Small Cap Mutual Funds have been a sought-after sub-category of equity mutual funds, shows the AMFI data. One of the reasons for this is that Small Cap Funds have a good return potential, making them a worthwhile choice for long-term wealth creation. Small Cap Funds invest a minimum of 65% of their assets in Small Cap stocks.

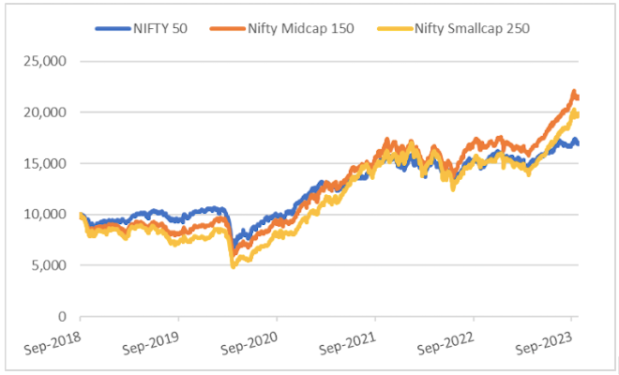

On a YTD basis, mostly the Small Cap Mutual Fund category outperformed by generating average returns of 27.2% on the back of a good rally in the broader market. Meanwhile, the Mid Cap Mutual Fund category generated average returns of 23.5% and the Large Cap Mutual Fund category generated average returns of 12.2%. (as of September 29, 2023)

Small-sized companies that prove their mettle even in the face of adversities have the potential to become big corporations in the future.

Small-caps hold the potential to outperform large-caps in the long run

Data as of September 29, 2023; Base taken as 10,000; (Source: ACE MF)

Past performance may or may not sustain in the future

As you may know, popular large-cap names of today, such as Bajaj Finance, Titan Company, Godrej Consumer Products, and Eicher Motors, among many others, were little-known small-cap stocks until around a decade ago.

In fact, several such companies even today are steadily climbing their way up the leadership ladder and, on the way, to generate good returns for its investors.

Thus, investors looking to uncover the potential of these multi-baggers of tomorrow while they are still relatively undiscovered can consider investing in Small Cap Funds.

Also Read: What is more tax-efficient for shareholders – Buyback or Dividends?

Are the valuations favourable?

The Nifty Smallcap 250 Index is currently near its all-time high levels with several stocks trading close to their 52-week highs.

It is noteworthy that the small-cap universe comprises over 4,000 stocks. However, many of these lack fundamentals and are therefore not actively tracked by analysts and market experts. Only a few hundred stocks fare well on key parameters such as financial strength, liquidity, quality of management, etc.

Therefore, from a valuation standpoint, the PE ratio of the small-cap index does not reflect a true picture.

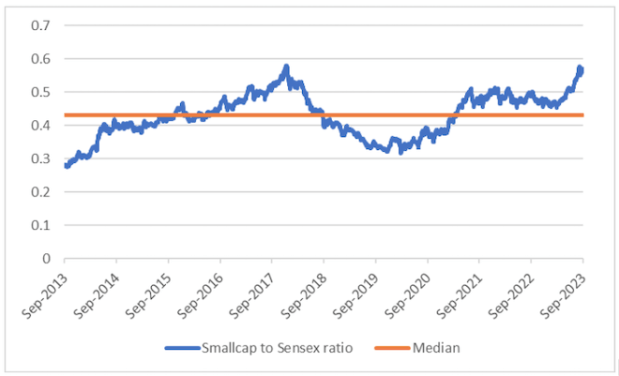

In such a case, a metric that can be used to determine valuations in the segment is the S&P BSE Smallcap to Sensex ratio.

The ratio currently stands at a 10-year peak of 0.57. This level was last seen in 2018 just before the mid and small-cap crash of 2018-19.

Nifty Small cap 250 index to Sensex ratio is at a 10-year peak:

Data as of September 29, 2023; (Source: ACE MF)

Past performance may or may not sustain in the future

This may warrant caution as the equity markets are known to be cyclical — peaks are followed by troughs, and vice versa.

Small-cap stocks in particular are highly sensitive to market sentiments; these stocks may plunge lower than mid and large-cap stocks during adverse market conditions. However, they have potential to soar high when market sentiments are upbeat.

Some fundamentally sound stocks in the segment may still have room for further growth and potential to scale fresh peaks. However, it will not be a surprise if a correction precedes the new highs.

Notably, small-caps have historically traded at a premium to large-caps and have outperformed their large-cap peers on many occasions in the past, despite the higher drawdowns in the near term.

Equity markets are known to be unpredictable. No one can accurately predict what’s going to happen in the near term, whether the small-cap segment will continue to rally or whether the market is headed towards correction.

So, instead of speculating about the future course of small-cap stocks and trying to pick individual stocks, investors may be better off opting for a well-managed Small Cap Fund that lays emphasis on fundamentals, quality, and liquidity.

Since mutual funds are actively managed by professionals who are experts in the field of investment and research, they are well-placed to identify and invest in quality, high-growth potential stocks that are available at reasonable valuations and avoid those that can turn out to be value destroyers.

Also Read: Want to make the most of Small Cap Funds now? Here’s an ‘ideal’ strategy you can follow

Factors that may work in favour of Small Cap Funds

1) Robust economic growth

The fortunes of small-cap stocks are closely tied to the economic growth. India has exhibited resilient growth in its economy even in the face of a global slowdown. This was one of the key factors for the good rally in small-cap stocks. As India is poised to continue to be one of the fastest growing emerging economies with reforms such as Make in India, Production Linked Incentive (PLI) schemes, and many others, small-cap stocks potentially would continue to benefit.

2) Healthy corporate earnings

Various small-cap companies have reported impressive growth in their profit margins over the past few quarters. Some financially sound companies may still have room for growth as small-sized companies are usually in their growth phase. Thus, Small Cap Funds may continue to generate good returns and potentially outperform Large Cap Funds that usually invest in mature and well-established businesses.

3) Opportunity to benefit from emerging sectors

Over the past few years, various niche and emerging sectors have spiked investors’ interest as they have the potential to turn out to be market leaders of tomorrow. This includes investments in green energy, new-age tech companies, logistics, hospitality & tourism, AI, geospatial systems, genomics, semiconductors, clean mobility, food processing, and biotechnology, among many others. Small Cap Funds with relatively higher exposure to such sectors and stocks therein may benefit as these sectors continue to be future-ready.

4) High retail participation

The high participation by retail investors in the last few years has been one of the key factors behind the good rally in small-cap stocks. With several small-cap IPOs seeing encouraging participation from investors, the equity markets and the small and mid-cap in particular are expected to do well.

Besides, the pause in rate hike action by the RBI and the probability of a subsequent decline in interest rate (if inflation continues to moderate further) would bode well for mid and small-sized companies as it will make it easier for these companies to raise capital.

Final Thoughts

Small Cap Funds are a good avenue to provide a boost to the equity portfolio. Holding a Small Cap Fund in the satellite holdings could potentially push the overall returns of your mutual fund portfolio.

However, when investing in Small Cap Funds, care should be taken to avoid getting swayed by the recent performance and instead focus on investing with a long-term view.

Also, Small Cap Funds aren’t for the fainthearted. Small Cap Mutual Funds find a place on the higher end of the risk-return spectrum, just a notch below the sector and thematic funds. Simply put, the risk of investing in a Small Cap Fund is very high.

Therefore, it is important to assess your risk appetite before investing in a Small-cap Fund.

Moreover, it is important to set realistic return expectations as no market cap segment can turn out to be an outperformer year after year. Likewise, you ought to keep a longer investment horizon of 5 years or more.

Whether to invest a lump sum or take the SIP route, the choice is ultimately yours. However, the latter at the market high may help handle volatility better with the inherent rupee-cost averaging and potentially compound wealth in the long run.

This article has been written by Chirag Mehta, CIO, Quantum AMC.

Disclaimer: Views or suggestions expressed above are the personal opinions of the author. Readers are advised to consult their financial advisors before investing in any market-linked instrument.