One of the most buzzing multibagger stocks, Suzlon Energy’s share price has fallen 16% in 2025 so far. The stock has been a multibagger over the long run. In the past 1 year, it has delivered returns of over 33%, though it had corrected significantly in the Covid times. The stock used to trade around Rs 1.90 in March 2020 but has consistently held over the Rs 50 a share mark in the near term. But is it still a ‘Buy’ at current levels?

A quick look at the company’s valuation, analysts point out how Suzlon’s earnings per share (EPS) have an edge when compared to its peers. Suzlon Energy has an estimated EPS growth of 63% over FY24-FY27, while that of ABB is 23%, Siemens (20%), Thermax (17%), and many others. According to Motilal Oswal, even if compared to global peers like SANY, Suzlon is better valued because SANY has an EPS growth of 26% annually on a compounded basis.

Motilal Oswal On Suzlon: Sees 21% upside from current levels

According to the brokerage house Motilal Oswal, it sees upside of 21% in the stock price from current levels and has placed the target price at Rs 70 per equity share. The company’s valuations in the capital goods segment have come down, however, there’s still some elevation due to healthy earnings, growth trajectory, strong order book, decent cash flow, and positive outlook for the industry.

JM Financial Services on Suzlon Energy

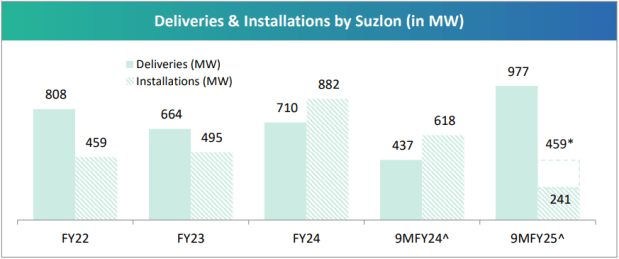

JM Financial Institutional Securities maintained a Buy call on Suzlon with a target of Rs 71 per equity share, implying an upside of 24% from the current levels. Suzlon remained upbeat about the revival as the company’s order book was at the highest ever levels. Further, JM Financial sees the initiatives to enhance capabilities to handle more volume and higher-rating WTGs as a positive. In a research report JM Financial added that “the area of the shop floor is under expansion by converting the existing warehouse into the new hub assembly shop.

The brokerage house believes that Szulon is trading favourably on the earnings front as well. It is trading at an estimated price-to-earnings growth (PEG) ratio of 0.6 times for FY26. This is below domestic peers like Thermax 2.5x, ABB India (6x), and CG Power (1.9x). The PEG above 1.0 suggests that the stock may be overvalued, while below 1.0 indicates that the stock may be undervalued.

Industry set to add 500 GW clean energy

Suzlon has an installed base of 15 GW, holding a 31% market share of India’s total wind capacity of 48.2 GW as of Q3 FY25. The company is yet to report its Q4 FY25 earnings. India achieved 214 GW of installed green energy capacity by the end of 2024, according to the Ministry of New and Renewable Energy. This achievement positions India on a solid trajectory of achieving the goal of 500 GW from non-fossil fuel sources by 2030.

Suzlon Energy: Retail ownership higher

Suzlon Energy’s retail ownership rose to 25.12% Q4 FY25, up from 24.49% in the last quarter or Q3 FY25, as per BSE shareholding data. This indicates that the retail investors are optimistic about the stock’s potential for growth. You can read more about it in the article linked below.

Suzlon Energy’s stock performance

The share price of Suzlon Energy has risen almost 6% in the last five trading days. The stock has given a return of 0.2% in the past one month. However, the stock has erased almost 24% of the investors’ wealth in the previous six months. Suzlon Energy’s share price has increased by 34% in the past one year.