Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices ended Friday’s trading session in the negative territory. The NSE Nifty 50 falls 34.20 points or 0.14% to settle at 24,964.25, while the BSE Sensex plunged 230.05 points or 0.28% to 81,381.36. The broader indices ended in mixed territory, with fall led by Large-cap. Bank Nifty index ended lower by 358.60 points or 0.70% to settle at 51,172.30. Pharma and Metal stocks outperformed among the other sectoral indices while Banking and Financial Services stocks shed.

The NSE Nifty 50 falls 34.20 points or 0.14% to settle at 24,964.25, while the BSE Sensex plunged 230.05 points or 0.28% to 81,381.36.

As of 3:25 PM on October 11, 2024, 2,077 stocks advanced on the BSE, while 1,785 stocks declined, and 123 remained unchanged, out of a total of 3,985 stocks traded. Additionally, 213 stocks recorded a 52-week high, and 24 hit a 52-week low. A total of 359 stocks traded in the upper circuit, while 144 stocks were in the lower circuit.

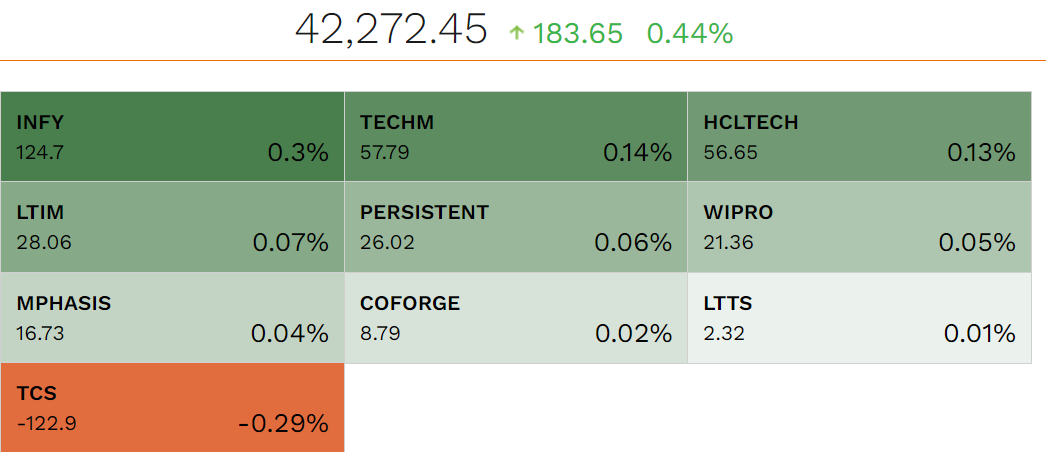

As of 3:20 PM, the top gainers on the NSE included Trent, up by 2.74%, followed by Hindalco with a 2.29% rise, HCL Tech gaining 1.66%, Tech Mahindra up 1.61%, and ONGC increasing by 1.23%. On the losing side, TCS dropped 1.82%, M&M fell 1.76%, ICICI Bank declined 1.62%, Maruti slipped 1.38%, and Cipla was down by 1.26%.

Sudarshan Chemical Industries' shares rose 2.50% on the NSE to Rs 1,040 after the company announced that its wholly-owned subsidiary, Sudarshan Europe BV, has entered into a definitive agreement to acquire the global pigment business operations of Germany's Heubach Group. The total consideration for the acquisition is valued at €127.5 million (approximately Rs 1,180 crore).

Pokarna shares surged 4.88% on the NSE, reaching Rs 1,090.35, after the company announced that operations at Unit II of its subsidiary, Pokarna Engineered Stone Limited (PESL), located in Mekaguda, Telangana, had resumed.

The top gainers among Nifty Pharma stocks on Friday included IPCA Labs, which rose by 3.84%, followed by Mankind Pharma with a 3.58% gain. Granules advanced by 3.24%, Lupin climbed 2.72%, and Torrent Pharma saw a 2.17% increase.

Commenting on the dollar rupee outlook Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas said that Indian Rupee fell below the 84 per US Dollar mark for the first time on demand from foreign banks amid FII outflows and elevated crude oil prices. Weak domestic markets also weighed on the Rupee. However, overnight softening of US Dollar index prevented a sharp fall in the Rupee. Dollar fell on higher than expected weekly unemployment claims data from US which overshadowed a hotter-than-expected inflation. US inflation rose more 0.2% m-o-m vs forecast of 0.1% and core CPI rose 0.3% vs forecast of 0.2%. Annual inflation also rose more than forecast.

Choudhary also added that we expect Rupee to trade with a negative bias on selling pressure from FIIs and geopolitical uncertainty amid the ongoing tensions in the Middle East. Overall strength in the US Dollar may further pressurise the Rupee. However, overall decline in crude oil prices may support the Rupee at lower levels. Traders may take cues from PPI and Michigan consumer sentiment data from the US. USDINR spot price is expected to trade in a range of Rs 83.90 to Rs 84.30.

Shares of Bandhan Bank surged over 10% on Friday following the Reserve Bank of India’s approval for the appointment of its new CEO. Analysts believe this development will bring management stability to the private lender, boosting investor confidence.

