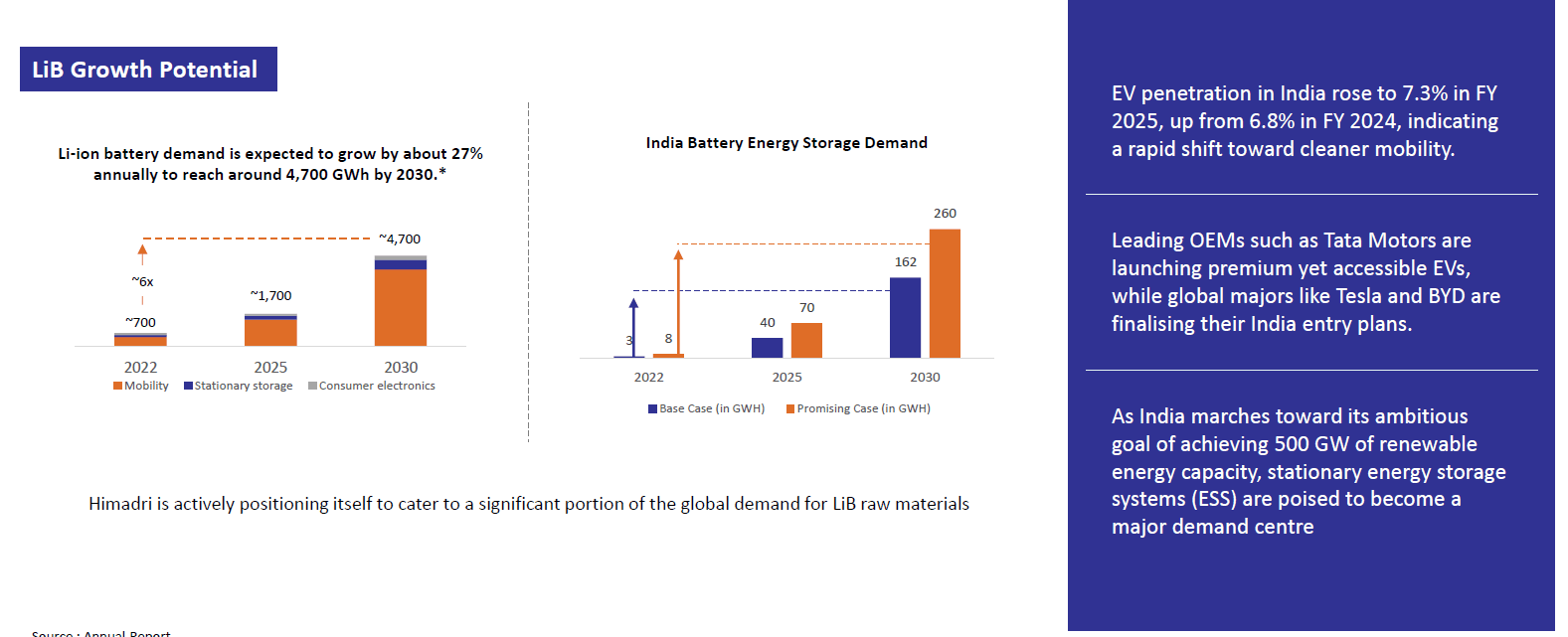

India’s energy transition is steadily moving from intent to execution, and batteries are emerging as the critical bridge between clean power generation and end-use consumption. Himadri Specialty states that Electric vehicle penetration has already inched up to 7.3% in FY25 from 6.8% in FY24, signalling a gradual but consistent shift toward cleaner mobility.

At the same time, India’s ambitious target of 500 gigawatts (GW) of renewable energy capacity is also driving demand for stationary energy storage systems, which are essential for managing intermittency and grid stability. Against this backdrop, lithium-ion batteries are set to become a structural growth market.

Li-ion Battery Set to Grow 3X

Himadri estimates global Li-ion battery demand could grow almost 3x from about 1,700 GWh in 2025 to nearly 4,700 GWh by 2030. Chemistries such as Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP) are likely to dominate this expansion. This is due to their high energy density, safety, cost, and cycle life, making them suitable for both electric vehicles and grid-scale storage.

