Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed on a lower note on October 04, continuing the downtrend. The BSE Sensex tumbled over 800 points or 0.98% to finish the day’s trading at 81,688. The NSE Nifty 50 fell 200 points or 0.79% to settle at 25,050. The Bank Nifty closed the day’s trading 0.56% lower at 51,556. Following the overall market sentiments, the Nifty Midcap 100 closed the session 529 points or 0.90% lower at 58,496.

The NSE Nifty 50 closed 0.79% lower at 25,050, while the BSE Sensex closed 0.80% lower at 81,793.16.

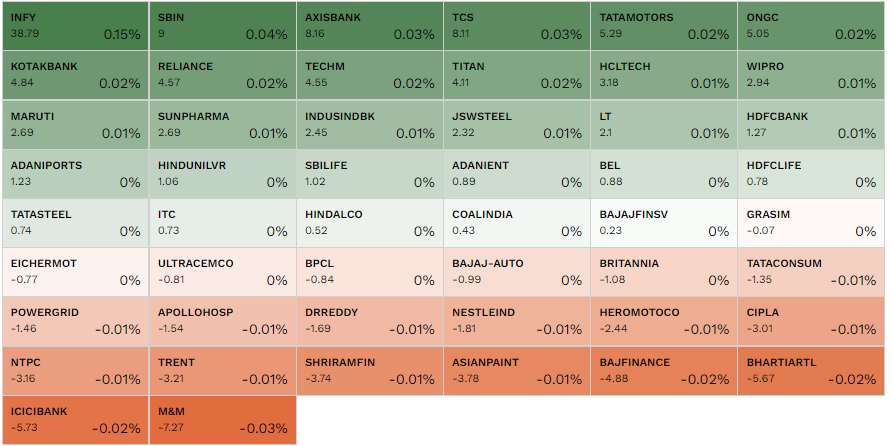

M&M, Bajaj Finance, Nestle India, Hero MotoCorp, and BPCL were the major losers in the Nifty 50. Meanwhile, Infosys, ONGC, HDFC Life Insurance, Tech Mahindra, and Wipro were the top gainers in the Nifty 50 on October 04.

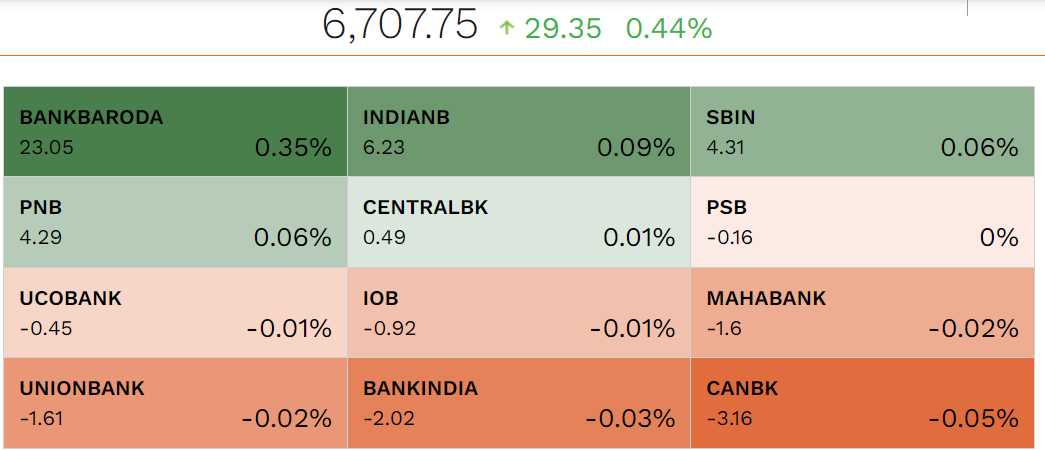

Nifty PSU Bank outperforms overall markets, rising 0.44%. The index was pulled up by Bank of Baroda, IndusInd Bank, and SBI on October 04.

Courtesy: NSE

"The risk of Israel’s retaliation to Iran’s attack earlier this week will continue to add risk premiums to crude oil prices in the short term, the comment from the US President discussing possibilities of hitting Iran’s oil facilities with Israel sent oil prices higher by 5% on Thursday. Oil is on track for its biggest weekly gain since March 2023 Both benchmarks were on track for weekly gains of about 8%. Crude oil will remain volatile in the short term, and any retaliation could escalate to broader tension in the region, which may see WTI rallying towards $78-$80, while any correction in the short term should be considered as a buying opportunity. While the support remains around $72-$70 for the day," said Mohammed Imran, Research Analyst with Sharekhan by BNP Paribas.

