It is not a secret that the Indian Investment space is a male dominated one. While names like Mukul Agarwal, Vijay Kedia, Ashish Kacholia or Madhusudan Kela keep making it to the news, there are some women super investors who are quietly causing ripples in the background. We call them the Women Warren Buffetts of India.

Two of these Women Warren Buffets of India, Vanaja Iyer (Holds 12 stocks word Rs 830 cr) and Sangeetha S (Holds 107 stocks worth Rs 520 cr) just made some sell decisions and it must be noted given the track record of these super investors.

While Vanaja has reduced stake in one of her holdings by 1%, Sangeetha has sold off one of her holdings that she had for quite some time now. What is it that made them make these sell decisions? Let us try to find out.

Hariom Pipe Industries Ltd

Incorporated in 2008, Hariom Pipe Industries Ltd is a vertically integrated manufacturer of high-quality steel products with 800+ SKUs of Iron & Steel products

With a market cap of Rs 1,399 cr, Hariom Pipe is one of the few players to have an end-to-end Backward Integration process for Hot Charging, from producing raw materials like sponge iron and billets to final products.

Vanaja Iyer, who held a stake in the company since June 2022, recently cut her stake in the company from 2.3% to 1.3% (worth Rs 18 cr). Her husband Sunder Iyer also cut his stake in the company from 2.5% to 1.6% in the same quarter (ending June 2025)

This decision to cut stakes at a time when the company has been reporting strong financials raise some very valid questions as to what triggered the decision.

The sales of the company grew at a compounded growth rate of 53% from Rs 161 cr in FY20 to Rs 1,357 cr in FY25. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) went from Rs 23 cr in FY20 to Rs 175 cr in FY25, logging in a CAGR of 50%.

Net profits also showed nothing less than an enviable trajectory as it jumped from Rs 8 cr in FY20 to Rs 62 cr in FY25, which is a compounded growth of a 51% in just 5 years.

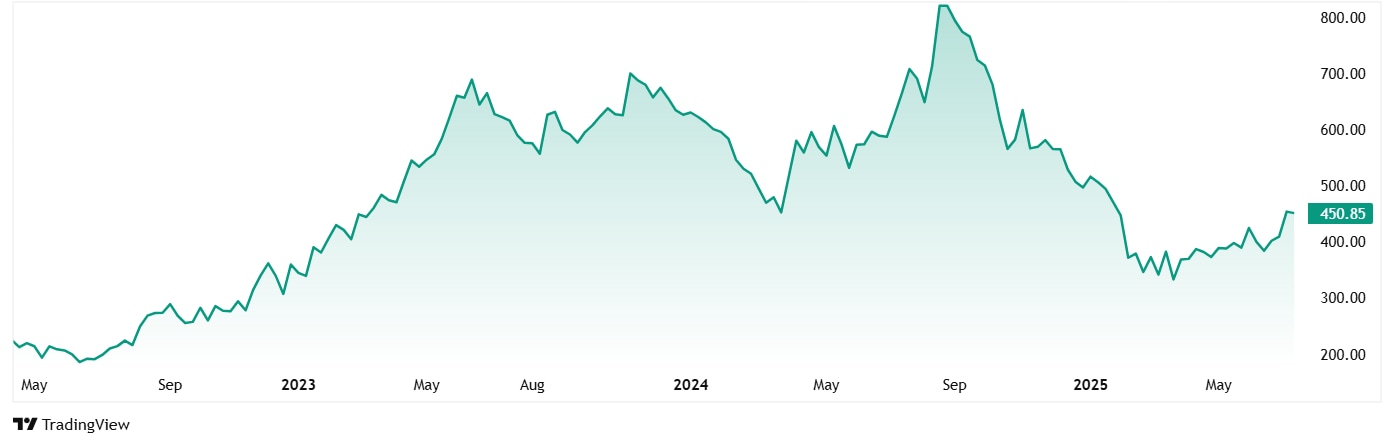

The share price of Hariom Pipe was around Rs 231 when it was listed in April 2022, and as of 14th July 2025 the price was Rs452, which is a 96% jump.

The stock is trading at a discount of almost 50% from its all-time high price of Rs 889. It is trading at a PE of 23x, while the industry median of 25x. Long term median PE for Hariom Pipe will be too soon to look at, but 10-year industry median is 17x.

According to the most recent concall in May 2025, the company is making a strategic foray into renewable energy, leveraging its core steel competencies to build a new vertical in solar infrastructure, while maintaining prudent capital allocation in its core business. The company acknowledges the margin pressures from product mix and input costs, adding that management remains confident of sustaining profitability through integration, market expansion, and value addition.