This is opening up opportunities for companies to position across the battery materials value chain. Here are three players who are diversifying across the battery value chain…

#1 HEG: Integrated Lithium-Ion and BESS Platform

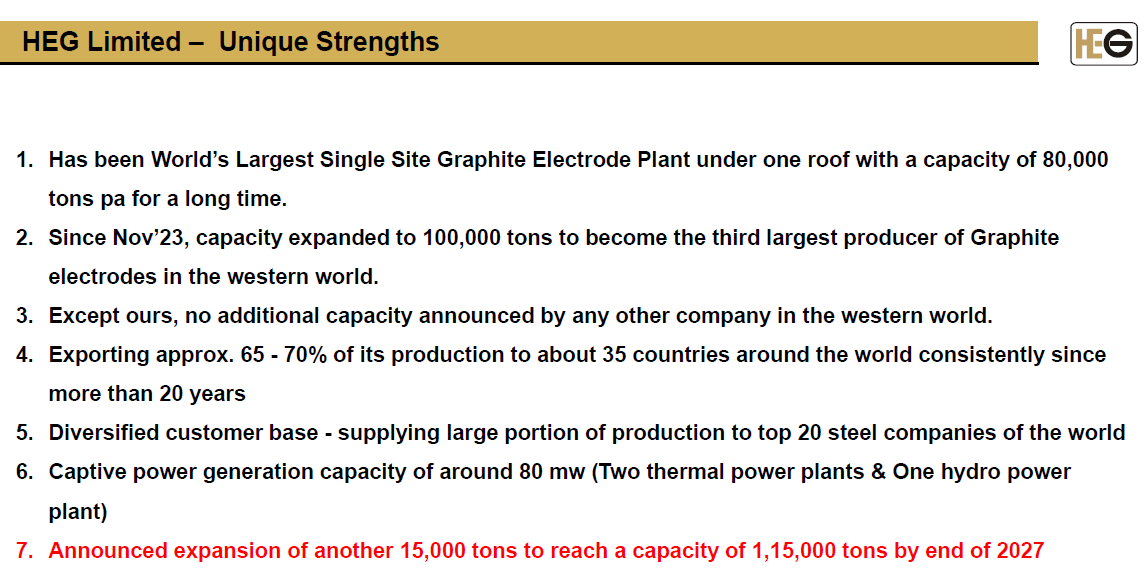

HEG is a leading global manufacturer of graphite electrodes. The company’s primary product, the graphite electrode, is a critical consumable used in Electric Arc Furnaces to generate the heat required to melt steel scrap. It operates the world’s largest single-site graphite electrode facility in Mandideep, India, with a current capacity of 100,000 tons per annum.

HEG Business Description

The Core: A Global Graphite Powerhouse

This company focuses heavily on exports, shipping 65% to 70% of its production to about 35 countries. Its customer base includes most of the world’s top 20 steel companies. The company places strong emphasis on the ultra-high-power segment, which accounts for about 70-75% of its production.

The Pivot: Inside the HEG Greentech Spin-off

In addition, HEG is significantly expanding its business in the battery and energy storage sector as part of its diversification strategy into green energy. These initiatives will be brought under a new company, HEG Greentech, to be formed following a planned demerger. The demerger is expected to receive NCLT approval by April 2026.

HEG is entering the lithium-ion battery value chain by manufacturing graphite anode materials. It aims to be among the first major producers in the non-China anode space. HEG plans to start production in 2027, with revenue generation starting in Q4FY27 and full EBITDA contribution commencing from Q1FY28. This segment is likely to be highly profitable, with EBITDA margins of 35% to 40%. EBITDA means Earnings Before Interest, Tax, Depreciation and Amortization.

Then comes the Battery Energy Storage System (BESS). HEG operates a BESS EPC (Engineering, Procurement, and Construction) business that serves both stationary energy storage (for the Power Grid) and mobility applications (Electric Vehicles). The company plans to expand its installed assembly capacity to 6 GWh by the first quarter of FY27, up from the current 1 GWh.

It currently procures cells and assembles them into battery systems. HEG is also developing Independent Power Production verticals that combine solar power with BESS. A 200 MWh project is expected to be commissioned by Q2 FY27, and even larger tenders (up to 2,000 MWh) are targeted for Q2 FY28.

Macro Tailwinds: The Electric Arc Furnace Shift

Beyond these businesses, HEG is also well-positioned in the graphite electrode market amid the green energy transition. It is positioning itself to capture significant incremental demand from the global shift toward cleaner steelmaking. The transition to Electric Arc Furnaces is expected to generate about 200,000 tons of demand for graphite electrodes by 2030 (excluding China).

To meet this demand, the company is increasing its capacity from 100,000 to 115,000 tons by the end of 2027. The production is expected to begin in early 2028. It maintains its competitive edge against Chinese suppliers by leveraging its position as a structurally low-cost manufacturer operating one of the world’s largest single-site plants.

Financials: 136% Profit Surge in H1

Turning to its financials, revenue rose by 15.5% to ₹1,316 crore in the first half of FY26. This was due to strong volume growth, as it was operating at over 90% capacity utilization in the first two quarters. Profit after tax (PAT) surged by 136% to ₹248 crore, as operating margins expanded by 500 basis points to 17%.

#2 PCBL Chemical: Developing the “Super-Food” for Batteries

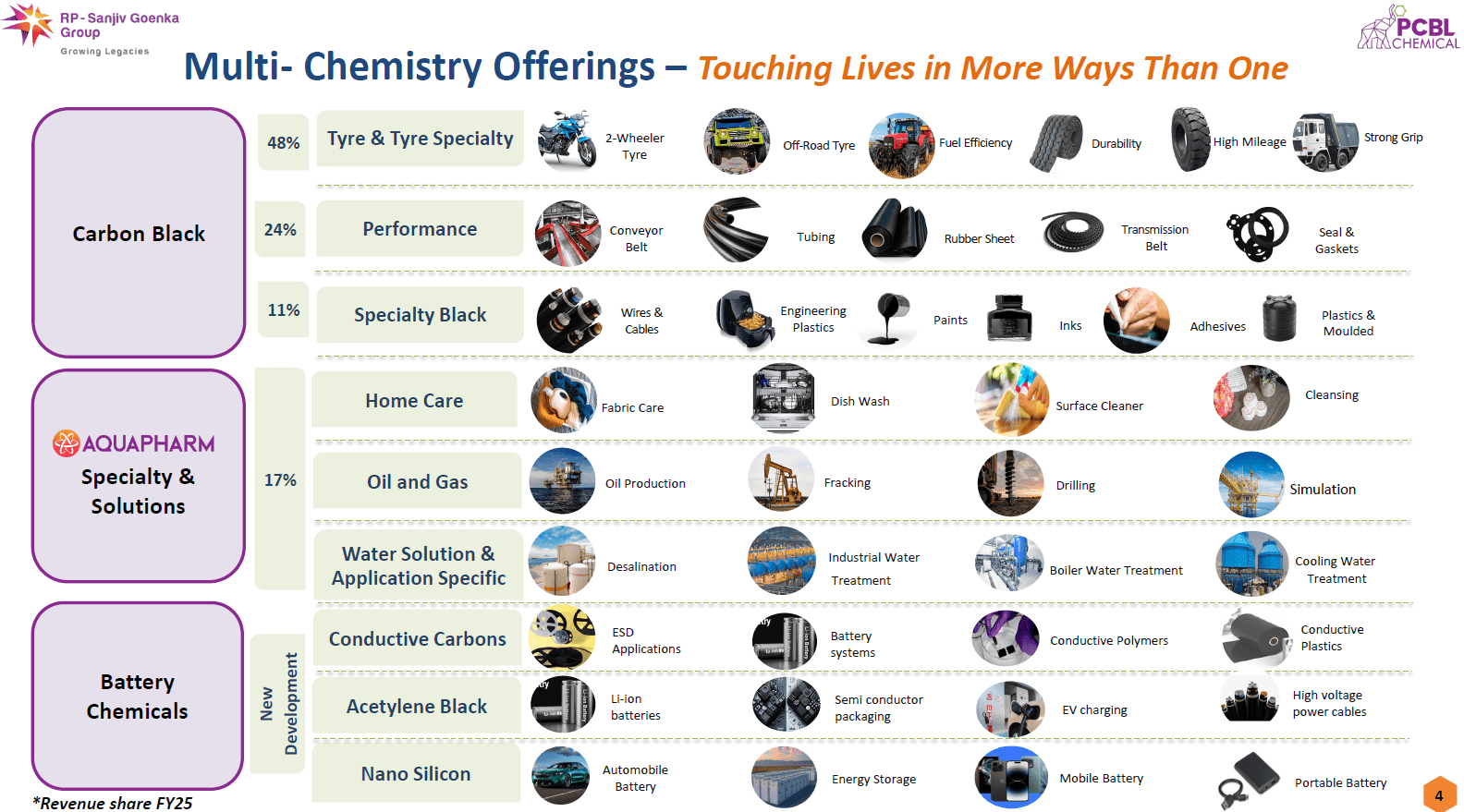

PCBL Chemical is a Group company of the RP-Sanjiv Goenka Group. The company is one of the world’s largest manufacturers of carbon black and a major player in the specialty chemicals industry. Its business is primarily divided into two main segments: carbon black and Aquapharm Chemical.

The Foundation: Carbon Black Dominance

Within the Carbon Black segment, PCBL produces specialised grades for tyres, performance chemicals, and specialty applications. It currently maintains a capacity utilization of over 99% and is working toward a target of over 1 million tons of capacity in the coming years.

Aquapharm is the largest producer of phosphonates in India and one of the top producers worldwide. It serves essential sectors such as home care, water solutions, and oil and gas. PCBL also generates its own power through co-gen plants. But it is diversifying into a multi-chemistry platform focused on high-margin, high-growth segments.

The Moat: A Unique Triple-Tech Advantage