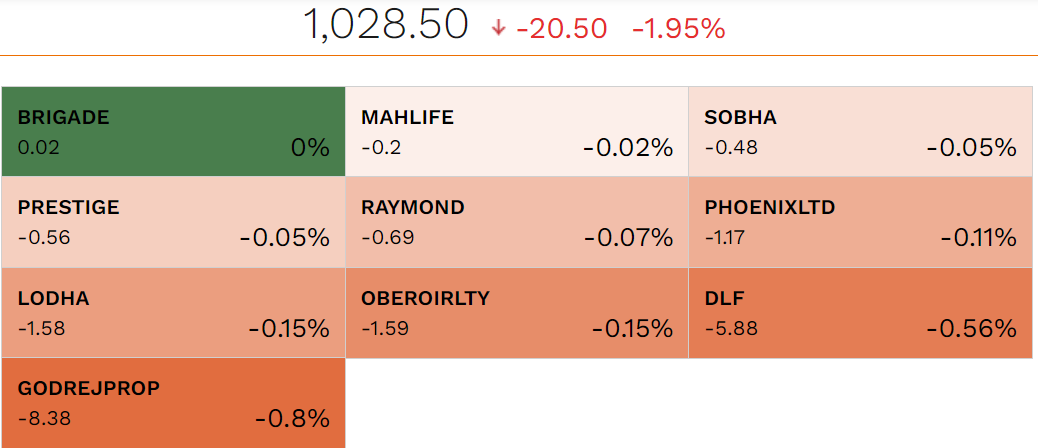

The sectoral index saw sharp cuts as the Nifty fell to an intra-day low level. Nifty Realty was down 2% dragged by index heavyweights like Godrej Properties, DLF, and Oberoi Realty among others.

Courtesy: NSE

BLS International FZE, a subsidiary of BLS International Services, has successfully acquired 99% of the share capital of BLS UNITED VENTURES S DE RL DE CV, a company incorporated under Mexican federal law. Following this announcement, BLS International Services' stock is trading flat on the NSE at Rs 355.30.

Several major stocks hit their 52-week highs on the NSE today, with Mirae Asset Mutual Fund leading the way, up by 10.94%. IIFL Securities followed with a gain of 7.99%, while ADF Foods increased by 4.85%. Redtape and ITC Cementation also recorded significant gains, rising by 3.59% and 2.44%, respectively.

On the second day of subscription on Tuesday, the Subham Papers IPO received strong interest, being subscribed 3.29 times. This marked a significant increase from its first day of subscription on September 30, when it was subscribed only 0.44 times. The public offer comprises a fresh issue of 61.65 lakh shares, with no portion allocated for sale. The IPO price band is set between Rs 144 and Rs 152 per share, and retail investors can participate with a minimum lot size of 80 shares.

Electronics Mart India Limited has officially commenced commercial operations for a new Multi Brand Store under the brand name 'BAJAJ ELECTRONICS.' However, the company's stock is trading 2.08% lower on the BSE, currently priced at Rs 211.50.

NHC Foods Limited, a leading exporter of agricultural commodities, has applied for a Rights Issue aimed at spurring growth and addressing its working capital requirements. The proceeds from this Rights Issue will be utilized to repay some secured loans, thereby enhancing profitability. During the Annual General Meeting, Mr. Apoorva Shah, Chairman & Managing Director of NHC Foods, shared the company’s expansion plans with shareholders.

Orient Cement has accepted a work order from Madhya Pradesh Power Generating Company Limited to install a Clinker Grinding Unit at the Satpura Thermal Power Station in Sarni, Madhya Pradesh. Following this announcement, shares of Orient Cement are trading at Rs 303.85 on the NSE, reflecting a decline of 1.78%.

Indoco Remedies has received final approval from the USFDA for its Abbreviated New Drug Application (ANDA) for Cetirizine Hydrochloride Tablets USP, 10 mg (OTC). Following this announcement, the company's shares rose by 2.49% on the NSE, trading at Rs 348.

As of 12:50 PM on October 4, 2024, stocks on the BSE showed positive momentum, with 2,137 advancing compared to 1,627 declining, while 166 remained unchanged. A total of 3,930 stocks were traded during the session. Notably, 167 stocks reached a 52-week high, while 50 hit a 52-week low. Additionally, 270 stocks were traded in the upper circuit, while 208 experienced trading in the lower circuit.

The board of NDR Auto Components has approved a proposal to acquire approximately 25 acres of land at MITL, AURIC, Bidkin, Chhatrapati Sambhaji Nagar, Maharashtra, for an estimated cost of Rs 37.63 crore. This acquisition is part of the company's future expansion plans. However, shares of NDR Auto Components are currently trading at Rs 835.55 on the NSE, reflecting a decline of 5.72%.

At 12:30 on the NSE, Infosys led the gainers with an increase of 2.74%, followed by ONGC at 2.17%, Tata Motors at 2.07%, JSW Steel at 2.07%, and Tech Mahindra at 1.98%. Conversely, the top losers included Shriram Finance, which fell by 1.56%, Cipla down by 1.44%, Hero Motocorp declining by 1.42%, Trent decreasing by 1.09%, and Apollo Hospitals dropping by 0.95%.

