Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices ended Wednesday’s trading session in the negative territory. The NSE Nifty 50 plunged 122.65 points or 0.49% to settle at 24,918.45, while the BSE Sensex fell 398.13 points or 0.49% to 81,523.16. The broader indices ended in mixed territory, with fall led by Large-cap and Mid-cap stocks. Bank Nifty index ended lower by 262.30 points or 0.51% to settle at 51,010. FMCG outperformed among the other sectoral indices while Media and PSU Banks stocks shed.

The NSE Nifty 50 plunges 122.65 points or 0.49% to settle at 24,918.45, while the BSE Sensex fell 398.13 points or 0.49% to 81,523.16.

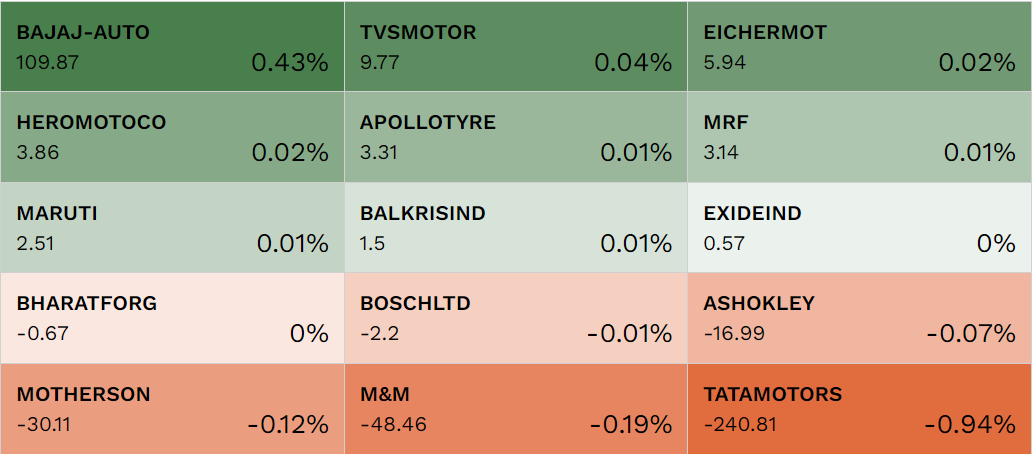

As of 3 PM, Bajaj Auto emerged as the top gainer on the NSE, rising by 3.88%, followed by Asian Paints, up 2.19%, and Bajaj Finance, which gained 1.44%. Other notable gainers included Britannia with a 0.57% increase and Shriram Finance, up by 0.55%.

On the losing side, Tata Motors experienced the steepest decline, falling by 5.55%. ONGC followed with a 3.57% drop, while Wipro, Hindalco, and SBI recorded losses of 2.15%, 1.87%, and 1.73%, respectively.

R Systems International’s board has approved a composite scheme of amalgamation involving Velotio Technologies Private Limited and Scaleworx Technologies Private Limited. Following the announcement, R Systems International shares rose 2.64%, trading at Rs 509.10 on the NSE.

Commenting on the GST reduction on cancer drugs Manisha Karmarkar, CEO, DPU Super Specialty Hospital said that The reduction of the GST rate on cancer drugs to 5% is a much-needed and revered move announced by the council that will ease the burden of this life-threatening disease. Currently, cancer is among the top 5 causes of death in India, and a considerable share of these cases are owing to the inability to bear medical expenses.

Karmarkar also added that India recorded approximately 1.49 million cases in 2023 and as per estimates, a 12.8% increase in annual cancer cases by 2025 is projected. This underlines the need to build a robust ecosystem to fight the inflating cancer load, and the move to reduce the GST rate is a coveted step in that direction.

PN Gadgil Jewellers' price-to-book ratio stands at 42.2 times, somewhat near to its competitors except for Kalyan Jewellers. The brokerage house Anand Rathi in a research note said that after looking at the company’s stable and growing profits and returns ratios the issue may be considered for its long-term growth.

Shares of ONGC fell 3.3% to an intraday low of Rs 285.85 after the crude oil traded for the first time in three years below the level of $70/barrel. Crude oil prices have plummeted to nearly three-year lows following a downward revision of demand forecasts by OPEC, primarily driven by reduced Chinese demand. In its monthly report released yesterday, OPEC lowered the global oil demand forecast for 2024 to 2.03 million barrels per day, down from the previous estimate of 2.11 million barrels per day. Chinese demand growth was also revised downwards to 650,000 barrels per day, compared to 700,000 barrels per day in the previous report.