PCBL’s battery-chemical roadmap is based on three distinct technological pillars, aimed at next-generation energy storage and electric vehicle applications. A dedicated plant for super-conductive grades with a capacity of 1,000 Metric tonnes per Annum (MTPA) is located in Gujarat. Commercial production for these grades was scheduled to begin in November 2025.

The nano-silicon project focuses on specialized nanomaterial processes for battery applications. A pilot plant is currently under construction in Gujarat to produce approval-grade materials for global customers. The company also plans to commission a 4,000 MTPA acetylene black plant within the next 18 months to further enhance its conductive solutions portfolio.

PCBL will be the only company of its kind globally to develop all three advanced technologies. It is also securing its technological edge through international patents. PCBL has already obtained a US process patent for its proprietary nano-silicon nanomaterial process. It expects to receive further patents from Japan, South Korea, and Europe in the next two quarters.

Patent applications have also been filed for carbon-silicon composites and battery-grade graphite derived from bio-sources. To strengthen its presence in high-value markets, PCBL has established a subsidiary in the USA focused on these advanced materials.

Battery Chemicals Set the Next Growth Chapter

Future Growth: Data Centers & Electrification

The company states that demand for these materials is primarily driven by rising electrification, data center expansion, and the global shift toward renewable energy. Once the Nanovace pilot plant is commissioned, PCBL expects a product approval cycle of approximately 6 to 9 months as they send materials to major global players for testing.

These battery materials represent a shift toward high-margin, specialty products, beyond the traditional carbon-black business. Once fully operational, PCBL aims to serve high-performance applications in Li-ion batteries, EV charging infrastructure, and grid-scale energy storage.

The Risk: Why Margins Are Compressing

From a financial perspective, revenue stayed flat (-0.7%) at ₹4,278 crore in the first half of FY26, due to muted demand. Although sales volume increased, the challenging global environment and pricing pressure significantly impacted overall profitability. Consequently, PAT declined by 35% to ₹156 crore, as operating margins decreased by 330 basis points to 13.7%.

