In the Indian investor community, whenever it comes to damaging shareholders’ wealth, one name always comes to mind. That is the Anil Dhirubhai Ambani Group. When Reliance was split between the two brothers (Anil and Mukesh Ambani) in 2005, Anil was considered the big beneficiary.

After all, he inherited high-growth businesses in sectors such as telecom, power, infrastructure, and financial services. It worked too. During the bull market that ended with the global financial crisis in 2008, Anil’s net worth skyrocketed as the telecom and power sectors boomed.

The buzz was so intense that Reliance Power’s ₹117 billion initial public offering was oversubscribed by 70x. According to Forbes, he was the sixth richest person in the world in 2008 with a net worth of about $45 billion. But things soon changed. His empire collapsed during the next decade due to the heavy debt and aggressive expansion.

After that, his net worth fell to zero, but now it has risen again to $1 billion as of June 26, 2025, as per Wikipedia. The trigger? One of the two flagship companies of the group is back in the news. Withdrawals from insolvency proceedings, debt reduction, earnings boosts, and a push for clean energy have reinvigorated the shares.

The share price has come under pressure again due to recurring governance concerns. This includes the searches conducted by the CBI on 23 August at premises linked to Reliance Communications and its promoter, director Anil Ambani.

Meanwhile, with some positive developments taking shape, it is worth reviewing how these companies performed in the recent quarter.

#1 Reliance Infrastructure

Reliance Infrastructure, an Anil Dhirubhai Ambani Group Company, is an infrastructure company that develops projects through various Special Purpose Vehicles (SPVs) across sectors, including power, roads, metro rail, airports, and defence.

The company operates a diversified portfolio of seven toll road assets, spanning a total length of about 2,468 lane kilometers across key high-traffic corridors in India.

The company also operates in the utility sector with a presence across the power value chain, including generation, transmission, distribution, and power trading. Its two subsidiaries, known as Delhi Discoms, serve over 5.2 million consumers in Delhi.

Mixed Q1FY26 Performance with Profit Turnaround

The company’s financial performance in Q1FY26 was mixed, with revenue declining and profitability surging. Total income in the first quarter fell 16.8% year-on-year to ₹60.4 billion, with most of the revenue coming from the power sector.

The power business at Delhi discoms added 51,434 new households during the quarter, taking the total number to 5.2 million. On the back of operational efficiency, transmission and distribution losses also came down to below 6.5% on a rolling basis.

Mumbai Metro One achieved its highest-ever Q1 fare revenue of ₹84 crore and secured new branding rights and retail outlets.

The company also turned profitable with a profit of ₹598 million (Before other comprehensive income), compared to a loss of ₹2.3 billion in the same quarter a year ago. This profitability was led by the power business too, with profit before interest, tax, share in associates, joint venture, and non-controlling interest surging 31.5% to ₹10.4 billion.

This was offset against finance costs and late payment charges. Meanwhile, with improvement in profit, its net worth increased by 4% sequentially to ₹148.5 billion.

Debt-Free Balance Sheet and Credit Upgrade

But it remains debt-free at the standalone level and has zero net debt to banks and financial institutions. This has also been acknowledged by India Ratings and Research, which (in July) raised its credit rating by three notches, citing its progress towards near-zero debt.

The company is working hard to reduce its consolidated debt (₹63.6 billion) by monetising its assets. To this end, on 22 August, Reliance has sold a 100% stake in PS Toll Road (Satara Toll Road) to Cube Highways for an enterprise value of ₹20 billion.

Of this, the company plans to spend ₹6 billion for future growth initiatives and ₹14 billion for debt reduction. The transaction is expected to be completed by the end of August, which is likely to reduce interest rates and increase profitability.

Resurgent Reliance’s Strategy and New Focus Areas

The company has launched the “Resurgent Reliance” initiative, with plans to take a bold step towards the future. Under this, the company plans to prioritise key sectors such as urban transport, highways, power distribution, engineering, and construction. Among these, the defence business has seen big traction of late.

Defence Business Gathers Momentum

Reliance became the first private player to undertake an aircraft upgrade programme worth ₹50 billion independently. The project is expected to be executed over the next 7 to 10 years. It has also signed a partnership with Diehl Defence to supply Vulcan 155 mm precision-guided munitions to the Indian armed forces.

Reliance Defence will act as the prime contractor for this project. It aims to generate ₹100 billion in revenue from this partnership. Additionally, a greenfield manufacturing facility is being set up at the Watad Industrial Area in Ratnagiri, Maharashtra.

The plant will have the capacity to produce 200,000 artillery shells, 10,000 tonnes of explosives, and 2,000 tonnes of propellants annually. The company has also entered jet manufacturing through a partnership with Dassault Aviation.