Adani Enterprises has successfully raised $500 million through a share sale to local insurance companies, mutual funds, and an existing US-based investor, according to sources with direct knowledge of the transaction. This strategic move comes as the conglomerate continues to strengthen its financial position. Despite the fundraising, Adani Enterprises' share price traded lower, closing at Rs 3,133.65 on the NSE, marking a 1.28% decline.

Birla Opus Paints, a brand under the Aditya Birla Group’s Grasim Industries, has launched its latest advertising campaign titled “Naye Zamane ka Naya Paint,” translating to “New Paint for the New Era.” The campaign, conceptualized by Leo Burnett India, features popular actors Vicky Kaushal and Rashmika Mandanna as brand ambassadors, highlighting the paint's unique features and quality. The film also includes veteran actors Neena Gupta and Saurabh Shukla. Meanwhile, Grasim Industries' stock traded flat on the NSE, priced at Rs 2,704.15.

Noel Tata has been appointed as Tata Trusts' Chairman, the successor to the late Ratan Tata.

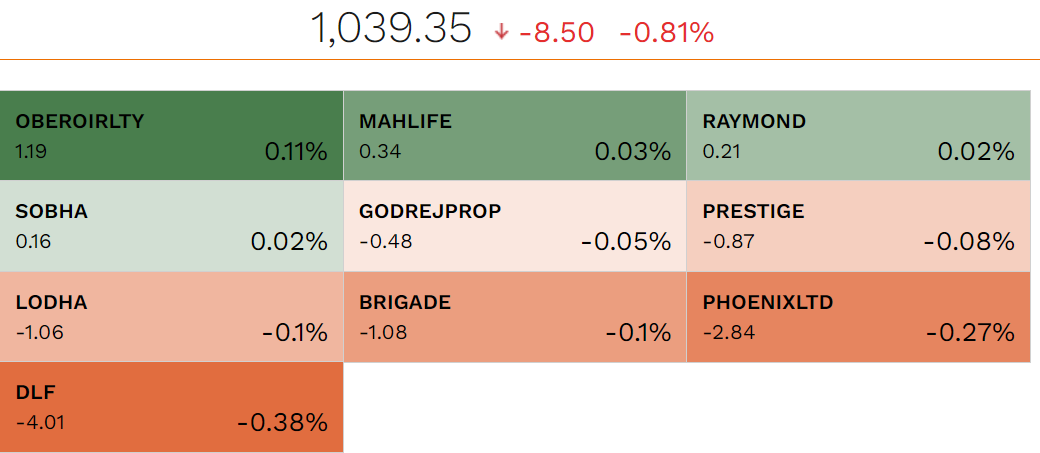

DLF, Phoenix, Brigade Enterprises, Macrotech Developers, and Prestige Estates were the major contributors to the fall of Nifty Realty on October 11.

Courtesy: NSE

Shares of Cummins India fell 5.7% to an intraday low of Rs 3,565. The stock was the major loser in the Nifty Midcap 100 on October 11. The lower band for the stock is placed at Rs 3,404.40.

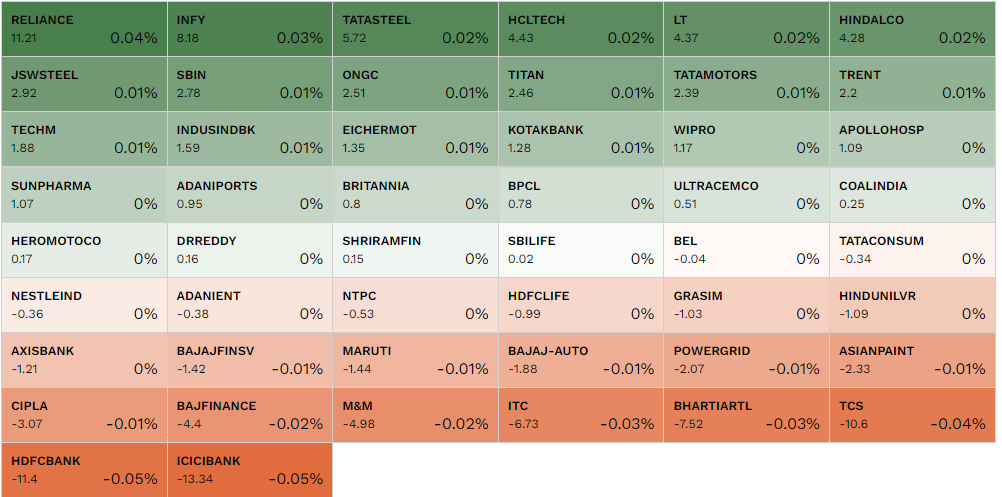

Hindalco, Trent, Tech Mahindra, HCL Tech, and ONGC were the top gainers during the afternoon trade in Nifty 50. TCS, M&M, ICICI Bank, Adani Enterprises, and Cipla were the major losers in the Nifty 50 on October 11.

