Personal loans are a way to use tomorrows income today. In fact, the demand for such loans has risen over the past few years, owing to the fact that one does not need a guarantor for these loans in most cases. These loans are disbursed by both banks and non-banking financial institutions (NBFCs), with the latter offering easier disbursals but higher interest rates in most cases.

However, taking personal loans can come with some riders, mainly high interest rates with shorter repayment periods, and the need for a very good credit score. Here are some essential things to check out before you commit to a loan of this nature.

Strict Eligibility Criteria

Lenders follow strict guidelines when it comes to eligibility criteria for personal loans. Most banks and NBFCs insist on a certain income level before considering an application. In addition to the income, the credit score of an applicant is also under scrutiny, and it is possible for an application to be rejected on account of a poor/average score. Since your credit score changes every quarter, it is wise to get it sorted before you apply for a personal loan.

Pre-Payment and Part-Payment Option

Most people opt for personal loans due to urgency, which means they are capable of paying back larger portions of the loan in due time. So it’s wise to check whether the said loan gives you the option to part-pay or pre-pay any of its installments or even bigger chunks to reduce your liability. Some banks charge extra for it to make up for the interest they will lose out on, while some allow it for free but have limits for it.

So make sure to check these options in detail before committing to a personal loan to have smooth repayment. Foreclosure Charges Just like pre- and part-payment, there is always a clause to foreclose your loans earlier than expected. In this case most banks charge you a part of the interest they would have got during the full tenure of repayment.

Interest Charges

Interest rates for personal rates are amongst the highest across loan instruments in the country. This is because firstly they are given without any guarantor in most cases and without any asset lockage. Banks can charge anywhere between 11 and 16% on an average, whereas NBFCs can charge a much higher rate. So, make sure to work out the rates and given that these floating rates factor in around 2 to 3% rate fluctuations. Also remember to work out your final EMI, given that most personal loans have a short repayment period when compared to other loans.

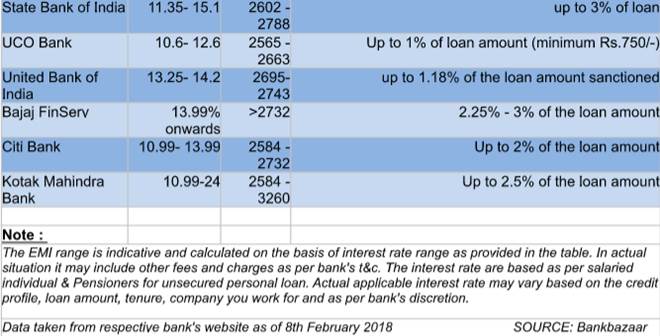

Here are the latest personal loan interest rates and processing fees of India’s leading banks ranging from State Bank of India, HDFC Bank to Kotak Mahindra Bank:

Processing Fees and Other Charges

Most often we ignore such charges thinking them to ne paltry. But some banks have a relatively high proportion of processing fee compared to the loan amount. Always check the same as well as other associated charges like GST, one-time fee and more.

(The writer is CEO at Bankbazaar.com)