India’s defence industry is on fire. According to a press release Press Information Bureau (PIB) issued in March 2025, during FY24, the defence production crossed Rs 1.27 lakh crore — an all-time high. Around 21% of this was from Indian firms. Even the exports reached an all-time high of Rs 21,083 crore.

This expansion is no coincidence. It’s a consequence of policy initiatives such as “Aatmanirbhar Bharat”, the Defence Acquisition Procedure (DAP), and ascendant global orders. India is not merely acquiring; it’s creating. And in this creation, there’s something more than missiles and warships.

This piece is not about the big defence giants such as Hindustan Aeronautics (HAL), Bharat Electronics (BEL), or Bharat Dynamics (BDL). It is about the behind-the-scenes heroes — the Tier-2 and Tier-3 vendors. The ones who are producing the bolts, brakes, bearings, actuators, fasteners, and carbon-composite components that propel India’s missiles, aircraft, and submarines. Without them, nothing happens. Literally.

Why these stocks? Because the boom in defence manufacturing is incomplete without this lot of companies. As India shifts from being a buyer to becoming a builder, these component manufacturers stand to benefit along with other major players. But usually, they go unnoticed.

We have shortlisted five companies. Each one of them manufactures critical sub-components for the defence ecosystem. We didn’t choose them haphazardly. We passed a trifecta of filters:

1. They need to provide real mechanical or electronic sub-components — not simulators or software.

2. They need to have established connections to defence or space customers such as HAL, DRDO, ISRO, BEL, or overseas original equipment manufacturers (OEMs).

3. They need to be listed companies with good fundamentals.

These five companies— although not defence brands — are highly integrated in the value chain. And in the sections that follow, we show why they could potentially be very valuable players in India’s defence tale.

#1 MTAR Technologies

MTAR Technologies develops and manufactures components and equipment for the defense, aerospace, nuclear and clean energy sectors. The company caters to the technical and engineering needs of the Indian government in the post embargo regime.

MTAR Technologies constructs key parts such as electromechanical actuators, roller screws, scramjet engine components, and ammunition boxes — all integral to missiles, jets, and propulsion systems. It handles the entire process from raw material to assembly.

Its customers include HAL, DRDO, and ISRO, in addition to global players like Thales, Elbit, GKN, and Israel Aerospace. Most of these collaborators have placed trial orders and are now expanding. MTAR’s facilities are already approved by a number of international defense OEMs

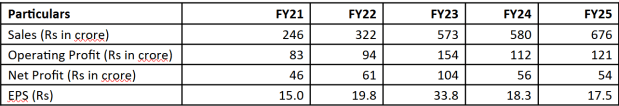

MTAR’s top line has expanded during the last five years from Rs 214 crore to Rs 676 crore — 26% compounded annual growth rate (CAGR). But profit expansion has fallen behind. Net profit touched a high of Rs 104 crore in FY23, fell to Rs 56 crore in FY24 and Rs 54 crore in FY25, reducing 5-year profit CAGR to a mere 11%.

The firm acknowledged the drop is the result of decreasing margins. Defence orders remained in the proto stage, while high-margin space and clean energy orders were decelerating. Consequently, lower-margin local contracts were the order of the day. Earnings before interest, tax, depreciation, and amortisation (EBITDA) margins decreased from close to 30% in FY23 to 18% in FY25.

Return on equity (RoE) averaged 11% — moderate for a precision engineering player. MTAR had Rs 196 crore of debt and a 0.5 debt-equity ratio as of FY25. It’s also budgeting Rs 180 crore of new capex. Management sees margin recovery only in the second half of FY26, when export orders pick up. Till then, profitability would remain weak.

MTAR Technologies 5-Year Financial Performance

MTAR is at the transition stage. It’s pursuing long-term export orders and venturing into clean energy, such as electrolyzer trials. But the majority of deals are preliminary, and near-term revenue is uncertain.

With increasing fixed costs from hiring and new facilities, short-term margins could remain under strain. The long-term opportunity exists — but execution is glacial, and returns could be slow to arrive.

#2 Data Patterns

Data Patterns (India) is one of the fastest-growing companies in the Defence and Aerospace Electronics sector in India. It is focused on in-house development and manufacturing facilities led by innovation and design and development efforts. It is in the business for over 35 years.

What sets Data Patterns apart is its ability to go beyond just assembling hardware. It creates mission-critical electronics from the ground up — including embedded computing and signal processing modules — specifically for particular defence requirements. This vertical integration enables more rapid iteration, greater IP control, and increased margins.

The strength of the company is in its compatibility with long-cycle strategic programs. After their systems are integrated into a platform like Tejas or BrahMos, replacement is expensive and difficult. That provides it a competitive advantage over vendors providing off-the-shelf components only.

