Several policies of the Indian government like the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) and the Ayushman Bharat Digital Mission have been giving a major push to the Indian hospital sector in recent years. The projected growth in healthcare spending over the next few years is expected to benefit the nation’s hospital stocks.

In the post-pandemic years, there has been a resurgence in health awareness among Indians. As per JM Financial Asset Management Ltd (JM), there is an anticipated increase in the number of senior citizens in the next two decades. However, it has been noted that India has just 0.5 hospital beds for every 1,000 people. This is significantly lower than the global average of 3. Moreover, 60% of healthcare facilities are centred in the Tier-I cities and large metros.

The urgency to close this substantial demand-supply gap has necessitated an increase in hospital sector investments, both by the government and private sector. This is reflected in a surge of bed additions and a steady climb of average revenue per occupied bed (ARPOB) across major hospital chains. Price jumps combined with solid profit margins from frequent elective surgeries, chronic therapies and customer-centric insurance coverage policies are driving this metric.

The attractiveness of the macro opportunity, and the increasing ability of pay a premium for quality healthcare, hospital stocks are on the watchlist of institutional investors. Fortis Healthcare, Global Health, Narayana Hrudalaya and Krishna Institute are on a high-growth trajectory riding on steadily rising revenues and net profit.

Market Opportunity

Per a report by IMARC Group, India’s hospital market was valued at approximately INR 11,42,932 crore in 2024 and is anticipated to reach INR 22,15, 582 crore by 2033, growing at a compound annual growth rate (CAGR) of 7.6% during the forecast period of 2025-2033.

Consolidation Scenario in Indian Hospital Sector

The hospital space in India is also seeing investor confidence in the form of a wave of high-intensity consolidation moves. For instance,IPO-bound Manipal Hospitals is most likely to acquire Sahyadri Hospitals with a bid of INR 6,838 crores. Blackstone, Fortis Healthcare and EQT partners are also in the race to acquire the same.

Let us take a look at 3 healthcare companies expected to benefit from the tailwinds of the sector. These companies are among the fastest growing over a 5 year period.

#1 Max Healthcare

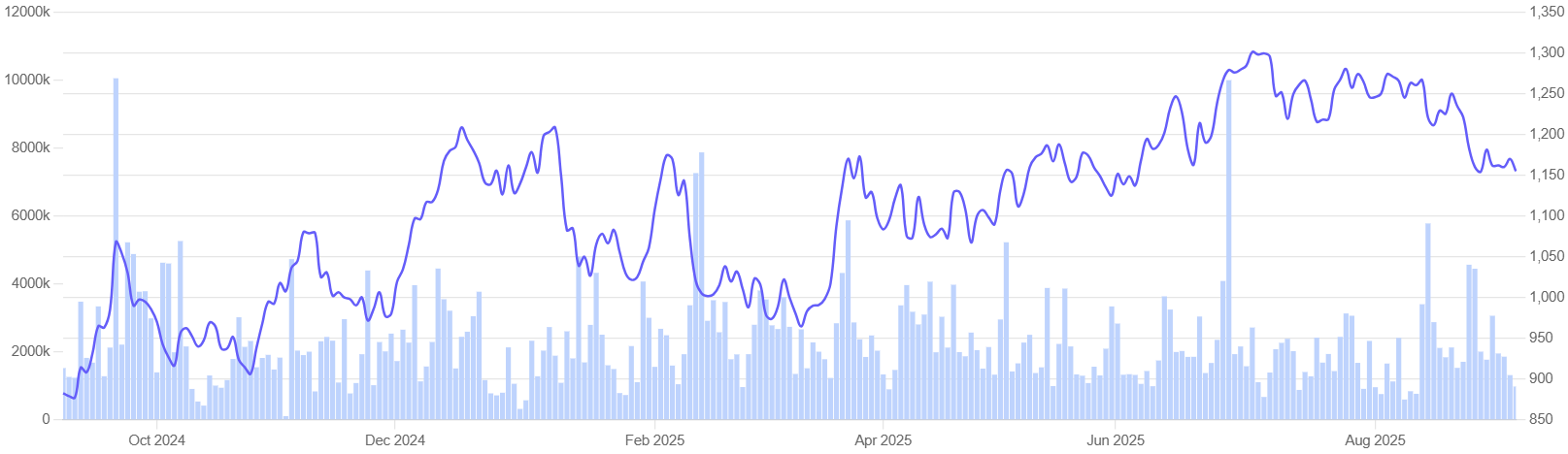

Valued at a market cap of INR 1,12,122 crore, Max Healthcare stock has returned approximately 31% to shareholders in the past one year.

