Ace investor Ashish Kacholia is known for identifying high-growth companies early, often in niche sectors. Three of his portfolio stocks have delivered over 20% profit growth over the last five years, reflecting strong operational momentum and steady demand.

These businesses are not only scaling up but also expanding into new markets and product segments. Here’s a closer look at what’s driving their growth—and whether they deserve a place on your watchlist.

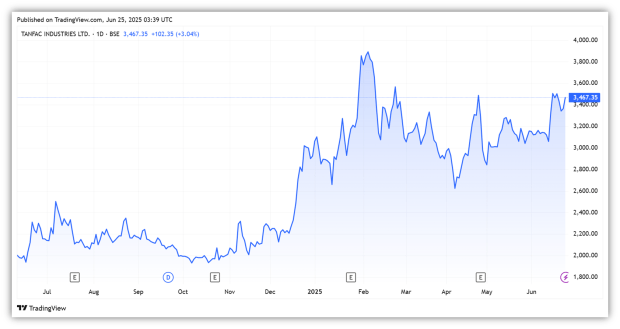

#1 Tanfac Industries

Tanfac is a joint venture between Anupam Rasayan and Tamil Nadu Industrial Development Corporation. It is among India’s leading producers of hydrofluoric acid and aluminium fluoride.

Supplying Critical Inputs to Sunrise Industries

The company also manufactures organic and inorganic fluorine-based products. The company caters to diverse industries, including solar cells, steel surfacing, refrigerants, agrochemicals, pharmaceuticals, and lithium batteries.

Strong Financial Performance

The company exports to 10 countries and serves around 20 international customers. Its sales have grown at a compounded annual growth rate (CAGR) of 28% over the last five years, reaching ₹5.6 billion in FY25. Net profit has grown at a faster rate of 39% to ₹0.9 billion.

Tanfac has maintained a healthy return profile, with a return on equity (RoE) of 32.5%, reflecting strong shareholder value creation. Return on capital employed (RoCE) is even stronger at 41.6%, indicating efficient use of capital.

Favourable demand prospects for hydrofluoric acid drove revenue growth. Additionally, capacity additions and a rising share of higher-margin, value-added products contributed to the company’s performance. Tanfac also benefits from forward integration with Anupam Rasayan.

Looking ahead, the company has recently expanded its hydrofluoric acid capacity, which is expected to further boost revenues amid strong demand. At the same time, its push into the value-added product segment is expected to support margin expansion.

As of March 2025, investor Ashish Kacholia holds a 1.59% stake in the company. Institutional interest has also increased, with mutual funds and foreign investors raising their stakes to 0.9% and 0.2%, from 0.6% and 0% in the December quarter, respectively.

Tanfac trades at a price-to-equity (P/E) multiple of 39x, well-above the 10-year median of 14.4x.

#2 Aeroflex Industries

Aeroflex is a leading manufacturer of flow solutions that are used to control the movement of solids, liquids, and gases across critical industries. The company exports to over 90 countries across Asia, America, Europe, and Africa.

It offers two main product lines: stainless steel (SS) flexible hoses, with and without braiding, as well as complete assemblies with fittings. These products are designed to handle high pressures and extreme temperatures, serving sectors such as aerospace, marine, oil refineries, solar, semiconductors, and hydrogen systems.

Assemblies and fittings account for 52% of Aeroflex’s revenue, while SS flexible hoses contribute the remaining 48%. About 74% of total revenue comes from exports, with the Americas contributing the highest share at 56%, followed by Europe (30%), Asia (10%), and Africa (3%).

Sector-wise, steel and metal industries account for 25% of the business, followed by oil and natural gas (20%), petrochemicals and chemicals (16%), and refineries (24%).

Steady Growth

Over the last five years, Aeroflex has reported a 21% CAGR in revenue, reaching ₹3.8 billion in FY25. Net profit grew faster at a 45% CAGR to ₹0.5 billion, supported by a rise in operating margins, from 15% in FY21 to 22% in FY25. This margin improvement has been driven by better capacity utilisation, which reached 75% in FY25.

However, return on equity (RoE) has declined to 16.5%, down from a peak of 31.9%, as the company continues to invest in capacity expansion. These returns are expected to normalize over the next few years as new capacity begins to contribute meaningfully.

Backed by Capacity Expansion

The SS flexible hoses’ capacity has increased from 11 million meters in FY23 to 16.5 million meters in FY25. The same is expected to jump to 20 million meters in FY26. Further, the value-added product segment—metal bellows and small metal bellows—is expected to play a key role in growth.

It has a total capacity of 3 lakh pieces, of which 1.2 lakh pieces were commercialised in December 2024. Ramp-up of this facility is expected to lead to revenue growth. At the same time, they offer higher margins, which can lead to higher overall margins.

In addition, Aeroflex has acquired Hyd-Air Engineering. Hyd Air has been a leading company in hydraulic and fluid connection solutions. With this acquisition, the company has also expanded into railways, shipbuilding, and heavy industries. Aeroflex will also add clients, including Mazgaon Dockyard, SAIL, BHEL, JSW, and ArcelorMittal.

As of March 2025, Ashish Kacholia holds a 1.92% stake in the company. Institutional interest has also increased, with mutual funds holding a 4.9% stake, compared to 4.7% in the December quarter. However, foreign investors’ stakes fell to 0.7%, from 1.6%.

Tanfac trades at a price-to-equity (P/E) multiple of 49x. The company has a short trading history of just 22 months, making it challenging to assess its historical valuation.

Aeroflex Industries Share Price

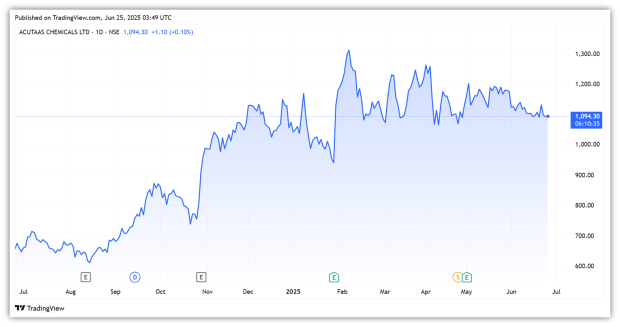

#3 Acutaas Chemicals

Diversified Product Play with Pharma in the Lead

Acutaas Chemicals manufactures advanced pharmaceutical intermediates and specialty chemicals. Within the Pharma segment, the company manufactures molecules that are under clinical trials or have been patented and launched in the generic market.

In the specialty chemicals space, it operates in parabens and paraben formulations, and key starting materials for cosmetics, fine chemicals, and agrochemicals. The company is also the only Indian manufacturer of photoresist chemicals and electrolyte additives.

It has well-established relations with over 600 customers in both domestic and global markets. Domestic customers include Cipla, Sun Pharma, Zydus, Lupin, and Aurobindo. This helps it attract new business from both existing and new customers.

Export-Led Growth

The company has shown consistent growth over the last five years. Revenue rose at a CAGR of 33% to ₹10 billion in FY25, while net profit at 41% to ₹1.6 billion. The pharma segment’s revenue rose at a 21% CAGR to ₹8.5 billion and now accounts for 85% of the total revenue.

On the other hand, the specialty chemicals business has grown at a 56% CAGR to 1.5 billion, and accounts for 15% of revenue, up from 5% in FY21. Exports remain the key growth driver, having risen to ₹7.4 billion in FY25, from just ₹1.7 billion in FY21.

The company has also ramped up capital investment. This can be seen from a 3x jump in gross blocks to ₹5.4 billion in FY25, from just ₹1.6 billion in FY21. However, return ratios have come down.

Due to new capacities, RoCE and RoE have come down from 31% and 32% to 19% and 15%, respectively. Looking ahead, the company expects a stronger FY26, guided by growth across all segments and a revenue growth target of 25% for the year.

As of March 2025, Ashish Kacholia holds a 1.92% stake in the company. Institutional interest has also increased, with foreign investors raising their stakes to 16.5%, up from 15.5%. Mutual funds, however, have reduced to 13% from 13.7%.

Tanfac trades at a price-to-equity (P/E) multiple of 56x, in line with its 4-year median of 55x.

Acutaas Chemicals Share Price

Conclusion

Ashish Kacholia’s picks—Tanfac, Aeroflex, and Acutaas—have demonstrated strong profit growth, driven by expanding capacities and a presence in niche, high-growth sectors. Their financial performance reflects operational strength and rising product demand. However, valuations remain rich, which may limit near-term upside.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternative, but widely accepted, source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.