Under this agreement, Falcon 2000 jets will be manufactured in India for both domestic and global markets, marking the first time Dassault is producing Falcon jets outside France. The first Make in India Falcon 2000 is expected to be delivered by 2028 for both corporate and military use.

Dassault will also transfer the front-section assembly of Falcon 8X and 6X jets, along with the complete fuselage and wing assembly of Falcon 2000, to DRAL. The company is also targeting defence orders worth ₹100 billion from the Ministry of Defence, along with another ₹100 billion in exports over the next decade.

Financial Cushion from Arbitration Award

Additionally, Mumbai Metro One recently secured an arbitration award worth ₹11.7 billion against the Mumbai Metropolitan Region Development Authority (MMRDA). The proceeds will help reduce Mumbai Metro One’s debt.

It has also secured major arbitration victories, including a ₹5.2 billion award against Aravali Power in August and a ₹7.8 billion award against Damodar Valley Corporation, both of which underline its improving financial position.

The company trades at a price-to-equity multiple of 2.7x, over 50% discount to the 10-year median of 6.3x.

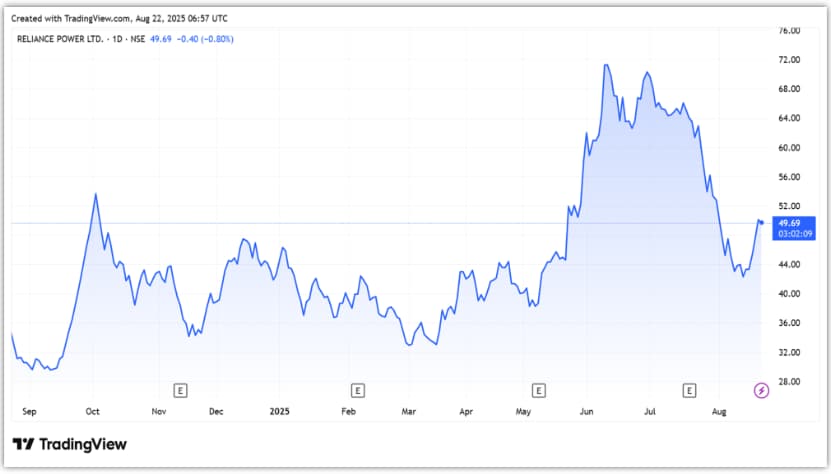

Reliance Infrastructure Share Price

#2 Reliance Power

Reliance Power focuses on developing, constructing, and operating power generation projects. In addition, the company also develops coal mines linked to these projects. It has a portfolio of 5,305 megawatt (MW) of operational power generation capacity.

It’s diversified across coal, gas, hydro, wind, and solar power. Major projects include the Sasan Ultra Mega Power Project (3,960 MW), the world’s largest integrated coal-based power project. The list also includes the Roza coal-based power project (1,200 MW), solar power project (140 MW), and wind power (5 MW).

Reliance Power’s Q1 Rebound Driven by Lower Costs

In Q1FY26, Reliance Power’s total income declined 5.3% year-on-year to ₹18.8 billion. However, the company turned profitable with a profit of ₹44.6 million (Before other comprehensive income) as against a loss of ₹97.8 million in Q1 FY25. Decline in fuel consumption, depreciation, and finance costs fueled the rebound.

Order Wins in Renewable Energy Portfolio

It has won several orders during the quarter.

This includes signing of a 25-year power purchase agreement (PPA) by its subsidiary, Reliance NU Suntech, with Solar Energy Corporation of India. The deal is Asia’s largest single-location solar and battery energy storage system (BESS) project, with a total investment of ₹100 billion.

The project includes 930 MW of solar capacity and a 465 MW / 1,860 MWh BESS.

Another subsidiary, Reliance NU Energies, has secured a 350 MW solar-plus-BESS order from SJVN. With this, Reliance Power has become India’s most significant company in the solar and BESS segment with 2.6 gigawatt (GW) of solar direct current capacity and over 2.5 GW of BESS capacity.

The project tariff stands at ₹3.33 per kilowatt hour.

Reliance Power also reported zero bank debt, improving its financial profile. Of course, the company has won orders and reduced debt, which sounds positive, but execution remains key.

Other businesses continue to Struggle

Meanwhile, its other businesses are struggling. Reliance Communications reported a loss of ₹25.6 billion on revenue of ₹830 million. Another group company, Reliance Home Finance, incurred a loss of ₹6.9 million, with zero sales.

Conclusion

Reliance Infra’s return to profitability, debt-free status, and arbitration wins mark a clear turnaround, while its defence and clean energy bets signal future growth avenues. Yet, governance concerns, high debt, regulatory investigations, and execution risks linger.

Turnarounds of this scale are rare but not impossible. Much will depend on how effectively the group completes its deleveraging, easing finance costs and allowing bandwidth to focus on growth. For now, debt reduction and governance improvements remain the most critical levers to watch.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.