Fixed deposits (FDs) have consistently been a favored investment option for individuals who prefer to minimize risk, as they provide a sense of security and guaranteed returns. Nevertheless, the wide array of choices available can be overwhelming. This discussion will focus on the appropriate circumstances for considering fixed deposits, the criteria for selecting a suitable bank, and effective methods for comparing interest rates.

Fixed deposits are particularly advantageous for those who value stability and assured returns. For investors who are cautious about market volatility and prioritize the preservation of capital, FDs represent an appropriate investment strategy. If your financial objectives are short to medium-term (generally ranging from 1 to 5 years), such as purchasing a vehicle or financing a holiday, FDs serve as a reliable means to enhance your savings.

Choosing an Appropriate Bank

It is advisable to select banks that possess a strong reputation and high levels of trustworthiness. Well-established public and private sector banks typically provide competitive interest rates along with a secure environment for investments.

Also Read: Top 5 investment options for retired persons to invest their Pension Funds – Check Calculations!

Evaluating Interest Rates

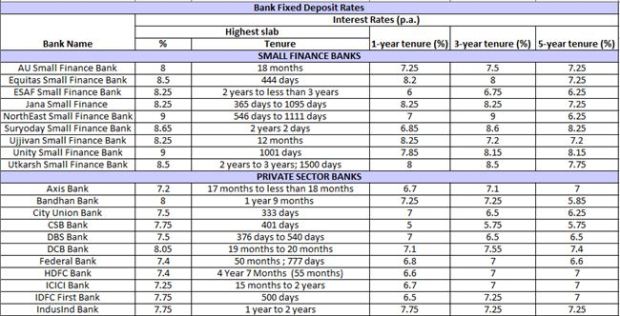

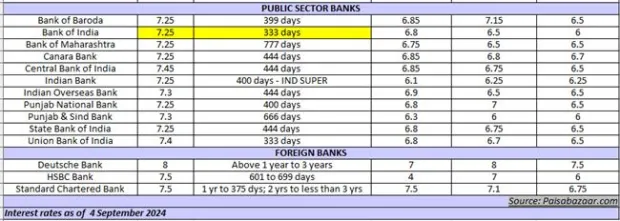

It is essential to assess the interest rates provided by different banks. Although higher rates may appear appealing, it is important to verify that they align with market norms and the overall stability of the bank.

1. Investigate Various Financial Institutions: Create a comprehensive list of banks that provide fixed deposits (FDs) and collect data regarding their current interest rates. Utilize online resources, financial news websites, or visit bank branches directly to obtain reliable information.

2. Assess the Duration: Interest rates can fluctuate based on the duration of the fixed deposit. Generally, longer durations tend to offer higher returns, although they may come with reduced liquidity. Consider your financial objectives and choose a duration that aligns with your investment timeline.

3. Be Aware of Promotional Offers: Financial institutions often present special promotions or enhanced rates for certain deposit amounts or demographics, such as senior citizens. Take these offers into account when comparing rates to optimize your returns.

4. Analyze Tax Consequences: It is essential to understand the tax implications associated with the interest earned on fixed deposits. While banks may advertise gross interest rates, the net yield will differ based on your tax bracket. Incorporate relevant taxes into your calculations to determine the actual returns.

5. Examine Withdrawal Penalties: Familiarize yourself with the penalties that may apply to early or partial withdrawals. Banks may impose fees that could affect your overall returns. Opt for banks that have reasonable penalty policies to ensure greater flexibility.

Fixed deposits provide a reliable means for safeguarding wealth and generating consistent returns. By meticulously selecting trustworthy banks, effectively comparing interest rates, and comprehending the intricacies of FD investments, you can successfully meet your financial objectives.

If you also plan to invest in a fixed deposit, here is a list of India’s top banks — including the HDFC Bank, Axis Bank, ICICI Bank, SBI, PNB, BoI, Union Bank, Kotak Mahindra Bank, and Yes Bank — offering the most competitive interest rates on FDs.