Small-cap stocks often attract attention when they deliver sharp price moves in a short span. Over the past year, three such names have surged by up to 100%, driven by a combination of earnings recovery, sectoral tailwinds, and investor optimism. Retail participation has also jumped sharply, with shareholding data showing a noticeable uptick in individual ownership.

But after such a steep run-up, questions around sustainability are starting to surface. Are the business fundamentals keeping pace with valuations? Is there more room for upside, or are investors at risk of chasing momentum?

Here’s a closer look at the companies and what their recent trends indicate.

#1 Balu Forge Industries

Balu Forge is one of India’s leading manufacturers of fully finished and semi-finished forged crankshafts and forged components. The company is also expanding into high-precision sectors, including railways, defence, and aerospace.

It caters to multiple industries, including automobiles, industrial vehicles, wind energy, aerospace, defence, railway, marine, agriculture, and other industries. As for Railways, it produces a wide range of wheels, axles, and wheel sets, contributing to the ‘Make in India’ initiative of the Government of India.

Balu Forge derives 90% of its revenue from exports. It exports to over 80 countries and serves more than 25 original equipment manufacturers worldwide.

The company’s financial performance saw strong growth in FY25. Revenue rose by 65% from last year to ₹9.2 billion–its highest-ever. Steady demand in its core business, supported by newer verticals such as defence, aerospace, and railways, contributed to this performance.

Along with revenue growing, EBITDA Margin expanded by 591 basis points to 27.2%, leading to a 118% increase in net profit to ₹2.0 billion. Operation cash flows also improved, backed by higher efficiency and collections of receivables.

Looking ahead, a major portion of its capital expenditure over the next 10 years will be directed toward this segment. Several joint ventures and technology partnerships are currently in progress.

Key areas of focus include artillery, undercarriage parts for armoured vehicles, weapons and ammunition for light and heavy regiments and forged and machined components for the engine division.

To support this, the company has increased its forging capacity to 1 lakh tonnes per annum (TPA), with further expansion underway. This additional capacity is expected to aid growth in defence, aerospace and railways.

It has also expanded precision machining capacity to meet growing demand. The company expects that non-automotive sectors will be the key drivers of overall revenue growth in the coming years.

It is also expanding its geographical footprint, particularly in the European and Asian markets. Management expects these capacities to become fully operational by H1 FY26 and contribute meaningfully in the coming quarters.

Retail holding in the company has increased from 9.76% in Q1FY25 to 12.26% in Q4FY25. The stock has appreciated 145% in one year, from ₹285 to ₹700.

From a valuation perspective, Balu Forge trades at a price-to-earnings multiple of 38x, at a premium to the 3.5-year median of 32x.

Balu Forge Industries Share Price

#2 Innova Captab

Innova Captab has been engaged in contract-based manufacturing of pharmaceutical formulations since 2005. It produces a wide range of products, including tablets, capsules, syrups, and injections, for both domestic and global pharma companies.

As of March 31, 2025, the company had 216 contract development and manufacturing (CDMO) customers. In addition to this, it also supplies generic formulations to government entities through tender-based contracts.

The company has a diversified revenue mix. 75% of its revenue comes from the domestic market. Within segments, the CDMO business contributes 53% of revenue, followed by domestic branded generics (18%), and international branded business (13%). The remaining (16%) comes from newly acquired Sharon Bio-Medicine.

In FY25, Innova’s operating revenue rose 15% from last year to ₹12.4 billion, driven by volume growth across segments. Sharon Bio-Medicines led the performance with 37% revenue growth, followed by international branded segment (25%), domestic branded business (21%), and CDMO segment (6%).

EBITDA margin expanded 50 basis points to 15.9%, supported by operating leverage. Net profit grew 36% to ₹1.3 billion, aided by stronger EBITDA and lower finance costs.

Looking ahead, Innova plans to expand manufacturing capacity and introduce new product offerings and dosage forms to drive growth for both CDMO and branded generic business.

A key focus will be on scaling operations at the Sharon Bio-Medicine facility, with an aim to improve synergies through a broader product portfolio. The company plans to ramp up overall capacity utilisation–from the current 50-60% to 70-75% over time.

In January 2025, the company also commercialised a new manufacturing plant in Jammu. It plans to gradually ramp up utilisation at this site to 40–50% over the next 2–3 years, and 70–75% in 5–6 years.

Management believes these capacity enhancements will be essential to sustain the current growth momentum. The company is also poised to benefit from Government’s ‘New Central Sector Scheme’, which gives 300% GST-linked incentive on investment in plant and machinery over 10 years, along with a 6% capital interest subsidy per annum.

In the CDMO business, 80% of revenue comes from customers with a relationship older than 5 years, highlighting strong customer stickiness. The company plans to deepen business with existing clients while expanding its customer base.

