Fixed deposit (FD) is a popular investment option for investors looking for a fixed income. While bank FDs remain the first choice for them, company FDs offered by NBFCs and manufacturing companies are also an alternative source for fixed income. Corporate fixed deposit or Company FDs are often a popular alternative because of their higher interest rates compared to those of bank FDs.

Here are five such company fixed deposits offering high rate of interest on their FDs.

1. Bajaj Finance Fixed Deposit

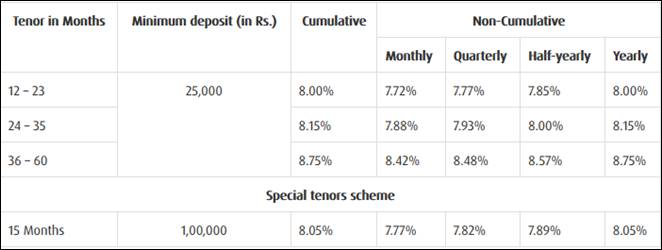

Bajaj Finance Fixed Deposits are rated high on safety and stability with ICRA’s MAAA (stable) rating and CRISIL’s FAAA/Stable rating. The FDs are available for a tenor between 12 months and 60 months. The minimum deposit required to invest in a Bajaj Finance Fixed Deposit is Rs. 25,000, while for the special tenure of 15 months that carries an interest rate of 8.4 percent, the minimum amount of investment is Rs 1 lakh. One may invest online by accessing the company website.

Bajaj Finance Fixed Deposit Rates: (Effective 17 Oct 2018)

Additional rate of 0.35 per cent for senior citizens

Renewal: +0.25% over and above the rate of interest at which the deposit is booked

2. Shriram Transport Finance fixed deposit

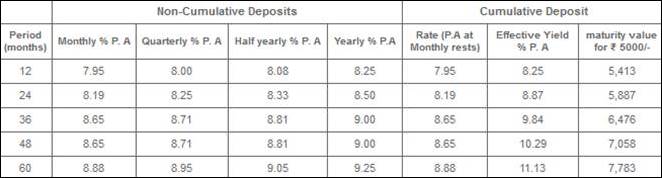

The Shriram Transport Finance Company fixed deposits are rated FAAA / Stable by CRISIL, indicating high degree of safety and ‘MAA+ / with Stable Outlook’ by ICRA indicating high credit quality. One may either invest through physical application form or through the company website. The minimum amount of investment is Rs 5000 for cumulative deposit and Rs 10,000 for non-cumulative deposit.

Under non cumulative deposits, the interest is paid through National Electronic Fund Transfer (NEFT) at Monthly/Quarterly/Half Yearly/Yearly intervals. Under cumulative deposits, the interest is paid at the time of maturity along with the principal amount.

What is unique in this FD is that the compounding of interest takes place on monthly basis. A monthly compounding is better than quarterly compounding which in turn is better than annual compounding. For a 60-month cumulative FD, the nominal interest rate is 9.11 per cent which effectively yields 11.49 per cent on maturity.

Shriram Transport Finance FD Interest rate on fresh deposits or renewals (Effective 1st November 2018)

Senior citizen scheme ( 60 years on the date of deposit or on renewal)

