GST 2.0 brought gifts in bulk for India’s healthcare sector. Be it insurance, medicines, or medical equipment, healthcare as a whole has been categorized as essential, and classed into the nil or 5% buckets.

As medicines get cheaper and insurance penetration improves, the demand for healthcare should receive a boost. Yet another push could come from hospitals shelling out less on medical equipment, and hopefully passing on the cost-savings to patients.

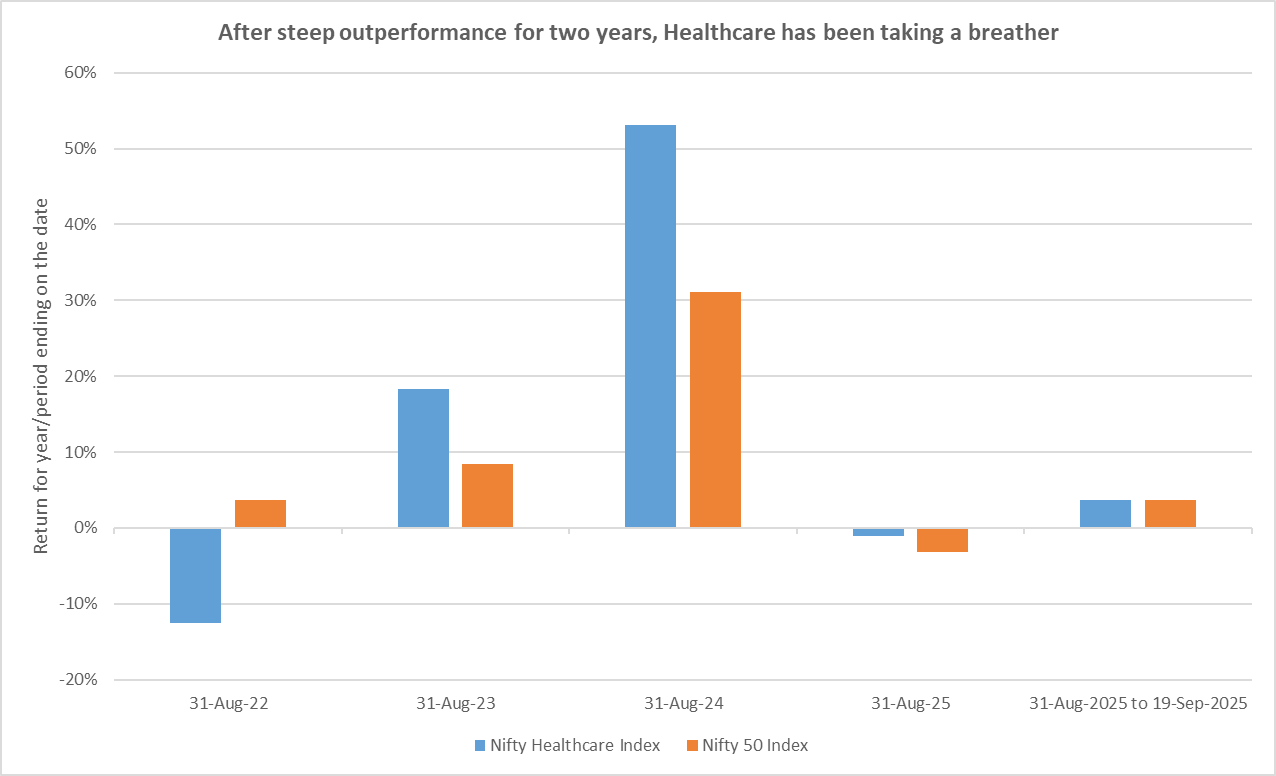

Looking at this from an investing point of view, the healthcare sector appears to be ripe for picking. Following two years of steep outperformance, Nifty healthcare Index has been taking a breather since late 2024. From trading at more than 44 times its earnings, the index P/E has moderated to below 39x.

Can GST 2.0 pull the sector out of its hiatus? How should investors position their portfolios?

Industry tailwinds

As the Indian economy develops, the middle-class will expand further, and discretionary income in the hands of consumers should pick up pace. This is expected to enhance their access to formal healthcare, which in turn would result in declining death rates. Combined with a proclivity towards having fewer children, the median age of Indian population is likely to trend upwards. Result? A virtuous cycle that drives up the demand for formal healthcare.

