– By Dr Manoranjan Sharma

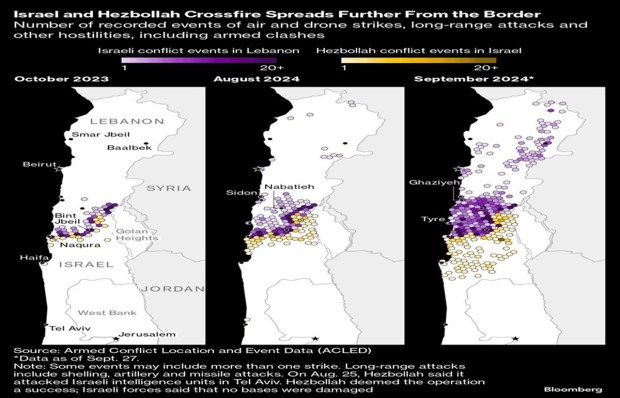

Iran’s extensive unprecedented but ultimately unsuccessful missile onslaught on October 1, 2024, was characterized by the launching of 181 ballistic missiles toward Israel, with at least some striking Israeli territory in response to Israeli attacks against people in Gaza and Lebanon. The assassinations of top IRGC, Hamas, and Hezbollah leaders mark yet another flashpoint in the year-old Middle East war scenario. The second attack by Iran this year, after it fired hundreds of missiles and drones at Israel in April marks an unmistakable deterioration and a clear escalation of the regional war scenario in these tumultuous times. It’s no brainer to say that Israel will respond in a more than disproportionate manner because such military “actions” have inevitable “consequences”.

Where do we go from here? It’s difficult to connect the dots because of the myriad inter-layered issues of attack, retaliation, anger, and restraint. With the US standing clearly with Israel, its long-time strategic and military partner, things would quickly move from bad to worse.

Netanyahu ominously said Iran had made a “big mistake” and would “pay for it”. Similarly, Israel Defense Forces spokesperson Daniel Haggari averred “We have plans, and we will operate at the place and time we decide”. The UN Secretary-General Antonio Guterres said it was time to stop a cycle of escalation “that is leading the people of the Middle East straight over the cliff.” But an imminent massive Israeli retaliation is clear; the only issue that remains to be seen is the scale, place, and timing of the retaliation.

Should Israel aggressively retaliate by attacking Iran’s nuclear facilities, smashing the oil-producing units or blocking the Hormuz Strait to prevent the global movement of Iranian oil, all bets are off and things would plummet irretrievably downhill in the multi-party West Asian conflict. This escalation of the war, widening conflict and heightening geopolitical tensions rocks the global scenario with incertitude and uncertainties.

Macroeconomic Impact-“No Country Is an Island in the Stream” (Ernest Hemingway)

This calamitous event has heightened economic instability, amplified sector-specific risks, and intensified regulatory uncertainties. These geopolitical events have accentuated global tensions, disrupted trade relations and caused fluctuations in the global markets, which in turn affect investor confidence and capital flows into emerging markets like India. This assumes greater significance in the case of industries, such as energy, infrastructure, and manufacturing, which are sensitive to international trade dynamics and supply chain disruptions. The volatility in global oil prices and energy supplies has further complicated the financial outlook for Indian companies reliant on imports or foreign debt, leading to potential downgrades. These conflicts influence sovereign credit ratings globally, with the possibility of higher borrowing costs and perceived risks for businesses operating in strife-torn regions. The ongoing regulatory changes and uncertainties, aggravated by geopolitical conflicts, require credit rating agencies to be vigilant and adaptive in their assessments of evolving corporate balance sheets and their effect on the overall credit ratio, as the broader market sentiment and liquidity are continually influenced by these significant global events.

With crude oil output of almost 3 million barrels per day (mb/d) i.e., about 3 % of the global production, Iran is a major oil producer and exporter and more importantly, 20 % of the world’s crude oil supply passes through the Hormuz Strait (60 % of Indian crude supply is accounted for from the Hormuz Strait), the crude oil prices per barrel per day could rise steeply from the present level of USD 72 to a level of USD 80.

In the case of the Indian economy, this surge in oil prices would negatively impact the triple deficits of the trade deficit, current account, and fiscal deficit. Since apart from macroeconomic fundamentals and the growth prospects of the firm and the industry, the capital market is also sentiment-driven, this war could negatively impact the BSE and NIFTY levels. But contrary to popular perception, extensive pessimism is unwarranted and a sense of all gloom and doom is unjustified. While there cannot be any silos or water-tight compartments in this increasingly interlinked and interdependent world, it would be facile not to factor in the strength and resilience of the Indian economy for a comprehensive assessment and perspective.

Bloodbath on the Bourses?

Post the October 1, 2024 Iran- Israel conflagration, the heightened global uncertainty would be manifested in surging oil prices, rising bond prices, rising gold prices and falling stock prices. The Indian benchmark indices —BSE Sensex and NSE Nifty50 took a debilitating hit because of the overarching negative sentiment caused by escalating tensions between Israel and Iran and an element of froth and bubble in the stock market. The BSE Sensex fell by 1,832.27 points, or 2.17 %, reaching an intraday low of 82,434.02. Similarly, the Nifty50 dropped 566.6 points, or 2.19 %, hitting an intraday low of 25,230.30.

While surging oil prices in the aftermath of the Iran-Israel war have a cascading macro-economic impact across sectors that could trigger a sell-off, oil-based sectors like automobiles, transportation, aviation, paints, tyres, cement, and chemicals could take the greatest hit because of the spike in crude oil prices. Oil-related companies like Indian Oil Corporation, (IOC), Bharat Petroleum (BPCL), HPCL, etc. could face the heat.

The Indian stocks with an Israeli connection include Adani Ports, Sun Pharmaceutical, Dr. Reddy’s and Lupin, NMDC, Kalyan Jewellers, and Titan. Further, oil marketing companies could be adversely impacted. The war could slacken India’s plan of building an India-Middle East-Europe Economic Corridor as reflected in the prices of railway stocks like IRCON, Jupiter Wagons, and RVNL. Defence stocks like Bharat Electronics and Hindustan Aeronautics Limited (HAL) could, however, be on the upswing with potential increases in defence spending.

The market could be disrupted by war-related risks, including the threat of margin pressure and near-term negative sentiment due to rising oil prices triggered by potential disruptions in supply from the Middle East. Hopefully, the supply-demand oil dynamics will continue to be largely unfettered. Long-term investors may use this event to buy on dips in the case of companies with strong fundamentals.

India’s Cognizable Dilemmas

India’s strategically time-tested relationship with Iran and Israel is fraught with difficulties on the policy and operational front. Israel has long been a trusted defence and security partner. Iran is a major crude oil supplier and has shared concerns about terrorism, the Afghanistan landscape, and the geo-strategically significant Chabahar port. The delicacy and sensitive nature of India’s multi-faceted relationship with Iran and Israel would make it difficult for India to define its “national interests” and choose sides. For, there are no shades of white and black in India. There are shades of grey in this saga- a saga of historical legacy, shared concerns, economic interests, and foreign policy standpoints caused by shifting paradigms.

With both sides taking an intransigent stand, protracted negotiation is fraught with the perils of exacerbating economic instability. There is a manifest need for greater care and vigil in this “new normal” in a real and worrisome sense. But extricating out of the vicious war cycle accentuated by hawks on both sides of the aisle is never easy and pain points are inevitable on the road to recovery. In sum, there are no easy answers, the choices are tough and a measured and calibrated response rather than brinkmanship on both sides is sorely needed. We are in for gathering storms, rocky times and volatility. The Middle East today is at a tipping point and needs coordinated and concerted measures with a sense of urgency to de-escalate to minimize the response since the escalator ladder does not serve either the interests of the stakeholders or the global economy at large.

Crunch time for the Middle East.

(Dr Manoranjan Sharma is the Chief Economist at Infomerics Ratings.)

(Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.)