The Indian railway sector is undergoing a very transformative phase. The government aims to modernise infrastructure, enhance operational efficiency, and expand network capacity.

These initiatives have created a fertile ground for the railway ancillary stocks, which are critical enablers of this growth because of the supply of essential technology, components, and project management expertise.

In this article, we are going to deep dive into 3 railway ancillary stocks with their key financials and order book strength.

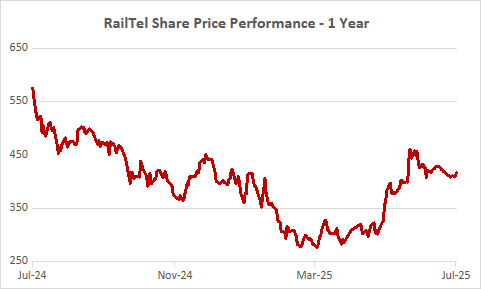

#1 RailTel Corporation of India Limited

Established in 2000, RailTel Corporation is a Navratna PSU that has transformed from serving Indian Railways’ communication needs into India’s largest neutral telecom infrastructure provider.

The company operates a Pan-India fibre network reaching 70% of the population while modernising railway safety and control systems.

RailTel stands out with a unique mandate that not only supports the Indian Railways’ communication needs but also allows it to tap into the commercial telecom space through its vast fibre network.

What makes it even more interesting is its neutral provider status—meaning it can serve both government and private clients beyond just the railways. This helps the company reduce its dependence on any one sector.

Backed by a healthy and well-diversified order book of Rs 70.2 bn, RailTel is well-placed to ride on multiple growth opportunities.

State governments contributed the largest share at Rs 20.8 bn (29.59%), followed closely by Indian Railways at Rs 20 bn (28.56%).

If we look at the major orders in FY 2024-25 and FY 25-26, they include Rs 2.4 bn for Kavach implementation on East Central Railway, Rs 2.3 bn for ITMS in Maharashtra’s Vidarbha region, and Rs 2.1 bn for student Kits in Bihar government schools, demonstrating RailTel’s expanding reach beyond traditional telecom infrastructure.

With the strong order book, if we look at the financials of the company, RailTel delivered an impressive result with revenue rising 35%, operating profit grew 15% and because of this profit of the company increased 22% YoY in FY25.

However, the operating margin compressed to 15% might be due to revenue mix changes, and the company improved cash conversion cycle from 180 days to 166 days, though it remains elevated, indicating room for further working capital optimisation.

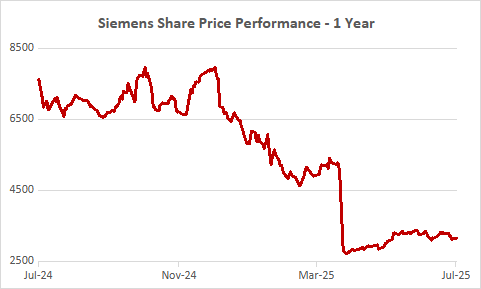

#2 Siemens Limited

It is India’s flagship entity of the German technology giant Siemens AG has been serving the country since 1867.

This technology powerhouse focuses on industry, infrastructure, digital transformation, and transport solutions, with its mobility unit delivering intelligent infrastructure, including signalling systems, electrification and rolling stock components.

Following the March 2025 demerger of its energy business to Siemens Energy India Ltd, Siemens Limited continues operations in its core segments.

Siemens’ global leadership enables it to deliver cutting-edge solutions like ETCS Level 2 signalling systems, positioning it as the preferred partner for complex, high-technology railway projects, including high-speed rail and advanced automation systems.

Siemens’ mobility business showcased remarkable performance with its order book surging nearly 300% to Rs 24.2 bn as of March 2025.

The company’s continuing operations (post energy demerger) demonstrated strong momentum, with Q2FY25 new orders increasing 44% to Rs 53.1 bn, primarily driven by robust public infrastructure spending in the Mobility and Smart Infrastructure segments.

Recently, the company has secured premium contracts, including Rs 7.7 bn from the Maharashtra Metro for the Nagpur Phase 2 CBTC signalling systems, Rs 12.3 bn share in the Mumbai-Ahmedabad High-Speed Rail’s ETCS Level 2 project, and commenced deliveries of 1,200 electric locomotives under a 3 billion EUR contract with 35-year maintenance agreements, positioning itself in cutting-edge railway technology segments.

Siemens delivered strong revenue growth, rising 19% in March 2025 compared to the previous quarter. It also surpassed the previous year’s March quarter by 3%.

However, operating profit declined 27% YoY, and net profit dropped 28% YoY. The company maintained its operating margin at 12% despite profitability pressure, while achieving an impressive negative cash conversion cycle of -1, indicating efficient working capital management.

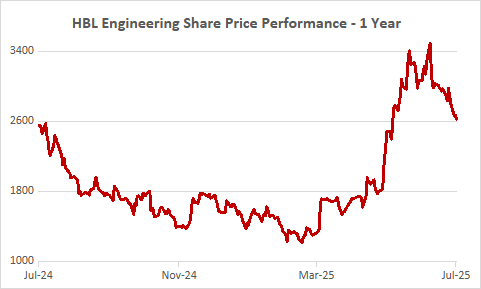

#3 HBL Engineering

HBL engineering Ltd, previously called HBL Power Systems Ltd, is one of India’s leading engineering companies specializing in batteries and railway safety systems.

The company started with as a battery manufacturer but has grown into the full engineering solutions provider for more than 40 years.

HBL operates in three main areas: industrial batteries, defense and aviation batteries, and electronic systems (including railway electronics and electric mobility).

HBL has expanded globally, serving customers in over 80 countries with subsidiaries in Europe and the United States.

Based in Hyderabad, India, HBL is the world’s second-largest nickel – cadmium battery manufacturer and India’s third-largest telecom battery manufacturer.

The company is particularly known for its work with the Indian Railways’ modernization program, especially the Kavach train safety system, making it a key player in improving railway safety across India.

And because of this company’s total order book reached to Rs 40.29 bn as of June showing a remarkable growth of 242% from Rs 11.79 bn in August 2024.

This biggest component is a Rs 15.22 bn contract from Chhitranjan Locomotive works for installing safety equipment in 2,200 locomotives.

Additional kavach systems contracts from various railway zones total over Rs 10 bn. These high margin railway contracts offer better payment terms and higher profits compared to traditional battery supply agreements.

Recently the company received multiple Kavach system orders totalling over Rs 4 bn in the first half of 2025.

These contracts provide substantial revenue visibility and support the company’s growth trajectory.

If we look at the financials number, in FY25, the company reported revenue of Rs 19.67 bn, a slightly decline of 4.1%, net profit also dipped 1.4%.

This drop is seen as temporary, driven by project timing and a shift in the business mix.

However, the net profit margin improved, reflecting better operational efficiency. The company now focusing on high – margin electronics and railway project systems over low – margin battery products.

Conclusion

India’s railway ancillary sector offers compelling investment opportunities backed by massive government infrastructure spending and diversified modernisation initiatives.

RailTel’s unique telecom-railway model drives strong revenue expansion, and Siemens commands premium technology segments with recurring maintenance revenues.

Each company’s substantial order books and strategic positioning reflect their integral role in India’s comprehensive railway systems transformation.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.