Mutual Fund SIP calculation: Several well-managed mutual funds have given very high returns over the long term. One such scheme is Nippon India Growth Fund, which is a mid-cap mutual fund investing primarily in midcap stocks.

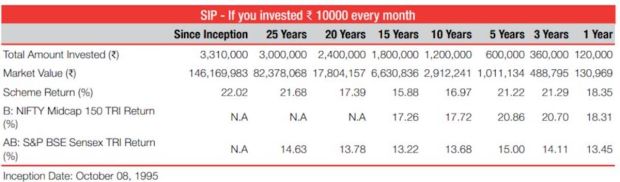

According to the fund’s latest factsheet, it has given 22.02% annualised returns since its inception in 1995. In the last 25 years, the fund has given annualised returns of 21.68% and 17.39% in the last 20 years.

Mutual Fund calculation quoted in the fund’s factsheet shows if someone had started a SIP of Rs 10,000 in this fund at inception, the value of his investment as of May 31, 2023 would have been approx Rs 14.6 crore. In 25 years, the Rs 10,000 SIP could have grown to Rs 8.2 crore.

That said, the following are the five key points to know about this scheme as per the fund’s latest fact sheet.

Also Read: These schemes turn Rs 10,000 SIP into Rs 3 crore to Rs 5 crore in 20 years

Nippon India Growth Fund Factsheet June 2023

Date of allotment: The fund’s inception date is October 8, 1995. It is an open-ended equity mutual fund scheme predominantly investing in mid-cap stocks.

SIP returns: According to the fund’s factsheet, the value of a monthly SIP of Rs 10,000 in this fund since inception would have been around Rs 14.6 crore. In 25 years, the value of Rs 10,000 SIP would have been more than Rs 8.2 crore.

Current NAV: The NAV of this fund’s Growth Plan as of May 31, 2023 was Rs 3215.7096. The NAV of this fund’s Direct Growth Plan was Rs 2493.9736.

Total Expense Ratio: The fund’s expense ratio for the regular plan of this fund is 1.75 and 0.99 for the direct plan.

Also Read: Direct Plan vs Regular Plan: The difference you should know before starting SIP in Mutual Funds

Top 10 stocks: As of May 31, 2023, the top stocks in which the fund has invested more than 2% of its assets are AU Small Finance Bank Limited (3.81%), Varun Beverages Limited (3.13%), Cholamandalam Financial Holdings Limited (3.67%), Power Finance Corporation Limited (2.86%), Mahindra & Mahindra Financial Services Limited (2.34%), Persistent Systems Limited (2.4%), Supreme Industries Limited (2.19%), Max Financial Services Limited (2.32%), Devyani International Limited (2.02%).

Disclaimer: The above content is for information purposes only. There is no guarantee or assurance that this fund will continue to give similar returns in future. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.