LIC rarely surprises the market. As one of India’s largest and most conservative institutional investors, it tends to stick with familiar names — mature businesses with stable fundamentals and predictable cash flows.

But in the March shareholding data, LIC quietly added three new companies to its portfolio. All first-time entries. None are flashy or newly listed — just steady businesses working in their respective niches.

That makes these moves worth a closer look.

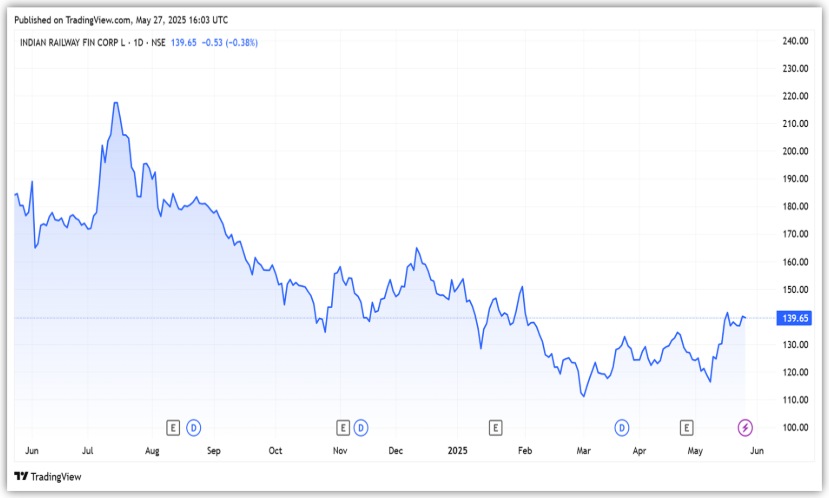

#1 IRFC

IRFC is the financing arm of the Indian Railways, responsible for raising funds to meet its development needs. Its primary function is to raise funds for purchasing engines, passenger coaches, and wagons on behalf of Indian Railways, as well as to finance railway projects.

Additionally, IRFC lends to public sector entities such as RVNL and IRCON. As of 31 March 2025, IRFC had assets under management (AUM) of ₹4.6 trillion, of which 99% were receipts from the Ministry of Railways.

However, such a high concentration also poses a risk.

Each financial year, the Ministry of Railways informs IRFC of its financing requirements, which IRFC meets through market borrowings. Thus, this portfolio concentration means that IRFC’s growth is entirely dependent on these budgetary resources.

This risk is evident in IRFC’s stagnant AUM – ₹4.6 trillion in both FY23 and FY24 – as the government allocated no additional fiscal resources. In line with this, IRFC total borrowings also remained flat at ₹4.1 trillion (as of March 31, 2025), as incremental disbursements for FY25 were just ₹7.3 billion.

But, to reduce this over-reliance, IRFC plans to diversify by funding entities that have forward or backward linkages with the Indian Railways. It is currently setting up systems and processes to support this diversification.

With stagnant AUM, IRFC’s financials have also shown no growth. Net interest income rose by just 2% to ₹65.7 billion in FY25, supported by a four-basis-point jump in net interest margin to 1.42%. It’s also worth understanding how IRFC earns its returns.

It follows a cost-plus model, where it earns a fixed markup over its borrowing costs. Under this agreement with the Ministry of Railways (MoR), the Railways repays IRFC in half-yearly instalments, covering the cost of funds plus an agreed margin.

At the same time, net profit grew 1.4% from last year to ₹65 billion. Negligible operating expenses of 0.1% ensure that its profit remains broadly in line with its net interest income, leaving no room for surprises or volatility in earnings.

The company’s Return on Total Assets also remained unchanged at 1.3% for both FY25 and FY24. Notably, the Ministry of Railways has not set any target for FY26, which means growth in FY26 will likely remain flat.

IRFC‘s dependence on the Ministry of Railways also means zero non-performing assets and negligible credit costs. The company is also exempted from providing standard provisions against its exposure to Indian Railways.

LIC bought a 1.05% stake in IRFC in the March quarter. From a valuation perspective, IRFC trades at a price-to-book multiple of 3.5x, a premium to the 4-year median of 1x.

#2 Jindal Stainless

Jindal Stainless is a part of the Rattan Jindal Group. It is the largest domestic manufacturer of stainless steel and among the leading players in the global market. The company is also the world’s largest producer of chrome manganese steel.

The company has a steel melting capacity of 4.2 million tonnes per annum (MTPA) as of March 2025. Its primary product types include 200, 300, and 400 grades, as well as duplex stainless steel products.