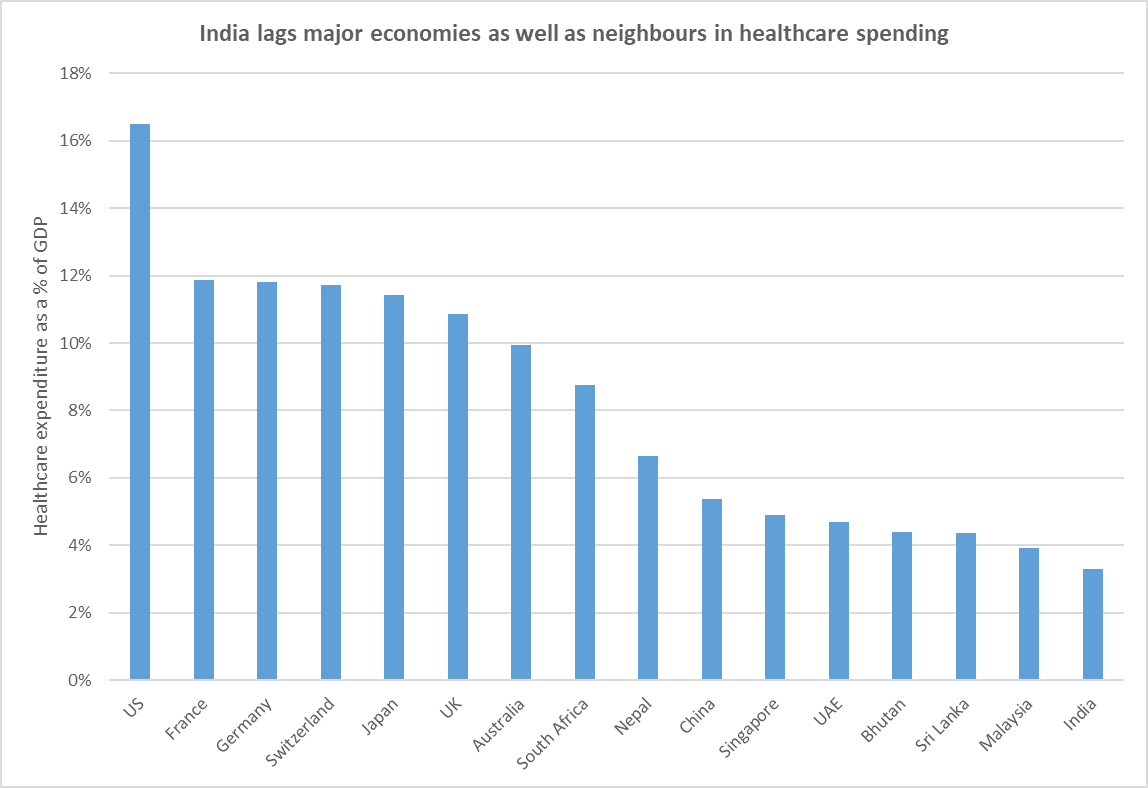

Moreover, compared to 16.5% of GDP spent on healthcare in the US, India spends a meagre 3.3%. India’s healthcare spending lags most major economies as well as neighbors. This is to say that as the demand for healthcare picks up, there is ample room for growth in India. Growth would be further supported by a conducive ecosystem from improving insurance penetration and growing private equity backing. Hospitals, in particular, stand out as the beneficiaries of these industry tailwinds.

