Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices closed the trading session on a lower note on the last day of September. The BSE Sensex tanked 1,200 points or 1.41% to finish the day’s trading at 84,365. The NSE Nifty 50 declined 357 points or 1.36% to 25,822. The Bank Nifty closed the day’s trading 1.58% lower at 52,985. The Nifty Midcap 100 closed the session 233 points or 0.39% lower at 60,148.

The NSE Nifty 50 closed 1.36% lower at 25,822.25, while the BSE Sensex closed 0.37% lower at 84,365.32.

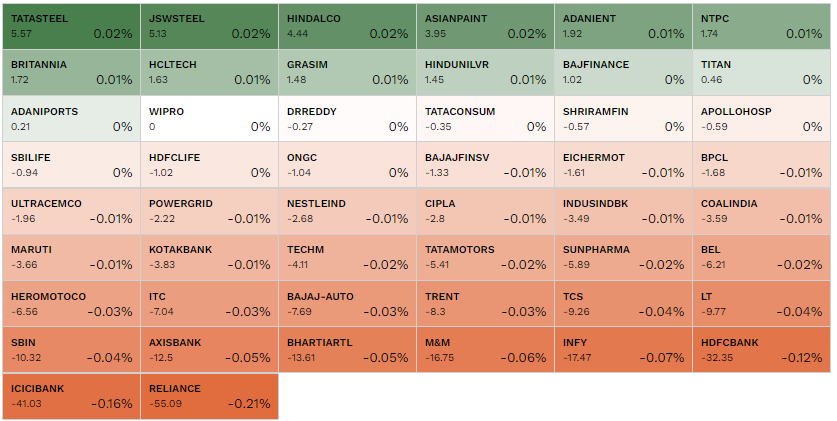

JSW Steel, NTPC, Tata Steel, Hindalco, and Britannia were the top gainers in the Nifty 50. While Hero MotoCorp, Trent, Axis Bank, Reliance Industries, and M&M were the major losers in the Nifty 50 on September 30.

ICICI Bank and HDFC Bank along with Axis Bank and SBI dragged the sectoral index Nifty Bank and key benchmark indices on September 30.

Courtesy : NSE

"Spot gold is currently trading flat at $2659 after closing 0.58% lower on Friday. The much-awaited US PCE deflator inflation data were largely subdued, which bolstered the case of a 50-bps cut. However, traders are cautious as this week's US data include ISM services, ISM manufacturing, ADP employment change, and nonfarm payroll. China's stimulus blitz is somewhat negative for the metal in the very short term. China's benchmark index rose 10% today as it hit the daily limit. Gold is expected to remain bid in the near term. Geopolitical tensions intensify in West Asia after the killing of the Hezbollah Chief Nasrallah by Israel. Israel has also struck the Houthis of Yemen as it destroyed aircraft, seaports, etc.," said Praveen Singh, Associate Vice President of Fundamental Currencies and Commodities at Sharekhan by BNP Paribas.

Shares of Ola Electric Mobility Ltd. have fallen for the ninth time in the last 11 trading sessions, slipping below the Rs 100 mark for the first time since its public listing in August. Following Monday's decline, the stock has now decreased by 37% from its peak of Rs 157.4, reached shortly after its debut.

Asian Paints has received an order from the Deputy Commissioner (ST)-II, Large Taxpayer Unit in Chennai, Tamil Nadu, disallowing input tax credit (ITC) amounting to Rs 3,74,660, along with a penalty of Rs 1,87,330. Meanwhile, shares of the company are trading flat at Rs 3,342.70 on the NSE.

In today's trading session, Nifty Auto stocks experienced notable declines, with Hero Motocorp leading the losses at -4.20%. TVS Motor followed closely with a decrease of -3.47%, while Bajaj Auto and M&M saw declines of -2.28% and -2.12%, respectively.

Shares of metal companies rallied on September 30, driven by a sharp increase in iron ore prices and China’s efforts to revitalize its struggling property sector. Leading the gains were NMDC, MOIL, Hindalco, and JSW Steel, all surging between 2-4%.

The rally followed a near 11% spike in iron ore prices after China’s decision to ease home-buying restrictions in three of its largest cities—Shanghai, Guangzhou, and Shenzhen. This policy shift is expected to improve the demand outlook for iron ore, aligning with Beijing’s broader efforts to support the country’s beleaguered property sector.

The board of Mankind Pharma has approved plans to raise up to Rs 5,000 crore through non-convertible debentures (NCDs) and an additional issuance of commercial paper totaling Rs 5,000 crore. Meanwhile, shares of the company are trading at Rs 2,561.50 on the NSE, reflecting a decline of 1.18%.

As of 1 PM on September 30, 2024, the advance-decline ratio on the BSE indicated that 1,562 stocks advanced, while 2,325 declined, and 159 remained unchanged, out of a total of 4,046 stocks traded. Notably, 258 stocks reached a 52-week high, while 48 hit a 52-week low. Additionally, 312 stocks traded at the upper circuit limit, whereas 288 stocks were at the lower circuit.

Antara Senior Living, a wholly-owned subsidiary of Max India Limited, has signed an agreement with Max Estates Ltd. to manage senior living residences within the recently launched intergenerational residential community, Estate 360, located in Gurgaon. Max India shares are currently trading at Rs 263.70 on the NSE, reflecting a rise of 3.25%.

In the latest noon trading session on the NSE, JSW Steel emerged as the top gainer, rising by 2.50%. Other notable gainers include Hindalco at 1.68%, Tata Steel at 1.65%, Adani Enterprises at 1.35%, and Asian Paints at 1.18%.

