Tata Small Cap Fund is a growth-oriented scheme in the Small Cap Fund category that has exhibited a noteworthy track record since its inception and has outpaced many of its prominent peers, thereby rewarding investors with superior risk-adjusted returns.

Launched in November 2018, Tata Small Cap Fund aims to invest in stocks of companies that are in growth mode and have the potential to make it big in the market. Tata Small Cap Fund looks to identify growth-oriented sound stocks available at reasonable valuations. Its emphasis is on stocks that carry low debt and high cash flow. The fund invests over 85-90% of its assets in stocks of small-sized companies as compared to the category average of 75%. While this may pose liquidity risk typically associated with stocks of small-sized companies, the fund’s focus on diversification in fundamentally sound stocks across various sectors has enabled it to reward investors.

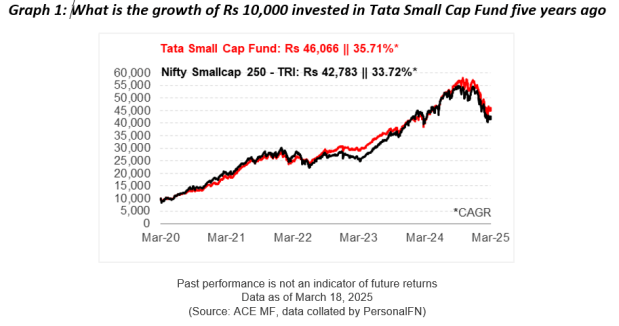

The fund has displayed remarkable growth since its inception, generating returns at a CAGR of about 22% and outpacing the benchmark returns of 18.6%. It has flourished under the supervision of Mr Chandraprakash Padiyar, who has been managing the scheme since its launch. Tata Small Cap Fund efficiently limited the downside risk during the market crash of 2020, while it also found a place among the top performers in the category in the recent bull phase. In the last five years, Tata Small Cap Fund has generated returns at a CAGR of 35.7% as against a CAGR of 33.7% in its benchmark Nifty Smallcap 250 – TRI. An investment of Rs10,000 in Tata Small Cap Fund five years back would have now accelerated to 46,066, while a simultaneous investment in the benchmark would now be valued at Rs 42,783.

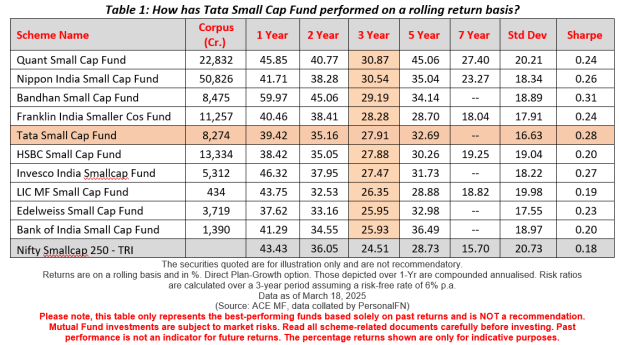

Within a relatively shorter time span of little over 6 years, Tata Small Cap Fund has established itself among the top performers in the Small Cap Fund category. Even though the fund has trailed the benchmark in the last one year, it has outperformed the category average. Over the longer 3-year and 5-year period Tata Small Cap Fund has maintained a lead of about 3 percentage points over the category average as well as the benchmark Nifty Smallcap 250 – TRI, on a rolling returns basis.

Despite relatively higher allocation to small caps, the fund has registered lower volatility compared to most of its peers as well as the benchmark. The fund’s risk-adjusted return, as denoted by the Sharpe ratio has been commendable, much ahead of the benchmark and among the highest in the category.

What is the investment strategy of Tata Small Cap Fund?

Tata Small Cap Fund is mandated to invest a minimum of 65% of its assets in equity and equity-related instruments of small-cap stocks. SEBI defines small-cap stocks as those ranking beyond 250th in terms of market capitalisation. Tata Small Cap Fund follows a ‘bottom-up’ strategy to assess the valuations and fundamentals of the stock they are considering.