Bajaj Housing Finance, the second largest housing finance company in terms of assets under management, trailing LIC Housing Finance. The company opened its IPO on September 09. It will close on September 11. The stocks of Bajaj Housing Finance clocked a premium of 100% in the grey market. It is an unofficial place where shares trade illegally ahead of listing.

Bajaj Auto is single-handedly contributing 0.5% to the index. However, as UBS maintained a "Sell" rating on Tata Motors, there's a strong push back from it.

Courtesy: NSE

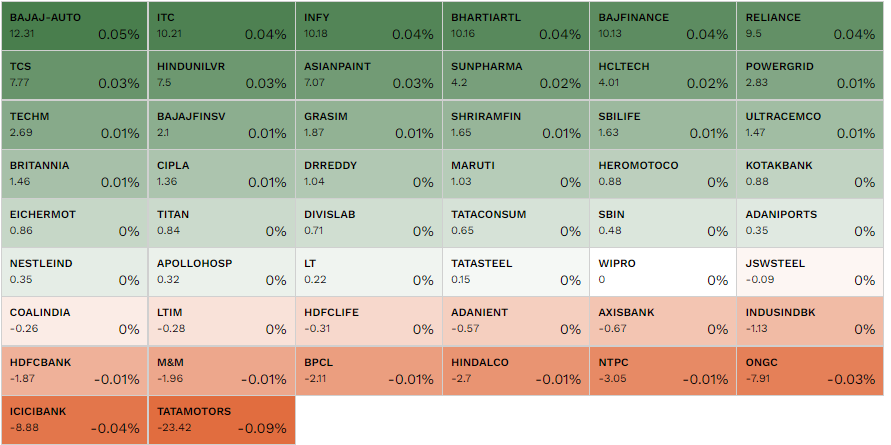

Bajaj Auto twins along with ITC, Infosys, and Bharti Airtel are pulling the index higher.

Courtesy: NSE

Bajaj Auto was the top gainer in the Nifty 50, with shares rising as much as 4.3% to a new 52-week high of Rs 11,459.30 from its previous close of Rs 10,987.75. The upper band for the stock is placed at Rs 12,086.50.

Commenting on gold outlook today Renisha Chainani, Head Research - Augmont - Gold For All said that Gold prices are on the verge of reaching a new high following the first debate between Democratic Vice President Kamala Harris and Republican Presidential contender Donald Trump. The vital US CPI report will have a significant impact on expectations regarding the extent of the Federal Reserve's rate decrease at the September 17-18 policy meeting, providing some substantial momentum to the non-yielding yellow metal.

Chainani also added that According to the CME FedWatch Tool, the markets are presently pricing in a 67% likelihood of a 25 basis point rate drop at the upcoming FOMC policy meeting on September 17-18. If Gold breaks its previous high of $2530, we could see new highs of $2550 (~Rs 73000) and $2600 (~Rs 75000) in the short term. While on the downside, if $2470 is broken, we might see profit-booking up to $2430 (~Rs 70000) and $2400 (~Rs 69000).

AUROBINDO shares climbed more than 1%, reaching an intra-day high of Rs 1,535 on the NSE following the USFDA approval for Eugia Steriles Private Limited, a 100% step-down subsidiary of the company.

Persistent Systems Ltd and Persistent Systems, Inc. have signed an Asset Purchase Agreement with SoHo Dragon Inc. to acquire specific assets, pending the fulfillment of standard closing conditions. The stock of Persistent Systems is trading flat on the NSE at Rs 5,282.40.

Crude oil futures traded higher on Wednesday morning, driven by concerns over potential supply disruptions from tropical storm Francine in the Gulf of Mexico.

As of 9:57 AM, November Brent crude oil futures were up 0.59% at $69.60 per barrel. Meanwhile, October West Texas Intermediate (WTI) crude futures increased by 0.50%, trading at $66.08 per barrel.

Hazoor Multi Projects' share price jumped more than 4% on Wednesday, reaching a record high after the company announced a potential merger with Square Port Shipyard Pvt Ltd. The small-cap multibagger stock surged as much as 4.86%, hitting a new all-time high of Rs 623.00 per share on the BSE.

Tata Motors shares fell over 4%, hitting an intra-day low of Rs 976 on the NSE after global brokerage firm UBS issued a ‘Sell’ recommendation on the stock. UBS has set a price target of Rs 825 per share, implying a potential downside of 20% from Tuesday’s closing price. The stock has already declined 12% from its record high of Rs 1,179, which it reached on July 30, 2024. In its note, UBS raised concerns about Tata Motors’ British subsidiary, Jaguar Land Rover (JLR), particularly the rising discounts on its premium models.

