Semiconductors are the foundation of today’s digital economy. They’re tiny chips that power everything from your smartphone and automobile to defence and medical devices. However, India currently imports nearly 90% of its domestic needs. This dependence on imports makes India vulnerable to supply chain risks, as seen in the post-pandemic period. To boost semiconductor manufacturing, the Indian government launched the India Semiconductor Mission with an outlay of ₹760 billion.

According to McKinsey, the Indian semiconductor industry is expected to help reduce India’s dependence on imports by $10-20 billion. India Electronics and Semiconductor Association projects that India’s semiconductor market will grow from ₹4.5 trillion in 2024 to ₹9 trillion by 2030. This offers a massive opportunity for companies.

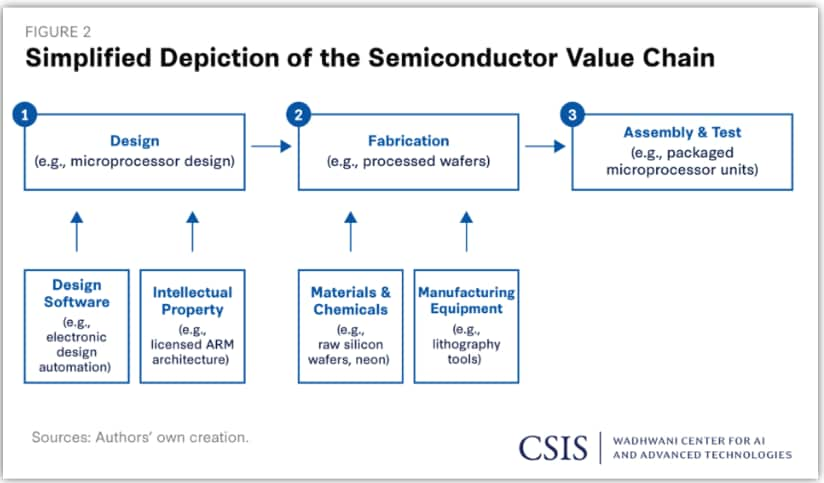

Semiconductor Value Chain

Therefore, here are three semiconductor stocks worth watching…

#1 The Power Player: RIR Power’s big bet on silicon carbide

RIR Power manufactures traditional semiconductor devices, including bridges, power modules, diodes, rectifiers, and thyristors. The company has continually brought advanced semiconductor technologies to India through collaborations with USA-based International Rectifier and Silicon Power Corporation.

Semiconductors and power equipment at the core

RIR operates through two synergistic verticals: Semiconductor Devices and Power Equipment. It also has a presence in Green Hydrogen solutions and next-generation Silicon Carbide (SiC) technologies. The company’s products serve critical sectors, including defence, railways, nuclear, renewables, and energy. It is also expanding into emerging domains, such as electric vehicles.

Within the semiconductor industry, it designs and manufactures devices for rectification, control, and switching applications, including phase control thyristors, inverter-grade thyristors, standard recovery diodes, fast recovery diodes, diode bridge rectifiers, high voltage modules, diode bridge modules, and IGBT modules (StarPower Products).

Leveraging its semiconductor expertise, it designs and manufactures robust power devices for industrial and infrastructure applications, including power rectifiers, battery chargers, high-power stacks and assemblies, AC voltage regulators, and universal control cards (UCCs). It also provides a stable DC supply, precise voltage control, and green hydrogen.

FY25 ended on a strong note, but Q1FY26 shows weakness

From a financial standpoint, total revenue increased by 29% year-on-year to ₹862.1 million in FY25. Increased demand across semiconductor devices, power equipment, and export segments supported this growth. EBITDA (earnings before interest, tax, depreciation, and amortization) rose by 14.4% to ₹113.9 million, with a margin of 13.22%.

Profit after tax (PAT) grew by 4% to ₹82.8 million in FY25.

Further, revenue in Q1FY26 was flat at ₹210 million, while PAT declined 38.5% year-on-year to ₹17.4 million. Its return ratios remain sluggish, with a return on equity of 9.1% and a return on capital employed of 12%.

Odisha SiC project positions RIR for next phase of growth

Looking ahead, RIR is setting up India’s first SiC manufacturing plant in Odisha to produce advanced SiC wafers and devices. It plans to reduce its dependence on imports and strengthen domestic capabilities. This is expected to enable next-generation applications in EVs, Renewables, Aerospace, and Green Hydrogen.

RIR is investing ₹6.1 billion in this project, with 10% of the amount already spent. It expects a 50% commitment from the state of Odisha, which can increase to 75% if the central government’s commitment is secured.

