Madhusudan Kela’s portfolio has quietly surged 66% year to date, touching ₹3,826 crore (as of 6 June 2025). But what’s drawing attention isn’t just the numbers—it’s the kind of companies he’s backing.

Known for spotting under-the-radar opportunities long before they become mainstream, Kela has recently added three small-cap names to his portfolio. Interestingly, these aren’t fresh listings or early-stage plays. Each of them has already experienced a massive run-up, rising over 165 times in the last five years.

We take a closer look at each of these bets.

Let’s take a look..

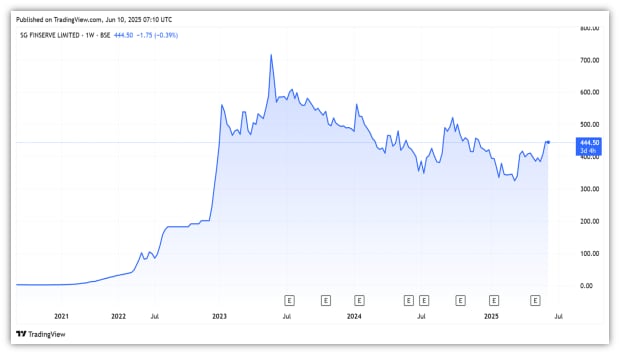

#1 SG Finserv

SG Finserv is a tech-enabled, RBI-registered non-banking finance company. It provides business financing solutions to channel partners, dealers, distributors, retailers, buyers, suppliers and other corporate stakeholders.

It leverages technology and a distribution network to provide tailored financing solutions to small and medium-sized enterprises (SMEs), micro, small, and medium enterprises (MSMEs), and other corporations.

Loan Book Expands, But Income Hit by Regulatory Disruptions

The company’s assets under management (AUM) increased 39% from last year to ₹23.3 billion in FY25. Over 75% of the loan book is secured, with the rest unsecured. Geographically, North India contributes 44%, followed by West (30%), South (23%), and East (3%).

However, total income declined 10% to ₹1.7 billion, as fees and other income fell 32%, and a 9% decline in interest income. The decline was driven by regulatory hurdles faced during Q4 FY24 through Q2 FY25.

Looking ahead, the company aims to increase its AUM to ₹60 billion by FY27, up from its current level of ₹23.3 billion. To support this growth, it has partnered with large companies, including the Tata Group, Ashok Leyland, JSW-MG Motors, Adani Group, Jindal Steel, Kajari Ceramics, and Bajaj Electricals.

Growth Plans Backed by Big-Ticket Partnerships and Fresh Capital

The company has also signed a memorandum of understanding worth Rs 55 billion with partners to achieve its FY27 loan book target. It has secured equity investments worth ₹4.5 billion in equity through warrants, with ₹3.4 billion expected in FY26.

This is a fresh buy for Madhusudan Kela, who had bought a 1.7% stake in Q4FY25. From a valuation perspective, it trades at a price-to-book multiple of 2.9x, a slight premium to the 10-year average of 2.6x.

SG Finserv Share Price is Up 164x in the last 5 years.

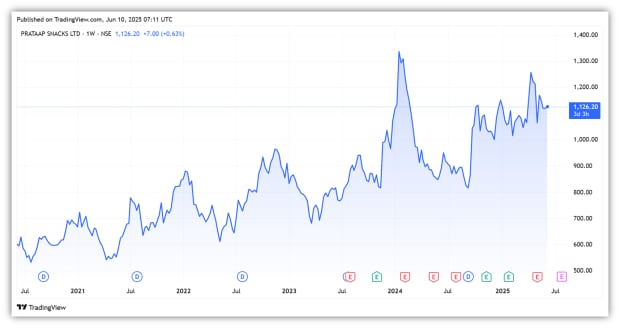

#2 Prataap Snacks

Prataap Snacks is an Indian snack food company. It manufactures and markets potato chips, extruded snacks, and traditional Indian savoury and sweet snacks under its two brands–Yellow Diamond and Avadh.

The company is the market leader in rings and extruded snacks. It follows a direct-distribution model, where stocks go straight to a sub-distributor before reaching the retailer. According to Pratap, this model helps improve its EBITDA margins by 3%. EBITDA means earnings before interest, tax, depreciation and amortization.

