By Suhel Khan

When Manish Gupta parted ways with RARE in 2014, his ex-boss and mentor, Rakesh Jhunjhunwala was supportive of his entrepreneurial dream. At the same time, he worried that asset management was a tough business to scale, very competitive and unsure if Manish was ready.

But in an Interview with NDTV Profit back in 2022 days after the investment maestro passed, Manish revealed how Jhunjhunwala’s big brotherly support and expertise had shaped him in his years at RARE, to be ready for this challenge.

Since 2014, Manish Gupta’s firm Solidarity Investment Managers has been guiding investors make the most of their investments by means of a streamlined approach.

And in the recent quarterly letter to partners, Solidarity revealed their portfolio picks for the quarter ending December 2024.

And the list has some really “out of favour” names like Solidarity calls them in the letter.

Let’s take a look at these holdings…

Restaurant Brands Asia Ltd (RBA)

The company with a market cap of Rs 3,866 cr is the national master franchisee for the brand, Burger King. It holds exclusive rights to develop, open, operate, and franchise Burger King restaurants in India.

Solidarity in its letter says that it believes RBA is being punished because the market is giving a negative value to its Indonesia business which is still burning cash even 3 years after been acquired by RBA.

Solidarity has bought into RBA for its India opportunity and track record and as they were willing to take a leap of faith that the Indonesian business will be worth at least its acquisition price.

RBA was listed in Dec 2020, so let’s look at the numbers since then.

The company’s sales grew from Rs 1,004 cr in FY21 to Rs 2,437 cr in FY24, which is a compounded growth of 34% and an absolute growth of 142%.

However, when it comes to profits, its is the area for which probably Solidarity calls it “out of favour”. The company saw losses of Rs 282 cr in FY21 and Rs 237 cr in FY24. The company still has to report its first profits since 2021.

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), perhaps a more important metric for a newly set up business, grew at a compounded rate of 111% from 25 cr in FY 21 to Rs 242 cr in FY24.

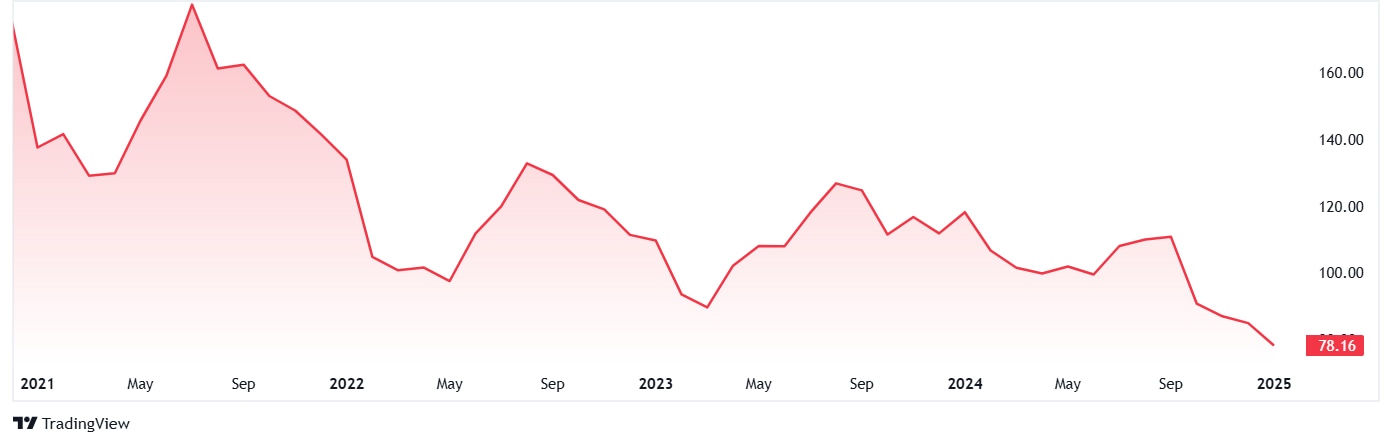

The share price has taken a tumble since the listing, as from its listing price of about Rs 158 it has now come down to Rs 77 (Closing Price Jan 16). That is a drop of over 51%.

The current valuations for the stock are not available on screener.in, probably because it is negative. However, the industry PE when compared with peers is also a staggering 464x.