Read more: Tata Motors shares plunge over 5% after UBS maintains Sell with target of Rs 825

"Crude oil prices have plummeted to nearly three-year lows following a downward revision of demand forecasts by OPEC, primarily driven by reduced Chinese demand. In its monthly report released yesterday, OPEC lowered the global oil demand forecast for 2024 to 2.03 million barrels per day, down from the previous estimate of 2.11 million barrels per day. Chinese demand growth was also revised downwards to 650,000 barrels per day, compared to 700,000 barrels per day in the previous report. We anticipate continued volatility in crude oil prices during today’s session," said Rahul Kalantri, Vice President of Commodities at Mehta Equities.

“We are of the view that the market completed one leg of a pullback rally and now 25000/81800 would be the crucial support level for traders. Above 25000/81800, it could bounce back up to 25150-25175/82200-82500. However, Below 25000/81800 the market could retest the level of 24900/81500. Further downside may also continue which could drag the index till 24850/81300,” said Shrikant Chouhan, Head of Equity Research at Kotak Securities.

“Bank Nifty too witnessed the continuation of the pullback however is facing resistance in the zone 51400 – 51500. Thus, it shall be a crucial level to surpass from a short-term perspective. On the downside, 50900 – 50800 shall be a crucial support zone from a short-term perspective,” said Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas.

The ₹6,560-crore public issue of Bajaj Housing Finance saw strong demand, with the IPO being subscribed over 7.5 times by the end of Day 2. The non-institutional investors (NII) category led the surge in interest, driving the high subscription rates.

As the bidding continues today, all eyes are on the qualified institutional buyers (QIBs), who have already subscribed 7.46 times their reserved portion of the IPO.

On Day 2, the NII quota remained in high demand, with subscriptions reaching 16.45 times. Retail individual investors (RII) also showed solid interest, with their portion being subscribed 3.83 times, while QIBs maintained a 7.46 times subscription level.

Tata Motors shares dropped over 4%, hitting an intra-day low of Rs 989 on the NSE. The decline followed a 'Sell' recommendation from global brokerage firm UBS, which set a price target of Rs 825 per share, indicating a potential 20% downside from Tuesday's closing price.

BPCL, Power Grid Corp, Tata Steel, JSW Steel, and Nestle India are the top gainers on NSE Nifty 5o index whereas the top laggards include LTIMindtree, IndusInd Bank, HDFC Bank, Tech Mahindra, and Axis Bank.

The NSE Nifty 50 opens down by 7.10 points or 0.03% at 25,034, while the BSE Sensex gains 6.83 points or 0.01% to 81,928.12 in the opening trade.

Commenting on Today's Market Outlook Prashanth Tapse, Senior VP (Research), Mehta Equities said that Yesterday’s bullish movement on Dalal Street suggests concerns about a US economic slowdown may be overstated, though technical strength in Nifty will only be confirmed above 25,333.65. Today, Nifty may show volatility, with negative cues from Wall Street, including stress in US banking stocks and a decline in trading revenue at Goldman Sachs, offset by falling WTI oil prices and FIIs buying Rs 2,208 crore.

Tapse also added that Bullish outlook on BERGER PAINTS, GODREJ CP, SYNGENE INTERNATIONAL, and BRITANNIA; recommended buying on intraday dips with an interweek perspective. Top stock pick: SYNGENE INTERNATIONAL (CMP 929): Buy between 900-910, stop at 871, targets 947/973, aggressive target at 1,001 (intermonth strategy), backed by higher highs/lows and bullish momentum oscillators.

The Reserve Bank of India (RBI) has imposed a fine of Rs 1.91 crore on HDFC Bank and Rs 1 crore on Axis Bank. According to an official statement, HDFC Bank was penalized for non-compliance with RBI guidelines related to interest rates on deposits, the use of recovery agents by banks, and customer service standards. Axis Bank also faced penalties for regulatory violations.

Foreign institutional investors (FII) bought shares net worth Rs 2,208.23 crore. Meanwhile, domestic institutional investors (DII) sold shares net worth Rs 275.37 crore on September 10, 2024, according to the provisional data available on the NSE.

Asian markets were trading lower on Wednesday morning. Japan's Nikkei 225 fell 0.55% to 35,962, while South Korea's Kospi declined 0.34% to 2,514.85. The Asia Dow edged down 0.17% to 3,453.54, and China's Shanghai Composite dropped 0.67%, trading at 2,725.78.

WTI crude prices were trading at $66.04 up by 0.44%, while Brent crude prices were trading at $69.44 up by 0.36%, on Wednesday morning.