Sameer Arora of Helios Capital made some notable additions to his portfolio in the March quarter, picking up stakes in three new companies. For someone known to back quality names with clear visibility, such fresh entries often invite curiosity.

These moves don’t always hint at a big thematic shift. Sometimes it’s about finding better value or spotting an underappreciated growth story. Still, if you follow his investing style or own any of these names, it’s worth asking—what’s he seeing that the broader market might be missing?

Let’s take a look.

#1 Axis Bank

Axis Bank is India’s third-largest private sector bank and the seventh-largest overall. It has a 5% market share in deposits, advances (5.4%), Unified Payment Interface (32%), and credit cards (14%)–highlighting its strong presence across key banking segments.

In FY25, the bank’s net interest income rose 9% year-on-year to ₹498.9 billion. However, net interest margin declined nine basis points to 3.97%. The margin declined due to the Reserve Bank of India’s interest rate cut, as 57% of the bank’s floating loans were repriced at lower rates.

Meanwhile, non-interest income–including fees, trading, and others—grew by 13% to ₹252.6 billion in FY25. Consequently, operating revenue increased 10% to ₹723.4 billion. With expenses rising at a slower pace of 6%, operating profit grew 13% to ₹371 billion.

Despite stronger revenue growth, net profit rose just 6% to ₹263.7 billion as credit cost rose 38 basis points to 1.04%. This led to a moderation in returns, with average return on assets and return on equity declining to 1.7% and 16.5%, respectively, from 1.8% and 18.9% a year ago.

The bank’s balance sheet continued to expand, growing 9% year-on-year to ₹16.1 trillion as of Q4FY25. Total deposits grew 10% to ₹11.7 trillion, driven mainly by a 14% increase in term deposits. Current and savings account deposits grew 6%, and 3%, respectively.

However, CASA deposits’ share in total deposits declined to 39% from 41% in Q4FY24– an industry-wide trend. On the lending side, advances rose 8% to 10.4 trillion. Retail loans accounted for 60% of the loan book, growing 7% to ₹6.2 trillion. Of this, 72% were secured loans, with home loans alone making up 27% of the retail portfolio.

The bank’s asset quality remained stable. Gross non-performing assets improved to 1.28% from 1.43% in Q4FY24, while net NPA rose slightly to 0.33% from 0.31%. The provision coverage ratio stood at 75%, down from 79% in Q4FY24.

Looking ahead, as the interest rate cycle is expected to decline, the bank expects some pressure on margins. However, it aims to manage this by optimising asset mix and improving balance sheet efficiency.

In terms of asset quality, the bank is becoming more stringent in classifying loans and has tightened its approach to one-time settlements. This could result in higher slippages in FY26. In unsecured loans, the bank has guided to maintain 100% provisioning.

As per Trendlyn, Helios Flexi Cap Fund made a fresh entry, adding 57.59 lakh shares (1.94% of total AUM) in April 2025. Shareholding percentage is not available.

From a valuation perspective, Axis Bank trades at a price-to-book multiple of 2x, about 10% lower than the 10-year median of 2.2x. It trades at a discount to HDFC Bank (2.8x) and ICICI Bank (3.3x).

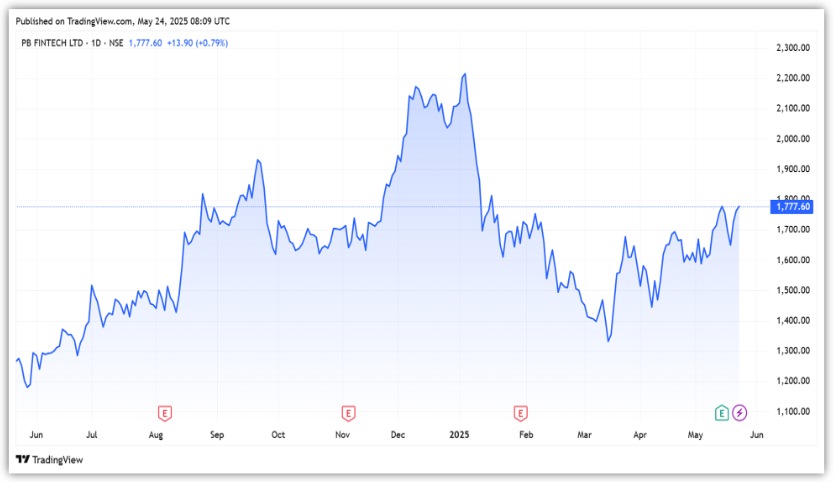

#2 PB Fintech

PB Fintech is the umbrella entity behind India’s leading digital marketplaces, PolicyBazaar and Paisabazaar. These marketplaces offer consumers a wide range of insurance and lending solutions.

