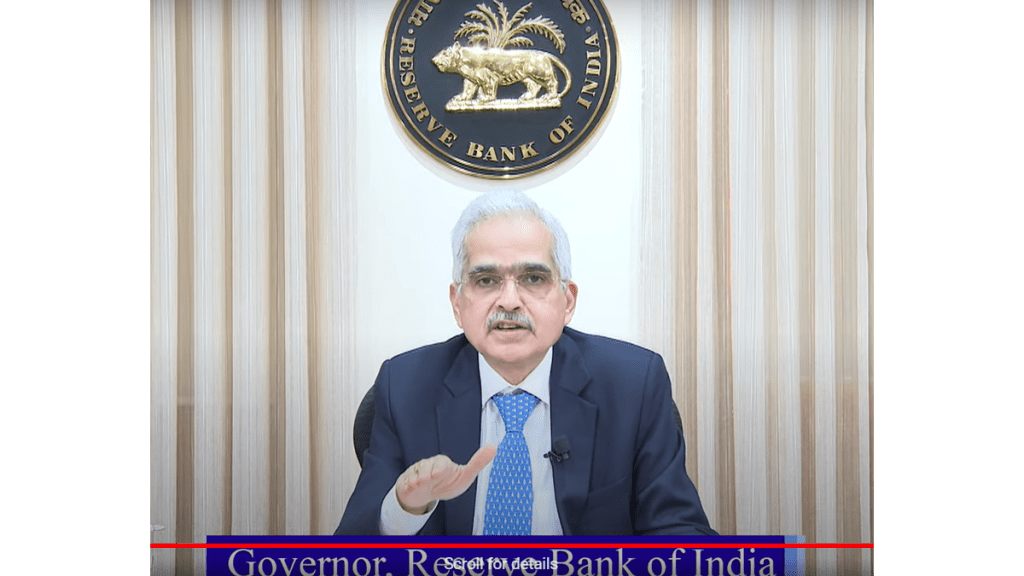

RBI Monetary Policy Announcement: The Reserve Bank of India’s (RBI) has kept the Benchmark interest rate unchanged at 6.50%. The RBI has stayed on hold for the past 18 months and the meeting that just ended is the 50th meeting of the RBI Monetary Policy Committee since its inception in September 2016. The detailed assessment of the macroeconomic conditions helped the RBI to decide on the current rate stance. According to RBI Governor also said the MPC remains focussed on withdrawal of accommodation to ensure inflation ultimately aligns with the RBI target.

The next RBI MPC meeting is scheduled on October 7-9. The MPC has kept the repo rate unchanged in the previous eight policy reviews. With today’s decision, the RBI has kept rates unchanged for the ninth consecutive time.

George Alexander Muthoot, MD, Muthoot Finance, said, “We commend the RBI’s commitment to maintaining stability in India’s financial system by keeping the repo rate unchanged at 6.5% and its stance on ‘withdrawal of accommodation’. This prudent approach is crucial, particularly given the uneven expansion owing to geopolitical tensions in the Middle East. Despite these challenges, we are glad to witness stability in domestic economic activity on the back of the steady progress in south-west monsoons.

We take pride in RBI’s appreciation of the Indian financial system as it has been able to maintain resilience and showcase broader macroeconomic stability. At the same time, we also diligently acknowledge the key areas of concern highlighted by the honorable RBI Governor today including the need to closely monitor alternate investment avenues, be vigilant on personal loans, adhere to loan to value (LTV) ratio, risk weights and monitoring of end use of funds, and unprecedented global IT outage.”

The status quo stance of the monetary policy, amidst continuing geopolitical crises and strong domestic macroeconomic fundamentals is welcome, said Sanjeev Agrawal, President, PHD Chamber of Commerce and Industry.

“It is highly appreciable that for the ninth consecutive time the RBI’s MPC has resolved to maintain the repo rate unchanged at 6.5%, maintaining a status quo. We expect inflation trajectory to stabilize within 4-4.5% by December 2024 and softening of the policy stance of the monetary policy. This decision will be favourable for sustained high growth of GDP, while ensuring continuous price stability. The projection of retail inflation at 4.5% during FY25 assuming normal monsoon and real GDP at 7.2% for FY25 is in line with industry expectations, said Sanjeev Agrawal.

Kapil Gupta, Executive Director- Research, Nuvama Institutional Equities, said, “The RBI policy was largely a status quo policy, both on rates and stance. Policymakers remain comfortable with the evolving growth trajectory and emphasized that RBI remains resolute in aligning headline inflation to the target of 4% on a durable basis. While core inflation is benign, stubborn food inflation poses the risk of second round effects and there requires constant vigil. Thus, policymakers are in no rush to lower their guard as of now. Trajectory of domestic food inflation and evolving path of the Fed rate are the key monitorables in the near-term.‘

Sanjeev Kumar Sharma, CFO, M3M India, said, “The RBI's decision to keep the repo rate unchanged at 6.5% is a welcome move for the real estate sector. This stability in borrowing costs will encourage more homebuyers and investors to enter the market, supporting ongoing and future projects. Additionally, the robust GDP growth projection aligns well with our expansion plans, allowing us to meet the rising demand for both residential and commercial spaces. We are encouraged by the government's dedication to fostering a conducive economic environment, which is essential for the long-term prosperity of the real estate industry. We are confident that this commitment will have a profoundly positive effect on our sector, promoting sustained growth and opportunities in the sector.”

“The maintenance of status quo on RBI’s monetary policy is in line with market expectations and exemplifies the Union Budget’s guidance of preserving overall macro-financial stability. The central bank’s unchanged FY25 forecasts of 7.2% GDP growth and 4.5% CPI inflation endorses confidence of a sustainable macroeconomic equilibrium for the Indian economy. Going forward, the sharp improvement in southwest monsoon performance since July 2024, moderation in international commodity prices, and continued emphasis on public capex would help to lower inflationary pressures. Strong likelihood of the commencement of monetary easing by the US Fed from September onwards would provide additional comfort. The recent improvement in systemic liquidity bodes well and alongwith disinflationary momentum should allow for Monetary easing during financial year 2024-25. The consumer friendly announcements viz proposed creation of a public repository of digital lending apps, enhancing UPI transaction limit for tax payments, and continuous clearing of cheques are a welcome steps towards boosting efficiency and transparency.”

Indranil Pan, Chief Economist, YES Bank, said, “Recent rumblings in the global financial markets and expectations for the US Fed to be aggressive in its rate-cutting cycle have failed to sway the RBI away from its views on how monetary policy needs to be conducted in India. I think the RBI was a tad more hawkish than in the previous MPC, probably to firmly establish in the minds of the market that it should not expect any rate cuts soon. In this context, the RBI clearly indicated that there is still a distance to cover to align inflation with the 4% target. RBI’s thought on the debate if it could be more suitable to target core rather than headline inflation indicates that for the MPC, food inflation remains important as it has a high share in the consumption basket of the public and that it could influence households' inflation expectations. The RBI acknowledges that the financial sector in India is strong but stresses the need to proactively flag off the risks and challenges. For the RBI, a high CD ratio of the banking system had been of some concern, and it could be true that the RBI would want to see the CD ratio come down to more reasonable levels before easing monetary policy.”

Vishal Raheja, Founder & MD, InvestoXpert, said, “The decision by Apex bank holds greater significance to the real estate sector, as it heralds greater stability in borrowing costs and a more predictable environment to both the developer and buyer. For a developer, keeping the repo rate status quo can help retain current project financing costs effectively, which is principal in financial planning and actual project execution. This relieves an immediate pressure off the loan rate fluctuations and lends better financial management. This consistency can also help developers either back out or lower the inflated costs of new projects, hence making them more affordable and therefore attractive to buyers. Therefore, this course of action by the RBI is a welcome move and will definitely keep up the momentum in the real estate market. It opens doors for both buyers and sellers to take advantage of a stable financial situation and go for growth with stability.”

Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE, said, “The Reserve Bank of India's decision to retain the repo rate for the ninth time in a row underscores a continued cautious approach to monetary policy. This indicates RBI's ongoing efforts to balance inflationary pressures with the need to foster a robust economic environment. By maintaining the status quo, the policy is likely to sustain momentum within the real estate sector, providing a stable rate environment that benefits the market and will aid in maintaining consumer confidence.”

Arsh Mogre, Economist - Institutional Equities, PL Capital - Prabhudas Lilladher, said, “In its latest policy review, the Reserve Bank of India (RBI) underscores a decisive focus on inflation control, starkly contrasting with the easing trends among major global central banks. This stance is not merely reactionary but a calculated alignment with long-term financial stability goals, given the disproportionate influence of volatile food prices on India’s CPI.

The RBI's commitment to maintaining the repo rate at 6.50%, despite international rate cuts, signals a deeper strategy: fortifying the economy against inflationary pressures while cautiously monitoring growth indicators. This approach reflects a profound balancing act, poised between nurturing economic resilience and preempting inflationary spirals, thereby crafting a monetary path that prioritizes sustainable economic health over transient growth impulses.

The RBI is likely to maintain its policy stance until at least Q3 FY25, pending a sustained alignment of inflation toward the target. This cautious approach may be influenced by external factors such as potential aggressive rate cuts by the US Fed.”

Manoranjan Sharma, Chief Economist, Infomerics Ratings, said, “This decision was entirely in line with our expectations and indeed those of most participants of the financial market. Playing with a straight bat, the MPC’s stance in the August Policy with 4:2 majority continued to be “withdrawal of accommodation” and the Repo Rate (last changed in February 2023) was kept unchanged for the ninth consecutive time to continue, as the Governor stressed “with the disinflationary stance of withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth”. This was justified because despite continuously declining core inflation, retail inflation breached the 5 % mark in June 2024 (five-month high of 5.08 % in June 2024) and persistently elevated food inflation causes concern, particularly to the vulnerable sections of society. Given the evolving situation the RBI did well to be in a wait and watch mode.

New customer-friendly efficient cheque clearing process would reduce the current clearance time from two working days to just a few hours and reduce settlement risk for all participants involved in the process. Public depository for registered entities is welcome.”

Achala Jethmalani, Economist, RBL Bank, said, “A food for thought policy. In a 4:2 vote the MPC maintained a status-quo on policy rates and stance. With food basket having a weight of 46% in inflation, it cannot be completely ignored. More so, when the risk is due to the nature of food inflation which has been more persistent than transitory. The weight to the thought of tracking inflation excluding food or looking at core inflation was reduced. The proactive liquidity management has kept liquidity conditions benign, and a pivot to easy policy is still a couple of quarters away. The majority of MPC has reiterated on its 4% inflation target and for the banking sector, the Governor (re)emphasised on deposit mobilization as deposit growth has been trailing credit growth. Overall, with the growth forecast of 7.2% YoY and inflation forecast of 4.5% for FY25 the MPC is not seen in a hurry to pivot to cuts in CY24. We still see first rate cut to come through in Q1 CY25.”

Ajay Kumar Srivastava, Managing Director and CEO, Indian Overseas Bank, said, “The RBI MPC’s decision to keep the repo rate unchanged at 6.5% as well as project a GDP growth for FY25 at 7.2 % is a very well-balanced measure that has been undertaken, and we welcome this move. Given that the current global financial markets have been in turmoil on concerns of growth slowdown, the RBI MPC’s decision to maintain its ‘Withdrawal on Accommodation’ stance as well as keep the standing deposit facility rates and marginal standing facility rates unchanged showcases a positive outcome for the banking sector to chart towards further growth.”

Murthy Nagarajan, Head-Fixed Income, Tata Asset Management, said, “RBI maintained its monetary policy stance of withdrawal of accommodation and kept all the policy rates unchanged. GDP growth is expected to remain at 7.2% due to good monsoon, higher sowing and expected pick up in the rural economy. RBI Governor indicated a shift in focus from Core Inflation to headline inflation from, and forecasted CPI inflation to come down at 4.5% for FY25. The pace of reduction is expected to be uneven due to repeated food shocks. The Governor stated food- which constitutes around 46% of CPI basket, contributed 75% of the rise in CPI inflation for June. Of which, vegetable inflation contributed 35% of the rise in CPI Inflation. All these statements are on expected lines and the market will focus on CPI inflation for July which is expected at 3.7%.”

Sunil Sisodiya, Founder, Geetanjali Homestate, said, “The RBI has maintained the status quo on the repo rate at 6.5% for the eighth month in a row. This was welcomed by real estate stakeholders because a low rate in home loans would add to the factor of affordability among customers. Stable interest rates give a fertile ground to encourage homebuyers and boost demand for luxury housing. The industry is hopeful that possible cuts in interest rates of a repo rate later in 2024 will act as another booster for demand in the housing market and further drive growth across all related sectors. This stable policy on the repo rate acts as a main catalyst to boost investor confidence and further spur the momentum of the sector. It would increase the probability for more investment as well as motivate homebuyers hence contributing to faster recovery of the economy. Stability, therefore, is offered mainly not only to the housing market but also to the economy at large for the country by this unchanged repo rate.”

Prashant Pimple, CIO-Fixed Income, Baroda BNP Paribas Mutual Fund, said, “This settles all the noise regarding expectations of stance change given a lower core inflation. On the growth front, RBI’s communication instilled confidence in India's economic activity. Resilient growth provides RBI with the space to remain focused on inflation targeting policy. With respect to liquidity, RBI has mentioned remaining nimble-footed and flexible towards liquidity management going ahead. This builds up our expectations of liquidity to be well managed and system liquidity to remain comfortable.

RBI’s unchanged inflation projection for FY25 instills our confidence that inflation continues to remain on a declining trajectory with current food shocks to be transitory. This along with developing global monetary policy dynamics around expectations of FED monetary pivot in September-24, creates a space for our expectations of a domestic monetary policy pivot in December-24. We expect a stance change in October-24 given inflation remains on track.”

Amit Jain, Chairman and Managing Director, Arkade Group, said, “The Indian real estate industry and the economy would have greatly benefitted from a rate cut, given that current macroeconomic parameters are favourable and the rate has been maintained at 6.5%. This is the longest the RBI has maintained a status quo in 25 years. We can expect more homebuyers and fence-sitters to come forward and fulfil their property purchases towards the end of this quarter and into 2025. From a borrowing cost perspective, this move ensures that homebuyers’ EMIs don’t increase, and for developers, it doesn’t increase their financial burden owing to the consistent rate of cost of capital. The MMR real estate market is also expected to witness strong purchasing demand from consumers, with infrastructure projects seeing incremental interest in the coming years and this will help to boost the economic growth too.”

Parijat Agrawal, Head – Fixed Income, Union Mutual Fund, said, “As expected, the Monetary Policy Committee (MPC) kept the rates and stance unchanged. The MPC kept the stance unchanged due to ample systemic liquidity. The focus remains on bringing headline inflation on a durable basis to 4%. Although core inflation is in a disinflationary trend, volatile food inflation is a cause of worry. Growth remains robust as visible in high frequency indicators. Global economic slowdown and financial market volatility is something which the MPC may have to address going forward. The evolving growth inflation dynamics point towards rate cut beginning from December policy.”

Santosh Agarwal, CFO and Executive Director, Alphacorp, said, "The recent announcement by the RBI to keep the repo rate unchanged at 6.5 per cent is a significant move for the real estate sector. Stability in interest rates provides a predictable environment, which is crucial for both developers and homebuyers. With the RBI focusing on maintaining a balance between growth and inflation, this decision supports the ongoing recovery in the housing market. The consistency in policy rates ensures that borrowing costs remain manageable, encouraging investment in both residential and commercial projects. As we move forward, this stability is expected to foster greater confidence among stakeholders, driving sustained growth in the real estate sector."

The Reserve Bank of India retained the growth projection at 7.2% for the current fiscal amid expectations of a normal monsoon.

Ranen Banerjee, Partner and Leader Economic Advisory, PwC India, said, “The continued pause in the policy rate and sticking with the stance of withdrawal of accommodation was expected given the RBI Governor’s earlier statements. There is no pressing need for any action on the policy rate as the yields on 10 year paper have already softened by almost 20bps owing to the index linked flows. There is still volatility in food prices and risk of food inflation that will keep the CPI elevated above 4% in FY25. So, we should expect a continued pause till Q4 unless we have a lowering of the weightage of food in the index being adopted in the interim. A very important announcement has been on delegated payments in UPI. This will be game changing as far as base expansion for digital payment adoption and financial inclusion is concerned.”

Aman Trehan, Executive Director, Trehan Iris, said, "The RBI’s decision to maintain the repo rate at 6.5% for the ninth consecutive time is a commendable move that balances inflation control with economic growth. We, as real estate developers, are encouraged by this move as it supports affordable homeownership and enhances market confidence. Moreover, the unchanged repo rate encourages more buyers to invest in their dream homes, particularly in the luxury sector. Additionally, this steady financial environment enables us to continue delivering exceptional living spaces and drive innovation in real estate, ultimately enriching community living and strengthening the housing market."

Anil Gupta, Senior Vice President, Co Group Head - Financial Sector Ratings, ICRA Ltd, said, “Deposit rates may continue to remain high, given the regulatory nudge to increase focus on the retail deposits while pursuing credit growth. Recent regulatory action on tightening liquidity coverage ratio regulations and concerns on credit growth outpacing deposit growth points towards likely slowdown in credit growth in near term. ICRA expects the credit growth to slow down to 11.6-12.5% in FY2025 from 16.30% in FY2024."

Avneesh Sood, Director Eros Group, said, “The Reserve Bank of India's decision to maintain the repo rate at 6.50% reflects a strategic approach aimed at sustaining economic stability amidst fluctuating inflationary pressures. By keeping the rate unchanged, the RBI underscores its commitment to managing price stability while supporting robust growth. This steady stance is particularly beneficial for the real estate sector, as it ensures that borrowing costs remain stable for both developers and homebuyers. Lower and predictable interest rates foster greater affordability in housing, bolster market confidence, and stimulate investment. As inflation trends show a decline and global economic conditions remain varied, this policy move provides crucial stability, enhancing predictability in the real estate market. By aligning monetary policy with growth objectives and inflation control, the RBI's decision is poised to support continued expansion in the housing sector, offering positive prospects for future homebuyers and investors. The focus on price stability will ultimately facilitate a conducive environment for sustainable economic and real estate sector growth."

Umeshkumar Mehta, CIO, SAMCO Mutual Fund, said, “RBI MPC is in wait and watch mode and has kept the interest rates unchanged, waiting for clues from the largest Central Bank of the world, US Federal Reserve, before acting. Though India’s position today is far more resilient on the economic front which could have allowed a slight rate reduction to test the water on inflation and exchange rates, RBI has taken a safer bet and decided to wait for rate reduction by the third or the fourth quarter of this year. Stock markets will continue to consolidate in the meanwhile.”

Rajeev Radhakrishnan, CIO - Fixed Income, SBI Mutual Fund, said, “The policy statement was decisive in terms of communicating RBI's mandate to align headline inflation closer to the target of 4%. Notwithstanding comforting signals from the easing core inflation, the importance of headline in shaping expectations and avoiding spillover to general prices was emphasized. This clearly pushes back expectations on RBI reacting to short term market volatility and US FED actions in changing the stance of policy in the near term. In the backdrop of robust domestic growth monetary policy will likely remain focused on aligning inflation closer to the target, while being alert to any threats to financial stability from external spillovers. Lack of any specific mention of OMO sales in the Governor's statement was at the margin comforting, even as we expect any excess liquidity to be gradually sterilised so that the overnight rate settings are aligned closer to the repo rate.”

Samir Jasuja, Founder & CEO, PropEquity, said, “The Reserve Bank’s decision should be seen in the context of inflation-growth dynamics and the ongoing geopolitical crisis. Any rate hike would have halted the real estate sales momentum which in the past few years have been on an upwards trajectory. Going forward, a reduction in the benchmark interest rate will go a long way in providing a further boost to the real estate sector, a major segment of the economy.”

Shishir Baijal, Chairman and Manging Director, Knight Frank India, said, “In line with expectations the RBI continues to maintain policy repo rate at 6.5%, especially considering the inflationary pressures, which is driven by persistently high food prices. Given that the system-wide liquidity is in surplus, by holding the rate steady the RBI seeks to mitigate inflation without stifling economic momentum. This decision underscores the RBI’s commitment to ensuring long-term price stability while fostering a conducive environment for sustainable economic growth. While some high frequency indicators indicate some moderation in growth it is encouraging that the central bank is confident of 7.2% GDP growth for FY25.

The decision to keep policy rates unchanged is particularly beneficial for the real estate sector, as stable interest rates mean that borrowing costs for homebuyers and developers remain constant, encouraging further investments in property. This stability will foster confidence among potential homebuyers, and support ongoing residential sales momentum and boost housing demand, contributing to the sector’s growth.

The RBI is closely monitoring global geopolitical tensions and economic volatility, which continue to pose significant risks to the global economy. Heightened geopolitical risks, such as ongoing conflicts and trade tensions, have led to increased market volatility and uncertainty. These factors further justify the need for a cautious monetary policy stance to safeguard India’s economic stability.”

Anita Rangan, Economist, Equirus, said, “RBI as widely expected kept policy rate unchanged at 6.5% with a majority vote of 4-2. However clarifying the debate around the importance of targeting headline versus core RBI has clearly stated that food inflation cannot be ignored as a) food inflation is now persistent and not temporary b) public understands inflation more from food c) high food inflation affects household inflation expectations d) unanchored inflation expectations can have spillovers in wages and cost of living which can result in pass through into services especially if demand is steady e) overall, inflation can become sticky if food inflation is ignored. Therefore RBI is not going to ignore food inflation. Overall according to RBI, the pace of inflation is moderating but the moderation is uneven and slow. Therefore patience is required.”

Lakshmi Iyer, CEO - Investments & Strategy, Kotak Alternate Asset Managers Limited, said, “Global Dangal to continue.. Indian central banker makes no change to policy brew.. Status quo on rates and Policy stance Was in line with our expectations. The RBI does not seem to be under any duress to act just because of global developments. Markets to be guided by Development on the global policy front, domestic inflation, and monsoon progress. Bond yields continue to find an anchor due to FPI buying. We maintain our preference for government bonds over corporate bonds.”

Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd, said, “The RBI’s decision to keep rates unchanged is on expected lines with an intention to keep inflation under check. While the RBI is focused on reining in inflation within its target limit, the expectation of good monsoon may prompt the apex bank to lower interest rates in the subsequent months thereby further propelling real estate sales momentum and also providing an opportunity to prospective homebuyers to enter in the market. While portraying a robust forecast for economic growth, the RBI’s all-round efforts will positively impact homebuyers sentiments and industry as well.”