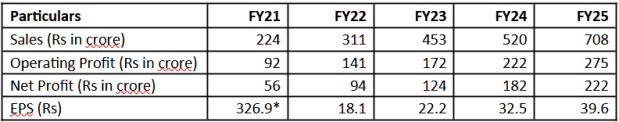

Data Patterns has posted impressive numbers in the last five years. Sales increased from Rs 224 crore in FY21 to Rs 708 crore in FY25 — 35% CAGR over the period of the last five years. Net profit increased from Rs 56 crore to Rs 222 crore in the same period, registering a 59% CAGR over last 5 years. Its RoE in the same time period has been around 16% on average, which reflects effective capital utilization.

FY25 numbers reflect sustained momentum. Revenue increased 36% year-on-year (YoY) and profit after tax (PAT) by 22%. Margins are still strong, with an operating profit margin of 39% and PAT margin well in excess of 30% — one of the highest in the defence electronics sector.

As of FY25 as well, the firm is debt-free. The firm enjoys strong cash balances and no immediate need to raise capital — either through debt or dilution. That puts them at ease relative to peers.

Data Patterns 5-Year Financial Performance

Source: Screener.in

Data Patterns is expecting 20–25% revenue growth in FY26, supported by a Rs 730 crore order book and robust margin guidance of 35–40%. In order to prevent execution delays, it has already started pre-order activities for possible orders worth Rs 1,000–Rs 2,000 crore. The firm is transitioning from component supplies to complete system integration and intend to create scalable platforms with reusable electronics.

It’s also increasing export initiatives in Europe and East Asia, although management concedes that global competition is tough and results are notional. On the home front, short-cycle defence orders amounting to Rs 1,000 crore are anticipated under emergency procurement and repeat orders.

In the past 18 months, Rs 150 crore has been spent on new radar and EW systems, which are currently advanced stage of evaluation. Although the pipeline looks robust, order conversion to reality hinges on customer approvals and Make-II program schedules — risks that the management acknowledged in last investor call meeting.

#3 Paras Defence and Space Technologies

Paras Defence and Space Technologies (PDST) is a private sector company primarily engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products and solutions.

The company caters to four major segments – Defence & Space Optics, Defence Electronics, Heavy Engineering and Electromagnetic Pulse Protection Solutions.

Paras Defence constructs niche hardware such as gimbals, IR optics, and thermal image modules deployed in missiles, drones, and satellites. It deals with high-accuracy, low-volume parts requiring in-house integration and technical depth.

Its key customers are BEL, HAL, DRDO laboratories, and ISRO. Although the projects are strategic, order flows are subject to long trial cycles and government approvals, which can hinder growth. The company is also working on indigenous technology development under Make in India.

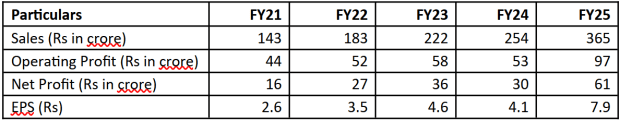

Paras Defence’s topline increased from Rs 143 crore in FY21 to Rs 365 crore in FY24, a 20% CAGR over five years. Net profit increased from Rs 19 crore to Rs 61 crore, at a 26% CAGR over the period under reference. RoE averaged about 9% over five years — modest for a high-tech defence player.

Increasing interest expenses and delayed payments from government customers are still major concerns as the company expands.

Paras Defence 5-Year Financial Performance

space optics. The company has already commenced R&D for newer applications and intends to integrate deeper with strategic defence programs.

The firm is also looking to increase its export share. It is seeking new global tie-ups to venture beyond India’s defence space, although no tangible orders have yet come through.

To address future demand, Paras is spending on capacity build-out at its Ambernath plant. It is also working towards indigenisation of key technologies that remain import-based.

With that said, implementation will be everything. Several of the aforementioned projects are either at R&D or early stages of engagement. Top-line visibility of revenue from such initiatives is scarce short-term. Management pointed out in investor call meeting that the business is subject to order conversions and client clearances in a timely manner.

#4 Mishra Dhatu Nigam (MIDHANI)

Mishra Dhatu Nigam (MIDHANI) manufactures superalloys, titanium, special purpose steel and other special metals. It was incorporated in 1973 at Hyderabad as a Government of India Enterprise under the Ministry of Defence.

MIDHANI caters to India’s defence needs by providing basic materials — not finished systems. It produces superalloys, titanium, and special steels used for engine components, missile bodies, and structural frames. These materials operate under severe stress and high temperatures.