Max Healthcare, the second largest hospital network in India, currently operates 22 healthcare facilities with around 5,000 beds.

The private hospital chain announced its plans to invest INR 6,000 crore over the next three years to cement its presence across key locations in India. By the end of the current financial year, Max Healthcare aims to expand its operational capacity by 30%, adding nearly 1,500 beds. The plan entails building four new facilities across its Saket, Mohali, Gurugram and Nanavati hospitals.

In April 2025, Max Healthcare inaugurated its 300-bed super speciality hospital in Dwarka. By the end of 2028, the hospital chain plans to add around 3,000 additional beds, taking the cumulative tally to nearly 8,000.

For Q4 FY2025, the hospital bed occupancy rate came in at 75%, with a 30% climb in bed occupied days (BOD). For the reported quarter, the ARPOB stood at INR 77100 marking a slight uptick from INR 76,800 in the year-ago period.

The stock is currently trading at a trailing price-to-earnings multiple of 93.4x.

The stock currently has an EV/EBITDA ratio of 54.1, as compared to the industry median of 27.1.

Max Healthcare Share Price Return: 1 year

#2 Yatharth Hospitals

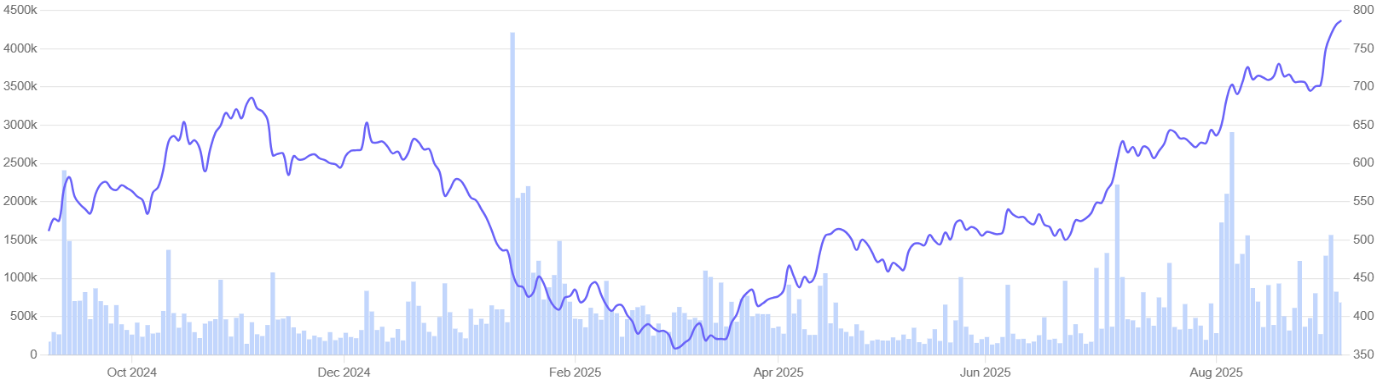

With a market cap of INR 7,580 crore, Yatharth Hospitals stock has returned 52.6% to shareholders in the past one year.

Founded in 2008, Yatharth Hospital and Trauma Care Services Limited operates a network of multi-care hospitals across Noida, Greater Noida, Noida Extension, Jhansi and Greater Faridabad. Currently, operates a total of 2,300 beds across 7 hospitals.

In July 2025, Yatharth commenced operations in its newly-inaugurated unit in Model Town, Delhi. In May 2025, Yatharth completed the acquisition of a 60% stake in healthcare services company, MGS Infotech Research & Solutions Private Limited. Through this strategic expansion, Yatharth aims to establish a 400-bed hospital in Faridabad, Haryana. The company also aims to invest additional INR 100 crore into the new facility to refurbish it with advanced medical equipment.

In FY 2025, Yatharth’s overall ARPOB climbed 8% YoY to INR 30,829. This was primarily driven by the Noida Extension hospital which saw a 11% ARPOB rise to INR 38,033. Bed occupancy rate improved from 54% to 66%, with the Noida Extension and Jhansi facilities reaching ~60% and ~50% respectively.

The stock is currently trading at a trailing price-to-earnings multiple of 53.1x. The stock currently has an EV/EBITDA ratio of 28.8, as compared to the industry median of 27.1.

Yatharth Share Price Return: 1 year

#3 Dr Agarwal’s Healthcare Ltd

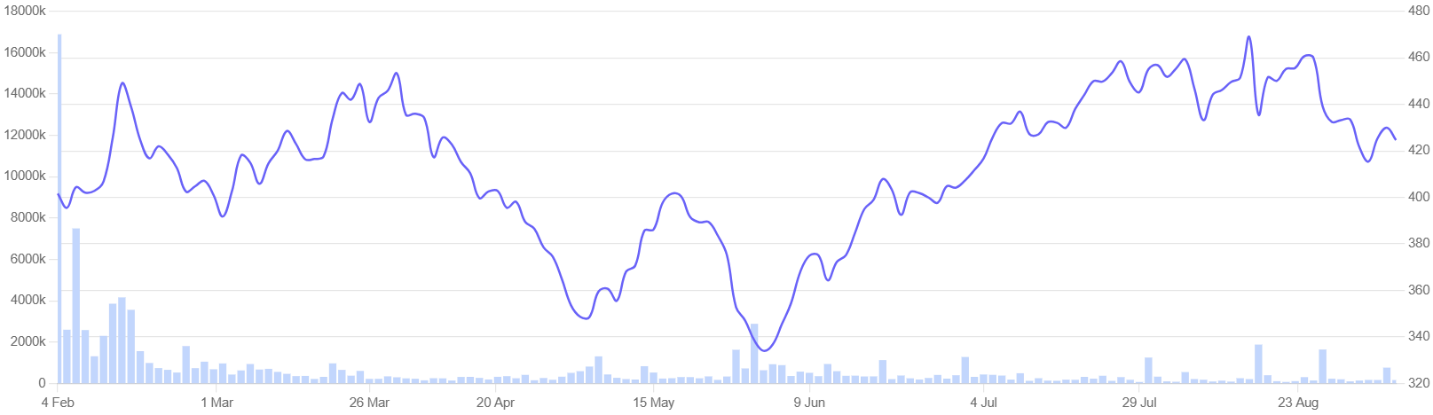

With a market cap of INR 13,579 crore, Dr Agarwal’s Healthcare stock has returned almost 7% to shareholders in the past one year.

Founded in 2010, Dr Agarwal’s Healthcare Ltd. (DAHCL) offers a variety of specialised eye care services like cataract and refractive surgeries, diagnosis, consultation and other non-surgical services. Currently Dr Agarwal’s operates 209 hospitals across India and Africa. In FY 2025, the eye care chain reported a total income of INR 1,757 crores, registering a YoY growth of 27.6%.

In January 2025, DAHCL, raised around INR 875.5 crore ahead of the issuance of its initial public offering (IPO) with the goal of both debt reduction and growth of its market share. Through acquisitions of small eye hospitals and chains as well as greenfield expansion of its network, the company aims to maintain its position as a market leader.

Over the next few years, DAHCL plans to invest around INR 1,200 crore to expand its presence across 300 hospitals in India and Africa. The eye care hospital network has a pipeline of currently developing hospitals across Mumbai, Punjab and central India.

Particularly with respect to Maharashtra, DAHCL plans to invest INR 300 crores to establish 20 eye hospitals and over 100 outreach clinics across the state over the next three years. In line with its plans for strategic expansion, the company has recently acquired the Aditya Jyot Eye Hospital in Mumbai and five hospitals in each of Pune, Haryana and Punjab.

The stock is currently trading at a trailing price-to-earnings multiple of 130x. The stock currently has an EV/EBITDA ratio of 26.1, as compared to the industry median of 27.1.

Dr Agarwal’s Healthcare Ltd Share Price Return: 1 year

Valuation Comparison With Peers

| Company | TTM P/E | ROCE | ROE | EV/EBITDA | 10 Year Median EV/EBITDA |

| Max Healthcare | 93.4 | 14.9% | 12.7% | 54.1 | 41.8 |

| Yatharth Hospitals and Trauma Care | 53.1x | 13.8% | 10.5% | 28.8 | 21.6 |

| Dr Agarwal’s Hospital | 130x | 10.4% | 5.3% | 26.1 | 29.8 |

| Apollo Hospitals | 71.7x | 16.6% | 18.4% | 34.8 | 27.9 |

| Fortis Healthcare | 78x | 12.0% | 10.1% | 40.8 | 23.9 |

| Narayana Hrudalaya | 45.4x | 20.8% | 24.2% | 27.2 | 23.2 |

| Industry Median | 58.7x | 14.9% | 12.9% | 27.1 |

Future Outlook

Post the COVID-19 pandemic, there has been an increasing inflow of investments into upgrading equipment and infrastructure of Indian hospitals. The major national chains are anticipated to continue bolstering their revenue and profit margins through capacity growth and increasing ARPOB.

While a lot of the growth seems to be factored into the current stock prices, it will be interesting to see if the sector is able to beat investor expectations in the years ahead.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.