The fund focuses on buying businesses that can grow in terms of profitability and cash flows with strong balance sheets where businesses can surprise the markets over a period of time in terms of delivery of earnings which in turn can lead to rerating of valuations. It follows the ‘Growth at reasonable price’ approach to pick stocks. Tata Small Cap Funds aims to maintain a well-diversified portfolio of small-cap stock at all times and hold them over the medium to long term to derive its full potential.

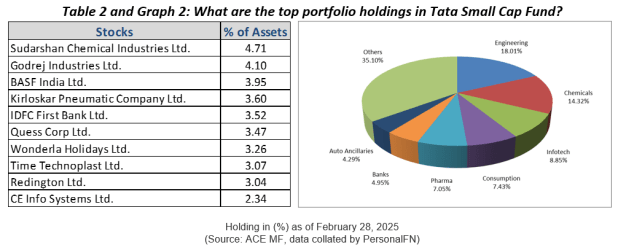

Tata Small Cap Fund holds around 50-60 stocks in its portfolio. As of February 28, 2025, the fund held 58 stocks in its portfolio with the top 10 stocks accounting for about 35% of its assets. The fund held higher allocation in stocks such as Sudarshan Chemical Industries, Godrej Industries, BASF India, Kirloskar Pneumatic Company, and IDFC First Bank. Tata Small Cap Fund avoids chasing momentum bets and focuses on investing with a long-term view. Accordingly, it has had a low portfolio churn of less than 20% in the last one year.

In the last two years, Tata Small Cap Fund benefitted the most from its prominent holdings in Radico Khaitan, BASF India, Kirloskar Pneumatic Company, Greenply Industries, Elantas Beck India, Gokaldas Exports, Krsnaa Diagnostics that collectively contributed about 15% to its absolute gains. The fund also gained from its exposure in Healthcare Global Enterprises, UTI Asset Management, Redington, KSB, Quess Corp, among others.

Sector-wise, Tata Small Cap Fund’s portfolio is skewed towards Engineering and Chemicals, having combined allocation of 32.3% in the portfolio. It also holds substantial exposure to Infotech, Consumption, Pharma, and Banks that form another 23% of its assets. Auto Ancillaries, Construction, Finance, Leisure, and Transportation are among the other core sectors in the portfolio. Notably, the fund’s portfolio is dominated by Sensitive and Defensive sectors, with some allocation to Cyclicals.

What is the liquidity profile of Tata Small Cap Fund?

As per the latest stress test results disclosed by AMCs, Tata Small Cap Fund would take 43 days to liquidate 50% of its portfolio, while it would take 22 days to liquidate 25% of its portfolio. While this makes the fund less liquid compared to many of its peers, its focus on maintaining a well-diversified portfolio within the small-cap space and preference for reasonably priced stocks can help it deal with stressful market conditions.

Is Tata Small Cap Fund suitable for my investment goals and risk tolerance?

Tata Small Cap Fund has performed consistently well since its inception in November 2018. The fund stood strong during the bear market of early 2020 and also proved its potential to capitalise on the market rallies in the recent bull phase. The fund has achieved this by maintaining a well-diversified portfolio of stocks across diverse sectors. With this, the fund has been able to reward investors with remarkable risk-adjusted returns.

While the fund has a higher allocation to stocks in the small-cap segment compared to its peers, making it less liquid, it manages the risk by identifying fundamentally sound stocks available at reasonable valuations. It has also capped the exposure in each of its stock holdings to under 5%, which can help it limit the downside risk.

Tata Small Cap Fund is suitable for aggressive investors looking to benefit from a diversified portfolio of growth-oriented small-cap stocks with a long-term view of at least 5-7 years.

Note: Tata Small Cap Fund has suspended fresh investments via the lump sum and switch-in mode with effect from July 2023 and now only accepts investments via SIPs and STPs.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.