Star Delta Transformers Ltd

Incorporated in 1980, Star Delta Transformers Ltd is a manufacturer and distributor of power transformers.

With a market cap of Rs 218 cr Star Delta Transformers is into multi product and service organization which does manufacturing, supplying, erecting, testing and commissioning of

Power and Distribution transformers along with special purpose transformers.

Sangeetha S, another woman Warren Buffett of India, had held a stake in the company since 2015 as per trendlyne, which has gone below 1% as of the quarter ending June 2025, hinting at a partial or complete sell off.

The sales of the company grew at a compounded growth rate of 17% from Rs 65 cr in FY20 to Rs 142 cr in FY25. EBITDA grew from Rs 5 cr in FY20 to Rs 15 cr in FY25, logging in a compound growth of 25%.

Net Profits of the company went from Rs 4 cr in FY20 to Rs 11 cr in FY25, which is a compounded growth of 19% in 5 years.

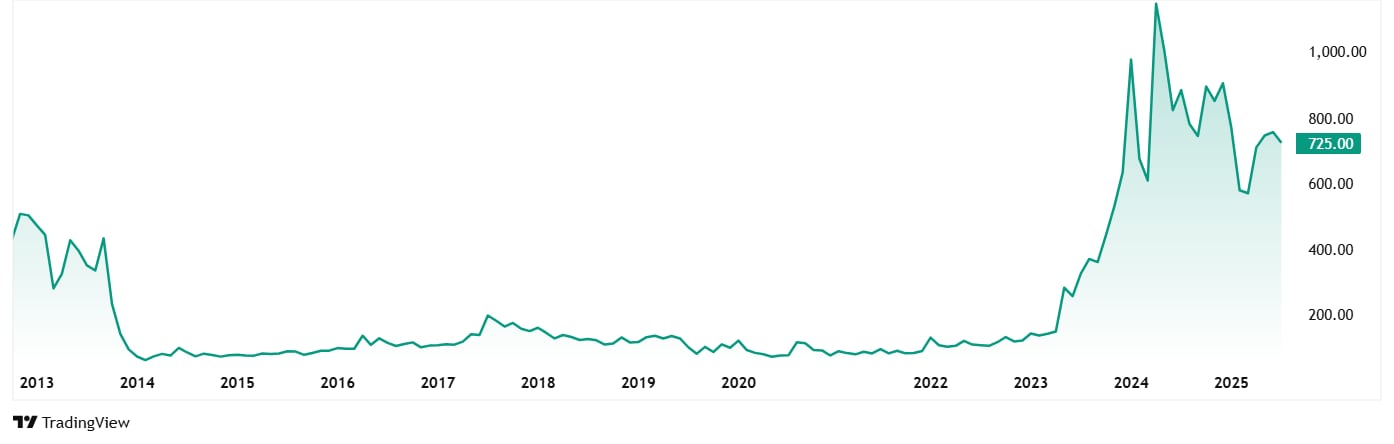

The share price of Star Delta Transformers was around Rs 74 in July 2020, and as of 14th July 2025, the price was Rs 725, which is a jump of almost 880% in 5 years. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 10 lacs today.

Currently, the share of the company is trading at a discount of 47% from its all-time high price of Rs 1,375.

The company’s stock is trading at a PE of 20x, while the industry median is 59x. The 10-year industry median PE is 15x while that for Star Delta Transformers is 14x. The company is almost debt free and has maintained a decent ROCE (Return on Capital Employed) of 14% in the last 5 years, while the current ROCE is 19%.

The company’s annual report for FY25 is still expected, but in the last annual report its MD Kishore Gupta has said, “We remain focused on executing quality products to our customers, adhering to time delivery and building long term relations with all our stakeholders. We are dedicated in advancing innovation, maximizing efficiency, and strengthening core businesses while also looking into new prospects and markets for growth. Overall, from an industry perspective, we are optimistic and confident of the growth potential in our product segment. The transformers industry is flushed with orders and demand outlook is positive with end use in various industries.”

Follow The Woman Warren Buffetts?

Vanaja Iyer and Sangeetha S are not the usual names you will see in the tabloids or on news channels where experts share their tricks. But they are some of the most followed names from the super investor community of India. They are carving a place for them in a male dominated space and that too with an enviable record.

No wonder their recent sell decision has made investors take note and tread cautiously. What was their reason to sell is something that only they know, but trying to find out what it is could be key to something big. While Hariom Pipe has been struggling on the financials end, Star Delta Transformers has been on an upward trajectory when it comes to financials.

It would be very interesting to see how these two stocks move and find out if the sell decision we saw today were strategic or a mistake. For now, it would be a good idea to add these stocks to a watchlist and keep an eye on them.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.