Share Market Crash News Today | Sensex, Nifty, Share Prices Crash Highlights: The benchmark equity indices crashed on October 03, closing the day 2% lower. The fall in indices can be attributed to escalated tension in West Asia and SEBI’s new diktats regarding F&O cubing. The BSE Sensex nosedived 1,730 points or 2.05% to finish the day’s trading at 82,536. The NSE Nifty 50 fell 530 points or 2.05% to 25,267. The Bank Nifty closed the day’s trading 2.01% lower at 51,860. Following the overall market sentiments, the Nifty Midcap 100 closed the session 1,350 points or 2.24% lower at 59,008.

The NSE Nifty 50 closed 2.05% lower at 25,266.95, while the BSE Sensex closed 2.05% lower at 82,536.52.

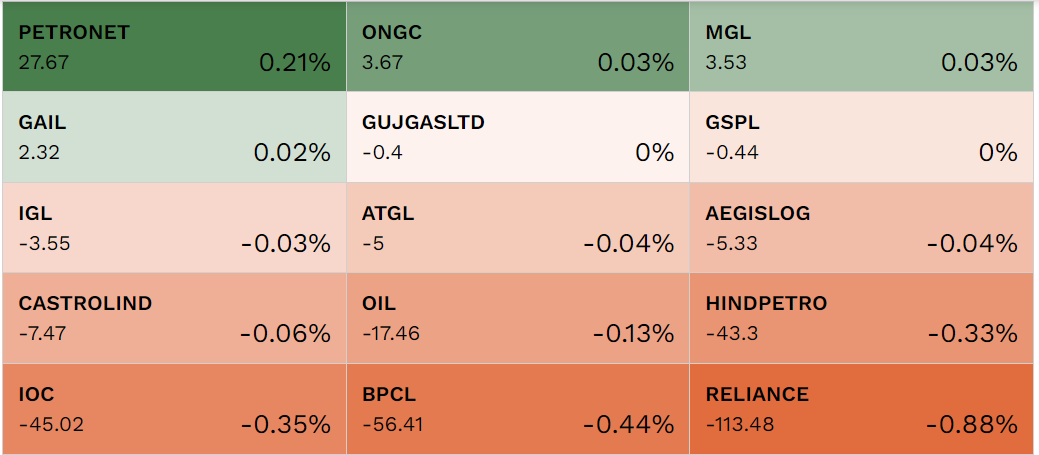

JSW Steel along with ONGC and Tata Steel were the top gainers in the Nifty 50. Meawhile, BPCL, Shriram Finance, L&T, Axis Bank, and Asian Paints were the major losers in the Nifty 50 on October 03.

Courtesy: NSE

"The Indian rupee declined on Thursday on weak domestic markets and a strong Dollar. The surge in crude oil prices also weighed on the rupee. The US Dollar rose amid rising geopolitical tensions in the Middle East after Iran fired ballistic missiles at Israel. We expect the rupee to trade with a slight negative bias on risk aversion in the global markets and a strong Dollar amid escalating tensions between Israel and Iran. A strong US Dollar and elevated crude oil prices may further pressure the rupee. Traders may take cues from ISM services PMI, weekly unemployment claims and factory orders data from the US. Investors may watch out for non-farm payrolls report from the US tomorrow," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

Asian Paints, Maruti Suzuki, L&T, Bajaj Finserv, and Tata Motors contributed most to the drag of Sensex on October 03.

Courtesy: BSE

RITES, a leading transport infrastructure consultancy, signed a Memorandum of Understanding (MoU) with Delhi Metro Rail Corporation (DMRC). Through this MoU, both organizations will combine their strengths to identify, secure, and execute metro projects in India and abroad, said the company in an exchange filing.

Shares of Tata Motors Limited were trading at Rs 937, down by Rs 28.20 or 2.92% on the NSE as of 11:11 am, following the company's announcement of a significant decline in domestic and international sales for Q2 FY25. Tata Motors reported total sales of 215,034 vehicles, an 11% decrease from 243,024 units in the same period last year.

Commenting on the KRN Heat Exchanger listing Prashanth Tapse, Senior VP (Research), Mehta Equities said that Despite markets selloff, KRN Heat Exchanger listing was in line with our expectations which was on the back of bumper subscription response from all sets of investors.

Tapse also added that for allotted investors, we had recommended to book profits as we believe post listing the valuations can over stretch on a higher side discounting all the medium term business growth visibility. For non-allottees it would be better to wait and watch for the price to settle.

Nifty realty stocks saw significant losses on Thursday, with DLF leading the decline, dropping 4.38%. Brigade followed closely, down 4.23%, while Godrej Properties and Sobha fell 4.16% and 3.15%, respectively.

Shares of BPCL fell 4.2% to an intra-day low of Rs 352.75 after oil prices jumped 4% on ongoing geopolitical tension in West Asia. Iran attacked Israel with missiles on October 01, to which Israel retaliated on the night of October 02.

Heavyweight stocks like Reliance Industries, ICICI Bank, HDFC Bank, L&T, and Axis Bank were the major contributors to the fall of Nifty 50.

Courtesy: NSE

NMDC shares fell as much as 2.6% to an intra-day low of Rs 238.13 after the company raised its ore price. State-owned NMDC hiked the iron ore prices by Rs 400 a tonne, which came into effect on October 01. The revision in iron ore prices came after two consecutive reductions in the prices.

Shares of Yes Bank experienced a drop in trading on Thursday after the private sector lender released its business update for the September quarter (Q2). While the bank reported robust year-on-year (YoY) growth in both deposits and advances, a sequential decline in its liquidity coverage ratio (LCR) dampened investor sentiment.

As of 10:45 AM, the top gainers on the NSE included JSW Steel, up by 2.40%, followed by ONGC, which rose by 1.66%. Tata Steel saw an increase of 1.32%, while Adani Enterprises and NTPC recorded gains of 0.14% and 0.11%, respectively.

On the other hand, Eicher Motors was among the top losers, declining by 2.29%. BPCL followed closely with a drop of 2.24%, while Asian Paints fell by 1.90%. Wipro and Tata Motors also faced losses, decreasing by 1.88% and 1.85%, respectively.

Commenting on the crude oil update Ajay Garg, Director & CEO, SMC Global Securities said that the escalating conflict between Israel and Iran has reignited crude oil prices. After recently dipping to as low as $65.27 due to a weaker demand outlook and talks of increased production by OPEC+ by December, crude is now hovering around $72.

Garg also added that if the situation worsens, particularly with Iran being a key crude oil producer and Israel possibly targeting oil wells and refineries, prices could rise to $76-$78 per barrel. On MCX, crude oil prices may surge to Rs 6,200 per barrel if tensions escalate further.

KPI Green Energy has received the necessary approvals from the Chief Electrical Inspector (CEIG) for a 5 MW solar power project under its captive power plant (CPP) business segment. Following the news, KPI Green Energy's stock stock fell by 1.65% on the NSE, trading at Rs 841.50.

KRN Heat Exchanger shares had a robust stock market debut on October 3, opening at Rs 480 per share on the NSE, reflecting a premium of 118.18% over the IPO price. The company raised Rs 342 crore through its IPO, which was available for public subscription at a price range of Rs 209-220 per share. On the BSE, shares debuted at Rs 470, translating to a premium of 113.6% over the IPO price.

Read More: KRN Heat Exchanger sees a bumper debut, lists at a premium of 118% on NSE

Commenting on gold outlook Renisha Chainani, Head Research - Augmont - Gold For All said that Gold prices stand tall and sustain above $2600 (Rs 76000) on the mixed fundamental backdrop. One should warrant some caution before placing aggressive directional bets as the market awaits the Nonfarm Payrolls report on Friday. The Federal Reserve Chair Jerome Powell's more hawkish comments on Monday and the upcoming improved US job market statistics help the US dollar maintain its rebound from its lowest point since July 2023.

Chainani also said that the geopolitical front, Iran launched more than 180 ballistic missiles toward Israel on Tuesday, increasing the possibility of a full-scale Middle East conflict. This prompted an Israeli assault on central Beirut, Lebanon, early on Thursday. Gold prices are well supported around $2650 (Rs 75400) levels, due to geopolitical concerns, since ceasefire negotiations are unlikely to take place anytime soon.

Shares of Dabur India plummeted nearly 8% to an intra-day low of Rs 571 on the NSE during early trading on Thursday, following a series of downgrades from multiple brokerages. Analysts cited weaker-than-expected second-quarter performance, slowing demand, and disappointing results as key factors behind the reduced target prices for the FMCG giant.

JSW Steel, ONGC, Tata Steel, SBI, and Grasim Industries were the top gainers in the Nifty 50. While Eicher Motors, BPCL, Shriram Finance, Asian Paints, and Tata Motors were the major losers in the Nifty 50 on Ocotber 03.

"Once in a century" described a stockbroker in Hong Kong to the sudden rally as they are having one of the busiest periods in their career. Tiger Brokers, a popular trading platform among Hong Kong retail investors, said it posted a 73% jump in account openings last week, reported Bloomberg.

The NSE Nifty 50 opened 0.81% higher at 25,589.10, while the BSE Sensex opened 0.87% higher at 83,535.93.

"In Tuesday’s trade, FIIs were net sellers of Rs 5,579 crores, while crude oil prices surged above $70 per barrel amid escalating tensions in the Middle East following Iran's strikes on Israel. Market volatility remains high, but much depends on the US non-farm payroll data due on Friday. Chinese markets have shown resilience, with the Hang Seng rallying 6.2% to close at its highest since February 2023. Nifty (CMP: 25797) shows strength only above 26051, with key support at 25351. Preferred trades include buying Nifty on dips and selling Bank Nifty," said Prashanth Tapse, Senior Vice President of Research at Mehta Equities.

The company reported a decline in production for September, marking the second consecutive month of reduced output as monsoon rains continued to impact operations. Production for the month fell by 1% year-on-year to 50.9 million tonnes, down from 51.4 million tonnes in September last year.

The company has received advisory and warning letters from both the National Stock Exchange (NSE) and BSE Ltd for non-compliance with SEBI’s Listing Obligations and Disclosure Requirements (LODR). The warnings were issued in response to the company’s handling of disclosures related to the resignation of Independent Director, Marc Desaedeleer.

Read More: Suzlon Energy Share Price Today Live Updates, 03 Oct, 2024: Suzlon Energy on the radar

Commenting on the Technical outlook of Nifty Kunal Kamble, Sr. Technical Research Analyst at Bonanza, said that The Nifty Index has closed negatively for three consecutive days, indicating a bearish trend. Since the rollover, the index has lost approximately 0.94% of its gains, with a 27.39% decrease in open interest, which suggests that many long positions are being squared off. However, 51.38% of long positions still remain open. Technically, the price is trading near the 0.618 Fibonacci retracement level, which coincides with the 20 EMA, signaling strong support at this level.

Kamble also added that the options front, the 25800 PE holds the highest open interest with a selling bias, while the 26000 CE also has significant open interest, indicating expectations that the market will stay below 25800 as long as it trades below 26000. The weekly PCR is currently at 0.66, approaching oversold conditions. Based on this setup, short positions should be considered on rallies as long as the index trades below 26000.