The Defence Acquisition Council has recently approved proposals worth ₹670 billion for the Indian Army, Navy, and Air Force. The proposals include procurement of everything from Compact Autonomous Surface Craft to Thermo Imager-based Driverless Night Sight. These signs show a strong intent to deepen domestic manufacturing.

Thus, there could be an increase in order activity for some listed companies in the coming quarters. Incidentally, their stock prices have also corrected from recent highs, and they too need a fresh look too. So, which stocks are likely to benefit?

#1 Bharat Electronics

Bharat Electronics (BEL) is a defence PSU in which the Indian Government holds a 51.1% equity stake as of July, 2025. BEL is strategically crucial for India’s defence ecosystem. BEL’s strength lies in its consistent investment in research and development, typically 6-7% of its annual revenue.

The company is a key domestic supplier of defence electronics equipment to the Indian defence sector. It supplies radars, communications & electronic warfare equipment to the Indian Armed Forces.

Why BEL Stands to Benefit

BEL is likely to benefit from the acquisition of thermal imager-based driver night sight for infantry fighting vehicles. This is because it already supplies commander thermal imaging sights for infantry fighting vehicles (BMP-1/2/2K) and T-72 tanks.

In addition, BEL is also expected to benefit from the upgradation of BARAK-1 Point defence missile systems and mountain radar. The government has also approved the upgradation of Saksham and Spyder weapons systems for integration with the air command and control system.

Robust Q1 Performance Driven by Margin Expansion

The company continues to deliver strong financial performance. Revenue increased 4.6% year-on-year (YoY) to ₹44.4 billion in Q1FY26, driven by strong order execution. Profit after tax (PAT) rose 22.5% to ₹9.7 billion, driven by 580 basis points (bps) margin expansion to 28.1%.

As of Q1FY26, BEL has a strong order book. The company’s unexecuted order book stood at ₹749 billion. It implies a book-to-bill ratio of 3x (based on trailing twelve-month revenues of ₹239.6 billion), offering strong revenue visibility.

Supported by Strong Order Pipeline

Looking ahead, BEL aims to grow its top line at more than 15% in FY26, with a margin of around 27%. On the order book front, it expects an order inflow of ₹270 billion in FY26, of which ₹76 billion has already been received in Q1FY26.

Additionally, the company expects to receive QRSAM orders worth ₹300+ billion, which are expected to be completed by Q4FY26. The company also plans to invest over ₹10 billion in expansion plans and procurement of new-generation test equipment.

It also plans to introduce an Indigenous product related to “Kavach” and expects to get clearance from the Indian Railways by Q3FY26. Additionally, it is exploring opportunities in networking, data centers, and cybersecurity to diversify its revenue.

Valuation at Premium

From a valuation perspective, it trades at a price-to-earnings multiple of 52x, about double its 10-year median of 24x.

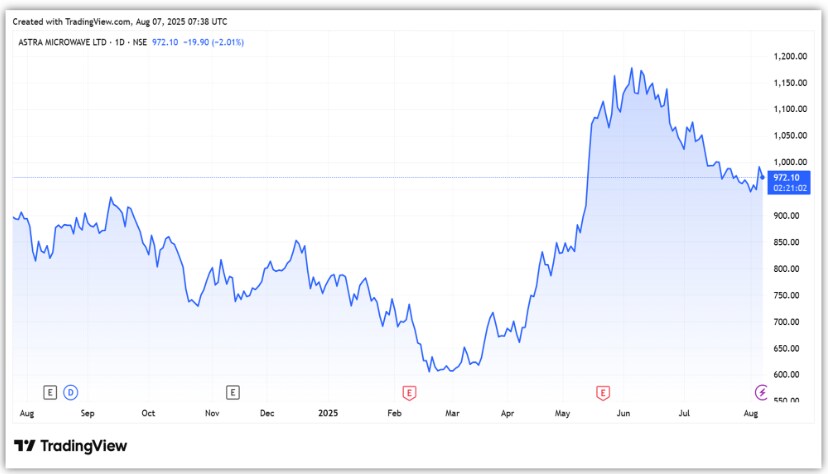

#2 Astra Microwave

Astra Microwave is engaged in the business of designing, developing and manufacturing defence, aerospace and space electronics, sub-systems and components. It is one of the few companies in India that designs and develops radar, tactical and space electronics systems and sub-systems.

