PPFAS Flexicap Fund and its lead fund manager, Rajeev Thakkar, both need no introduction. Over the years, both have together built a reputation which is of following the principles of value investing. Focus on fundamentally strong companies trading well below their intrinsic value. So, when they make changes to their holdings, investors of all types pay complete attention.

According to its recent factsheet, the fund has bought a substantial stake in the world’s 3rd largest telecommunication giants, with presence in 18 countries.

Apart from that, the fund has also raised its stakes in 4 other companies it was already holding. Is there a trend one can decode or a bigger change in the waiting? Let us see if we can find out.

Bharti Airtel Ltd

Established in 1995, Bharti Airtel Ltd is a global telecom solutions provider, serving over 550 million customers in 17 countries across South Asia and Africa. The Company ranks amongst the top three mobile operators globally and its networks cover over two billion people.

With a market cap of Rs 11,14,088 cr, the company has seen a fresh stake by PPFAS Flexicap, which bought a 2.1% stake in it.

Bharti Airtel has reported a compounded jump of 15% in sales from Rs 87,539 cr in FY20 to Rs 172,985 cr in FY25. EBITDA (earnings before interest, taxes, depreciation, and amortisation) was Rs 36,610 cr in FY20 which grew at a compounded rate of almost 21% to Rs 93,159 cr in FY25. As for the net profits, the company logged in losses of Rs 30,663 cr in FY20 but has witnessed a turnaround. In FY25, the company logged in profits of Rs 37,481 cr.

The share price of Bharti Airtel Ltd was around Rs 560 in June 2020 and as of closing on 10th June 2025 it was Rs 1,858, which is a growth of 232% in 5 years.

The company’s share is trading at a current PE of 40x while industry median is just around 44x. The 10-year median Pe for Airtel is 62x and the industry median for the same period is 34x.

Google will be investing up to $1 Bn in partnership with Airtel as part of its Google for India Digitization Fund. The deal includes an investment of $700 Mn to acquire 1.28% ownership in Airtel and up to $300 Mn towards potential multi-year commercial agreements.

Bajaj Holdings & Investment Ltd

Incorporated in 1945, Bajaj Holdings & Investment Ltd, a part of the Bajaj group of companies, is an Investment and Credit Company.

With a market cap of 1,60,416 cr, the company operates primarily as a long-term Investment Company with strategic investment in group companies and investments in listed and unlisted securities of other companies.

PPFAS Flexicap held 6.5% stake in the company under the Parag Parikh Flexi Cap Fund until April 2025, which has jumped to 6.9% as per the latest factsheet.

The company’s sales have growth from Rs 435 cr in FY20 to Rs 684 cr in FY25, logging in a compounded growth of 9%. The EBITDA saw a compounded jump of about 11% in 5 years from Rs 301 cr in FY20 to Rs 505 cr in FY25. The net profits more than doubled from Rs 3,080 cr in FY20 to Rs 6,626 cr in FY25, which is a compounded growth of 17%.