The first phase is expected to start generating revenue from Q4FY26 onwards, with estimated revenues of ₹100-120 million in that quarter. The entire facility is expected to be operational by FY30, with peak revenues of ₹12 billion and EBITDA margins of 25-28%.

From a valuation perspective, RIR is trading at a mind-numbing price-to-earnings (P/E) multiple of 335x, which is significantly higher than the 10-year median of 46x.

RIR Power Electronics Share Price

#2 The Design House: MosChip’s fabless ambition

Moschip is recognised as India’s first Fabless Semiconductor company. Its focus is encapsulated by the motto: “Silicon | Software | Systems- Connecting the World”. It has several key business units, including Semiconductors, Software, System Design, and Product Engineering (Embedded Software, Digital Engineering).

Strong revenue growth backed by ASICs and IP Services

MosChip revenue rose 59% year-on-year to ₹4.6 billion in FY25. The Semiconductor segment contributed ₹3.6 billion (78%) of the revenue, while the Software & System Design segment contributed ₹1.0 billion (22%). Revenue growth was primarily attributed to the expansion of Turnkey Application-Specific Integrated Circuits (ASICs) and IP services revenue.

PAT more than tripled to ₹330 million, from ₹100 million in FY24. The momentum continues in Q1FY26 too, with revenue rising 70% year-on-year to ₹1.3 billion, while PAT almost doubled to ₹110 million, from ₹40 million in the same period last year. RoE and RoCE are moderate at 11.2% and 11.9%, respectively.

Indigenous innovation and HPC Projects to drive future

Looking ahead, MosChip views itself as a global engineering partner specializing in two complementary domains: silicon engineering and product engineering. Its strategic direction focuses on diversification and high-growth areas.

The company plans to continue growing its design services offerings, aiming to deepen and stabilize its engagement. It also intends to maintain its position among the top global semiconductor companies (10 of the top 20 are current customers). Moship plans to add emulation to the semiconductor service portfolio.

MosChip is developing an indigenous Smart Energy Meter IC under the Government of India’s Design Linked Incentive (DLI) Scheme. This product will cater to both the domestic and global markets. The market for smart energy meter ICs in India is expected to reach about 60 million units, and the overseas market 2 billion units by 2028.

It is also co-developing the AUM processor (an Indigenous HPC SoC) with C-DAC on TSMC 5 nm technology, which is part of India’s National Supercomputing Mission. This project is expected to create significant opportunities in both domestic and international markets for complex tasks, such as AI and scientific simulations.

Valuation-wise, it is trading at a P/E of 125, which is lower than the 10-year median of 186. Still, the valuation looks lofty.

Moscip Technologies Share Price

#3 The Turnaround Play: SPEL’s high-stakes revival

SPEL is primarily engaged in wafer sort, assembly, test, and drop-shipment services of IC chips. It functions within the outsourced assembly and test (OSAT) industry. The company has been servicing the US market for over 20 years, leveraging emerging technologies such as AI, 5G, IoT, and electric vehicles.

Financial stress persists despite stock performance

From a financial standpoint, SPEL is too small, with revenue of just ₹80 million in FY25, while net loss stood at ₹210 million. In Q1FY26, revenue declined 9.4% year-on-year to ₹19.3 million, while loss increased by 56% to ₹55.9 million. That said, its share price has delivered a 56% compounded annual growth rate over the last three years.

Betting on R&D and government incentives for revival

Looking ahead, the company expects production orders to improve in fiscal year 2025-26. The outlook for fiscal year 2025-26 is positive, and SPEL plans to add new customers from the European and US regions.

The company has ambitious plans for future investment in research and development. This package includes investments in intellectual property, aiming to increase the company’s revenue and profitability in the years to come.

SPEL aims to leverage government support and capitalize on shifting global supply chain dynamics. It is actively seeking funding to take advantage of special incentives announced by the Indian Government and the Tamil Nadu Government for assembly and testing units.

Concerns are also there due to consistent losses and the generation of negative cash flows. To address these issues, the company is seeking shareholder approval to sell or transfer up to 1.8 acres of land to repay dues and meet its growth objectives.

SPEL Semiconductor Share Price

Bottomline

The semiconductor industry in India is still in its early stages, but the pace of development is accelerating rapidly. Government incentives, industry push, and the growing demand for chips across sectors are gradually setting the stage for domestic players to scale. RIR Power is betting big on silicon carbide manufacturing, MosChip is carving a niche in design and IP-led solutions, while SPEL is trying to turn around its OSAT business.

Each company has its own unique set of strengths and challenges. RIR has lofty valuations, but a strategic SiC project. MosChip has strong growth momentum, albeit with elevated multiples, and SPEL has high investor interest despite financial stress. What ties them together is the opportunity to participate in a market that is projected to triple in less than a decade.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.