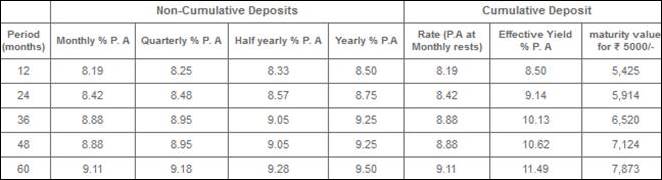

3. Mahindra Finance’s Fixed Deposit

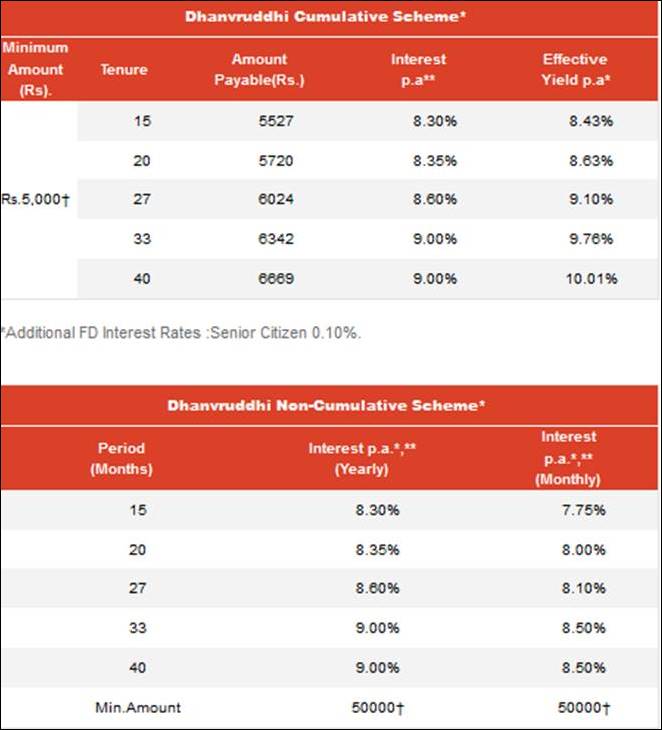

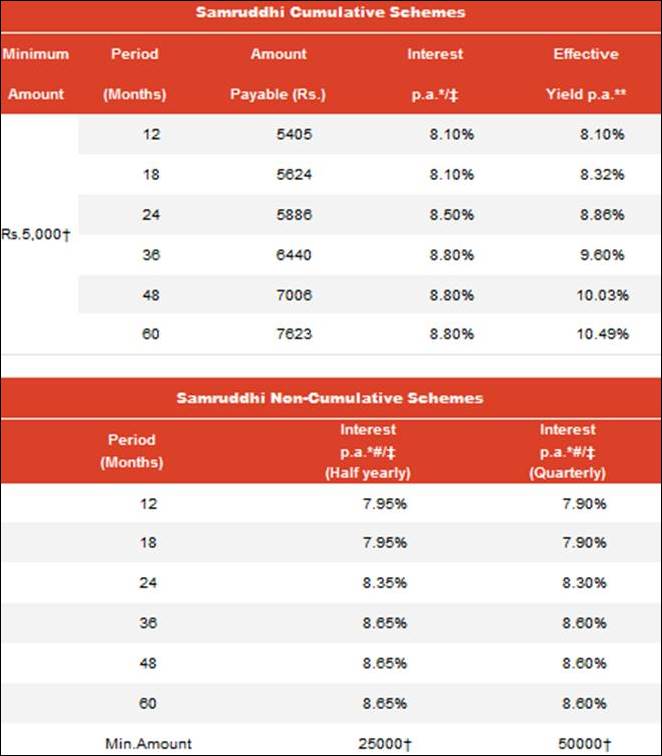

Mahindra Finance’s Fixed Deposit has a CRISIL rating of ‘FAAA’, which indicates a high level of safety. The Mahindra & Mahindra Financial Services (MMFSL) FDs are of two types – Samruddhi Fixed Deposits, where investments are made offline while the other FDs are Dhanvruddhi Deposits which are available only online through the company’s website.

The minimum deposit for the cumulative deposit scheme is Rs.5,000 and under the non cumulative scheme it is Rs.50,000 for yearly, Rs.25,000 for half yearly and Rs.50,000 for quarterly, and Rs 1,50,000 for monthly schemes. In the case of Mahindra & Mahindra Financial Services, the compounding is on annual basis and in case of cumulative deposit, interest is compounded before deduction of tax, if any.

What is unique in this FD is that the Mahindra Finance’s Fixed Deposit comes with a free accidental death insurance provided as a group insurance cover to any depositor between the age 18 to 70 years. The cover is for Rs 1 lakh and is for a period of one year from the date of deposit.

There is 0.25 per cent additional interest rate for senior citizens for Samruddhi Fixed Deposits while an 0.10 per cent additional interest rate for Senior Citizens for Dhanvruddhi Deposits where the mode of investment is only online.