The midcap lead

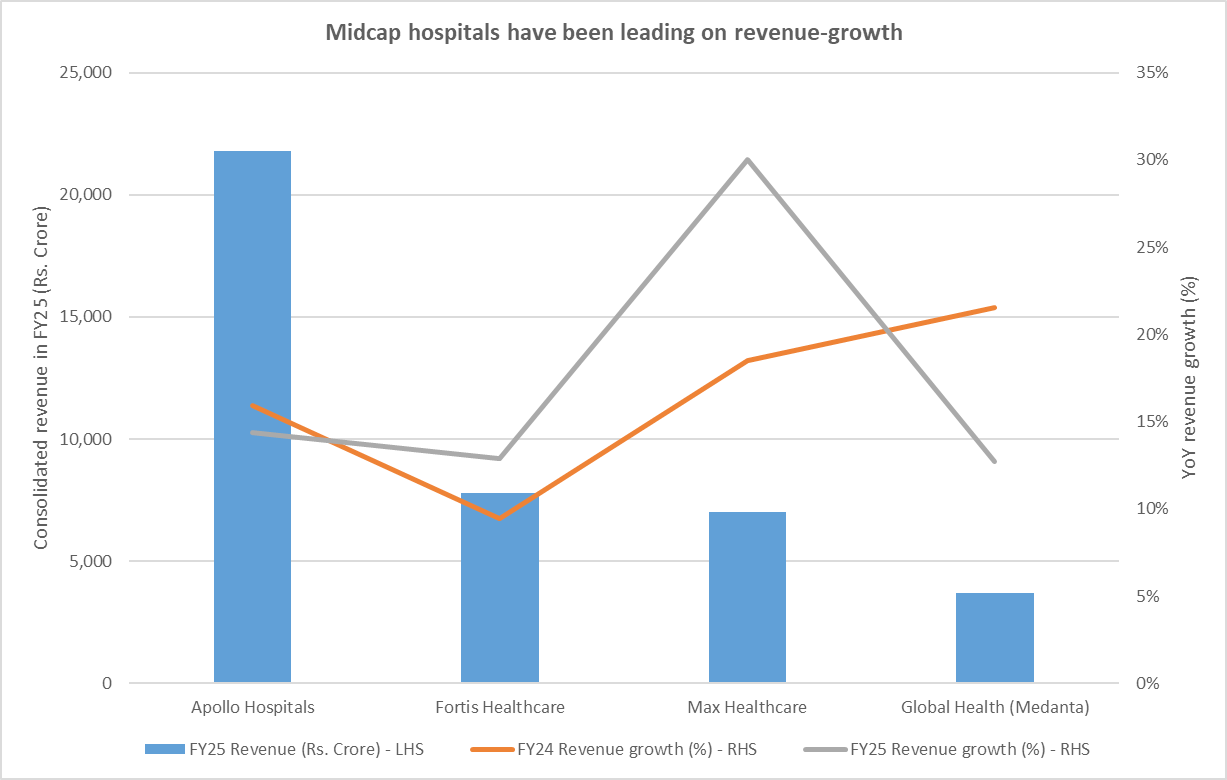

Among the largest hospitals listed in India, Apollo Hospitals is a constituent of the Nifty 50 Index, while the Nifty Midcap 150 Index includes Max Healthcare, Fortis Healthcare, and Global Health (Medanta). Barring Fortis which has had issues of its own (dealt in detail in a subsequent section), midcap hospitals have in general, been outpacing their large-cap peer, Apollo.

On a higher base of more than Rs 20,000 crore in consolidated revenues, Apollo Hospitals has been clocking mid-double-digit growth. In sharp contrast, Max Healthcare reported more than 30% topline-growth in FY25, following 18% growth in the previous fiscal. While Medanta has slowed down in FY25, it had reported a robust 22% growth in FY24. Fortis has lagged behind with growth barely touching low-double-digits.

Reflecting this scope for superior growth in midcap hospitals, their stocks have outperformed Apollo. Since November 2022 when Medanta was listed, midcap hospital stocks have delivered a CAGR between 40% and 50%. At the other end of the spectrum, we have Apollo Hospitals, which has appreciated at a much mellower 22% CAGR.

Max is a class apart

Max Healthcare commands the highest valuation, with a P/E of more than 95x. Fortis and Medanta follow at 78.7x and 63.6x respectively. But Max has the fundamentals to back up its rich valuation.