On the flip side, Hero Motocorp led the losses, declining by 4%. Other significant losers included Trent with a drop of 2.78%, M&M down 2.57%, Reliance falling by 2.28%, and Bajaj Auto decreasing by 2.25%.

Marine Electricals (India) has secured an order worth ₹8.58 crore from Princeton Digital Group for the supply of LT and MV panels for the MU1 DC1 Airoli Navi Mumbai Project. The delivery of the panels is scheduled to occur over a period of 6 to 8 months. Following this Marine Electricals shares are priced at Rs 219.45 on the NSE, reflecting a decrease of 1.04%.

Heavyweights like Reliance Industries, ICICI Bank, HDFC Bank, Infosys, and M&M were contributing the most to the fall of Nifty 50 on September 30.

Courtesy: NSE

Indian benchmark indices started the week on a negative note and faced downward pressure, amidst mixed cues from global markets. This decline was largely attributed to significant sell-offs in major heavyweight stocks, including Reliance Industries, Infosys, TCS, and ICICI Bank, which collectively influenced the market's negative sentiment. "Derivative data suggests hefty option writing by call writers at 26000, 26100 & 26200 strikes which indicates that bears are actively pressurising the markets overall. We expect markets to remain under pressure in the second half of the day as well," said Stoxkart.

The Calcutta High Court has upheld a Rs 780 crore arbitration award in favor of Reliance Infrastructure Ltd in its dispute with West Bengal's Damodar Valley Corporation, according to a stock exchange filing by the Anil Ambani-led company. Following the court's decision, Reliance Infrastructure's stock surged 5.43% on the BSE, reaching Rs 340.50.

Scanpoint Geomatics has been shortlisted for a project with the Indian armed forces under the "MAKE-II" and IDDM (Indian Design, Development, and Manufacturing) initiatives, which focus on promoting indigenous capabilities for the defense sector. Following this development, Scanpoint Geomatics' shares surged 5% on the BSE, reaching Rs 9.24.

Shares of Reliance Power Ltd, which had surged 44% in the past two weeks, fell over 4% in Monday's trading session ahead of a board meeting to discuss raising long-term resources from domestic and global markets. The stock declined by 4.33%, reaching a low of Rs 44.35 on the BSE.

Shares of Manba Finance Limited had a positive start on their stock market debut on September 30, listing at Rs 150, which represents a 25% premium over the issue price of Rs 120 on the BSE.

However, these listing gains are slightly lower than grey market estimates, where shares were trading at a premium of approximately 28%. The grey market is an unofficial trading platform where shares are exchanged before the offer opens for subscription and continue to trade until the listing day.

Catch Live Updates : Manba Finance IPO 2024 Live Updates: Manba Finance shares list at 25% premium over IPO price

BSE shares jumped over 2% to an intra-day high of Rs 3,741 on the National Stock Exchange (NSE) during the early session on September 30. This surge follows the announcement that transaction charges for Sensex Options and Bankex Options contracts in the equity derivatives segment will be revised starting October 1, 2024.

Read More: BSE shares jump 2% as stock exchanges hike transaction charges from October 1

"Crude oil prices recovered from their lows on Friday but prices fell last week amid demand concerns and higher supply from global oil markets. As per market sources, OPEC+ will increase production by 1,80,000 barrels per day each month starting from December. The Libyan dispute has also settled and its exports could resume soon. Also, the Chinese central bank announced a cut in RRR by 50 basis points and undertook stimulus measures to revive the Chinese economy thus supporting crude oil prices at lower levels. Escalating tensions in the West Asia are also supporting crude oil prices. We expect crude oil prices to remain volatile in today’s session," said Rahul Kalantri, Vice President of Commodities at Mehta Equities.

Hindalco, NTPC, JSW Steel, Tata Steel, and Britannia were the top gainers in the Nifty 50. Hero MotoCorp, Tech Mahindra, Coal India, M&M, and ICICI Bank were the major losers in the Nifty 50 on September 30.

The NSE Nifty 50 opened 0.28% lower at 26,106, while the BSE Sensex opened 0.34% lower at 85,283.32.

"We will begin the week with the prospects of 26600 continuing to be alive but with a higher chance of volatility stepping up. Though yet another attempt to push higher could be seen, the oscillators still give out the same signals that had triggered a turn lower on Friday. We shall therefore mark 26230 and 26130 as exhaustion points on either side of the initial range," said Anand James, Chief Market Strategist at Geojit Financial Services.

The company has been declared the lowest (L1) bidder by the Brihanmumbai Municipal Corporation (BMC) for a project valued at Rs 1,989.9 crore. The project involves the design and construction of an 8.48 km tertiary treated water conveyance tunnel from the Dharavi Wastewater Treatment Facility (WWTF) to the Ghatkopar WWTF, to be completed within 93 months.

"Markets will likely witness a weak start on Monday, mirroring the fall in the Gift Nifty index and bearishness in other Asian indices with Japan's Nikkei crashing nearly 5%. Investors are hoping that subdued US inflation data on Friday could result in an outsized rate cut by the Fed in the current financial year. This may push the domestic bond yields further lower going ahead and prompt overseas investors to pump funds into Indian financial markets in the medium to long term. The GST numbers and auto sales data for September will trickle in on Tuesday, showing how the domestic economy has been faring in the light of the uncertain global economy and rising geo-political tensions," said Prashanth Tapse, Senior Vice President of Research at Mehta Equities.

The 24-carat gold rate in India was Rs 75,180 per 10 grams on September 30. The rate for 24-carat gold per gram is Rs 7,518. The rate of 22-carat gold was Rs 68,915 per 10 grams.

The rate of 24-carat gold has risen by 1.63% in the last one week, and the yellow metal has risen by 1.90% in the last ten days. The silver is currently quoted at Rs 91,380 per kilogram.