There are some investors in India that do not hog the limelight but silently create ripples in the background. They are super investors, or as we call them, the Warren Buffetts of India. They are followed by thousands of investors for their expertise.

One such Warren Buffett of India, Sunil Singhania just made some big changes to his portfolio. It is something that has raised a bunch of questions in the minds of investors across the board. He has just sold off 3 stocks which he had been holding for some time now.

What triggered this partial or complete exit from these 3 stocks? Let us try to see if we can find the reason behind the exit of Value investor Sunil Singhania.

Mastek Ltd

Incorporated in 1982, Mastek is a provider of vertically focused enterprise technology solutions. Having its presence in IT industry for almost 4 decades, Mastek Ltd has evolved from an IT solutions provider to Digital transformation partner.

With a market cap of Rs 8,269 cr, Mastek Ltd offers services such as Application Development, Application Maintenance, Business Intelligence and Data Warehousing, Testing & Assurance, and Legacy Modernisation

Sunil Singhania held a 2.8% stake in the company (1.4% through Abakkus Emerging Opportunities Fund-1 and another 1.4% through Abakkus Growth Fund-1) up until the quarter ending March 2025. However, as per the filings made for the quarter ending June 2025, his holding has fallen below 1%, meaning a partial or complete exit from the company.

The sales of the company grew at a compounded growth rate of 26% from Rs 1,071 cr in FY20 to Rs 3,455 cr in FY25. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) went from Rs 156 cr in FY20 to Rs 546 cr in FY25, logging in a CAGR of 28%.

Net profits jumped from Rs 114 cr in FY20 to Rs 376 cr in FY25, which is a compounded growth of a whopping 25% in just 5 years.

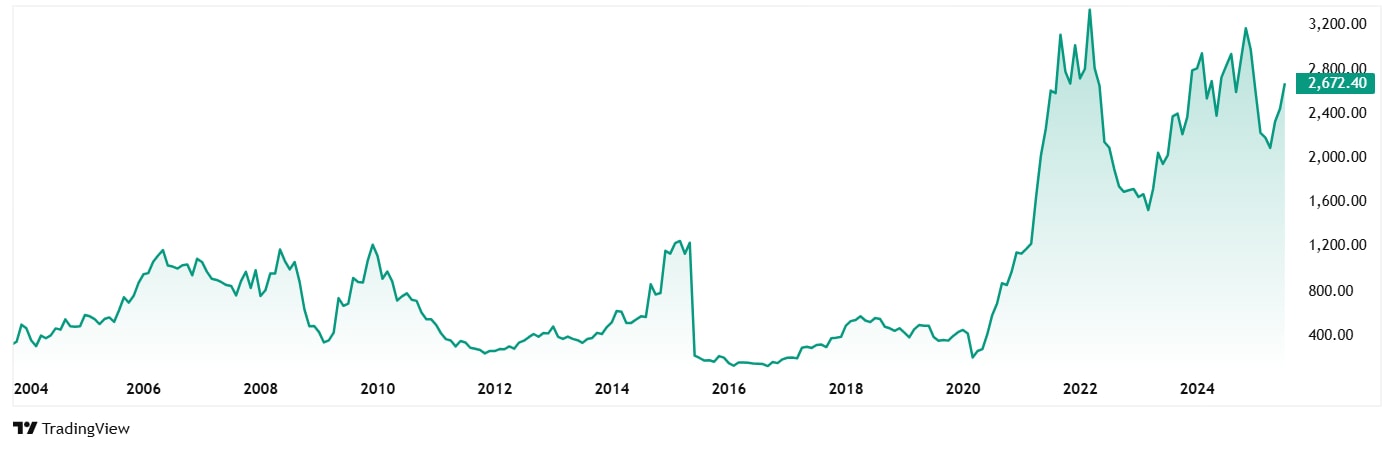

The share price of Mastek Ltd was around Rs 420 in July 2020, which has jumped to Rs 2,670 as of closing on 22nd July 2025. That’s a growth of 535%.

The stock is trading at a PE of 21x, while the industry median of 30x. The 10-year median PE for Mastek is 18x and the industry median for the same period is 23x.

In Jan 2025, the company appointed Mr. Umang Nahata as the Chief Executive Officer. With that change, the company aims for double-digit revenue growth across the UK and Europe.

ADF Foods Ltd

ADF specializes in the production and export of a variety of traditional Indian food products, including pickles, chutneys, pastes, sauces, ready-to-eat meals, frozen, and canned foods. Its market spans Europe, the US, Australia, and the Gulf.

