Systematic Investment Plan or SIP has been the preferred option for wealth creation among investors, according to the AMFI data.

If you’re an aggressive investor looking to create wealth over the long term and have a horizon of at least 8-10 years, SIP in a mid-cap fund may be suitable for your satellite portfolio.

Midcaps are defined as companies ranking from 101st to 250th in terms of full market capitalisation.

Compared to smallcaps, midcaps have better access to capital and other resources, can adapt to new trends, their management teams are stronger, and have the potential to become tomorrow’s largecaps or bluechips.

Mid-cap stocks have delivered excellent returns in recent years and have outpaced their large-cap peers by a wide margin.

The reasons behind this are resilient growth of the Indian economy, better-than-expected corporate earnings, and strong participation of retail investors towards midcaps.

In this editorial, we take you through 4 mid-cap funds that have fared well in terms of both returns and risk, which you could consider for SIPs.

#1 Invesco India Mid Cap Fund

Launched in April 2007, this fund has seen a sharp growth in its assets after the pandemic. Its AUM as of July 2025 is over Rs 78 bn.

It is a growth-oriented mid-cap fund focusing on investing in high-quality mid-sized companies.

Like its peers, the fund adopts a bottom-up stock selection strategy with a view to finding scalable companies with excellent financials, sustainable business models, good governance, and clear long-term growth visibility.

The fund’s investment philosophy is high-conviction ideas based on fundamental analysis, valuation comfort, and capital efficiency.

It has shown consistency in performance across various time horizons, placing it among the front-runners in the mid-cap funds category.

The fund usually holds 45-50 stocks in its portfolio, making it fairly diversified.

As of July 2024, the fund has 48 stocks in its portfolio. The top 10 comprise around 41%. These include BSE (4.7%), Glenmark Pharma (4.6%), Swiggy (4.5%), etc.

Finance (21.7%), healthcare (19.7%), and retail (11.4%) are among the top 3 sectors of the fund, making up over 52.8% of its portfolio.

The portfolio turnover in the last one year has been in the range of 40-80%.

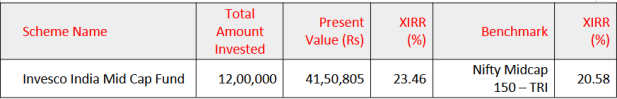

Invesco India Mid Cap Fund, in the last 10 years, has delivered an XIRR or SIP return of 23.46% compared to 20.58% by its benchmark, the Nifty Midcap 150 – TRI as of 25 August 2025.

Invesco India Mid Cap Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), would now be valued at Rs 4.15 m.

#2 Edelweiss Mid Cap Fund

Launched in December 2007 as Edelweiss Mid and Small Cap Fund, it was rechristened as Edelweiss Mid Cap Fund after the recategorization and rationalisation of norms for mutual funds came into force.

Its AUM has increased over the years, but more so after the pandemic. As of July 2025, it is managing assets over Rs 110 bn.

Like its peers, the fund aims to identify strong and quality businesses primarily in the mid-cap space. It identifies stocks with good earnings growth potential, profitable products and services, and are run by good management.

It follows a bottom-up approach to pick stocks that have the potential to compound wealth over the long term. Usually, it holds a portfolio of 70-80 stocks.

As per the July 2025 portfolio, the fund has 81 stocks. Of these, the top 10 stocks are 25.5% of the portfolio and include Max Healthcare Institute (3.4%), Persistent Systems (3.1%), and Coforge (3%).

The fund has exposure to a wide range of sectors, but the top 3 are finance (14.6%), healthcare (10.7%) and IT (10.3%), comprising 35.7% of the portfolio.

Overall, the fund has held a well-diversified portfolio, with a turnover ratio in the range of 40-50% in the last one year.

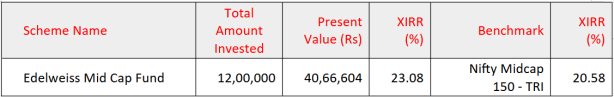

In the last 10 years, Edelweiss Mid Cap Fund has delivered a XIRR or SIP return of 23.08% compared to 20.58% by its benchmark, the Nifty Midcap 150 – TRI as of 25 August 2025.

Edelweiss Mid Cap Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 m, would now be valued at Rs 4.07 m.

#3 Nippon India Growth Mid Cap Fund

Launched in October 1995 as Nippon India Growth Fund, this scheme is the oldest scheme in the mid cap fund category.

