Dharmesh Shah, ICICI Securities

The week that was… The equity benchmark indices inched northward amid elevated global volatility. The NSE Nifty 50 settled the week at 18563, up 29 points. In the process, broader market continued to outperform as Nifty Midcap surged 0.5% while small cap index gained 1.2%. Sectorally, Auto, energy, metal and PSU outshone while IT, PSU Banks underperformed.

NSE Nifty 50 Technical Outlook

- The index witnessed a volatile week and formed a small bear candle with an upper shadow, highlighting profit booking amid overbought conditions. In the process, stock specific action prevailed.

- Going ahead, we reiterate our stance of Nifty gradually heading towards its lifetime highs in June 2023. In the process, buy on dips strategy would remain in focus which has been fared well since March as Nifty has not corrected for more than 400 points while sustaining above its 20 days EMA, placed at 18450.

- In the upcoming week, bouts of volatility ahead of upcoming Fed meet can not be ruled out which would consequently result into temporary breather amid overbought conditions. We believe, such a breather would help index to form a higher base and pave the way for next leg of up move.

- Structurally, we expect the broader market to relatively outperform as the midcap index recorded breakout from 18 months consolidation and hovering at All time highs while small cap index is still 13% away from life highs and expected to catchup gradually. Stocks from Auto ancillary, capital goods, BFSI, consumption, pharma forming part of small cap index are expected to relatively outperform.

- On stock front, in large cap we prefer Reliance Industries, Axis Bank, United Spirits, JSW Steel, L&T, Sun pharma, Tata motors, NTPC while in midcap Apollo Tyres, Bhel, Balrampur Chini, KPR Mills, IRFC, HEG, Zensar, Justdial, Chemplasts, AIA Engineering remain in focus

- Structurally, formation of higher high-low on the weekly and monthly chart signifies elevated buying demand that makes us confident to revise support base at 18400 as it is 50% retracement of current up move (18060-18778) coincided with 20 days EMA placed at 18450.

Nifty Chart

Bank Nifty Technical Outlook

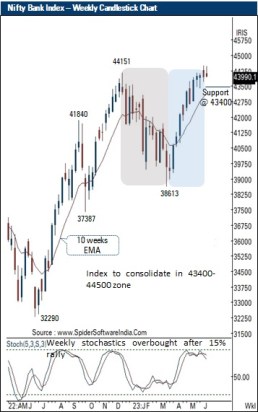

- The Bank Nifty index closed marginally higher for the week after trading choppy even as RBI maintained statusquo on interest rates. PSU Banking stocks underperformed private peers during the week. The Bank Nifty closed the week at 43989, up 0.12%.

- The weekly price action formed inside candle as price action remained contained within prior week’s trading range (44500-43706) indicating slowdown in momentum after 11 week rally measuring 15% led weekly momentum oscillators in overbought trajectory (weekly stochastics around 90.

- Going ahead, we expect index to prolong consolidation in the band of 43400-44500 for few sessions. A decisive move from this range would set further directional bias.

- Structurally, Bank Nifty has witnessed a faster retracement of the 14 weeks decline (44151-38613) during Dec22-Mar23 in just seven weeks. Faster retracement in just half the time interval indicates structural improvement from medium term perspective. However, after such sharp rally consolidation near life highs would make larger trend healthier.

- The index has immediate support at 43400 levels being the confluence of the last two weeks identical lows and the 50% retracement of the recent up move (42582-44151).

- Among the oscillators, the weekly stochastics has approached overbought trajectory flagging a possibility of a consolidation.

Bank Nifty Chart

(Dharmesh Shah is Head-Technical at ICICI Securities. The views and opinions expressed in this story are the author’s own.)