The company serves sectors including defence, aerospace, space, metrology and telecom. The company is expected to benefit from orders for Mountain Radar, following the recent clearances by the Defence Acquisition Council (DAC).

Financial Performance Strengthens with Margin Expansion

Coming to its financials, Astra revenue rose 15.7% YoY to ₹10.5 billion in FY25. Its operating margin also expanded by 450 bps to 25.6%. As a result, PAT rose 27% to ₹1.5 billion. Its order book stood at ₹23 billion as of March 2025, which gives revenue visibility of 2.2x of FY25 revenue.

New Orders Seen in Radar and Missile Systems

Looking ahead, the company aims to grow its top line by around 20% to ₹12 billion, and bottom line by 18% in FY26. On the order book front, the company targets to book orders worth ₹14 billion for FY26. Of this ₹10 billion will come from the domestic segment and the balance from exports.

The company has a significant portion in the subsystems area (TR modules) and missile programmes in the QRSAM. It expects to receive orders after BEL the contract by Q4FY26. It also expects to receive Akash Missile Contracts from a potential product requirement.

The company also expects to benefit from the growing use of radars in electronic warfare. The company says Astra will make a significant contribution to the design and production of anti-drone solutions in various configurations, including surveillance systems and high-altitude tactical drones.

It is also building new radars to penetrate even deeper. Space is also being seen as the next frontier for Astra.

Valuation at Premium

From a valuation perspective, it trades at a price-to-earnings (PE) of 60x, well-above its 10-year median of 33x.

#3 Hindustan Aeronautics

Hindustan Aeronautics (HAL) is India’s largest defence public sector undertaking (PSU), with Maharatna status. The company is strategically important to India and operates in a sector with high entry barriers.

HAL has extensive expertise in designing, developing, manufacturing, maintaining, and upgrading fighter aircraft, helicopters, and aero engines. It focuses on indigenous research to manufacture its products and enters into technology transfer and license agreements when required.

So far, HAL has built over 4,200 aircraft and 5,200 engines, including 17 types of Indigenous designs. It has also repaired over 11,000 aircraft and 33,000 engines. Beyond manufacturing, HAL provides repair and overhaul (ROH) services to the Indian Defence Services and others.

Under the recent proposal, the company will benefit from orders for Medium Altitude Long Endurance (MALE) drones, for which it is a partner in the Defence Research and Development Organisation MALE programme.

Profit Growth outpaced Revenue Growth

HAL revenue rose 2% YoY to ₹301 billion in FY25. The subdued revenue growth was due to supply chain issues for LCA Mark 1A and the grounding of the ALH fleet due to an accident. However, PAT grew at a much faster pace of 9.7% to ₹83.6 billion, driven by higher operational efficiency.

Looking ahead, HAL’s order book remained healthy at ₹1.9 trillion (as of Q4FY25), which increased from ₹941 billion last year. This includes new manufacturing contracts worth ₹1.02 trillion for AL-31FP engines for Sukhoi-30 (240), LCH Prachand (156), and Sukhoi-30MKI aircraft (12).

The order book implies a book-to-bill ratio of about 6 times (as per FY25 revenue of ₹301 billion), providing strong revenue visibility. However, despite a strong order book, timely execution remains critical.

Supported by Strong Order Pipeline

In addition to the current order book, the visibility for future orders remains strong. HAL expects an order pipeline of about ₹1 trillion for manufacturing projects and ₹200 billion for repair and overhaul within the next 1-2 years.

The company also plans to invest around ₹150 billion to expand its manufacturing capabilities and set up repair and overhaul facilities. The company is also partnering with the private sector to increase the production of light combat aircraft.

Nonetheless, the government’s push for domestic manufacturing, strong entry barriers, business moat, and long-standing client relationships will continue to benefit HAL. With Russia still accounting for over 50% of India’s total defence imports, HAL stands out as a key player in localizing defence production.

Valuation at Premium

From a valuation perspective, it trades at a price-to-equity (PE) of 36x, well-above its 10-year median of 14x.

Conclusion

The recent policy push and ₹670 billion worth of DAC approvals mark a renewed commitment to indigenising India’s defence capabilities. Companies like BEL, Astra Microwave, and HAL are not only well-placed to benefit from upcoming orders but also enjoy strong order books and execution visibility. While valuations remain elevated, the broader opportunity and multi-year demand cycle may justify a fresh look at these defence plays.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.