Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed the trading session on a lower note on September 04. The BSE Sensex fell 73.60 points or 0.29% to finish the day’s trading at 82,384.12. The NSE Nifty 50 closed 74 points or 0.29% lower at 25,206.25. The Bank Nifty closed the day 0.59% or 305.40 points lower at 51,689. The Nifty Midcap 100 closed 57.85 points or 0.10% higher at 59,240.

The NSE Nifty 50 closed 0.29% lower at 25,206.25, while the BSE Sensex closed 0.21% lower at 82,384.12.

Asian Paints, Grasim Industries, Hindustan Unilever, Apollo Hospitals, and Sun Pharma were the top gainers in the Nifty 50. Meanwhile, Coal India, Wipro, ONGC, Hindalco, and M&M were the major losers in the Nifty 50 on September 04.

"We view the capacity addition in the cable segment as a positive development for the company. However, the commissioning of the Tumakuru facility has been delayed by approximately six months, previously announced to be operational by March 2024. The W&C sector is projected to achieve a 13% value CAGR over FY23-27, driven by strong demand from infrastructure and real estate. Havells' W&C segment is anticipated to report an 18.0% revenue CAGR over FY24-26E. The Tumakuru capacity expansion is expected to contribute to volume growth beginning in H2FY25. Additionally, the capacity additions in Tumakuru and Alwar are likely to benefit the company from FY27 onwards," said Prabhudas Lilladher on Havells India.

"Indian Rupee traded on a flat note. Weak domestic markets and risk aversion in the global markets pressurised the Rupee. However, a decline in crude oil prices and FII inflows cushioned the downside. India’s services PMI expanded to 60.9 in August vs forecast of 60.4 and a reading of 60.3 in July. We expect Rupee to trade with a slight negative bias on weak global equities and concerns over global economic growth. However, overall weakness in the US Dollar and weak crude oil prices may support the Rupee. Any intervention by the RBI to prevent the Rupee to fall to fresh lows may also support the domestic unit. Traders may take cues from JOLTS job openings and factory orders data from US the today," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

ABB India has received a penalty of Rs 3,03,918 from the Assistant Commissioner of State Goods & Service Tax, Bhubaneswar-Odisha. The penalty, imposed under Section 73(9) of the OGST/CGST Tax Act, 2017, relates to tax ITC mismatch and adjustment of GST advances. In other news, ABB India has launched new wireless home automation solutions. Despite these developments, the company's stock declined by 1.51%, trading at Rs 7,650.95.

Several major stocks reached 52-week highs on the NSE, with Morepen Labs leading with a 12.98% gain. Geojit Financial followed with a 10.19% increase, while IIFL Securities saw a rise of 7.53%. Media Assist and Religare also marked new highs, with gains of 3.32% and 5.69%, respectively.

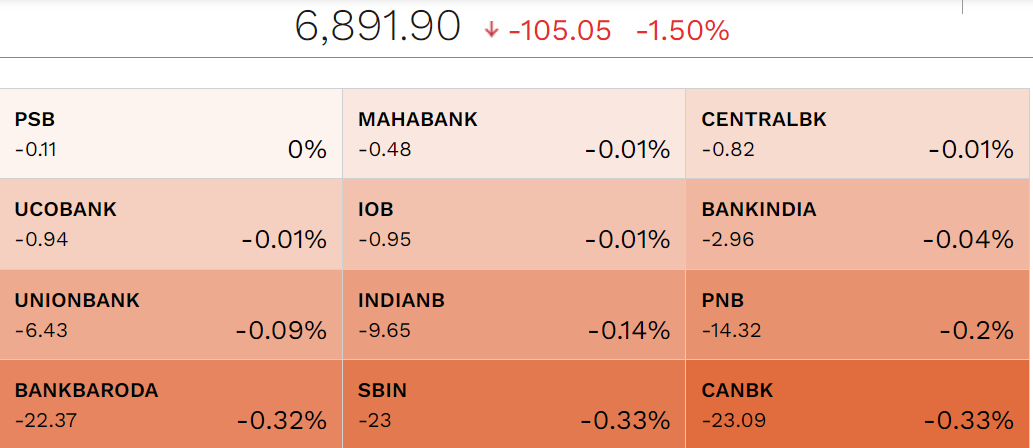

Top losers among Nifty PSU Bank stocks included Indian Bank, which fell by 2.65%, followed by Canara Bank, down by 2.50%. Bank of Baroda declined by 1.93%, while Punjab National Bank (PNB) and Punjab & Sind Bank (PSB) dropped by 1.51% and 1.47%, respectively.

Interarch Building Products has inaugurated phase 1 of its new state-of-the-art PEB manufacturing plant in Attivaram, Andhra Pradesh. Despite this development, the company's stock declined by 1.16% on the NSE, trading at Rs 1,127.

UPL board has granted in-principle approval to explore various options for unlocking value in Advanta Enterprises Ltd. This includes raising funds through primary or secondary issuances of securities via private placements, public offerings, or other permissible methods. Following the announcement, UPL shares inched up 0.72% on the NSE, trading at Rs 606.55.

Gala Precision Engineering IPO will stop taking bids from September 04r. It opened the issue to investors on September 02. The company wants to raise a total of Rs 167.93 crore through a combination of fresh shares and an offer for sale.

Minda Corp has entered into a technology licensing and assistance (TLA) agreement with Sanco Connecting Technology (Guangdong) Co., Ltd. China.

Stock rises 2.22% on the NSE, trading at ₹583.05.

Bikaji Foods International has successfully completed the acquisition of a 55% stake in Ariba Foods Pvt Ltd. Following this development, Bikaji Foods International's stock edged up by 0.84% on the NSE, trading at Rs 878.70.

Green Portfolio has launched new investment portfolios focused on India's rapidly growing defence, railway, energy, pharmaceutical, and automotive sectors. These portfolios target sectors projected to see significant expansion by 2030, with combined opportunities exceeding Rs 500 crore across the energy, defence, pharma, and automobile industries. Each portfolio comprises a carefully selected group of 8-12 stocks, offering concentrated exposure to sectors poised to benefit from indigenisation, modernisation, sustainability, and global competition.

High Energy Batteries has been notified by the Tamil Nadu State GST Authority to pay a penalty of Rs 82,800 due to discrepancies in stock discovered during an inspection. Despite this, the company's stock is trading at Rs 720 on the NSE, up by 2.48%.

"Torrent Power is currently developing two transmission projects, namely the Khavda transmission project for Rs 800 crore and the Solapur Transmission project, which costs Rs 470 crore. The company plans to expand its renewables portfolio, with over 3.2 GW of projects under the pipeline. This, combined with the transmission projects, will see the company investing close to Rs 20,000 crore in the next 3-4 years. We arrive at a target of Rs 1,893, thereby upgrading our rating to 'Accumulate'," said Geojit Financial Services in a research report.

Gala Precision Engineering IPO will stop taking bids from September 04r. It opened the issue to investors on September 02. The company wants to raise a total of Rs 167.93 crore through a combination of fresh shares and an offer for sale. The company’s shares were fetching a premium of 44% in the grey market. Gala Precision Engineering set the IPO price band between Rs 503 to Rs 529 per equity share.

Nifty PSU Bank is the major dragger of Nifty 50. The sectoral index was down 1.5% at 6,891.90.

Courtesy: NSE

Shares of key defence companies gained on September 4 after the Defence Acquisition Council (DAC) approved major procurement proposals worth Rs 1,44,716 crore for the Indian Armed Forces.

Shares of Mazagon Dock and Garden Reach Shipbuilders (GRSE) saw their stocks rise by over 6% and 4%, respectively, while Hindustan Aeronautics Limited (HAL) and Bharat Dynamics shares were up by 1%. Mishra Dhatu Nigam and Bharat Electronics Limited (BEL) also traded in the green.

ECO Mobility debuted on the National Stock Exchange at Rs 390, reflecting a 16.7% premium to its issue price. The company had set the IPO price band between Rs 318 and Rs 334 per equity share.

IEX shares traded flat at Rs 205.40 on the NSE, despite the company reporting significant growth in August 2024. Total volumes reached 12,040 million units (MU), marking a 35.8% year-on-year increase. Electricity volumes alone rose by 17.1% YoY to 9,914 MU, while the renewable energy certificate (REC) segment surged by 737.4% YoY to 2,116 MU.

“Bank Nifty has witnessed a strong breakout above the 51,500 mark, indicating potential targets of 52,000 and 52,500 in the near term. Traders are advised to buy on every dip and consider buying at the current market price (CMP), with a stop loss at 51,400 to capture the expected upside. The charts are showing robust strength, and strong buying interest in banking stocks is driving momentum higher. This setup suggests a bullish outlook, with significant gains likely from here,” said Riyank Arora, Technical Analyst, at Mehta equities.

The US Dollar Index (DXY), which measures the value of the dollar against a basket of six foreign currencies, traded up by 0.03% at 101.70.

Shares of General Insurance Corporation of India (GIC Re) declined over 4% to an intra-day low of Rs 400.95 as the Indian government commenced the sale of nearly 7% of its stake through an offer for sale (OFS) route. The government intends to divest 3.39% equity, with an additional 3.39% stake available under a green shoe option.

Read More: GIC Re shares slide 4%; Govt to sell 7% stake via OFS

Commenting on the Technical outlook of Nifty Rupak De, Senior Technical Analyst, LKP Securities, said that Nifty remained rangebound, closing positively for the 14th consecutive day. It encountered resistance at 25,300, highlighting strong call option writing at that strike. Moving forward, only a decisive move above 25,300 might trigger a rally toward 25,500. On the downside, support is positioned at 25,200 and 25,000.

Shares of ONGC fell 2.2% to an intraday low of Rs 308.40. The stocks opened at Rs 315 apiece. The share of ONGC was the major loser in the Nifty 50. While it has a previous close of Rs 322.20. ONGC touched its 52-week low of Rs 179.90, on October 26, 2023. The company's shares hit its 52-week high of Rs 345 on August 13, 2024.

ONGC, Hindalco, Wipro, LTIMindtree, and JSW Steel were the major losers in the Nifty 50. Meanwhile, Asian Paints, BPCL, Sun Pharma, and Hero MotoCorp were the only gainers in the Nifty 50 on September 04.

The NSE Nifty 50 opened 0.65% lower at 25,116.10, while the BSE Sensex opened 0.65% lower at 82,015.51.