Swiggy has secured investor approval to increase the size of its Initial Public Offering (IPO), positioning its public market debut to potentially become one of the largest new-age IPOs in India. The overall size of the IPO could reach Rs 10,414 crore ($1.25 billion) or even Rs 11,664 crore ($1.4 billion) if further increases are implemented.

Read More: Swiggy gets investor approval to increase IPO size to Rs 5,000 crore

Shares of Vedanta Ltd., owned by Anil Agarwal, are in the spotlight on Friday, October 4, following the company’s business updates for the second quarter and half-year ended September 30, 2024. Vedanta reported its highest-ever aluminium production for both the quarter and half-year period. Alumina production for the first half of FY24 reached 1,039 kt, a 21% increase year-on-year, while aluminium production rose 3% year-on-year to 1,205 kt, driven by operational efficiencies.

Markets bounced back and are on their way to recovering yesterday's losses.

Courtesy: NSE

Avenue Supermarts shares declined 4.8% to an intra-day low of Rs 4,703 after the company’s revenue growth moderated due to lower store additions and store productivity. “Revenue growth moderation was due to lower store additions in the past few quarters (except 4QFY24) and weaker store productivity (+1% YoY). We believe preference for convenience (rapid adoption of quick commerce) over value could also have contributed to growth moderation for DMART,” said Motilal Oswal in a research report.

Shares of Mahindra & Mahindra Financial Services Ltd fell by 7% after the company reported a decline in disbursements and mixed asset quality results for the September quarter. The company estimated disbursements at approximately Rs 13,160 crore for Q2 FY25, reflecting a 1% year-on-year (YoY) decline.

Despite the drop in quarterly disbursements, Mahindra & Mahindra Financial Services recorded total disbursements of Rs 25,900 crore for the first half of FY25, showing a 2% growth compared to the same period last year, according to its stock exchange filing.

Commenting on the Technical outlook of Ajay Garg, Director & CEO, SMC Global Securities, said that The NIFTY index has been on a remarkable ascent, achieving record highs and displaying a clear pattern of higher highs on its daily charts. However, this upward momentum is currently facing challenges as a downturn appears to be triggered by global market influences.

Garg also added that Technically, the index has recently broken the trend line of its rising channel, signaling potential vulnerability. From a derivatives standpoint, there has been substantial call writing observed at critical strike levels, particularly at 25,600, with further activity noted at 25,700, 25,800, and extending to 26,000.

Morgan Stanley expressed optimism about the company’s prospects. The firm highlighted that the focus in Q2 will be on management’s confidence regarding asset quality improvement from Q3.

Morgan Stanley also stressed that commentary on the future trajectory of credit costs will be crucial. It has given Bajaj Finance an ‘overweight’ rating with a price target of Rs 9,000, suggesting a potential upside of 21% from the stock’s last closing levels.

Commenting on the gold outlook Renisha Chainani, Head Research - Augmont - Gold For All said that The price of gold is still trapped in a small trading range due to conflicting underlying signals. Geopolitical worries support the metal, although the strength of the USD limits recent advances. Additionally, traders hesitated to place directional bets, waiting to see what happens with the US NFP report, which is expected to be announced today.

Chainani also added that Hezbollah shot around 230 rockets from Lebanon into Israeli territory on Thursday and Israel began strikes early on Friday targeting Hezbollah's intelligence offices in the southern suburbs of the Lebanese capital Beirut. Iran launched approximately 180 ballistic missiles on Tuesday night; Israel is planning a massive counterattack within days, increasing the likelihood of a full-scale war and supporting the Gold market. Gold remains supported at around $2650 (Rs 75400), and resistance is around $2700 (Rs 76500).

Prime Securities, a SEBI-registered Category-I Merchant Banker, is expanding its presence in the financial services sector by venturing into the wealth management business through its wholly-owned subsidiary, Prime Trigen Wealth Ltd. (PTWL). This strategic move is aimed at capitalizing on new growth opportunities with significant scalability potential.

To spearhead its wealth management operations, PTWL has appointed industry veterans Mr. Sailesh Balachandran and Mr. Maneesh Kapoor as Executive Director, Founders, and Joint-CEOs. The company plans to initially launch its services in key cities, including NCR, Mumbai, Bangalore, and Chennai, with future expansion plans targeting top Tier 1 and Tier 2 wealth destinations across India.

Shares of Bajaj Finance fell by more than 3% to intra-day low of Rs 7,198 on October 4, following the release of its Q2 business update, which highlighted the slowest asset under management (AUM) growth in six quarters.

Diffusion Engineers was listed at Rs 193.50 on the National Stock Exchanger, a premium of 15% to the issue price. The stock was listed at Rs 188 on BSE, a premium of 12%.

SBI Life Insurance, ONGC, IndusInd Bank, HDFC Life Insurance, and Axis Bank were the top gainers in the Nifty 50. While BPCL, Bajaj Finance, Trent, Hero MotoCorp, and NTPC were the major losers in the Nifty 50 on October 04.