The company plans to increase its restaurant count to 510 by FY25 in India. It is targeting a 69% gross profit by FY27 from 67% in FY24 primarily driven by increasing profitability in the delivery business and achieving a cash break-even in Indonesia.

Star Health & Allied Insurance Company Ltd

The company is India’s first Standalone Health Insurance provider and is the largest private health insurer in India with a market share of 31% in retail health insurance.

Post Covid, the Health Insurance industry was weighed down by higher medical inflation and higher frequency of claims. Star Health has consistently missed the Claim Ratios guidance they believe the business should operate at.

Solidarity however believes that high Claim Ratios are not a STAR issue alone but an industry wide issue. Their pick is based on the math that more hospital bed additions should reduce medical price inflation and price increases should bring Claim ratios to normalized levels over time.

With a market cap of Rs 27,292 cr, the major shareholders in the company include Safecrop Investments India LLP (WestBridge Capital – holding 40.40%) and (Late) Rakesh Jhunjhunwala & family (holding 17.21%).

The sales for Star Health jumped from Rs 3,775 in FY19 to Rs 14,022 in FY24, which is a compounded growth of 30% and an absolute growth of over 270%.

The net profit saw a big swing from Rs 128 cr in FY21 to Rs 845 cr in FY24, which makes it aa CAGR of 88%.

EBITDA was Rs 210 cr in FY19 and did take a fall for the worst in FY 21 and FY22. It has however bounced back to a positive in FY24 at Rs 1,184 cr. Which makes it a CAGR of 41% between FY19 and FY24.

The share prices were around Rs 906 when listed in December 2021. As of the closing on 16th January, the share was trading at Rs 464, which is a drop of nearly 50%.

Coming to the valuations, the company’s share is trading at a P/E of 32x while the current industry average when compared to peers is 56x. The 10-Year median P/E is 42x while the industry median for the same period is 45x.

The company seemed to be in rough waters in August 2024, as it received a demand order for ~Rs. 195 cr for non-payment of GST liability on the re-insurance commission received by the company during the period FY 2019-2020.

In October 2024, the company was also shaken by a data leak for sensitive data affecting millions of Star Health customers. The hacker claimed that the company’s chief information security officer (CISO), Amarjeet Khanuja was involved in this leak.

Kama Holdings Ltd

KAMA Holdings Ltd is a core investment company while the principal activities of its subsidiaries are manufacturing, purchasing, and sale of technical textiles, chemicals, packaging films, and other polymers.

With a market cap of Rs 8,250 cr, the company derives bulk of its value from its Chemical segment which is facing short cyclical growth headwinds from slowing global Agri demand, inventory rationalisation and China dumping.

But Solidarity believes that the company’s chemical business enjoys strong edge (leadership in high entry barrier Fluoro chemicals, strategic manufacturing relationships with Global Agri majors) and the current earnings pressure is temporary reflecting the business cycle and Chinese dumping.

Also Kama continues to make large Cap Ex investments which can deliver >15% earnings CAGR this decade.

The company’s sales have grown from Rs 7,153 cr in FY19 to Rs 13,440 cr in FY24, which is a compounded growth of 13.4%.

The profits also saw a surge form Rs 647 cr to Rs 1,539 cr in the same period, making it s a compounded growth of 19%.

EBITDA when from Rs 1,274 cr in FY19 to Rs 2,838 in FY24 which is a compounded growth of 17.3%.

The share price in January 2020 was around Rs 1,117 which has growth to the current price of Rs 2,571 (Closing as on Jan 16), which is a jump of 130%.

The company’s share is trading at a current P/E of 11x while the industry average is 21.56. The 10-Year median is 7x while the industry median is 18.4x.

Apart from these, Solidarity has also revealed its stakes in Axis Bank, IndiaMART and RACL Gear Tech.

Really “Out of Favour”?

The numbers for companies like Restaurant Brands Asia Ltd and Star Health do not look very appealing for it to warrant interest. However, Solidarity’s interest in them may be raising some very interesting doubts.

Is there something common investors are missing in these companies, that Rakesh Junjhunwala’s Protégé and his team sees? Let’s not forget that Manish learn from the master himself how not to be afraid to be contrarian.

Which way these stocks will go is something we will find with time, but it definitely warrants an addition to watchlists.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do / do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.