With over 5,200 distributors and 16 manufacturing units across India, Prataap ensures strong market reach, lower logistics costs, and quicker product availability.

In FY25, revenue rose 6% from last year to ₹16.9 billion, driven by distribution network expansion and a focus on core markets. 56% of this revenue came from Extruded Snacks, followed by Potato Chips (21%), Namkeen (18%), and others.

Geographically, revenue remained well-diversified. West India accounted for 38%, followed by North (31%), East (24%), and South (7%).

Margins Take a Hit Despite Steady Revenue Growth

However, gross margin declined 623 basis points to 27.2% due to a 15% increase in raw material costs. EBITDA margin declined 586 basis points to 2.9%. The company reported a loss of ₹0.34 billion, compared to a profit of ₹0.53 billion last year. This includes an exceptional loss of ₹0.34 billion due to a fire incident at the Jammu plant.

Looking ahead, margins are expected to improve in FY26, aided by stable raw material prices and cost optimization. Over the long term, it plans to drive growth through distribution network expansion and margin expansion.

It is working on diversifying its product range and expanding into exports and quick commerce to boost growth. The company also appointed a consultant to improve its growth more effectively. With tax cuts and a good monsoon, the company may perform better this year.

Kela, Authum Bought Controlling Stake

In Q4FY25, Mahi Madhusudan Kela and Authum Investment & Infrastructure bought 4.6% and 42.9% stakes, respectively, from Sequoia. Both have jointly purchased a controlling stake in the company.

Since the company reported a loss, we used the price-to-sales (P/S) ratio for valuation. It trades at 1.6x P/S, a slight premium to its 7.5-year median of 1.4x.

Prataap Snacks Share Price is Up 88% in the last one year.

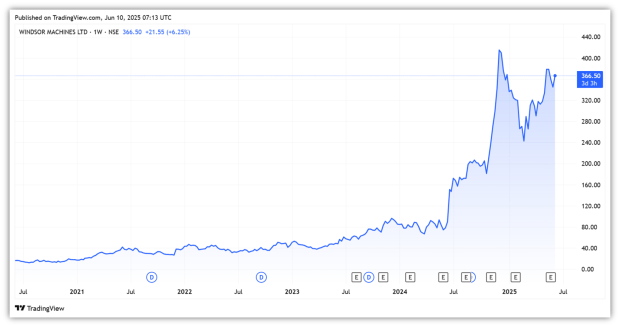

#3 Windsor Machines

Incorporated in 1963, Windsor Machines is in the business of manufacturing plastic processing machinery. The company services the plastic processing industry in over 65 countries, with an installed base of over 30,000 machines.

It has collaborations with global players such as Kuhne GmbH (Germany) and Italtec (Italy). Windsor positions itself as a leading machine supplier with one of the lowest operating costs per kg of processed polymer.

Revenue Grows Modestly, Loss Narrows in FY25

Windsor’s revenue increased 4% to ₹3.7 billion in FY25. 51% of revenue came from injection moulding machinery, 38% from extrusion machinery, and the rest from CNC and VMC machinery. Its net loss narrowed to ₹30 million, from ₹80 million in FY24.

Looking ahead, Windsor is investing in research and development to differentiate its product offerings. It believes the plastics processing industry is well-placed given its role in reducing waste and supporting recycling initiatives.

Kela Buys In as Windsor Bets on R&D and Recycling Push

As per the latest quarterly shareholding data, Madhusudan Kela bought a 7.7% stake in Windsor Machine in Q4FY25. From a valuation standpoint, it trades at a P/S multiple of 6.8x, well-above the 10-year median of 0.9x. We have used P/S as it’s a loss-making company.

Windsor Machines Share Price is Up 21x in last 5 years

Conclusion

All three companies show distinct paths in FY25. Prataap Snacks is navigating margin pressures despite stable revenue, SG Finserv has resumed strong AUM growth post regulatory clarity, and Windsor Machines appears to be stabilising after losses, though bottom line remains in the red. While SG Finserv stands out with visible momentum, the outlook for the other two hinges on execution and a recovery in profitability.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.