ome of India’s most enduring wealth creators come from legacy business houses that have built strong, diversified businesses over time. The Murugappa Group, with interests spanning engineering, financial services, and agri-related segments, is one such conglomerate. Its listed companies have quietly compounded investor wealth over the past five years.

Some of these stocks have delivered exceptional long-term returns, reflecting consistent execution and a sharp focus on capital efficiency. But do these stocks still offer room for long-term compounding? Let’s take a look..

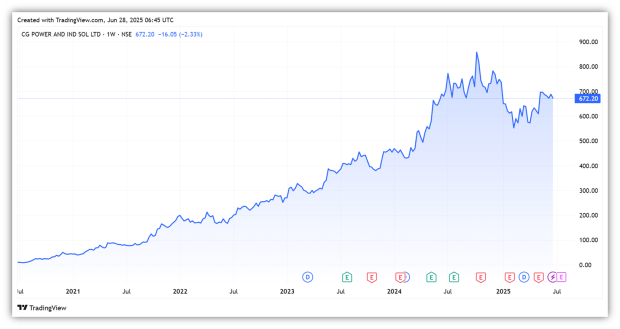

#1 CG Power and Industrial

CG Power is an 86-year-old engineering group and a leader in the electrical engineering industry. The company operates in two business lines: Industrial Systems and Power Systems. It manufactures traction motors, propulsion systems, signaling relays, and other components for Indian Railways.

Additionally, it manufactures induction motors, drives, transformers, switchgear, and other products for the industrial and power sectors. It has also forayed into the consumer appliance market, offering products such as fans, pumps, and water heaters.

The industrial segment dominates, accounting for 59% of revenue, with the remaining 41% coming from the power segment. However, the power business is more profitable, with margins of 20% compared to 12.8% in the industrial segment.

Strong performance across segments in FY25

In FY25, revenue from the industrial segment grew 16% year-on-year (YoY) to ₹58 billion. However, profit before interest and tax (PBIT) declined 5% as margins dropped by 280 basis points to 12.8%. Rising commodity prices and increased investments in the consumer business contributed to the margin contraction.

On the other hand, the power sector revenue rose strongly by 35% to ₹35 billion. Margins also rose 280 bps to 21.1%, driven by better price realization and operating leverage. As a result, PBIT grew 57% to ₹7.1 billion.

At the consolidated level, revenue rose 23% to ₹99 billion, driven by both segments. However, overall margins declined slightly by 50 bps to 14.8%, mainly due to pressure in the industrial business. Net profit (before exceptional items) rose 15% to ₹9.7 billion.

Strong order book supports growth outlook.

Looking ahead, CG Power aims to maintain a robust growth rate, supported by a strong order book, which provides visibility into revenue growth. The total order book stood at ₹146.8 billion (up 40% YoY), providing revenue visibility for about 1.5 years on FY25 revenues.

The industrial segment had an order backlog of ₹32.9 billion (+29% YoY). Meanwhile, the power segment had an order backlog of ₹66.2 billion (+77%).

The company is expected to benefit from the expanding power transformer market. It is investing ₹7.1 billion to set up a 45,000 megavolt-ampere transformer manufacturing unit. With this expansion, CG Power aims to cater to growing domestic and export demand, further strengthening its market position.

It also plans to enhance its export capabilities, particularly in the power segment. Additionally, the company is developing electric vehicle motors and controllers to leverage electric mobility and energy efficiency technology solutions.

The company trades at a price-to-equity (P/E) multiple of 106x, well-above its 10-year median of 75x.

CG Power Share Price has Gained 85x in 5-Years

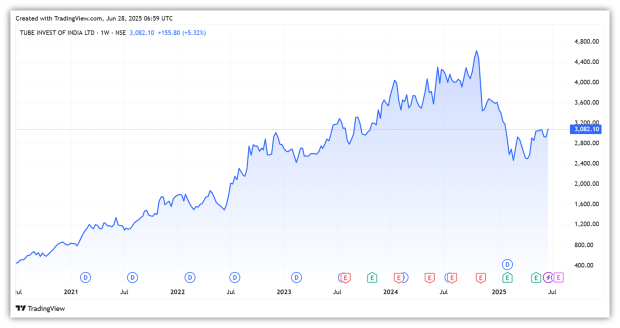

#2 Tube Investment

Tube Investment operates across engineering, metal-formed products, and mobility at the standalone level. In the engineering division, it is the world’s leading manufacturer of cold-drawn, welded precision tubes.

The metal fabrication business manufactures auto components (such as chains and kits), doorframes, railway parts (including coach parts), and fine blanking. Its mobility division houses the bicycles business, with reputed brands like Hercules, BSA, etc.

The company is the largest producer of cold-drawn welded steel tubes in India. It also holds a leadership position in the transmission chain market and is the second-largest manufacturer of cycle transmission chains in India.

Its subsidiaries include Shanthi Gears and CG Power. It has also recently forayed into electric vehicles (EVs) and Contract Development and Manufacturing Organization (CDMO) business.