With a market cap of Rs 2,957 cr, ADF Food’s products are marketed through eight brands namely, Ashoka (USA, Canada, UK and APAC), Camel (Middle East), Truly Indian (Germany and USA), Aeroplane (Middle East), Nate’s (USA), PJS Organics (USA), ADF Soul (Mumbai), and Khansaama (UK, US, Canada).

Sunil Singhania’s Abakkus Asset Management held a 1.5% stake in the company through Abakkus Emerging Opportunities Fund-1, which has dropped below 1% as per filings made for the quarter ending June 2025, signalling a full or partial exit.

The sales of the company grew at a compounded growth rate of 16% from Rs 285 cr in FY20 to Rs 590 cr in FY25. EBITDA was Rs 53 cr in FY20 and in FY25 it was Rs 98 cr which is a compound growth of 13%.

Net Profits went from Rs 43 cr in FY20 to Rs 69 cr in FY25, which is a compounded growth of 10% in 5 years.

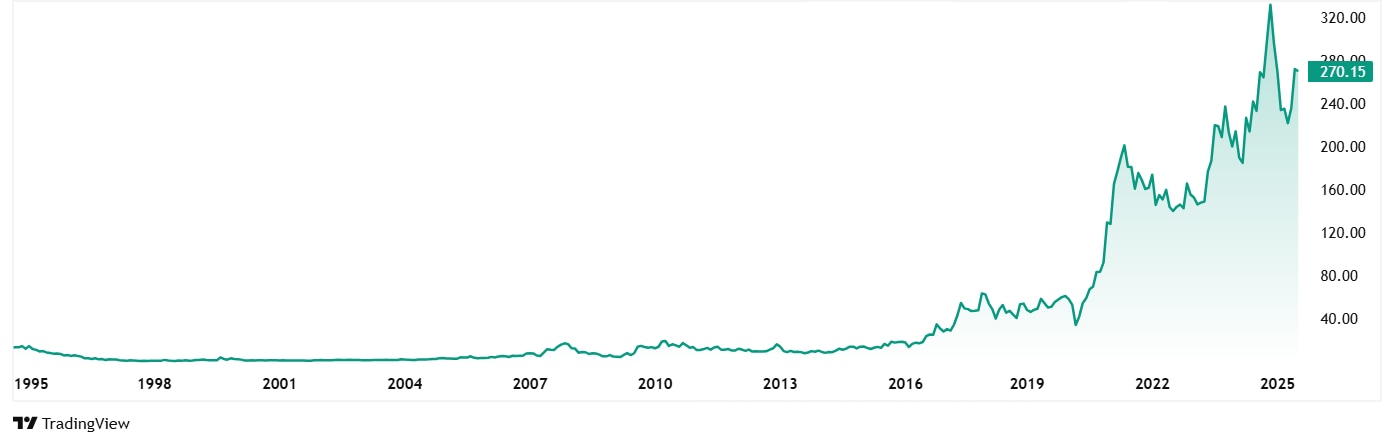

The share price of ADF Foods Ltd was around Rs 65 in July 2020 and as of closing on 22nd July 2025, it was Rs 270, which is a jump of 315% in 5 years.

The company’s stock is trading at a PE of 43, while the industry median is 68x. The 10-year industry median PE is 32x and the industry median for the same period is 44x.

ADF Foods is in a phase of heavy brand investment and capacity expansion, with clear strategic focus on scaling its own brands (Ashoka, Truly Indian, Soul) and leveraging new distribution rights (Lipton US). Near-term margin pressure is acknowledged, but management sees this as a strategic investment for future growth, with a confident outlook on both revenue and margin recovery as new initiatives mature and cost pressures abate. Key watchpoints include execution on US growth, Soul brand turnaround, and commissioning of Surat facility.

Ethos Ltd

Apart from Mastek and ADF Food, Singhania also held a 1.1% stake in Ethos Ltd through Abakkus Growth Fund-2, which has gone below 1% as per the filings made for the quarter ending June 2025. Once again, meaning a partial or complete exit.

Follow Singhania?

Although the financials of companies that Sunil Singhania sold off in the latest quarter don’t raise any alarms and the stock price gains do not show any red flags, Singhania decided to still sell off, keeping the markets guessing.

This could be a strategic exit or just the beginning for a bigger plan that Singhania has. No one knows this but Singhania himself. However, given that an investor of his calibre has made these sell decisions, the market and investors are sure taking notes.

How these stocks will do in near- and long-term future will be interesting to watch, as it will tell us if this was a strategic move or an honest mistake. Till then, add to watchlist, maybe?

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.