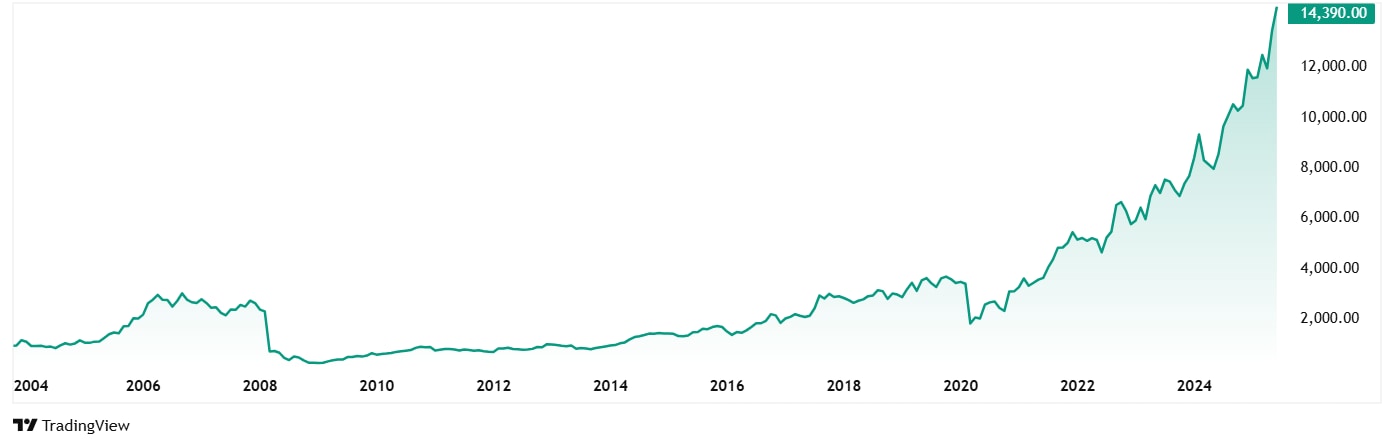

The share price of Bajaj Holdings & Investments Ltd was about Rs 2,350 in June 2020, and as of closing on 10th June 2025, the price was at Rs 14,390, a jump of over 510%.

The company’s share is trading at a PE of 25x while the current industry median however is 23x. The 10-year median PE for Bajaj Holdings & Investments is 12x, while the industry median for the same period is 13x.

Mahindra & Mahindra Ltd

Incorporated in 1945, Mahindra & Mahindra Ltd is one of the most diversified automobile companies in India with presence across 2-wheelers, 3-wheelers, PVs, CVs, tractors & earthmovers. Its part of the Mahindra group of companies.

With a current market cap of Rs 3,81,421 cr, the company also has presence across financial services, auto components, hospitality, infrastructure, retail, logistics, steel trading and processing, IT businesses, Agri, aerospace, consulting services, defence, energy and industrial equipment through its subsidiaries and group companies.

PPFAS Flexicap’s holdings were 3.3% in the company as per its April 2025 factsheet, which has gone up to 3.5% as per the factsheet for May 2025.

As for sales, M&M’s numbers doubled from Rs 75,382 cr in FY20 to Rs 159,211 cr in FY25, which is a compounded growth of 16%. EBITDA grew at a compounded rate of 25% in the same period. The net profits have been a turnaround story of the decade, as the company grew from losses of Rs 321 cr in FY20 to Rs 14,073 cr in FY25, logging in a compounded growth of about 80%.