The fund followed a multi-cap strategy, maintaining a balanced exposure across large-cap, mid-cap, and small-cap stocks until 2017.

However, after that, it was repositioned and recategorised as a mid-cap fund.

Today, it manages assets over Rs 385 bn as per its July 2025 portfolio and is the third-largest fund in the category.

The fund employs a Growth at Reasonable Price (GARP) strategy to identify high-potential stocks and follows a bottom-up approach.

It avoids momentum-driven bets, instead focusing on quality stocks available at reasonable valuations and holding them with a long-term perspective.

The fund holds a large portfolio of 90-100 stocks.

As per the July 2025 portfolio, it’s holding 96 stocks.Among them, the top 10 stocks comprise 23.5%. They include BSE (3.2%), Fortis Healthcare (3%), Cholamandalam Financial Holdings (2.6%), etc.

Among a wide range of sectors, the top 3 are finance (15.8%), auto & ancillaries (12.7%), and healthcare (11.7%).

The fund’s portfolio turnover in the last 1 year has been in the range of 9-22%, which indicates that most of its stocks with a long-term view.

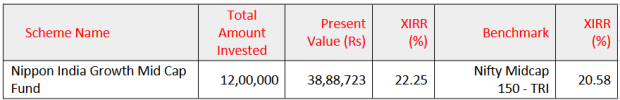

With this strategy, Nippon India Growth Mid Cap Fund, in the last 10 years, has delivered a XIRR or SIP return of 22.25% compared to 20.58% by its benchmark, the Nifty Midcap 150 – TRI as of 25 August 2025.

Nippon India Growth Mid Cap Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over a 10-year period, i.e., a total investment of Rs 1.2 m, would now be valued at Rs 3.89 m.

#4 HDFC Mid Cap Fund

Launched in June 2007, HDFC Mid Cap Fund (earlier HDFC Mid-Cap Opportunities Fund) has solidified its position in the mid cap fund category.

Its AUM has grown over the years and is now over Rs 838 billion (bn) as per the July 2025 portfolio – the highest in its category.

The fund has delivered above-average returns across diverse market conditions. It has consistently been in the top-quartile performers over the years.

It invests in stocks that have reasonable growth prospects, sound financial strength, sustainable business models, and are available at acceptable valuations. A bottom-up approach is followed to identify high-quality businesses.

It usually holds a large portfolio of 65-75 stocks and limits exposure to a single stock to within 5%.

As of July 2025, the fund has 73 stocks in its portfolio. The top 10 comprise about 32%. These include Max Financial Services (4.6%), Balkrishna Industries (3.8%), Coforge (3.2%), etc.

Among sectors, the top 3 are auto & auto ancillaries (16.4%), banking (12.9%), and healthcare (12%).

The fund manager, Chirag Setalvad, has steered clear of chasing market trends. He holds stocks with conviction, keeping the portfolio turnover in the range of 15-25% annually.

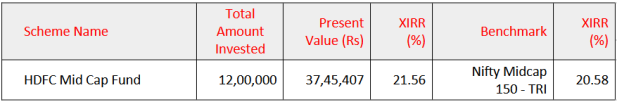

With this approach over the last 10 years, HDFC Mid Cap Fund has delivered an XIRR or SIP return of 21.56% compared to 20.58% by its benchmark, the Nifty Midcap 150 – TRI as of 25 August 2025.

HDFC Mid Cap Fund – 10 Year SIP

A monthly SIP of Rs 10,000 in the fund over a 10-year period, i.e., a total investment of Rs 1.2 m, would now be valued at Rs 3.75 m.

Conclusion

Keep in mind that while midcaps have the potential to generate high returns, the risk of investing is also high. They are not for the faint-hearted.

At present, the trailing PE of the Nifty Midcap 150 index is 33, slightly higher than the 5-year average of 29. This means that midcap valuations are rich.

In volatile times, SIPs can help you mitigate risk with the inherent rupee-cost averaging feature, but don’t get carried away.

Make sure you are only considering funds that align with your personal risk appetite, investment objectives, and investment horizon.

Be a thoughtful investor.

#Table Notes: Data as of 25 August 2025. Returns are XIRR in percentage. Monthly SIP of Rs 10,000 over a 10-year period in the Direct plan – Growth option considered.

“Past performance is not an indicator of future returns. The securities quoted in the table are for illustration only and are not recommendatory.”

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary