The National Geospatial Policy (2022) has liberalised access to geospatial data, boosting innovation in the public and private sectors. Its motive was to use geospatial data for innovation in governance, business, and academia. Moreover, the sector also benefits from policy support.

Budget 2025 has allocated ₹1 billion for the National Geospatial Mission in FY26 and launched key initiatives. These include Operational Dronagiri, Agricultural Decision Support System, Mission Mausam (₹2,000 crore), and Digipin. These initiatives collectively indicate India’s ambition to become a global geospatial superpower.

The opportunity is such that MapmyIndia even estimates that the Indian geospatial market will reach ₹1 trillion by 2030. And only three listed companies have the key to directly playing on the geospatial theme. So let’s take a look at them…

#1 MapmyIndia: Homegrown Rival to Google Maps

Mapmyndia helps India move smarter, with one of the most comprehensive and detailed digital map databases. It is a pioneer in digital mapping and geospatial solutions with high-definition maps, real-time geospatial analytics, & Internet of Things (IoT) platforms.

Its core business offerings include Maps as a Service (MaaS), Software as a Service (SaaS), and Platform as a Service (PaaS). Under MaaS, India has access to its leading 2D, 3D, and HD map database, which includes terrain, buildings, real-time updates, and RealView content.

In SaaS, it offers IoT solutions for mobility and logistics, as well as to enterprises, governments, and consumers (through Mappls apps and gadgets). Within PaaS, its modular platform enables custom real-time integration across various customer segments.

Maps and IoT Fuel Segment-Wise Momentum

In Q1FY26, the company’s revenue grew 19.8% year-on-year to ₹1,216 million, driven by the automotive and mobility tech segment (A&M). EBITDA rose 30.6% to ₹559 million due to operating leverage. Margins also expanded 385 basis points (bps) to 46% due to improved revenue mix. Profit after tax (PAT) grew 27.7% to ₹458 million.

EBITDA refers to earnings before interest, tax, depreciation, and amortization.

Within the segment mix, A&M revenue grew 24.4% to ₹560 million, accounting for 46% of the total revenue. This growth has been fueled by the rising demand for its automotive solutions, which are seeing rapid adoption. Primarily, it has built strong relationships with electric vehicle manufacturers who are integrating MemyIndia’s technology.

The Consumer Tech and Enterprise Digital segment’s revenue grew 16.1% to ₹656 million, accounting for 54% of total revenue. Customer acquisition and increased engagement with existing customers contributed to this growth.

The maps business remained a key driver of growth, with revenue growing 26% to ₹982 million. Map-based margins also expanded 470 basis points (bps) to 54.8%. IoT-based revenue remained stable at ₹234 million, as it is undergoing a period of slow growth.

Long-Term Ambition to Double Market Share

Looking ahead, it aims to achieve revenues of ₹10 billion by FY28, almost double the ₹4.63 billion in FY25. To achieve this, the company aims to double its market share in the automotive segment from the current 11% to 25%.

The company sees its deep relationships with auto manufacturers and regulatory leverage for localisation as key growth drivers. It says that mobility has a large untapped aftermarket potential of over 20 million vehicles.

It aims to sell 3 million devices by FY28, with margin expansion achieved through hardware and software bundling. MapmyIndia also inked a joint venture with Hyundai AutoEver to expand in Indonesia, which is expected to deliver 2.5-3x higher average revenue per user than in India.

Valuation at Discount

From a valuation perspective, it is trading at a price-to-earnings (P/E) multiple of 56.9x, below its 3-year median of 73x.

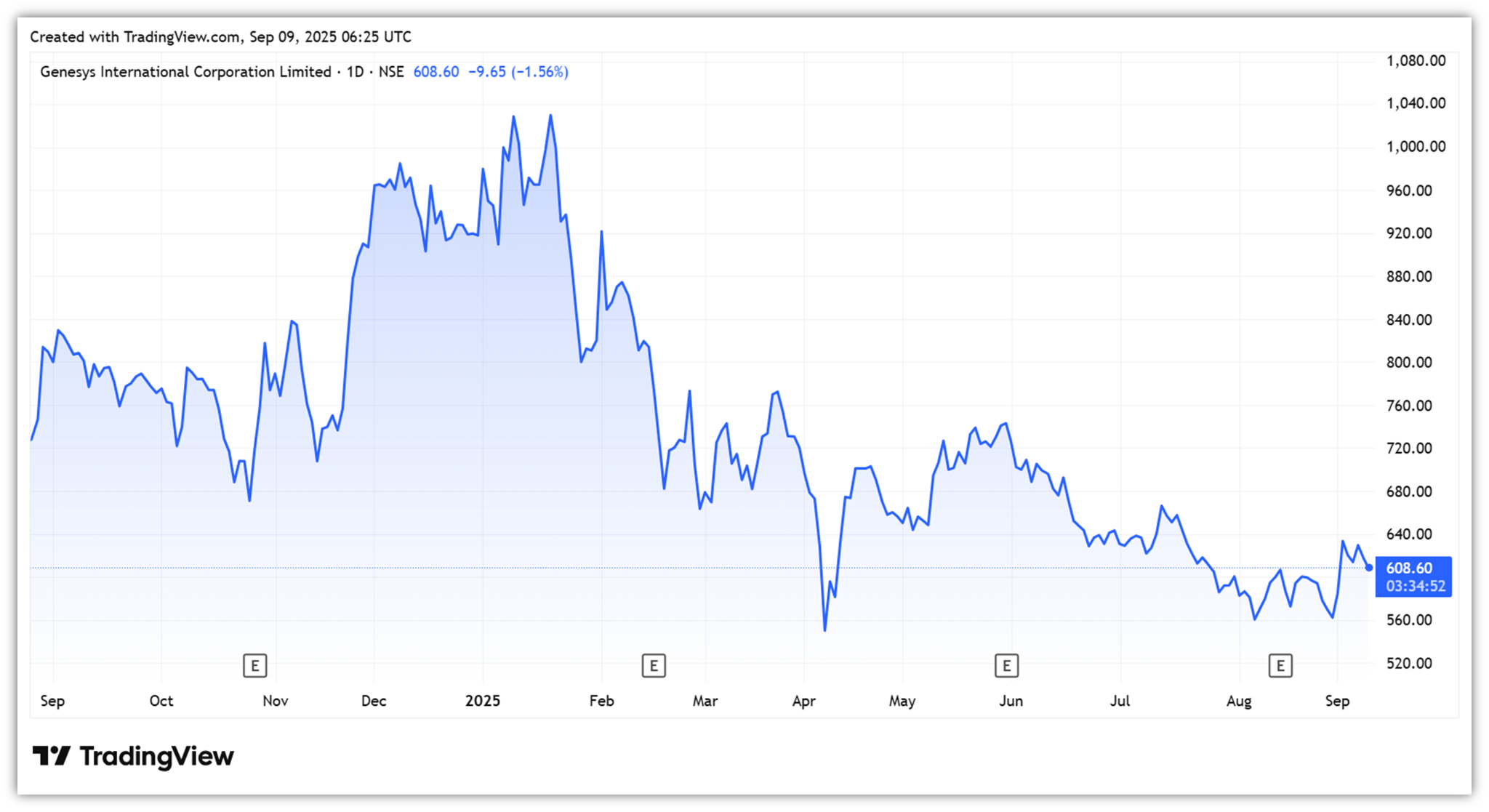

#2 Genesys International: A Pioneer in 3D Mapping

Genesys International provides geospatial information systems, which primarily involve digitizing maps and converting paper-based drawings to digital platforms. The company offers services across urban development, utilities, natural resources, disaster management, telecommunications, and the media sector.

The company is a leader in 3D mapping and has proven expertise in marquee international projects, positioning it as a pioneer in the space. It has partnerships with reputable clients, including Google, Microsoft, the Survey of India, and NNG Automotive.

Strong Growth Backed by 3D Mapping Leadership

Genesis’ revenue in Q1 FY26 grew 27% year-on-year to ₹708.7 million, while PAT rose 31.7% to ₹69.8 million. In FY25, it also performed exceptionally, with revenue growing 57% to ₹3,110 million, while PAT increased 154% to ₹560 million. This growth was driven by increased demand for advanced geospatial mapping and analytics solutions.

Oyster Platform Builds India’s Digital Twin

Looking ahead, the company has developed a proprietary platform, Oyster. Oyster serves as India’s digital twin, supporting applications across various industries, including 5G planning, renewable energy, and urban planning. The company has already completed major projects in India and abroad.

The company utilizes diverse datasets, including traffic movement, dwell time, and movement patterns, which are beneficial for decision-making in retail, government, and other sectors. This is expected to become a major driver of growth going forward. In fact, it is conducting research to assess broader risks for city-centric infrastructure and assets, including utilities and critical urban facilities.

Government Programs as Key Demand Catalyst

Genesis is also expanding its presence in the automotive sector to capitalize on the next generation of connected and automated vehicles. It is seeing increased traction from existing and new customers. It is also fully prepared to support India’s integrated digital frameworks, such as DIGIPIN, and the digitisation of public infrastructure.

Large-scale government programs, such as the National Geospatial Policy (NGP), the PM Gati Shakti National Master Plan, and Smart Cities Mission 2.0, are also expected to benefit Genesys.

The company trades at a P/E of 41.6, which is a discount to its 10-year median of 52.2.

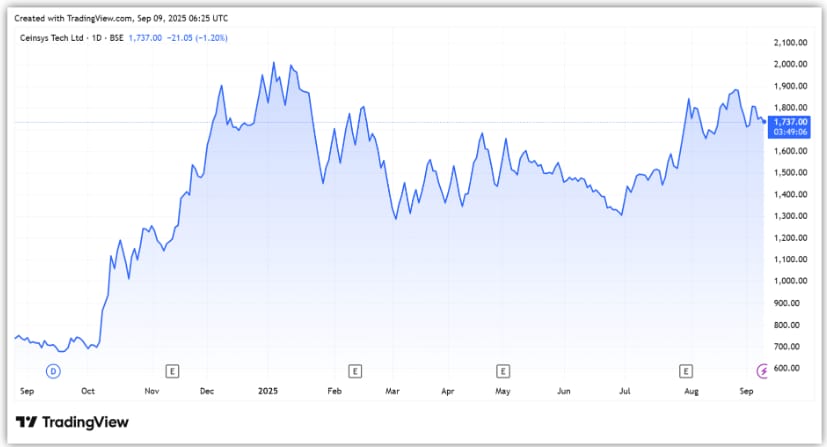

#3 Ceinsys Technology

Ceinsys Technology is a technology solutions provider of geospatial engineering, mobility engineering services, and enterprise solutions. It provides real-time data integration from drones, satellites, and sensors. The company operates across two segments: Geospatial and engineering services, and technology solutions.

Project Execution Drives Triple-Digit Growth

In Q1FY26, the company’s revenue grew 112.2% year-on-year to ₹1,566 million due to the strong execution of projects. Geospatial and engineering services revenue rose 72% to ₹723 million, accounting for 46.2% of revenue. Another sector, technology solutions revenue grew 167% to ₹839 million, accounting for 53.6% of the total revenue.

High-Margin Technology Solutions Take Lead

The company’s focus on technology solutions is proving to be fruitful, as it offers high margins of around 30%, which is double the 15-16% margin typically seen in geospatial and engineering services. This is also evident from its EBIT of ₹259 million, against geospatial and engineering services (₹108 million). EBIT refers to earnings before interest and tax.

With such strong revenue growth, Ceinsys’ EBITDA also grew 129.5% to ₹303 million, leading to margin expansion of 146 bps to 19.3%. The management said that the successful execution of projects contributed to the strong margins. As a result, PAT rose 166% to ₹317 million.

Employees’ expenses decreased to 22% of revenue in Q1 of FY26, from 25% in Q1 of FY25, contributing to the PAT growth. The company’s order book stood at ₹12 billion, which is about 2.9 times its FY25 revenue of a little over ₹4 billion.

Robust Order Book Supports Ambitious Guidance

Looking ahead, the company aims to double its revenue to ₹8-9 billion in FY26 from ₹4.1 billion in FY25. Of this, around ₹ 4 billion is expected to come from the Jal Jeevan Mission project. The company is also focusing on international expansion, especially in the US, through both organic and inorganic growth.

The company trades at a P/E of 36.5, which is a premium to its 10-year median of 21.3.

Bottomline

India’s geospatial story is still in its early innings, but the direction is clear. Policy support, large government missions, and the rapid adoption of digital mapping and analytics are opening up a trillion-rupee opportunity. With only a handful of listed players directly exposed, the space offers investors a rare, concentrated way to ride this emerging theme. The real question is which of these companies will turn early promise into long-term leadership.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.