A portfolio of 17 stocks currently with a net worth of almost Rs 3,800 cr, Madhusudan Kela does not need an introduction. Over the years he has proved repeatedly, that he is one of the most prolific investors in the Indian markets, with a penchant of picking and exiting stocks at just the right time.

When he makes changes to his portfolio, investors across board pay close attention to, just to try and gauge what the strategy behind the moves is.

So, before the fresh exchange filings for the quarter ending June 2025 start coming in from July, it is a wise decision to look at what he has done with his portfolio in the first 6 months of 2025, to try and see if we can figure out his future moves.

The Fresh Picks

Windsor Machines Ltd

Incorporated in 1963, Windsor Machines Ltd is into the business of manufacturing of plastic processing machinery, which includes pipe extrusion, blown film extrusion and injection moulding machines.

With a market cap of Rs 3,125 cr, the company has substantially reduced its overall debt in the last 5 years from Rs 53 cr to Rs 12 cr. Madhusudan Kela bought a 7.7% stake in the company earlier in 2025, worth Rs 240 cr.

The company has recorded a compounded jump of 5% in sales from Rs 283 cr in FY20 to Rs 369 cr in FY25. EBITDA (earnings before interest, taxes, depreciation, and amortisation) has also grown from Rs 6 cr to Rs 24 cr in the same period, logging in a compounded growth of 32%.

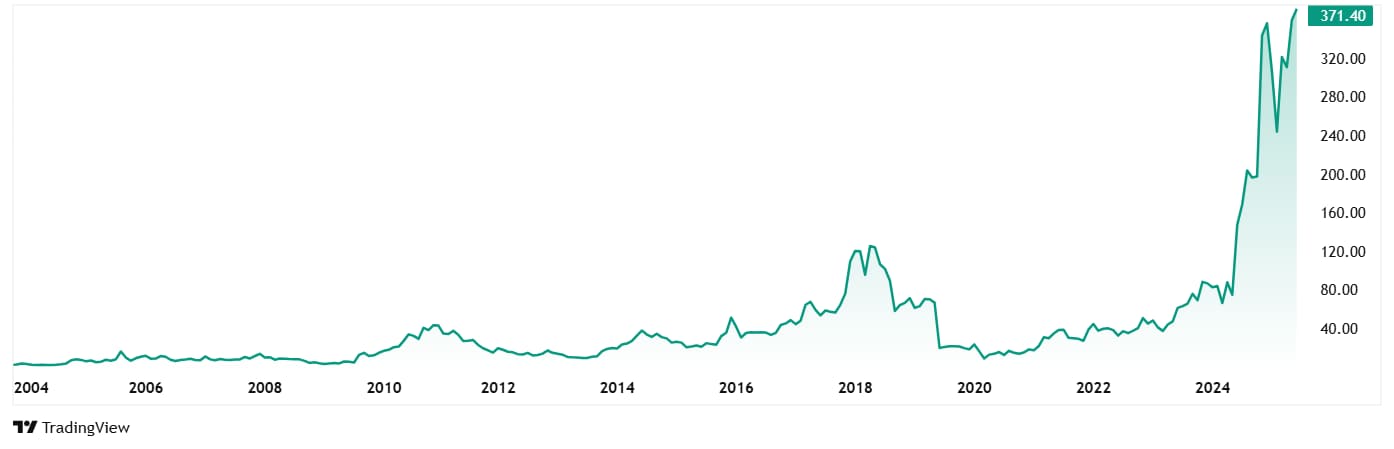

The share price of Windsor Machines was around Rs 17 in June 2020 which is grown by 2,076% to its current price of Rs 370 as on 18th June 2025. The stock is still trading at a 16% discount from its all-time high price.

The company’s share is trading at a PE of a big 421x, while the industry median when compared to peers is a modest 36x. The 10-Year median PE for Windsor Machines is however 45x, and the industry median for the same period is due to the losses recorded, but the industry median is 28x.