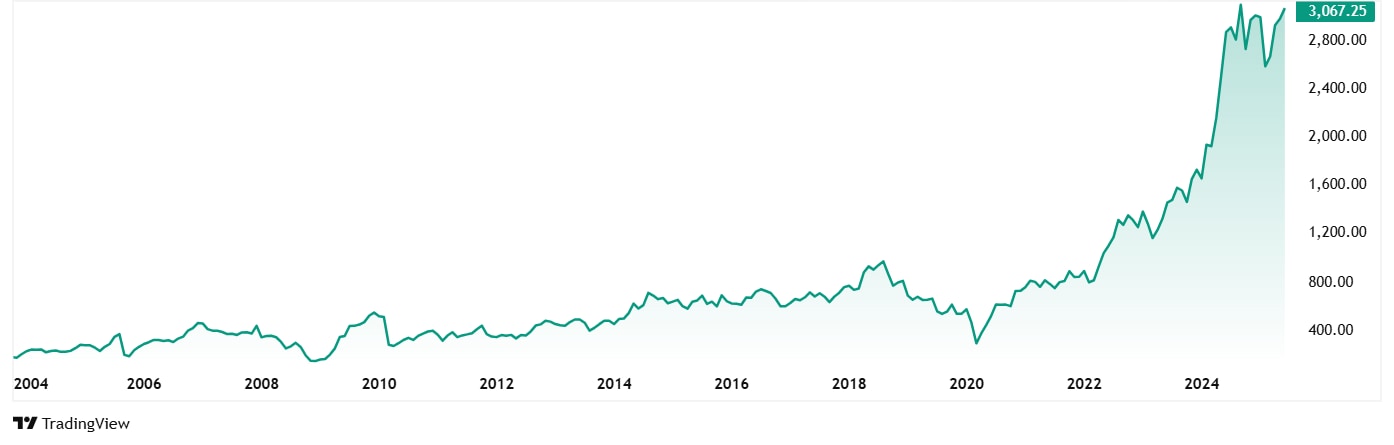

The share price of Mahindra & Mahindra Ltd has seen a jump of 503% from Rs 508 in June 2020 to its current price of Rs 3,067 (as of closing on 10th June 2025).

The company’s share is currently trading at a PE of 30x, which is same as the current industry median. The 10-Year median PE for Mahindra & Mahindra is 25x and the industry median for the same period is 32x.

Coal India Ltd

Incorporated in 1973, Coal India Ltd is a ‘Maharatna’ company under the Ministry of Coal, Government of India with headquarters at Kolkata, West Bengal

With a market cap of Rs 2,46,255 cr, Coal India Ltd is the single largest coal producing company in the world and one of the largest corporate employers.

PPFAS Flexicap raised its stakes in Coal India, from 5.8% to 6% as per the most recent factsheet for PPFAS.

The company’s sales have grown at a compounded rate of 8% in the last 5 years form Rs 96,080 cr in FY20 to Rs 143,369 cr in FY25, while the EBITDA logged in a compounded jump of about 112% in 5 years. The net profits have also seen a compounded jump of 16% in the same period.

The share price of Coal India Ltd was around Rs 135 in June 2020, which has now jumped to Rs 400 (as of closing on 10th June 2025), which is a jump of about 197%.

The company’s share is trading at a current PE of 7x, while industry median is around 12x. The 10-year median PE for Coal India is about 8x while the industry median for the same period is 11x.

EID Parry (India) Ltd

Established in 1900, EID Parry is engaged in Sugar, Nutraceuticals and ethanol production. A part of the Murugappa group, it is also has a significant presence in the Farm Inputs business including Bio pesticides through its subsidiary, Coromandel International Limited.

With a current market cap of Rs 17,321 cr, the company is part of the Murugappa group of companies, which is a 123-year-old conglomerate with a presence across India and the world with diverse businesses in agriculture, engineering, financial services etc.

PPFAS Flexicap raised its stake in the company from 0.2% to 0.3% as per its latest factsheet.

The company’s sales have grown at a compounded rate of 13% from Rs 17,129 cr in FY20 to Rs 31,609 cr in FY25. The EBITDA has gone from Rs 1,887 cr to Rs 2,633 cr in the same period. The net profits have seen a 10% compounded jump from Rs 889 cr to Rs 1,773 cr during the same period.

The share price of EID Parry (India) Ltd was about Rs 226 in June 2020 and has jumped to its current price of Rs 974 (as of closing on 10th June 2025).

The company’s share is trading at a current PE of 23x, and industry median is also 23x. The 10-year median PE for EID Parry is 11x while the industry median for the same period is 27x.

Follow The Parikh-Thakkar Pattern?

For a true value fund that PPFAS Flexicap is, addition of a stock like Bharti Airtel is sure to turn heads, as some in the industry consider it a momentum stock. The Sensex was up around 8% in the last year while Bharti Airtel is up almost 30%, which is why many are calling it a momentum stock. There is definitely something other than the profit turnaround that the fund sees in Bharti Airtel.

Other than that, the 4 stocks where the fund has raised stakes also display a mix of financials but have one thing in common – the trust of one of the most trusted funds in the country.

How these stocks will do in the short and long-term will be a ride to watch, given that some of the best fund managers have shown a lot of trust in them. It would not be such a bad idea to keep a very close eye on these stocks, add to the watchlist, may be?

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.