Among the various types of home loans available, floating rate home loans are a common choice due to their potential for lower initial interest rates and flexibility. Floating rate home loans have interest rates that fluctuate based on market conditions.

The interest rate on these loans is tied to a benchmark rate, usually the Reserve Bank of India’s (RBI) repo rate. When the benchmark rate changes, the interest rate on your home loan also changes. Let us understand everything about floating rates home loans so that you can take a call while taking a loan for buying your dream home.

How Does Floating Rate Home Loan Work?

When you opt for a floating rate home loan, the interest rate you initially pay is often lower than that of a fixed-rate loan. However, this rate is subject to change over the loan tenure, depending on the movement of the benchmark rate. If the benchmark rate rises, your loan interest rate and, consequently, your EMI will increase. Conversely, if the benchmark rate falls, your loan interest rate and EMI will decrease.

Also Read: Buying life insurance? Know about the lock-in period to make the most of it

Top Benefits:

Potential for Lower Interest Rates

The initial interest rates for floating rate home loans are usually lower than fixed-rate home loans. This can result in significant savings, especially in a declining interest rate scenario.

Rate Cuts and No Prepayment Penalty

When the RBI reduces the repo rate or when the benchmark rate decreases, the interest rate on your floating rate home loan also reduces, lowering your EMI or loan tenure.

Also, most banks and financial institutions do not charge a prepayment penalty on floating rate home loans. This allows you to make additional payments or repay the loan early without incurring extra costs.

Drawbacks:

Interest Rate Risk

The primary disadvantage of floating rate home loans is the uncertainty of interest rates. If the benchmark rate increases, your interest rate and EMI will rise, which can affect your financial planning and budget.

Fluctuating EMIs

With floating rate home loans, your EMI amounts are not fixed and can fluctuate with changes in the benchmark rate, leading to potential financial instability.

Key Considerations When Choosing Floating Rate:

Market Trends

Assess the current economic scenario and interest rate trends. If the trend indicates a stable or declining interest rate, floating rate home loans can be beneficial.

Loan Tenure and Risk

Floating rate home loans are more advantageous for long-term loans. Over an extended period, the likelihood of benefiting from interest rate cuts increases. Consider your risk tolerance. If you are comfortable with potential fluctuations in your EMI and can manage financial uncertainties, a floating rate home loan may be suitable for you.

Financial Planning:

Ensure you have a robust financial plan that can accommodate variations in EMI payments. This includes having an emergency fund or additional income sources to buffer against potential increases in interest rates.

Floating rate home loans offer an attractive option for borrowers looking to take advantage of potentially lower interest rates and the flexibility of no prepayment penalties. However, they come with the inherent risk of fluctuating EMIs due to changes in the benchmark rates.

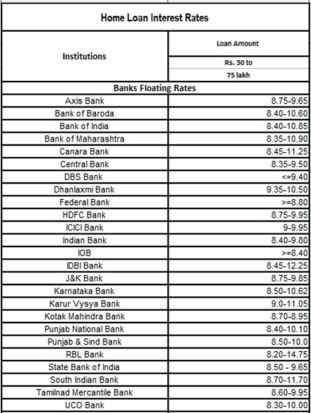

The table below helps you compare the floating home loan interest rates of different banks. You can compare and decide based on what suits your requirements:

Note: Rates that vary with tenures or credit scores within the specified loan amounts are indicated as a range. Data taken from respective bank’s website as on Jun 07,2024. Contributed by BankBazaar.com.