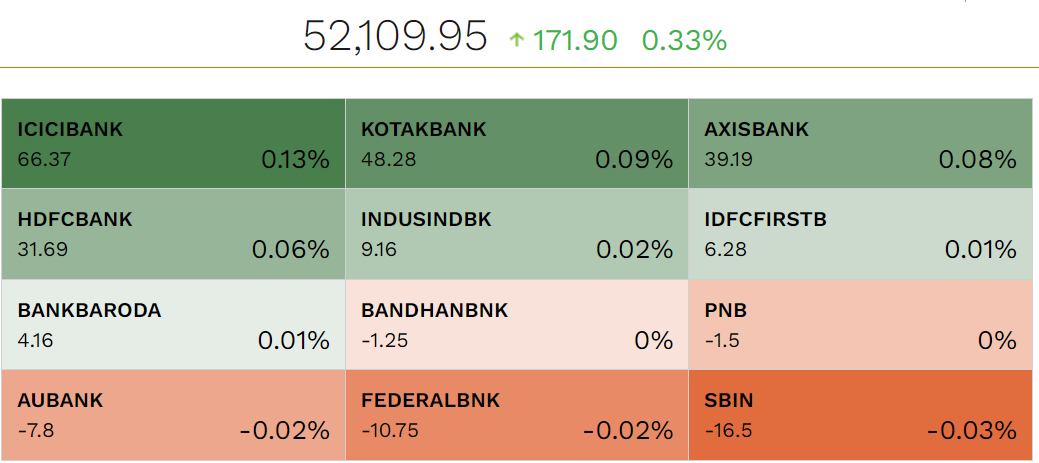

Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed the trading session on a flat note on September 16. The BSE Sensex rose 98 points or 0.12% to finish the day’s trading at 82,988.78. The NSE Nifty 50 closed 27.25 points or 0.11% higher at 25,384. However, the Bank Nifty closed the day 0.41% or 215 points higher at 52,153.15. The Nifty Midcap 100 closed 225.70 points or 0.38% higher at 60,259.75.

The NSE Nifty 50 closed 0.08% higher at 25,377.80, while the BSE Sensex closed 0.09% higher at 82,967.71.

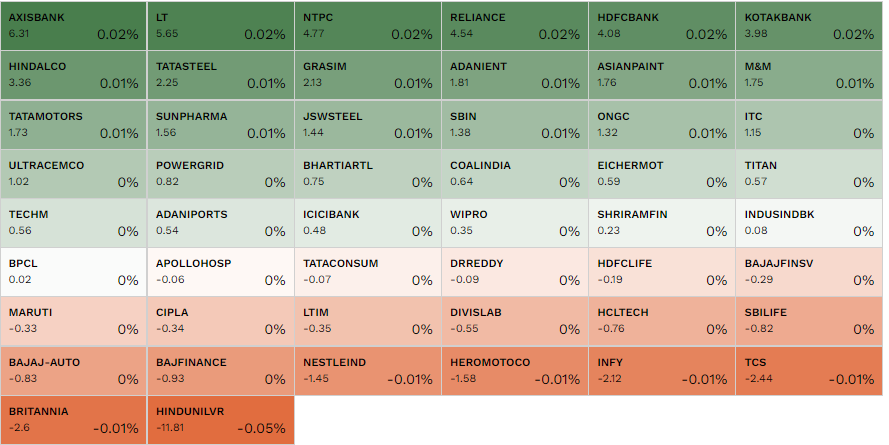

NTPC, Hindalco, JSW Steel, Shriram Finance, and L&T were the top gainers in the Nifty 50. Meanwhile, Bajaj Finance, Hindustan Unilever, Bajaj Finserv, SBI Life Insurance, and Britannia were the major losers in the Nifty 50 on September 16.

"Indian Rupee appreciated on Monday amid positive domestic markets and weakness in the American currency (US Dollar). FII inflows also favoured the Rupee. However, firm crude oil prices capped sharp gains. We expect the Indian Rupee to trade with a slight positive bias on continued weakness in the US Dollar ahead of the FOMC meeting this week. There are broad expectations of a 25 bps rate cut by the Fed following a 25 bps rate cut by the ECB last week. Fresh foreign inflows and a positive tone in equity markets may further support the domestic currency. However, a recovery in crude oil prices may cap a sharp upside," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

"Buoyed by the possibility of a 50 bps rate cut by the Fed at its September 19 FOMC meeting, spot gold continues to trade with a positive bias hitting a series of successive highs. On Friday, spot gold eventually breached the crucial resistance at the previous all-time high of $2531 to take out yet another stiff resistance at $2550 to close with a gain of 0.69% at $2584. Today, the metal is up 0.24% as it trades at $2589. Gold is expected to trade with a positive bias, more so as China's economic data continue to disappoint," said Sharekhan on gold.

Shyam Metalics and Energy (SMEL) has announced the expansion of its production capabilities with the establishment of a Greenfield Cold Rolling Mill (CRM) in Jamuria, West Bengal. Following the news, shares of the company rose by 2.16%, trading at Rs 890 on the NSE.

Kross IPO debuted at Rs 240 per share on the National Stock Exchange, marking a flat listing. The IPO was open for bidding from September 9 to September 11, alongside Bajaj Housing Finance. Despite the flat initial listing, Kross shares rose 10% to an intraday high of Rs 265.99.

Read More: Kross IPO makes flat debut, lists at Rs 240 on NSE

The company opened the IPO for bidding to investors on September 16 and will close on September 19. The company will raise Rs 410 crore via fresh capital. The company kept the IPO price band in a range of Rs 121 to Rs 128 per equity share. A retail investor needs to apply for a minimum of 110 shares or one lot that costs Rs 14,080.

Read More: Arkade Developers IPO Day1: Check price band, issue size, and other key details

Shares of KRBL, known for India Gate basmati rice, surged by up to 8% on Monday, while LT Foods Ltd., renowned for its Daawat brand, saw gains of up to 10%. The increase in share prices for these rice companies, including Chaman Lal Setia Exports, comes after the government announced the removal of the Minimum Export Price (MEP) on basmati rice. This decision, prompted by ample domestic rice stocks and ongoing trade concerns, has boosted market confidence in the sector.

Shares of Dixon Technologies surged over 6% on Monday, reaching a 52-week high and approaching Rs 14,000 for the first time. The day's gains lifted Dixon's market capitalization to Rs 82,353 crore.

Shares of Mahindra & Mahindra (M&M) increased by 1.46% on the NSE, trading at Rs 2,779, following the company's launch of the All-New Veero. The new light commercial vehicle (LCV) under 3.5 tons is priced starting at Rs 7.99 lakh.

Saboo Sodium Chloro Limited’s stock surged 12.65% to Rs 32.60 on the BSE following the company's announcement that it is considering a strategic restructuring of its hospitality assets into a fully owned subsidiary. The firm plans to publicly list Samskara Resorts as part of this move.

Natural gas prices have been climbing sharply over the past three weeks. The Natural Gas Futures contract on the Multi Commodity Exchange (MCX) rose from a low of Rs 156.70 per mmBtu in late August to a high of Rs 202.40 last week, marking a 30% increase. Prices have since eased slightly and are currently trading at Rs 191 per mmBtu.

At noon on September 16, 2024, the BSE saw 2,053 stocks advancing compared to 1,865 that declined, while 144 stocks remained unchanged. Of the 4,062 stocks traded, 330 reached a 52-week high, and 28 hit a 52-week low. Additionally, 373 stocks were trading in the upper circuit, and 194 in the lower circuit.

As of noon on the NSE, M&M led the gainers with a rise of 1.42%, followed by NTPC, which increased by 1.26%. Shriram Finance gained 1.17%, Eicher Motors climbed 1.16%, and Hindalco rose by 1.08%.

On the other hand, Bajaj Finance experienced the most significant loss, falling 2.85%. Hindustan Unilever followed with a decline of 2.68%, while Bajaj Finserv decreased by 2.19%. SBI Life and Britannia also saw losses, dropping 1.44% and 1.12%, respectively.

Shares of Adani Power and Adani Green Energy soared by around 6% on September 16 after both companies announced receiving a Letter of Intent (LoI) from Maharashtra State DISCOM for the supply of 6,600 MW of hybrid solar and thermal power.