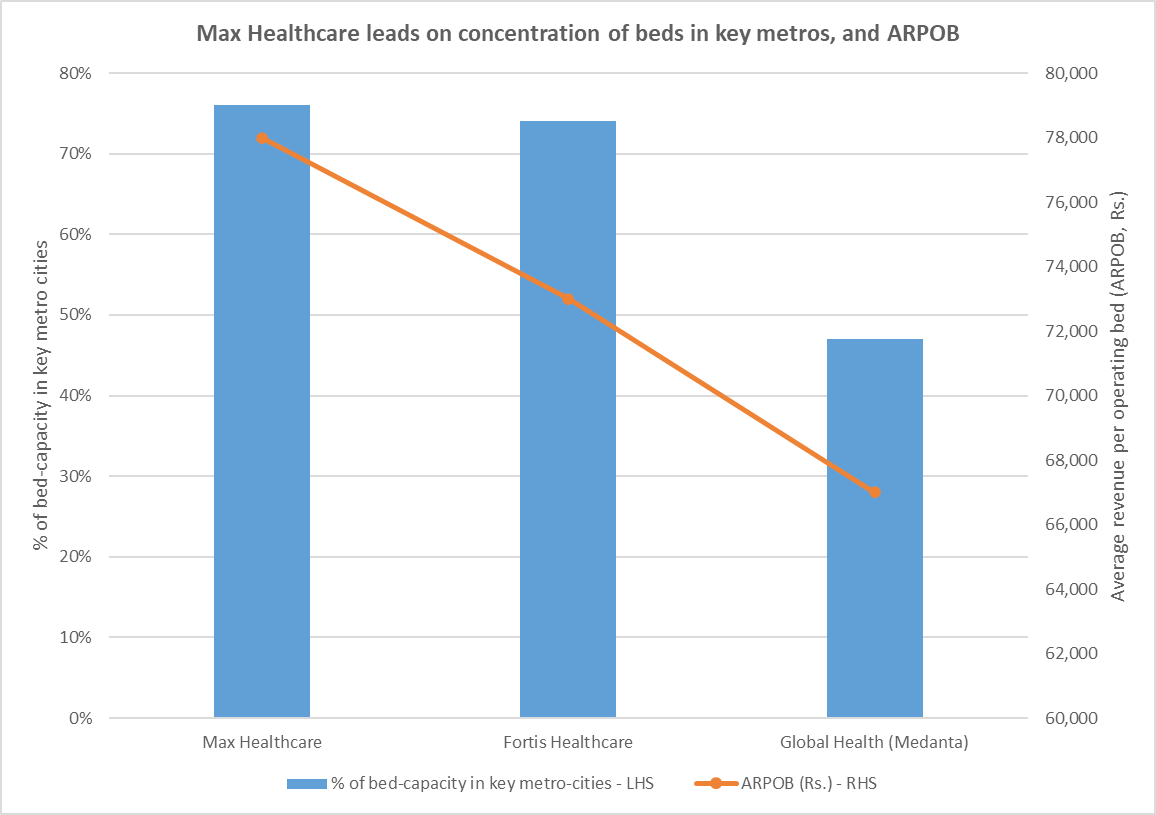

While Medanta and Fortis are focused on Cardiac, Max’s specialty-mix is tilted towards Oncology which contributes more than a quarter of its revenues. It has seen the fastest growth among peers, having surpassed Fortis on revenues in Q1 FY26. This can also be attributed to Max’s higher concentration of bed-capacity in key metro cities, leading to higher average revenue per operating bed (ARPOB) as well as faster growth.

Max also reports the highest occupancy at 76% against 63-69% for its peers. Combined with higher ARPOB, this has resulted in higher operating leverage and consequently, better margins for the hospital chain. With 25% operating EBITDA margin as of Q1 FY26, Max surpasses the 22-23% margin reported by Fortis and Medanta.

With a presence across the entire healthcare chain from insurance, hospitals, homecare, and pathology labs, Max has the ingredients in place to become a full-service healthcare provider.

The Fortis turnaround story

Fortis Healthcare had fallen under when its promoters, the Singh brothers, got embroiled in legal woes over Ranbaxy’s sale. Even within Fortis, mismanagement, and alleged poor corporate governance including siphoning of funds and related party transactions had led to persistent losses which eroded its net worth.