Its top customers include HAL, ISRO, DRDO, BDL, and L&T. MIDHANI’s materials are part of key programs like LCA Tejas, Agni missiles, K-series submarines, and Gaganyaan. It often works closely with these clients to develop custom alloys.

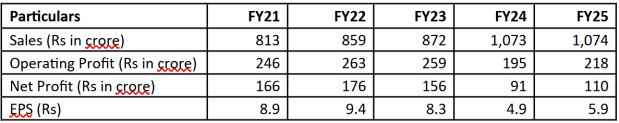

Over the last five years, MIDHANI’s sales have grown at a CAGR of 9%, rising from Rs 813 crore in FY21 to Rs 1,074 crore in FY25. However, net profit fell from Rs 160 crore to Rs 110 crore during the same period, indicating margin pressure. RoE averaged around 12% over five years.

In FY25, revenue was flat at Rs 1,074 crore, but PAT rose 21% to Rs 110 crore. EBITDA grew 11% to Rs 249 crore, but margins declined to 23% from 30% in FY24. Management noted better working capital control and an Rs 8.5 crore reduction in inventory, helping improve cash flow and reduce debt.

MIDHANI 5-Year Financial Performance

MIDHANI anticipates sustained demand from aerospace, defence, and atomic energy industries. As diversification, it is working on alloys for healthcare, oil & gas, and power sectors. The company spent Rs 50 crore in FY24 on capacity expansion and infrastructure buildup.

In FY 24 exports almost tripled YoY (excluding deemed exports), indicating global traction. With Rs 1,832 crore order book as of April 1, 2025, MIDHANI has good revenue visibility for FY25.

Management is upbeat regarding margin enhancement and tighter working capital management in FY25.

#5 Bharat Forge

Bharat Forge produces key subcomponents of defence platforms such as artillery guns, armoured vehicles, and missile systems. It exports forged barrels, chassis, and machined components—not complete systems. Major customers include DRDO, BEL, BEML, and international OEMs like Boeing and Rafael.

The firm is the backbone of projects such as ATAGS but has long gestation periods and tardy execution. Although defence is a growing area, it still contributes modestly to revenues.

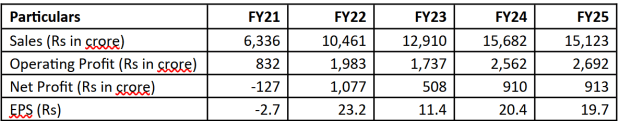

Bharat Forge’s revenue in the past five years increased by a CAGR of 13%, from Rs 6,336 crore in FY21 to Rs 15,123 crore in FY25. Net profit also increased from a loss of Rs 127 crore in FY21 to Rs 913 crore in FY25.

But FY25 profit was stagnant YoY, reflecting stagnation amidst margin improvement. RoE over five years averaged 10%, whereas FY25 RoCE (adjusted for cash) was 18.1%, reflecting improved capital effectiveness.

In FY25, standalone EBITDA margin improved to 28.5%, while consolidated revenue declined 3.6% to Rs 15,123 crore. EBITDA margin still rose to 18.2% due to reduced losses in subsidiaries. The U.S. unit turned EBITDA-positive in Q4, but overseas utilization remains subpar at 60–65%.

Defence order book amounted to Rs 9,500 crore. Aerospace exports increased 4 times over five years and now constitute 15% of industrial exports. Total industrial exports were flat at Rs 1,600 crore since FY19 due to a decline in oil & gas.

Bharat Forge 5-Year Financial Performance

E-mobility is poised to become profitable by H2 FY26, but it is an early-stage business with untested scale. The company is also venturing into electronics manufacturing, including servers, with manufacturing to commence in the second half of FY26 using SMT lines installed under KPTL Overseas operations demonstrate mixed trends.

The U.S. business became EBITDA-positive in Q4 and is ramping up capacity, but Europe remains soft, especially steel, which is being restructured. Complete turnaround will be time-consuming and subject to exogenous factors such as demand revival and tariff clarity.

The company is to complete the acquisition of American Axles India assets by June 2025, with an aim to increase content per vehicle and boost auto segment presence. As sound as it is, success in integration will be based on post-transaction execution and the state of the markets.

Conclusion

The defence and engineering industry is irresistibly on the cusp of long-term expansion, led by increasing government spending, export potential, and growing emphasis on indigenization. But for all the compelling narrative, most stocks in the sector are trading at high valuations that account for future profits which might be sluggish to take shape. Execution issues, policy delays, and uneven global demand also contribute to near-term uncertainties.

With these dynamics, investors are better off being patient. Rather than entering at sky high valuations that build in a perfect outcome, it would be more prudent to wait for more favorable valuations or more definitive evidence of earnings gains. The industry holds great promise—but timing the entry just right will be crucial to realizing its full value.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions