Known for his strategic focus on midcap and smallcap stocks across varied industries, Sunil Singhania, the founder of Abakkus Funds is all about finding fairly or undervalued companies with strong fundamentals and significant growth prospects. His picks are driven by thorough research and keen market trend analysis.

No wonder he is referred to as a Warren Buffett of India. After all, he does not get easily influenced by market sentiments while buying or selling. Which is why, when he just bought fresh stakes in 4 lesser-known companies, investors are busy trying to figure out this move.

What triggered these buy decisions. Let us try and find out.

Treating neurodegenerative disorders – Suven Life Sciences Ltd

Incorporated in 1989, Suven Life Sciences Ltd is a clinical-stage biopharmaceutical company focused on the acquisition, development and commercialisation of novel therapeutics for the treatment of neurodegenerative disorders.

With a market cap of Rs 4,553 cr, the company has been working towards developing new molecules/ compounds in the complex CNS (central nervous system) space.

Singhania bought a 1.3% stake worth Rs 59 cr in the company, which when one looks at the financials might sound like a risky bet.

The company sales, EBITDA (earnings before interest, taxes, depreciation, and amortisation) and Net profits have all seen huge drops in the last decade.

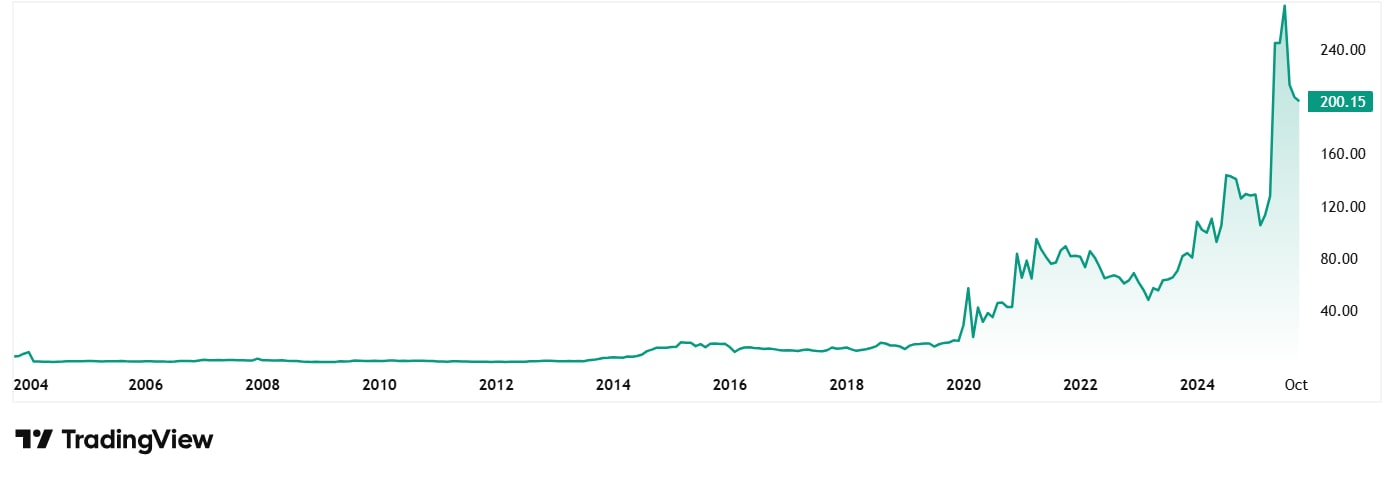

The share price of Suven Life Sciences Ltd was around Rs 45 in October 2020 and as of closing on 16th October 2025, the share price was Rs 200. This is a 34% discount from its all-time high price of Rs 303.

The company’s share is trading at a negative PE due to consistent losses in the last few years, while the current industry median is just around 44x.

Agricultural lifesaver – Indogulf Cropsciences Ltd

Incorporated in 1993, Indogulf Cropsciences Limited is engaged in manufacturing crop protection products, plant nutrients, and biologicals in India.

With a market cap of Rs 675 cr, the company is engaged in the manufacturing and marketing of crop protection products, plant nutrients, and biologicals.

Singhania, through Abakkus Funds, bought a 4% stake in the company worth Rs 27 cr.

The company’s sales grew at a compounded rate of almost 8% from Rs 443 cr in FY21 to Rs 590 cr in FY25. The EBITDA saw a compound growth of 13% from Rs 39 cr to Rs 64 cr in the same period. The net profits grew from Rs 22 cr in FY21 to Rs 31 cr in FY25, logging in a compound growth of 9% in 4 years.

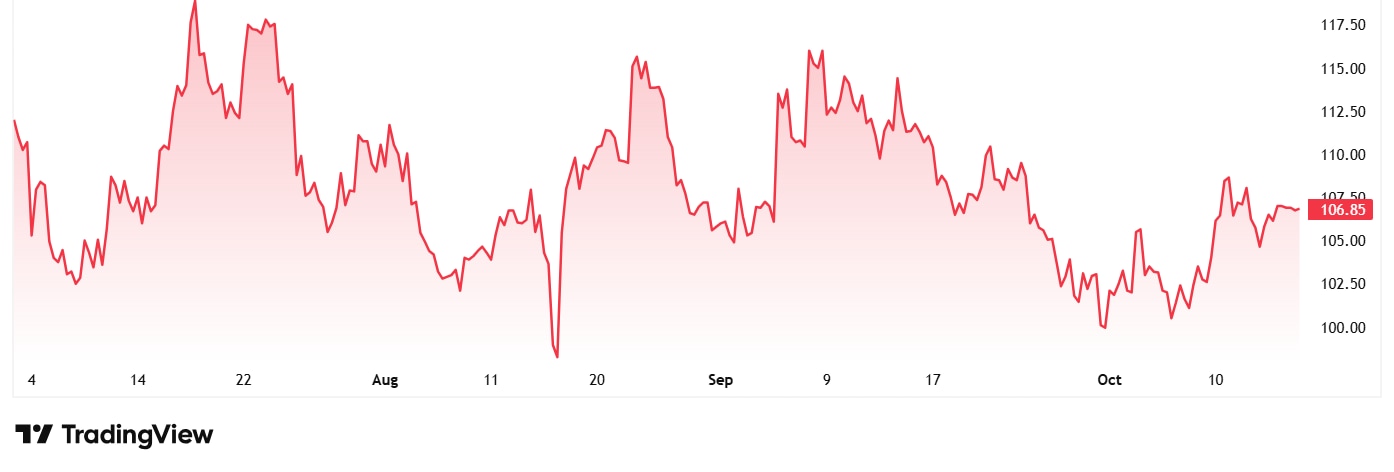

The share price of Indogulf Cropsciences Ltd was about Rs 110 when listed in July 2025 and as of closing on 16th October 2025, it was Rs 107.

The company’s share is trading at a PE of 22x which is lower than the industry median of 29x.

Also, the promoter holding of the company has fallen from 97% as of the quarter ending June 2025 to 69% as of the quarter ending September 2025.

Pre-Engineered buildings champion – M & B Engineering Ltd

Incorporated in 1981, M&B Engineering Ltd is a design-led engineering solutions provider.

With a current market cap of Rs 2,462 cr, the company is a leading player in India’s Pre-Engineered Buildings (PEBs) sector, operating through two key divisions.

Singhania bought a 2% stake in the company through Abakkus Funds, a holding worth Rs 50 cr.

The company’s sales have grown at a compound rate of 14% in the last 5 years from Rs 520 cr in FY20 to Rs 989 cr in FY25. The EBITDA climbed from Rs 37 cr in FY20 to Rs 127 cr in FY25, logging in a compound growth of 28%. The net profits logged in a compound growth of 48% between FY20 and FY25.

The share price of M & B Engineering Ltd was Rs 408 when listed in August 2025 and as of closing on 16th October 2025, it was Rs 431.

The company’s share is currently trading at a PE of 32x while the current industry median is 22x.

According to the company’s last concall in August 2025, the management’s conservative guidance and refusal to over-promise on margins are consistent with the volatile external backdrop, but the building blocks for structurally higher returns are visibly in place.

Household plastics giant -All Time Plastics Ltd

Incorporated in 1971, All Time Plastics Ltd manufactures and exports plastic houseware products.

With a market cap of Rs 1,823 cr, the company specializes in production of plastic consumer ware designed for everyday household use. It primarily operates on a B2B model, manufacturing consumer ware for clients who market products under their own brands.

Singhania bought a 6.2% stake in the company through Abakkus Funds, a holding worth Rs 112 cr.

The company’s sales have grown at a compound rate of 14% in the last 5 years from Rs 289 cr in FY20 to Rs 558 cr in FY25. The EBITDA logged in a compound jump of almost 20% in the same period. The net profits also saw a compound jump of 25% in the same period.

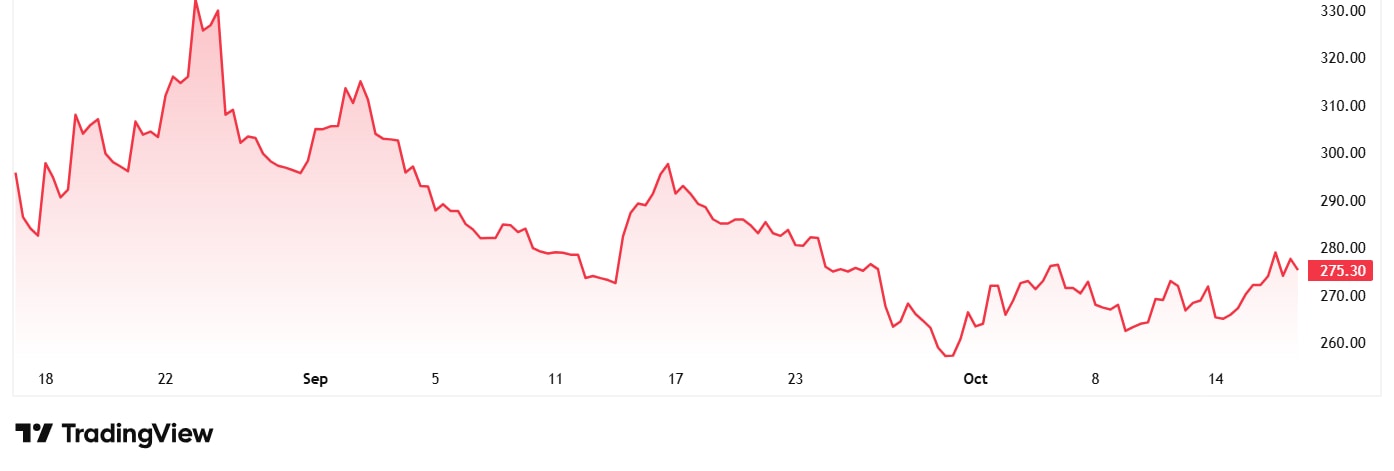

The share price of All Time Plastics Ltd was around Rs 283 when it was listed in August 2025 and as of closing on 16th October 2025 it was Rs 278.

The company’s share is trading at a current PE of 39x, which is close to the current industry median of around 40x.

Apart from Sighania’s Abakkus, Sun Life Aditya Birla India Fund also bought a 1.07% stake in the company as per the exchange filings for the quarter ending September 2025.

Will the Singhania magic work again?

Each of the 4 stocks we saw today has something working in its favour. Even a stock like Suven Life Sciences, which hasn’t seen a profit in the few years, has logged in compounded share price gains of 35% in the last 5 years.

What has trigged the buy decision for Sunil Singhania is a secret that only he knows. But as investors across know, he is not someone to make decision without extensive research. So, when he adds stocks to his personal holdings or in any of the Abakkus Funds, it deserves to be looked into.

Only time will tell us how or what that these buy decisions were. But if at all these are the stocks that Singhania sees as his future multibaggers, to miss them would be a shame. May be one must add them to a watchlist and follow them closely.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.