"Gold continues to trade firm with International spot price moving close to $2600 per ounce, supported by a weaker U.S. dollar and falling bond yields, amid rising expectation of a bigger rate cut by the U.S. Federal Reserve at its policy meeting on Wednesday. Traders have priced in a cut of 25bps, but the odds of a 50bps cut is rising with both having a probability of near 50:50 now," said Pranav Mer, Vice President, EBG - Commodity & Currency Research at JM Financial Services.

Shares of Bajaj Finance dropped 3.6% to an intraday low of Rs 7,322 from its previous close of Rs 7598.50. The stock was the major loser in the Nifty 50. It touched its 52-week low of Rs 6,187.80 on March 06, 2024.

Courtesy: NSE

Commenting on the Technical outlook of Nifty Rupak De, Senior Technical Analyst at LKP Securities, said that The index remained range-bound throughout the day. On the higher end, it faced resistance at the rising trendline on the daily chart. On the lower timeframes, the RSI has entered a bearish crossover, signaling an early indication of a potential bearish momentum reversal. In the near term, the trend may remain sideways. Support is observed at 25,150–25,200, while resistance is seen at 25,460.

Shares of Thermax Ltd surged nearly 3% in early trading on Monday after the company announced that its subsidiary secured a repeat order worth Rs 516 crore. Thermax shares gained 2.69%, reaching Rs 4,851.55 from the previous close of Rs 4,727.25 on the BSE. The company’s market capitalization now stands at Rs 57,492 crore.

Apollo Micro Systems has received orders worth Rs 4.70 crore from Economic Explosives Ltd and ARDE-DRDO (Defence Research and Development Organisation). Following this announcement, the company’s stock rose by 2.68% on the NSE, trading at Rs 110.

Bajaj Housing Finance debuted at Rs 150 on the National Stock Exchange, marking a 114% premium over its issue price. The IPO was open for subscription from September 9 to September 11.

Read More: Bajaj Housing Finance IPO makes stellar debut, lists at 114% premium

The rupee appreciated by 5 paise to 83.87 against the US dollar in early trade on Monday, aided by the weakening of the American currency in global markets and strong foreign fund inflows.

Forex traders noted that market participants are closely watching the US Federal Reserve's policy announcement on Wednesday. While a rate cut is widely expected, the size of the reduction remains uncertain.

Courtesy: NSE

"The last two days’ upsides were challenged by the Bollinger upper band. With oscillators in short-term periodicities continuing to be overbought, it may require a pullback before we get back onto the 25500-800 trajectory. Dips to 25255 would be within our expectations, which may be stretched up to 25200, without needing to abandon upswing possibilities, but a drop beyond 25150 could signal re-domination of bears," said Anand James, Chief Market Strategist at Geojit Financial Services.

"Bajaj Housing Finance is set to list on Monday, September 16, 2024, after receiving Rs 3,80,000 crore worth of bids for its Rs 6560 crore IPO, with the grey market premium (GMP) remaining above 100%. The week ahead promises action on Dalal Street, with seven new public issues and 13 stock exchange debuts. Gift Nifty is racing towards record highs, while investor optimism builds ahead of the Federal Reserve’s expected interest rate cut," said Prashanth Tapse, Senior Vice President of Research at Mehta Equities.

Hindustan Unilever Ltd (HUL) has filed a petition before the Bombay High Court challenging a Rs 962 crore tax order issued by the Income Tax authorities. The notice relates to a dispute over Tax Deducted at Source (TDS) in connection with HUL’s acquisition of GlaxoSmithKline’s (GSK) consumer healthcare business.

Indian multinational engineering company Thermax Ltd, specializing in clean air and energy solutions, has announced that its subsidiary, Thermax Babcock & Wilcox Energy Solutions Limited (TBWES), has secured a repeat order from a client in Botswana. The project involves setting up a 600 MW greenfield energy plant, with the order valued at Rs 516 crore.

Maharashtra State Electricity Distribution Company (MSEDCL) has issued a Letter of Intent for the supply of 6,600 MW of hybrid solar and thermal power. Adani Green Energy will supply 5,000 MW of solar power from its Khavda project, while Adani Power will provide 1,496 MW of thermal power from a new 1,600 MW ultra-supercritical facility.