Here are the Mahindra Finance FD rates (Effective 24th October 2018.)

For online investors through Mahindra Finance website

Additional FD Interest Rates :Senior Citizen 0.10%.

FD interest Rates Only through Physical applications

Senior Citizen additional 0.25% fixed deposit interest rate

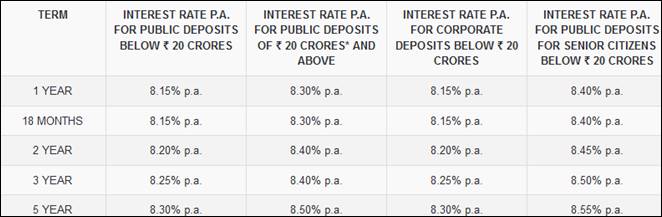

4. LIC Housing Finance

SANCHAY is the name of Public Deposit scheme offered by LIC Housing Finance Limited and are rated FAAA / Stable by CRISIL. The minimum amount of investment is Rs. 10,000 and thereafter additional deposit are accepted in multiples of Rs. 1,000. The deposits can be placed under both cumulative and non-cumulative option for duration of 1 year, 18 months, 2 years, 3 years and 5 years. However the maximum term of deposit allowed for NRI is 3 years.

LIC HFL fixed deposit rate (Effective 5th November, 2018)

The interest is paid and compounded on annual basis. The payment of interest under cumulative Option will be compounded with annually rest and will be paid at time of maturity. Under non-cumulative option, interest will be paid annually and is directly credited to bank account, if ECS option is opted.

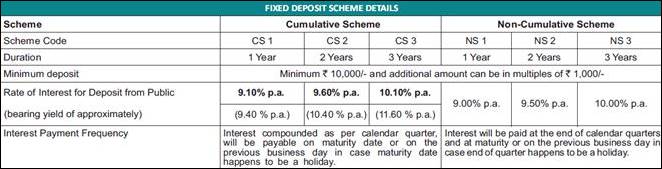

5. Future Enterprises Fixed Deposit – affiliate company Big Bazaar

Future Enterprises Limited (FEL) is a recent entrant in the FD market raising deposits through their FDs. Some of its affiliate company’s formats are Big Bazaar, FBB( Fashion Big Bazaar), Home Town etc.of the Future Group.

The minimum deposit is Rs 10,000 while the deposits can be made for 1 – 2 or 3 years under both cumulative and non-cumulative option. Under the cumulative option, the compounding will happen on a quarterly basis, while for regular income, the interest payout happens every quarter.

chart

The Big Bazaar FD or the FEL deposits carry CARE Ratings of AA – (Fixed Deposit), Outlook Stable, that means a high degree of safety regarding timely servicing of financial obligations. The ratings were obtained on November 01, 2018 and one should be aware that the ratings may change over time and may not be the same during the currency of the tenure.

Big Bazaar FD rates

Common factors across all company fixed deposits

All company FDs are unsecured and are subject to the Companies (Acceptance of Deposits) Rules, 2014 and other applicable rules or regulations for the time being in force. Company FDs are one of the riskiest of all the fixed income investments. If any company defaults, as has been the case in the past with several companies, the risk of losing the entire principal in them is highest.

The new Companies Act, 2013 has to some extent made CFD’s much safer under the Companies (Acceptance of Deposits) Rules, 2013. Also, provisions have been made for relatively sound companies having a net worth of not less than Rs. 100 crore or turnover of not less than Rs. 500 crore to raise deposits from the public.

The interest earned is fully taxable in the hands of the investor and is to be added to the ‘income from other sources’. If the amount of interest exceeds Rs 5,000 a year, tax at source is deducted by the company, subject to submission of Form 15G/H as the case may be.

What to do

If your risk profile is high, you may consider investing some portion of your funds in company FDs after factoring in the risks involved. Such investors may stagger the investment across different tenures and across different companies to manage the reinvestment risk and the default risk, respectively. Conservative investors may, however, stay away from company FDs even if the rate of interest is higher than other safer options.