Foreign Institutional Investors (FIIs) are viewing the Indian market through an optimistic lens. In fact, they have begun actively seeking undervalued opportunities in penny stocks.

This shift in FII sentiment presents a positive opportunity for retail investors. Institutional money often flows into fundamentally strong companies before broader market recognition.

In this editorial, we will discuss 4 penny stocks seeing FII buying.

Read on…

#1 Sigachi Industries

The first company in our list is Sigachi Industries Ltd (SIL). It’s India’s largest manufacturer of Micro-Crystalline Cellulose Powder (MCCP) and ranks among the top 5 globally.

Sigachi Industries is quietly making big moves. While already known for its role in pharma excipients, it’s now branching out into APIs and specialty chemicals to strengthen its core.

The company is also innovating with next-gen solutions like co-processed MCCs and even 3D-printed medicines.

Backed by five plants across India and a presence in 65+ countries, it serves over 500 customers globally. The real buzz? FIIs are taking notice—stake rising from just 0.08% in March 2025 to 2.89% by June.

Sigachi Industries delivered impressive financial results in FY25. The company’s revenue jumped 25.42% YoY from Rs 3,989 million (m) in FY24 to Rs 5,003 m in FY25.

The main product, Micro-Crystalline Cellulose (MCC), performed well with 35.75% revenue growth. This robust growth in MCC revenue was due to high demand leading to a ramp-up in utilisation.

The net profit also grew 23.25% YoY, rising from Rs 572 m to Rs 705 m. The company’s operating profit surged 46.21% YoY. The operating margin for FY25 improved to 22.38% from 19.2% in FY24.

However, there was a serious accident at one of its factories in June 2025, which created some concern. A rating agency has put the company under review because of this incident. The company has insurance and backup plans, such as using other factories to meet the demand.

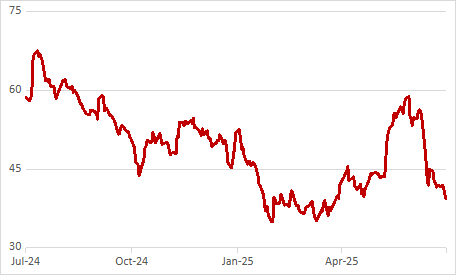

Sigachi Industries Share Price – 1 Year

#2 Vishal Fabrics

Second on our list is Vishal Fabrics, a textile contract manufacturing company specialising in denims.

The company generates revenue through textile production, job work, lease rent and chemical sales, showing a diverse business approach within the textile sector.

It targets denim exports to Europe, Latin America and Africa with a target of 5 million meters this year. The company aims to increase its sales from the current 6.5 BN to 8.5–10 BN, 30–50%increase.

This expansion isn’t limited to international markets. The company is also focusing on domestic opportunities, particularly targeting brands in major cities like Mumbai and Bengaluru.

What makes the company unique is its high-capacity utilisation of 85-90%, indicating efficient operations and strong demand for its products.

FII holdings increased from 3.21% in March 2025 to 8.72% in May 2025.

Examining the financial numbers, the company reports mixed results for FY25. Revenue grew modestly by 4.8% to Rs 15.2 bn.

The net profit increased 12.8% in FY25. The improvement in financials after a challenging FY24 demonstrates operational resilience.

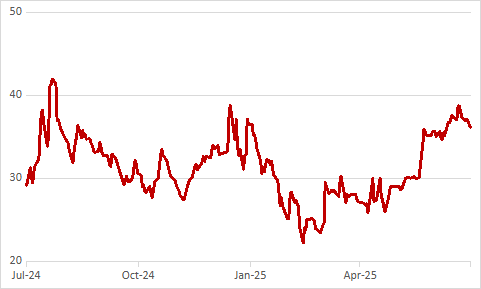

Vishal Fabrics Share Price – 1 Year

#3 Nandan Denim

The third company in our list is Nandan Denim. It specialises in manufacturing, trading, and exporting denim products including knit denim, basic denim, lightweight shirting, poly dobby, cotton dobby, and various printed denims.

Nandn Denim has a focus on research and development to create high-quality products, including super-stretch and two-way stretch denims, novel weave designs, and sustainable fibre blends.

The company exports to over 15 countries through a dealer-distribution network and serves numerous international and domestic brands.

With an in-house creative design studio, Nandan Denim has a strategy of technological advancement with a commitment to sustainability.

FII holdings jumped from 0.58% in March 2025 to 1.4% in June 2025.

The company’s revenue surged from Rs 10.9 bn in March 2021 to Rs 35.5 bn in March 2025.

In the March 2025 quarter, the company achieved a revenue of Rs 10.5 bn and Rs 106.3 m net profit.

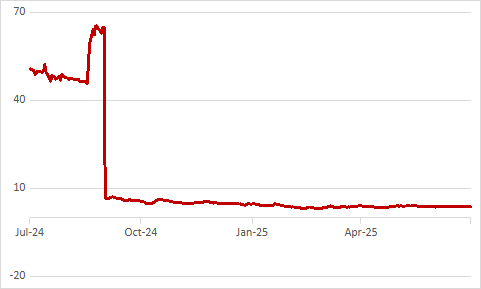

Nandan Denim Share Price – 1 Year

#4 Modern Threads

The fourth company in our list is Modern Threads. It was established in 1980 and is one of India’s leading manufacturers and exporters of yarn products.

The company started with industrial yarn and sewing thread production but has successfully expanded into synthetic blended grey, dyed, and fancy yarn manufacturing.

It’s one of India’s largest producers of wool and blended worsted yarn and operates specialised facilities including a modern woollen division in Bhilwara, Rajasthan.

Modern Threads has positioned itself for future growth by embracing sustainability trends.

The company manufactures and exports products certified under the Responsible Wool Standard (RWS) and Global Recycled Standard (GRS), which will meet the growing demand and give the company a competitive advantage in international markets where eco-friendly materials are increasingly preferred.

FII holding increased from nil in March 2025 to 1.26% in June 2025.

Looking at Modern Threads’ financial performance, revenue from operations declined by 13.5% from Rs 3 bn in FY24 to Rs 2.6 bn in FY25. The fall in profitability was even higher, with net profit decreasing from Rs 254 m in FY24 to just Rs 34 m in FY25.

This drop in profitability, despite a relatively smaller revenue decline, suggests the company is struggling with cost management and operational efficiency.

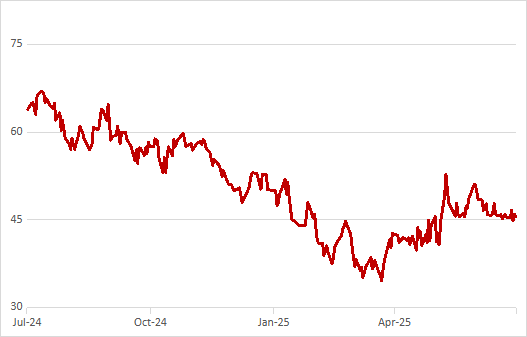

Modern Threads Share Price – 1 Year

Conclusion

The growing FII interest in these penny shares indicates a clear tendency – BIG players are beginning to look beyond hidden, hidden price in India’s developed market.

Some of these companies are showing real progress, whether it is a margin expansion, revenue growth, or a push towards stability. Others are still finding their legs, with mixed financial and ongoing challenges.

This is why it is important for investors to dig deeply. Just because foreign investors are not making a certain condition a certain condition.

In Penny Stock Space – where volatility moves high -salted fundamental and a clear growth is triggered, which is far more than purchasing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.