Life Insurance Corporation of India (LIC), the country’s largest institutional investor, has long held concentrated bets on a handful of blue-chip names. Its top three holdings — ITC (15.5%), Larsen & Toubro (L&T) (13.3%), and Infosys (10.5%)—collectively make up a significant portion of its investment book. We have not taken IDBI Bank, in which LIC owns a 49.2% stake, as it is categorised differently given its strategic nature.

With markets hovering near all-time highs and many investors reassessing their portfolios, the question is whether LIC’s top equity picks still offer enough upside or are these holdings now more about capital preservation than fresh growth?

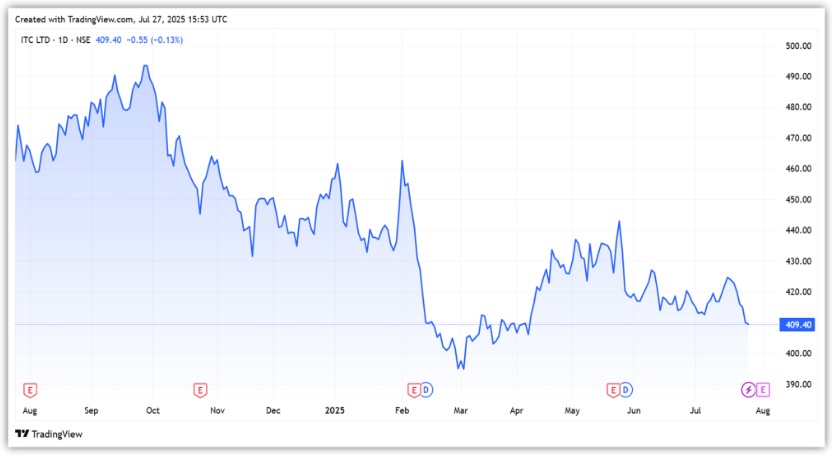

#1 ITC

ITC is the country’s largest cigarette manufacturer and seller. It operates in four business segments: FMCG cigarettes, FMCG others, paper and packaging, and agribusiness. The company’s hotel business was spun off into a new company, ITC Hotels.

Cigarettes Remain Core Profit Driver Despite Diversification

Cigarettes contributed the most at 44.4% of its ₹734.6 billion revenue in FY25. FMCG-Others contributed 30% (or ₹219.8 billion), Agribusiness 27% (or ₹197 billion), Paper & Packaging 11.5% (or ₹84 billion) and Others. Although ITC has diversified its revenue profile over the years, cigarettes still account for 75% of its profits.

In FY25, cigarette business revenue grew 7.1% year-on-year, while profit before interest and tax (PBIT) rose 5% to ₹200 billion. The growth was primarily volume-led, driven by market share gains from illicit trade, premium offerings, and stability in tax rates.

FMCG Others Sees Margin Pressure Amid Weak Demand and Inflation

FMCG Others revenue grew 5%. The growth was led by growth in the flour, spices, snacks, dairy, premium personal wash, homecare and agarbatti categories. But, the segment’s Profit before interest and tax (PBIT) declined 11% to ₹15.8 billion as severe inflation and marketing investments impacted its margins.

EBITDA margin fell 140 basis points (bps) to 9.8%. EBITDA stands for earnings before interest, tax, depreciation, and amortization.

The sector also faces weak demand conditions and increasing competition, particularly from regional and private label brands, as consumers increasingly opt for non-branded products over branded ones. However, its premium portfolio continued to exhibit strong performance.

ITC has launched over 100 new products during the year, focusing on health & nutrition, hygiene, protection & care, convenience, and indulgence. The Company also expanded its market coverage to about twice pre-pandemic levels and rapidly scaled up its digitally powered eB2B platform, UNNATI, covering nearly 8 lakh outlets.

Digitally enabled sales, along with modern trade, now account for 31% of the Company’s branded packaged foods, personal care products, incense sticks (Agarbattis), and safety matches sales, up from 17% in FY20.

The company also acquired several new-age businesses in the FMCG sector, including 24 Mantra Organic Foods, Mother Sparsh and Prasuma & Metigo. These acquisitions have given ITC a direct presence in high-growth and forward-looking businesses.

Agri Business Outperforms, While Paper Segment Lags Behind

ITC’s agri business delivered an exceptionally strong performance, with segment revenue growing 25% and PBIT increasing 18% to ₹14.8 billion. Leaf tobacco, value-added agri products (VAAP), and rice exports led the robust growth.

To further maintain momentum, it’s focusing on scaling up its VAAP portfolio, which includes species, coffee, frozen marine products, and processed fruits. It’s also strengthening its presence in food-safe markets, like the USA, EU, and UK, for spices.

The ITCMAARS (crop-agnostic, full-stack AgriTech platform) has been successfully scaled up across 11 states, adding over 2,050 Farmer Producer Organisations (FPOs) that encompass about 2.1 million farmers. This aims to create new revenue streams for the agri sector and farmers.

The paperboard segment also remained sluggish. Its revenue grew 1%, while PBIT fell 34% to ₹9.1 billion. Lower demand, high lumber prices and low-priced Chinese and Indonesian supplies continue to impact its paper segment.