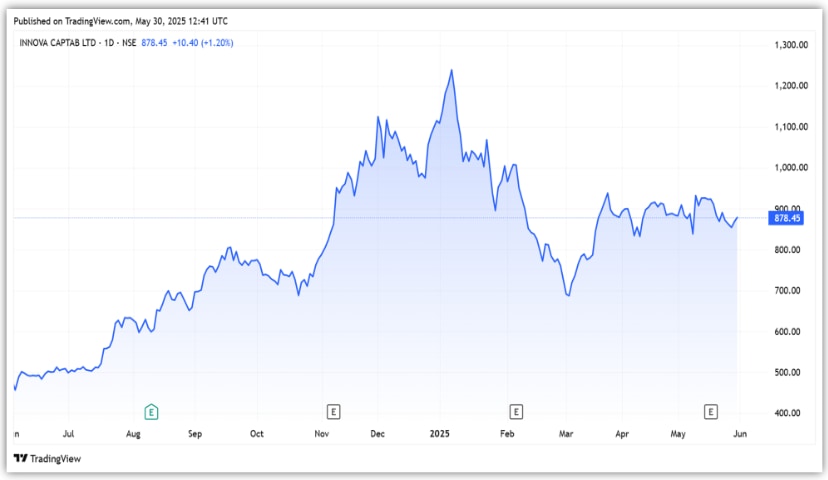

Retail shareholding in the company has increased from 3.67% in Q1FY25 to 5.24% in Q4FY25. The stock has appreciated 82% in one year, from ₹481 to ₹873.

From a valuation standpoint, Innova Captab trades at a price-to-earnings multiple of 39x. The short trading record limits clarity on long-term valuation trends.

#3 Lloyds Metals & Energy

Lloyds Metals manufactures and supplies iron and steel products. It manages the entire value chain—from iron ore mining to the production of direct reduced iron (DRI) and sponge iron.

In FY25, Lloyds Metals revenue grew a modest 3% to ₹67.7 billion. About 80% of the revenue came from iron ore, followed by sponge iron and power (16%), and pellet trading (4%). Despite strong volumes in sponge iron and power, lower iron ore dispatches—the company’s primary revenue driver—constrained overall growth.

However, operating performance improved. EBITDA rose 13% to ₹20.0 billion, aided by better iron ore realisations. EBITDA Margin expanded 251 basis points to 29.6%, leading to a 16.7% rise in net profit to ₹14.5 billion.

Looking ahead, Lloyds Metals is aggressively ramping up capacity. The company has outlined a capex plan of ₹60-65 billion annually over the next two years to scale production capacity across segments.

Iron ore mining capacity is being increased from 10 million tonnes to 25 million tonnes, while sponge iron capacity is being doubled from 0.34 million tonnes to 0.70 million tonnes.

Alongside, the company is investing in steel-making infrastructure and beneficiation facilities, aiming to align with India’s broader steel production goals. It is also setting up 100 megawatts of captive renewable energy capacity. This facility will help in cost control, efficiency and profitability.

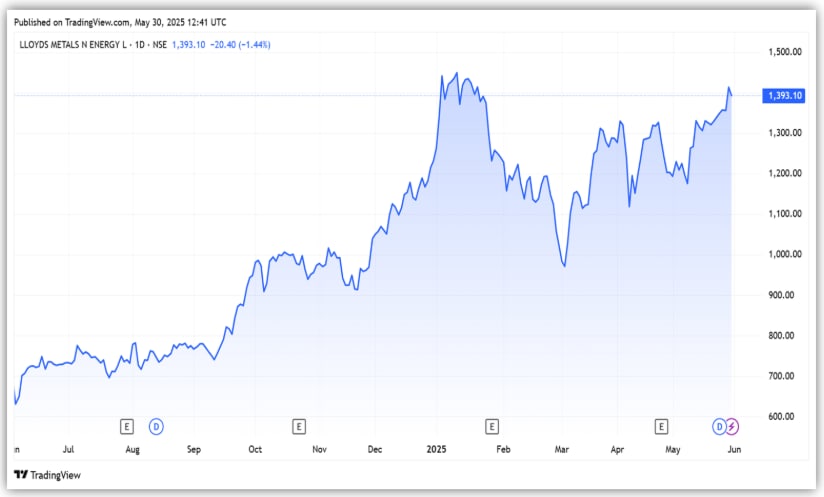

Retail shareholding in the company has increased from 5.89% in Q1FY25 to 6.58% in Q4FY25. The stock has appreciated 105% in one year, which has made the valuation costly. It trades at a price-to-earnings multiple of 48x, premium to the about 10-year median of 27x.

Lloyds Metals & Energy Share Price

Conclusion

Each of these small-cap stocks has delivered strong returns backed by solid earnings and expansion plans. However, with price-to-earnings multiples now at a premium to their historical averages, the valuations leave limited room for error.

Retail investor interest has clearly surged, but sustained performance will depend on how execution plays out in the coming quarters. While the long-term story remains intact, near-term caution may be warranted as the rally shows signs of maturity.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.