Swan’s Shipyard, a subsidiary of Swan Energy Limited (SEL), has appointed Rear Admiral Vipin Kumar Saxena (IN Retd.) as Chief Executive Officer. Admiral Saxena’s appointment marks a pivotal step in the company’s ongoing transformation. In this critical role, he will lead the shipyard’s operations, with a focus on driving future growth, modernization, and expansion across critical areas of shipbuilding and marine infrastructure.

Commenting on the TCS Q2 numbers Sagar Shetty, Research Analyst, StoxBox said that The Q2FY25 result of TCS fell short of expectations, with margins contracting. Despite the above-estimated top-line growth, the margins continued to get pressurised, likely due to their deep dive into the talent pool. The offset expected from the deferment in wage hike didn’t come through. While the discretionary spending was impacted in the quarter, Cybersecurity, AI, cloud, and TCS Interactive continued to grow. Win themes across key deals involved vendor consolidation, managed services, UX transformation, technology simplification, legacy modernization, enterprise network transformation, automation and GenAI initiatives. The company saw a steady revival in its BFSI vertical, and growth markets displayed a solid performance.

Shetty also added that the expected rate cut in the US in the upcoming months, we expect a rise in discretionary spending, further improving the company’s revenue visibility. The key things to consider going ahead would be the management plans to achieve its margin guidance of 26-28% in FY25 and the likely shape up of net headcount addition in the coming quarters. The company’s outlook on its order book and demand environment would also be key factors.

Groww added over 4.7 million new SIPs in the July-September 2024 quarter, with 1.6 million new SIPs recorded in September alone. The surge was driven by young investors, over 50% of whom are under 35, and increased financial engagement among women, with female participation at 24%, higher than the national average. Notably, 80% of transactions came from non-metro cities, reflecting growing interest in systematic investment plans (SIPs) across smaller towns. This growth highlights India's shift towards disciplined, long-term financial planning, supported by Groww's efforts to simplify the investment process through UPI autopay.

Tata Elxsi shares surged 2.8% on Friday, hitting a day’s high of Rs 7,980.30 on the BSE after the company posted a solid 14% growth in consolidated net profit for the second quarter ended September 30, 2024. The company’s net profit reached Rs 229 crore, up from Rs 200 crore in the same quarter last year.

Nomura has maintained a Neutral rating on Tata Consultancy Services (TCS) with a target price of Rs 4,150. According to the report, TCS posted a modest miss in revenue for the second quarter (2Q), with a more significant miss in margins. Growth in 2Q was driven by the BSNL deal, while the pipeline is reported to be near record-high levels. Despite this, the total contract value (TCV) has moderated but remains within a comfortable range. Nomura has cut its FY25-26F earnings per share (EPS) estimates by 1.6%-2.4%.

Shares of Bandhan Bank rose 9.5% to an intra-day high of Rs 205.65 after RBI gave the nod to appoint Partha Pratim Sengupta as the MD & CEO of the bank. Sengupta has been appointed for three years.

ICICI Bank, HDFC Bank, TCS, Bharti Airtel, and ITC were the top contributors to the Nifty 50 on October 11.

Courtesy: NSE

Tata Elxsi shares rose more than 3% after the Indian engineering and technology services firm reported a 14.7% year-on-year increase in net profit for the second quarter ended September 30, 2024, surpassing market expectations. The company’s net profit climbed to Rs 2.29 billion (approximately $27.28 million), driven by robust demand in its transportation segment.

"Bank Nifty remains in a strong bullish trend with major support at 51,000 and immediate resistance at 52,000. The index is likely to maintain its upward momentum, with the potential to breach the 52,000 level soon. As the rally continues, we could see further upside towards 52,200 and above. Traders are advised to buy on dips near the 51,000 level, with a stop loss at 50,500, capitalizing on the ongoing bullish momentum," Riyank Arora Technical Analyst at Mehta equities.

BPCL, JSW Steel, Tata Steel, Nestle India, an IndusInd Bank are the top gainers on NSE Nifty 50 index whereas the stop laggards include Tech Mahindra, Apollo Hospitals, HDFC Bank, and Power Grid.

The NSE Nifty 50 opens down by 13.15 points or 0.05% at 24,985.30, while the BSE Sensex falls 132.91 points or 0.16% to 81,478.49 in the opening trade.

Commenting on today's market outlook Prashanth Tapse, Senior VP (Research), Mehta Equities said that Nifty's upside appears capped due to key factors: FIIs turned net sellers, offloading Rs 4,927 crore yesterday, and over Rs 54,200 crore this month. Oil prices spiked to $76 per barrel amid tensions between Israel and Iran, TCS's Q2FY25 results missed expectations with net profit falling to Rs 11,909 crore, and US CPI inflation was higher than anticipated in September. Watch for US PPI data on October 11th.

On the preferred trade side Tapse added that: Nifty (CMP 24,998) buy on dips at 24,850-24,900 with targets at 25,151/25,301, while Bank Nifty (CMP 51,531) buy at 51,100-51,300 with targets at 51,500/51,801. Sell DR Reddy's Labs (CMP 6,583) for targets at 6,481/6,301.