#3 Himadri Speciality: Building the World’s (Outside China) First Lithium Iron Phosphate Plant

Himadri Speciality Chemicals is a global specialty chemicals company that is transforming from a carbon value chain player into a leading player in the mobility and energy storage sectors. Himadri operates in several key chemical value chains: specialty carbon black, coal tar pitch, and specialty chemicals.

Capacity Expansion: Building the World’s Largest Plant

The company is undertaking a brownfield expansion to more than double its carbon black capacity to 130,000 MTPA by Q3FY26 end. This expansion aims to create the world’s largest specialty carbon black capacity at a single location.

Himadri has also recently commissioned high-temperature liquid terminals at Haldia and Mangalore to strengthen its footprint in the international liquid coal tar pitch export market. The company is revitalizing the Birla Tyres brand through a strategic turnaround plan.

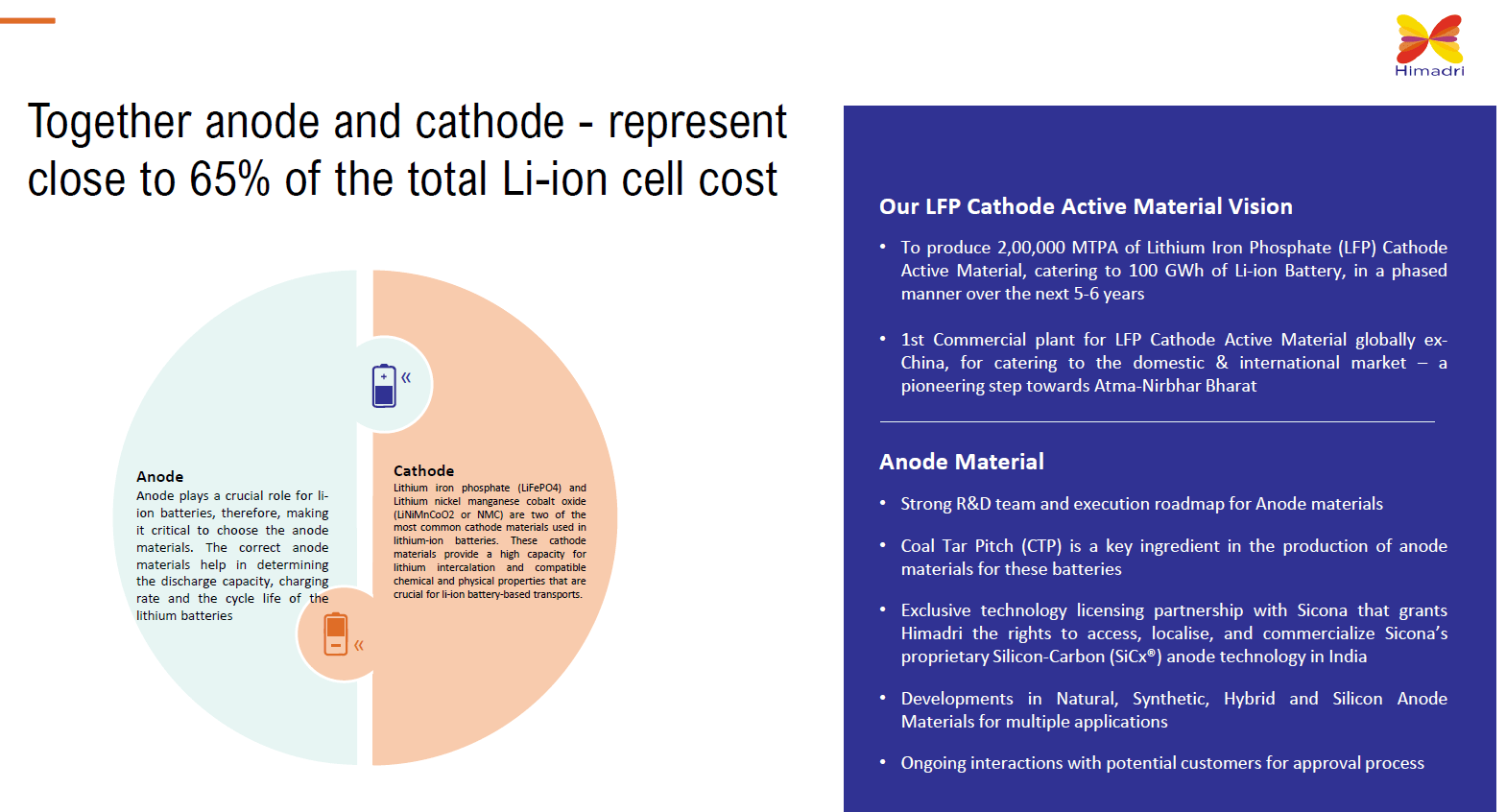

Beyond the traditional business, Himadri is positioning itself as a key player in the Lithium-ion Battery supply chain. The company’s goal is to address a substantial portion of the raw material requirements for Lithium-ion Batteries, which are essential for India’s push toward 500 GW of renewable energy capacity.

The LFP Bet: Challenging China’s Monopoly

To capitalize on the growing demand, Himadri is at the forefront of producing Lithium Iron Phosphate (LFP) cathode active material. This material is known for its safety, non-toxicity, and long lifespan. The goal is to gradually increase production to 200,000 MTPA of LFP over the next 5-6 years, which would be sufficient to meet the needs of 100 GWh of lithium-ion batteries.

This facility will be the first commercial LFP plant outside of China. A demonstration plant is under construction to expedite customer approvals. The first commercial phase, with a capacity of 40,000 MTPA, is expected to be operational by Q3 FY27.

With a partnership with Sicona Battery Technologies, Himadri is developing natural, synthetic, and silicon-carbon anode technologies. Himadri holds the rights to commercialize proprietary silicon-carbon anode technology in India. This technology can increase energy density by more than 20% and reduce charging time by over 40% compared to traditional graphite cells.

