded flat on the NSE at Rs 1,419.95.

The NSE Nifty 50 was down 0.19% at 25,080 while the BSE Sensex was down 0.16% at 81,841.

Bajaj Auto shares fell 3% to an intra-day low of Rs 11,533.15. The stock was the major loser in the Nifty 50. The lower band for the stock is placed at Rs 10,709.40 while the stock touched its 52-week low of Rs 5,032 on October 16, 2023.

VA Tech Wabag shares rose 4.3% to an intraday high of Rs 1,744.20 after it bagged an order worth Rs 1,000 crore. The company received the order from Indosol Solar Private (‘Indosol Solar’) to provide water security for the Solar PV sector. "This order includes the Engineering Procurement (EP) scope of design, engineering, supply, Installation, Testing and Commissioning of the 100 MLD Desalination Plant which will be executed over a 38-month period, followed by a 15 years Operation and Maintenance (O&M) contract," said the company in a media release.

Reliance Industries, HDFC Bank, M&M, Bajaj Auto, and Bajaj Finance were the major contributors to the fall of Nifty 50 on October 15.

Courtesy: NSE

As of 10:42 AM on October 15, 2024, the Hyundai Motor India IPO has been subscribed 0.05 times. The Non-Institutional Investors (NII) portion is subscribed 0.04 times, the retail portion at 0.08 times, and the shares reserved for employees are subscribed 0.15 times. The issue will close on October 17, 2024.

Shares of SpiceJet rose by 1.20% on the NSE, reaching Rs 66.50, following the company’s resolution of a $23.39 million dispute with Aircastle (Ireland) Designated Activity Company and Wilmington Trust SP Services (Dublin) Limited. The settlement amounts to $5 million and includes an agreement regarding the treatment of certain aircraft engines.

TD Power Systems has announced the receipt of two significant orders from major international gas engine Original Equipment Manufacturers, totaling ₹142 crore for the supply of gas engine generators. Following the news, the company's shares surged by 5.50% on the NSE, reaching Rs 406.80.

Shares of Tamboli Industries rose over 6% after its subsidiary company, Tamboli Castings Limited, received an invitation from the Indian Space Research Organisation (ISRO) to participate in the 75th International Astronautical Congress (IAC) in Milan, Italy, from October 14 to 18. As the sole representative from the casting and machining sector among twenty Indian companies, Tamboli Castings will be part of ISRO's delegation, which is a platinum sponsor of the event. Organized by the International Astronautical Federation (IAF), the IAC expects to attract industry leaders, innovators, and space technology enthusiasts.

BPCL, Asian Paints, M&M, Bharti Airtel, and Shriram Finance were the top gainers in the Nifty 50. While ONGC, Reliance Industries, Coal India, Axis Bank, and JSW Steel were the major losers in the Nifty 50 on October 15.

"International and domestic crude futures tumbled on Monday on Dollar strength and Chinese demand weakness. Losses in crude were limited after the S&P 500 rallied to a new record high, which shows confidence in the economic outlook that supports energy demand and crude prices. Additionally, heightened Middle East tensions are underpinning crude prices on concern an escalation of hostilities could lead to a disruption of the region's crude supplies. OPEC lowered its global oil demand forecast for 2024 and 2025 for the third consecutive month, citing lower-than-expected consumption in certain regions. Data showed that crude imports from China, the world’s largest importer, fell by almost 3% year-on-year from January to September," said Sriram Iyer, Senior Research Analyst at Reliance Securities.

"Going into the Q2 results season, the market has been expecting good numbers from IT and banking. HCL Tech’s good results confirm the optimistic expectations and the banking results, particularly from the leading private banks, also are likely to be good. Unlike IT stocks with limited valuation comfort, banking stocks offer decent valuation comfort and, therefore, have the potential to move up from the present levels. The sharp cut in Brent crude by 3% is a macro positive for India, but CPI inflation for September coming worse than expected at 5.49% is a concern and the MPC will be forced to take this seriously and postpone the rate cut to 2025," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.