Policybazaar is India’s leading online insurance marketplace with a market share of 93%. As of Q4FY25, the platform had 104.8 million registered users and 20.6 million active users, and has sold over 52.6 million insurance policies.

On the other hand, Paisabazaar is the country’s largest comparison platform for credit products. It has served over 50.8 million consumers across 820+ cities, covering 16% of the country’s active credit score consumers.

The platform caters to diverse borrower bases, including salaried, self-employed, and new-to-credit customers. It has a base of 5.8 million transacting consumers, with an average transaction of 8.3 million per customer.

PB Fintech’s revenue mix is diversified. The core online business, comprising insurance and loans, contributed 62% of total revenue. Of this, 52% comes from insurance and 10% from loans. The remaining 38% came from new initiatives such as PB Partners, PB for business, PB UAE, and PB Connect.

In FY25, within the core business, insurance revenue rose 52% to ₹25.7 billion, supported by strong premium growth. However, loan revenue declined 14% to ₹5 billion, as the pace of disbursal declined due to an industry-wide credit slowdown. Despite this, the segment stayed profitable.

On the other hand, revenue from new initiatives grew sharply by 79% to ₹19 billion. But this segment remained loss-making at the EBITDA level, posting a ₹168 crore loss. That said, PB Fintech turned profitable on a consolidated level, reporting a positive EBITDA of ₹0.9 billion and a net profit of ₹3.5 billion, respectively.

Looking ahead, the company maintains a long-term annual growth target of 30%. Management believes it can grow at 2–3x the industry rate, and in some segments like health insurance, its new business acquisition is scaling at 4–5x the industry growth rate.

As per Trendlyn, Helios Flexi Cap Fund made a fresh entry in April 2025, adding 2.28 lakh shares. This represents 1.25% of the fund’s total AUM, though exact shareholding percentage in the company is not yet disclosed.

#3 Ather Energy

Ather Energy is a leader in India’s electric two-wheeler (E2W) market. The company designs, develops, and assembles electric scooters in-house, along with battery packs, charging infrastructure, and supporting software services.

As of FY25, Ather operates 351 experience centers and 3,611 charging points nationwide. It holds an 11.4% market share in the E2W market, behind Bajaj Auto, TVS Motor, and Ola Electric. Together, these four players account for over 80% of India’s E2W sales.

In FY25, Ather’s revenue increased 29% from last year to ₹22.6 billion, driven by a 42% surge in vehicle sales. Of the total revenue, 88% came from vehicle sales, while the remaining 12% came from vehicle-related ancillary services. Notably, gross margins doubled to 19%, up from 9% in FY24.

However, the company remained in the red, with a net loss of ₹8.1 billion, down from Rs 10 billion in FY24. A contributing factor was the 12% drop in revenue per vehicle sold, which fell to ₹0.128 million.

Management remains optimistic about FY26, citing a strong industry outlook. This expected growth momentum is partly due to the industry’s focus on overcoming hurdles such as battery life, warranty, charging anxiety, and resale value.

To meet this demand, Ather plans to launch more products, expand distribution, and intensify its marketing efforts. The company has cited the expansion of the distribution network as the biggest driver for growth. It plans to reach hundreds of cities where it is not present.

On the profitability front, Ather expects FY26 and FY27 to be quite transformative for the company’s overall profit and loss. Operating leverage is expected to kick in more as volumes grow, potentially turning the company profitable at the net level.

As per Trendlyn, Helios Flexi Cap Fund added 6.99 lakh shares (0.76% of total AUM) in April 2025. Shareholding percentage is not available.

From a valuation perspective, Ather trades at a price-to-sales multiple of 5.3x, a premium to Bajaj Auto (4.9x), TVS Motors (3x), and Ola Electric (4.2x). Since it is a newly listed company, historical valuation benchmarks are unavailable.

Conclusion

Sameer Arora’s latest picks reflect a mix of stability, new-age business, and future-ready themes. While Axis Bank is already an established and leading bank, PB Fintech and Ather Energy are emerging new-age companies with high growth potential in the long run.

However, as with every business, there are inherent risks, like a change in commission structure in the case of PB Fintech, and Ather continues to remain in the red for an extended period.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was unavailable have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.