The company serves a diverse end-user base across various industries, including pharmaceuticals, oil and gas, aerospace, defense, nuclear power, and consumer goods (durables and kitchenware) sectors.

Management estimates that it catered to nearly 50% of India’s stainless steel demand in FY24, out of the total domestic consumption of 4.39 MTPA. It operates 16 stainless steel manufacturing and processing facilities in India, Spain, and Indonesia.

Jindal Stainless’ revenue grew 2% from last year to ₹393 billion in FY25, driven by a 9% increase in sales volume. Lower realisation led to moderate revenue growth. 91% of revenue came from the domestic market, while 9% came from exports.

However, the EBITDA margin remained flat at 12.8%. Meanwhile, net profit declined 7% from last year to ₹25 billion, due to higher finance costs and depreciation.

Looking ahead, the company is well-positioned to capitalize on the increasing demand for stainless steel in the domestic market. According to CareEdge Ratings, Stainless steel consumption increased from 3.5 MTPA to 4.4 MTPA in 2024 and is expected to grow at an annual rate of 8-10% over the next three years.

Lower per-capita stainless steel consumption also gives a long growth runway. Global per capita stainless steel consumption is around 6 kg, compared to just 2.8 kg in India, indicating strong growth potential for companies like JSL.

Sectors such as automotive and railway have seen strong growth, with programmes like Vande Bharat and the PM Gati Shakti Project boosting demand. Emerging sectors, such as ethanol blending, renewable energy, and the processing industries, are also driving demand.

Management anticipates that this fiscal growth will be supported by Amrit Bharat, Vande Bharat, and metro trainsets. Additionally, the increasing use of stainless steel in infrastructure projects, such as flyovers, roads, and footbridges, is expected to drive further demand for stainless steel.

To capitalise on the growth opportunity, the group has announced a capital expenditure of ₹57 billion for both organic and inorganic growth. This includes a joint venture in Indonesia for setting up a 1.2 MTPA capacity, the acquisition of a 0.6 MTPA cold rolling plant in Gujarat (Chromeni Steel), and other projects.

LIC picked up a 1.24% stake in Jindal Stainless in the March quarter. From a valuation perspective, it trades at a price-to-earnings multiple of 21x, a premium to the 7-year median of 14x.

#3 KPIT Technologies

KPIT is a technology company focused on automobile engineering and mobility solutions. It provides technology solutions to original equipment manufacturers (OEMs) in the automotive industry, including powertrain (conventional and electric), connectivity, autonomous (vision and control systems), and diagnostics.

Each of its practice areas offers software IP, software integration, feature development, and verification and validation services. KPIT is present in 14 countries across the Americas, Europe, and the Asia-Pacific (APAC) region.

KPIT’s revenue in FY25 grew 20% over the previous year to ₹58 billion, driven mainly by passenger cars, while commercial vehicles lagged. Feature development and integration accounted for 60%, followed by architecture and middleware consulting (22%), and cloud-based connected services (18%).

EBITDA margin remained stable at 21%, while net profit jumped 41% to ₹8.4 billion. The company also generated a robust cash flow of ₹15.8 billion in FY25.

The company is geographically diversified, with 48% of revenue from Europe, 27% from the US, and 25% from Asia. It is expanding rapidly in Asia, with 71% YoY revenue growth in FY25, compared to 5% and 8% growth in the US and Europe, respectively.

Looking ahead, the company aims to diversify beyond passenger cars into commercial vehicles and off-highway applications. Initial OEM projects are underway, with major ramp-ups expected in FY27.

That said, passenger vehicles remain the primary growth engine, supported by new deal wins, such as Mercedes-Benz. The company is also diversifying into cybersecurity services, rolling out cost-optimisation programs to strengthen its position.

Management estimates modest growth in the first half of FY26, amid tariff and geopolitical headwinds, with a meaningful pickup in H2 as key deals ramp up.

LIC bought a 1.32% stake in KPIT in the March quarter. From a valuation perspective, it trades at a price-to-equity multiple of 43x, a discount to the 5-year median of 52x.

Conclusion

LIC’s entry into IRFC, Jindal Stainless, and KPIT isn’t a significant shift, but it does convey a message. These aren’t risky bets. They’re steady businesses with room to grow. Whether it’s IRFC’s predictable income, Jindal’s growing role in India’s steel story, or KPIT’s place in the evolving auto tech space, each pick sits comfortably within LIC’s long-term, fundamentals-first approach.

That said, IRFC’s stable AUM requires caution, or maybe LIC expects a rise in disbursements, while Jindal Stainless and KPIT are well-positioned in their respective industries.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternative, but widely accepted, source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.