SG Finserve Ltd

Incorporated in 1994 as Moongipa Securities Ltd, the company now known as SG Finserv Ltd, provides financing solutions to channel partners (Dealers, Distributors, Retailers, Buyers, etc.) of Indian corporations at competitive rates of 10-13% per annum to grow their business and that of their business partner.

With a market cap of Rs 2,824 cr, the company saw a fresh stake by Kela of 1.7% worth Rs 41 cr, as per the exchange filings for the quarter ending March 2025.

Revenue wise, the company has achieved a complete turnaround after the name and business model change in 2022. From 0 revenues in FY20 to Rs 171 cr in FY25, the company recorded a compounded growth of 251%. In FY20, the company was making a loss of Rs 1 cr in Financing profits, but in FY25 that also grew to Rs 111 cr. In terms of the net profits, the company jumped from losses of 1 cr in FY20 to profits of Rs 81 cr in FY25.

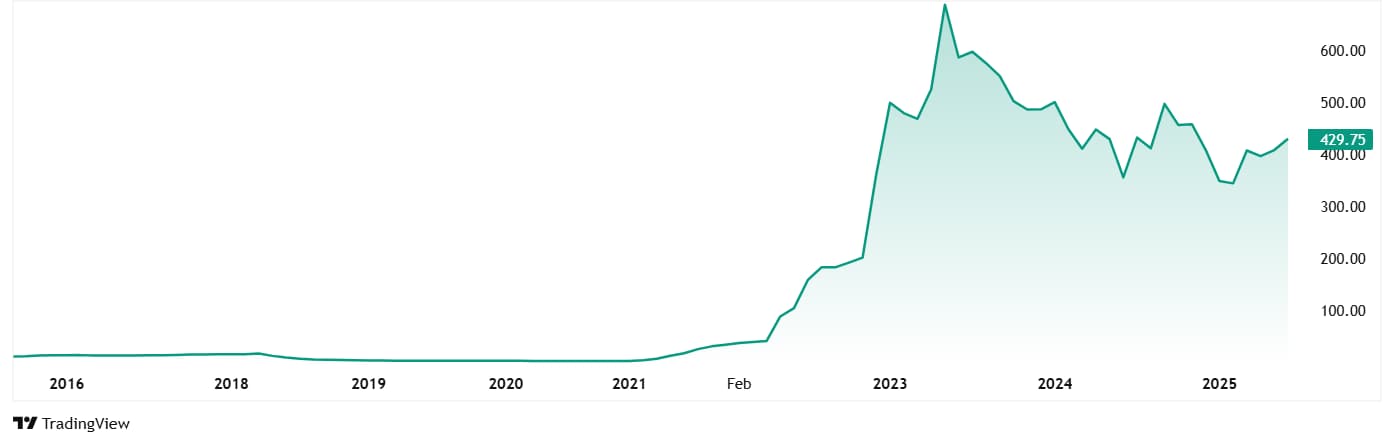

The share price of SG Finserv was about Rs 2.5 in June 2020, which today as on 18th June 2025 is Rs 428. A jump of 17,000%! Rs 1 lac invested in the stock 5 years ago would have been close to a whopping Rs 1.72 cr.

The company’s share is trading at a PE of 35x which is higher than the industry median of 24x. The 10-year median PE for Sg Finserv is 32x, while the industry median for the same period is a just 21x.

Prataap Snacks Ltd

PrataapSnacks Limited is an Indian snack food company engaged in manufacturing and marketing of multiple product variants like potato chips, extruded snacks and namkeen (traditional Indian snacks) under the Yellow Diamond brand and sweet snacks under the Rich Feast brand.

With a current market cap of Rs 2,564 cr, the company saw fresh 4.6% stake by Madhusudan Kela worth Rs 120 cr.

The company’s sales have grown at a compound rate of 7% from Rs 1,226 cr in FY20 to Rs 1,708 cr in FY25. The EBITDA however has seen a drop from Rs 86 cr in FY20 to Rs 49 cr in FY25. The net profit is also now an area of worry, as the company saw it first loss of Rs 34 cr in the last decade for FY25.

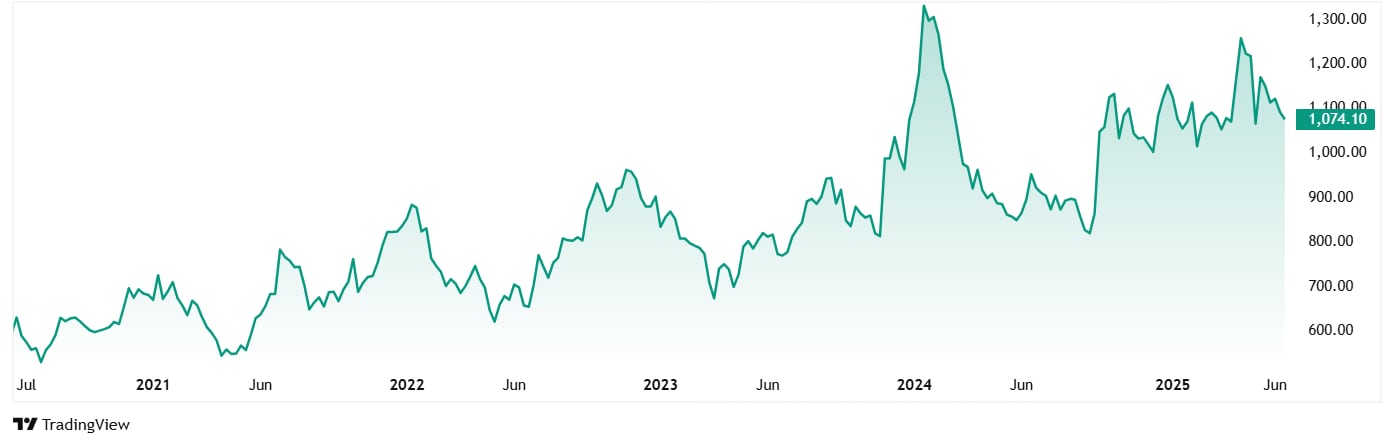

The share price of Prataap Snacks was around Rs 595 in June 2020 and as on 18th June 2025 it is 1,074, which is a 80% jump.

The company’s share is currently trading at a negative PE due to the losses. The industry median is however currently 69x. The 10-Year median PE for Prataaap Snacks is 54x while the industry median for the same period is 43x.

Additional Stakes

Apart from the above new picks, Kela also bought additional stakes in 3 companies he had been holding for some time now.

| Sr No | Company | Holding Dec’24 | Holding Mar’25 | Stake Added |

| 1 | Indostar Capital Finance Ltd | 2.50% | 5% | 2.5% |

| 2 | Kopran Ltd | 1.00% | 1.5% | 0.5% |

Stake Reductions

Coming to the stocks which have seen Kela’s interest probably falling, there are 3 in the list in which he has cut his stakes in the first 6 months of 2025.

| Sr No | Company | Holding Dec’24 | Holding Mar’25 | Stake Reduced |

| 1 | IRIS Business Services Ltd | 5.4% | 5.2% | 0.1% |

| 2 | Niyogin Fintech Ltd | 5.3% | 4.5% | 0.8% |

| 3 | Choice International Ltd | 10.5% | 9.2% | 0.2% |

Follow The Madhusudan Strategy?

The Warren Buffetts of India are a rare breed as they have time and again proved why they deserved to be called so. And Madhusudan Kela is no exception.

His portfolio movements in 2025 are a mystery to some and a guiding light for some. While what triggered the fresh buy decision or the selling decisions is something he himself can throw light now, a retrospective look at the movements give us a window to his investment style.

So, as the investor community waits patiently for the fresh exchange filings to see the next action Kela takes on these changes, it makes sense to add these stocks to a watchlist and track them vigilantly.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.