First Commercial LFP Plant Globally

In addition, the company has acquired stakes in several technology-driven companies, including Invati Creations and International Battery Company, to gain access to state-of-the-art Li-ion cell manufacturing and molecular research. Beyond these initiatives, Himadri has launched the Li+ and LB Series of specialty carbon blacks, specifically for conductive battery applications.

Profitability: Expanding Margins in a Tough Market

From a financial perspective, revenue declined 6.3% year-on-year at ₹2,189 crore in the first half of FY26, due to muted demand. A 13%–15% decline in raw material prices and the deferral of sales recognition for a large export shipment to the third quarter impacted revenue growth.

But despite the dip, Himadri’s operating margins expanded by 490 bps to 16%, driven by a shift toward high-value-added speciality and advanced materials, as well as operational efficiency. Consequently, PAT surged by 37% to ₹355 crore. It plans to double its FY24 PAT (₹411 crore) by FY27.

Valuation Check: Are These Stocks Overheated?

Himadri, with its superior profitability, boasts strong return ratios, including Return on Capital Employed and Return on Equity. On the other hand, PCBL’s and HEG businesses have shown poor growth with relatively volatile bottom lines. This is reflected in PCBL’s moderated return profile and HEG’s relatively weak return metrics.

Valuation Assessment (X)

| Company | EV/EBITDA | 10-Year Median EV/EBITDA | Industry EV/EBITDA | RoCE (%) | RoE (%) |

| HEG | 18.3 | 9.4 | 18.3 | 4.0 | 2.6 |

| PCBL | 13.6 | 9.4 | 18.7 | 11.8 | 12.5 |

| Himadri | 23.8 | 22.2 | 22.0 | 16.4 |

In terms of valuation, Himadri is trading near its 10-year median multiple, but at a slight premium to industry valuations. This can be justified by its higher return ratios and better growth. PCBL is trading at a discount to the industry multiple but above its own median, while HEG is valued close to the industry benchmark and also at a premium to its historical median.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were unavailable have we used an alternate, widely accepted, and widely used source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.