Muted growth in core, but capacity in place for a pickup

In FY25, standalone revenue grew 4% YoY to ₹79 billion. Adjusted net profit (excluding one-time fair value gain) rose 2% to ₹7.5 billion. The engineering segment contributed 64% of the revenue, with growth of 2% YoY to ₹50.3 billion. PBT remained flat at ₹6.2 billion, primarily due to capacity constraints.

A new plant in Nashik is now operational and is expected to contribute to growth from the second half of FY26.

The metal-formed products division revenue rose 3% YoY to ₹15.6 billion, constituting 20% of the revenue. PBT declined 14% to ₹1.6 billion, as the margin fell 210 bps to 10.3%. Subdued auto demand and the absence of major railway orders weighed on performance.

However, the company has secured a ₹10 billion railway contract to be executed over seven years. This order could improve the outlook for this segment by end-FY26.

The mobility division, which constitutes just 8.5% of revenue, reported revenue of ₹671 crore, up 1% YoY. This segment remains under pressure due to competition from unorganised players. However, exports helped the business turn profitable, with a profit of ₹4.8 crore, compared to a loss of ₹17.8 crore the previous year.

Newer segments are gaining traction.

The EV subsidiary, TI Clean Mobility, posted revenue of ₹541 crore, more than double last year’s ₹206 crore. But losses also widened to ₹549 crore, including a ₹137 crore fair value loss. Adjusted losses stood at ₹412 crore. Management is targeting a break-even point in electric trucks and three-wheelers by the end of FY26.

The CDMO plant is still under construction, and operations are expected to begin by FY26-end. Early customer response has been positive.

Core businesses are expected to recover as capacity increases and new contracts take effect. At the same time, newer areas, such as EVs, CDMOs, and exports, are being scaled up. Together, these initiatives are expected to support growth momentum from FY26 onwards.

It trades at a P/E multiple of 45x, well below its 10-year median of 73x.

Tube Investment Share Price rose 6x in 5-years

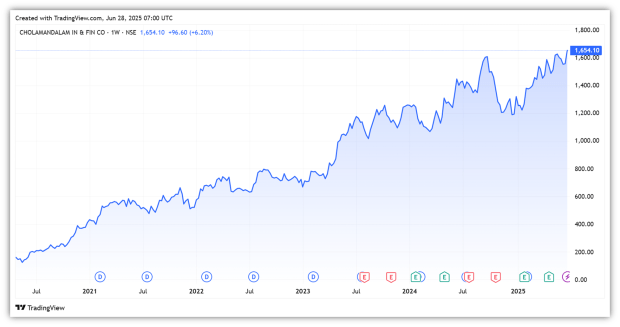

#2 Cholamandalam Investment

Cholamandalam Investment is a non-banking financial company with a track record of over four decades. It operates across multiple loan segments, including vehicle finance loans, loans against property, home loans, consumer loans, personal loans, SME loans, stockbroking, and the distribution of financial products.

Cholamandalam’s branch network is geographically diverse, with 92% of its 1613 branches located in Tier-III, Tier-IV, Tier-V, and Tier-VI cities. Maharashtra tops the list with 164 branches, followed by Uttar Pradesh and Rajasthan (119), Madhya Pradesh (105), and Bihar (77).

Strong growth in AUM, but rising credit costs

As of Q4FY25, assets under management (AUM) grew 27% YoY to ₹1.85 trillion, while disbursements grew 14% to ₹1.0 trillion. AUM is well-diversified, with loans against property contributing 21%, light commercial vehicles (11%), and housing loans (9%).

The company’s net income grew 36% YoY to ₹135.7 billion, while net income margin improved two bps to 7.7%. Asset quality, however, saw some pressure with gross non-performing assets (NPA) rising 33 bps to 2.8%, and net NPA 21 bps to 1.5%.

As a result, net credit losses increased by 89% to ₹24.9 billion. Even so, higher income and improved operating efficiency helped net profit rise 24% to ₹42.6 billion. A lower cost-to-income ratio of 39.3% (down 160 bps) also supported profitability. Return on assets fell 2 bps to 2.4%, while return on equity fell 8 bps to 19.8%.

Growth to be broad-based across segments

For FY26, management is targeting 20% AUM growth and 15% disbursement growth in vehicle finance, up from 12% in FY25. This is expected to be driven by a favourable monsoon and better utilisation in the commercial vehicle space.

Loan against property is expected to see 30% growth in both disbursements and AUM. The home loan book, which still accounts for 60% of AUM from the South, is now expanding into the East, West, and North.

The company has also entered the gold loan business, with 120 standalone branches already operational across the South and East in Q1FY26. It aims for an AUM of ₹20 billion within 12–18 months, with further expansion contingent upon initial performance.

It trades at a price-to-book multiple of 5.9x, at a premium to the 10-year median of 4.5x.

Cholamandalam Price rose 7x in 5 years

Conclusion

Over the past five years, Murugappa Group companies have delivered remarkable wealth creation, underpinned by strong fundamentals and prudent capital allocation. While CG Power has led with a turnaround backed by a robust power segment, Tube Investments is entering a new phase of growth with its capacity expansion and bets on EVs and CDMO. Cholamandalam continues to scale with a well-diversified lending book and deep rural reach. For long-term investors, the group remains a steady compounder worth tracking.

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternative, but widely accepted, source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.