On a consolidated basis, its gross revenue rose 10% to ₹735 billion, while net profit rose just 1% to ₹201 billion. The company anticipates consumption to pick up in FY26, driven by recovery in urban demand, lower inflation, and tax cuts, which are expected to boost disposable incomes.

ITC trades at a price-to-equity multiple of 26x, in line with the 10-year median of 26x.

#2 Larsen & Toubro

Larsen & Toubro (L&T) is one of Asia’s largest vertically integrated engineering, procurement and construction groups. It has strong market positions across sectors including infrastructure, power, hydrocarbons and heavy engineering.

L&T operates in six major sectors. Infrastructure dominates contributing 51% to revenue, followed by services (26%), energy (16%), high-tech manufacturing (4%), and others.

Infrastructure and Power Segments Drive Growth in FY25

Infrastructure segment revenue rose 15% YoY to ₹1,299 billion in FY25, driven by efficient order book execution. EBITDA margin also improved 20 bps to 6.4%. L&T expects a project pipeline of ₹9.6 trillion and significant order pickup in FY26.

The power projects segment’s revenue grew 38% to ₹407 billion. However, margins fell 160 basis points to 8.4%. The high-tech manufacturing segment is relatively small, with revenues growing 18% to ₹97 billion. Margins also expanded 100 basis points to 17.3%.

Revenue from development projects declined 4% to ₹53.7 billion. This segment includes power development (Nabha Power) and Hyderabad Metro. Due to the decline in revenue, the segment margin declined 380 basis points to 19.9%.

On a consolidated basis, revenue (excluding financial services) grew 16% to ₹2.4 trillion, driven by strong execution of large order book in the EPC business. EBITDA margin declined 40 basis points to 10.8% due to sluggish performance in the IT business. Net profit grew 14% to ₹176.7 billion.

Order Book Strength Underpins Medium-Term Outlook

As of March 2025, order book stood at ₹5.8 trillion, with the majority of orders coming from infrastructure (62%), energy (28%), high-tech manufacturing (7%). International orders accounted for 46% of the order book, mainly from the Middle East. These are expected to drive strong revenue prospects over the next three fiscal years.

Strong Guidance supported by Order Inflows

Looking ahead, L&T expects order inflows to grow by 10% in FY26. The management has also said that it will revise its guidelines after monitoring performance in the first half of FY26 due to evolving geopolitical conditions.

L&T also expects group revenue to grow by 15% in FY26. Strong order book execution across all segments is expected to contribute to this growth. From a valuation perspective, it trades at a P/E of 31x, premium to 10-year median of 28x.

#3 Infosys

Infosys is the second-largest listed Indian IT services company in terms of revenue. It offers a range of digital and traditional IT services to corporate across sectors.

Its digital offerings include emerging segments like AI-based analytics, cloud migration, Internet of Things, and cybersecurity. Traditional services include application development, and enterprise solutions. It serves clients across sectors like financial services, retail, manufacturing, hi-tech, and energy.

In FY25, Infosys derived nearly 28% of its revenue from the banking, financial services and insurance (BFSI) sector. It also has a strong presence in other sectors such as retail (13.5%), communications (11.7%), energy, utilities, resources and services (13.3%), manufacturing (15.5%), high-tech (8.0%), and life sciences (7.3%).

In FY25, revenue rose 6% year-on-year to ₹1.6 trillion, led by 5.2% growth in financial services and 11.2% in manufacturing. Net profit rose 2% to ₹267 billion. Infosys, like the broader sector, is facing demand challenges, which have weighed on its performance.

In Q1FY26, revenue rose 7.5% YoY to ₹423 billion, while net profit grew 8.6% to ₹69 billion. Growth was driven by better pricing and higher volumes. Operating margin stood at 20.8%, down 30 bps from 21.1% in Q1FY25.

Manufacturing and Europe Lead Recovery in Q1FY26

Manufacturing continues to lead with 15% revenue growth, followed by energy (7%), financial services (6%). Geographically, Europe led with 16% revenue growth, while North America (0.5%), India (-3.1%), and the Rest of the World continue to lag.

The company added 93 clients during the quarter, with total client now standing at 1,861. Most large deals stemmed from client consolidation. The top 5 clients account for 13% of revenue, top 10 for 21%, and top 25 for 35%. The number of $1 million+ clients rose to 1,011, up from 987 in Q1FY25.

Moderate Guidance Reflects Subdued Demand

Looking ahead, the company expects the first half to be stronger than the second due to seasonality and near-term visibility. It has guided for 1–3% constant currency growth, with the lower end revised upward from 0–1%. The margin guidance for FY26 remains at 20–22%.

Infosys currently trades at a P/E of 23, in line with its 10-year median of 22.

Conclusion

For LIC, ITC, L&T, and Infosys, offer a mix of steady growth, strong fundamentals, and defensive appeal. While valuations are largely in line with historical averages, near-term upside may depend on broader market sentiment. For long-term investors, these names still hold relevance, though fresh returns could be more measured. Add them to your watchlist?

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.