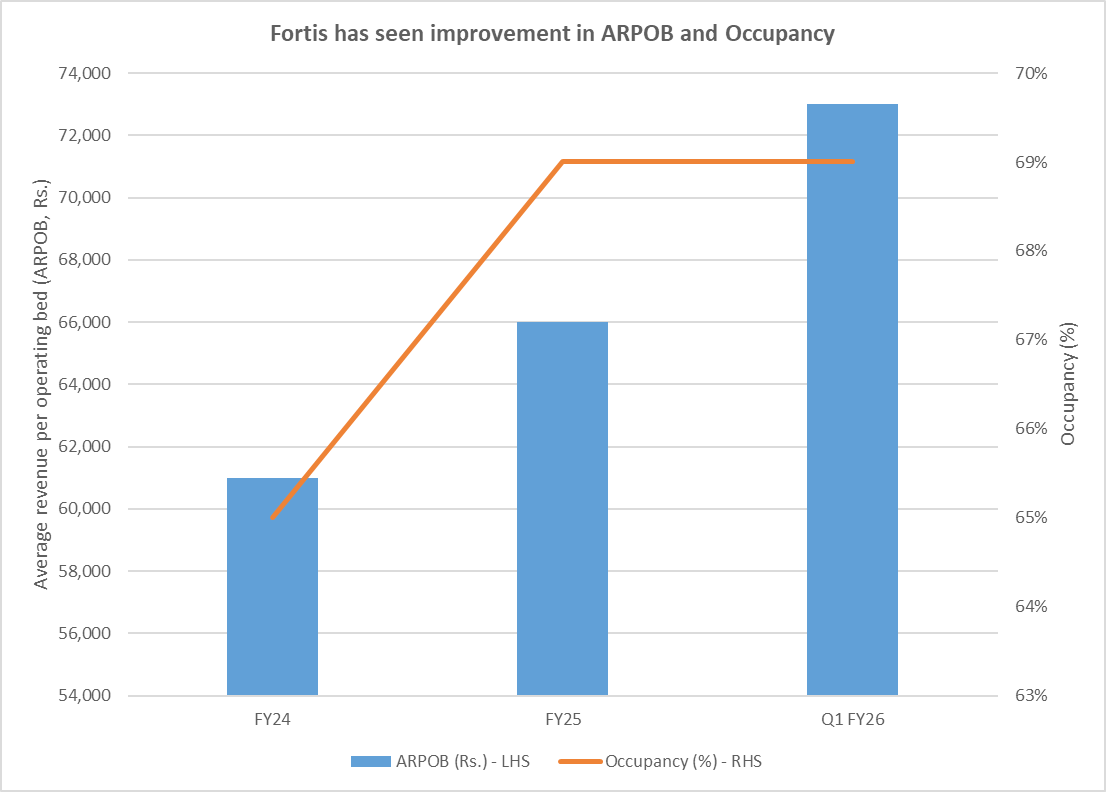

But since IHH Healthcare acquired Fortis in 2018, the business has turned around. Portfolio-rationalization with sales of loss-making facilities, and an aligned management have led to improved operating performance, as well as pared debt. ARPOB has shot up from Rs 61,000 in FY24 to Rs 73,000 in Q1 FY26. Occupancy has scaled up as well, going from 65% to 69%, now ranking second only to Max Healthcare.

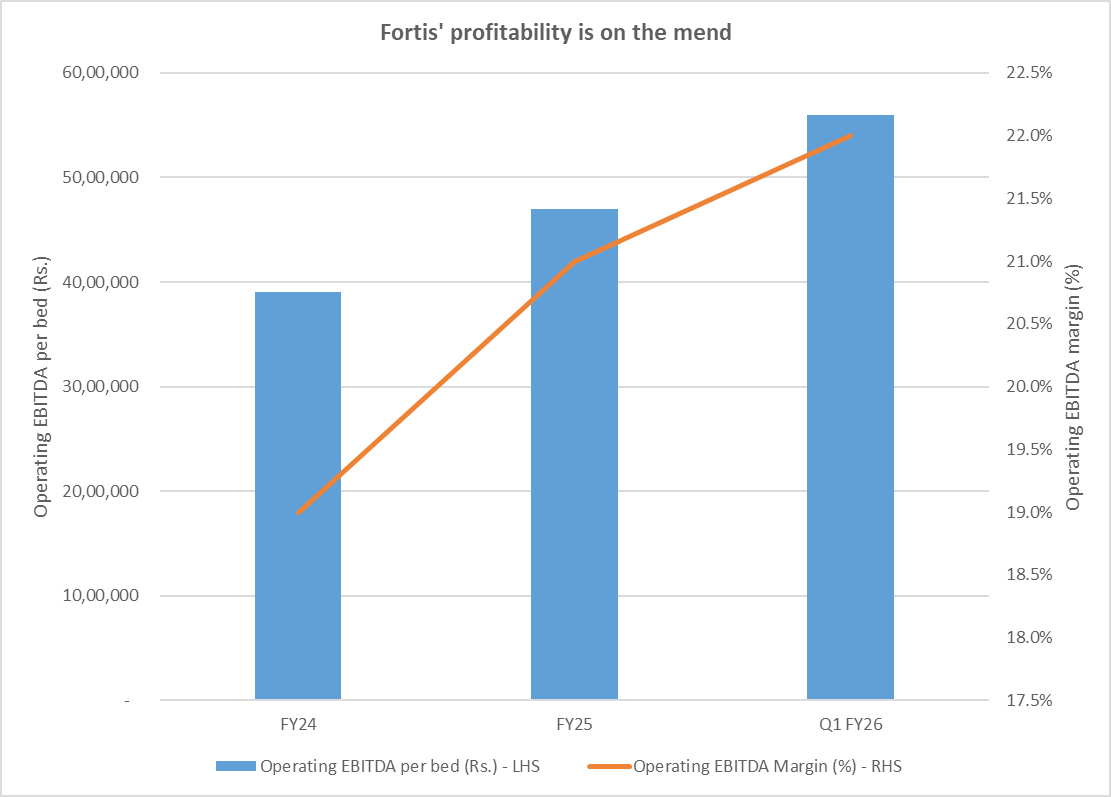

Thanks to the resulting higher operating leverage, margins are on the mend as well. At 22% operating EBITDA margin, Fortis’ profitability has caught up with Medanta’s 23% margin. That said, 75% of its revenues come from 11 mature hospitals. So, effective expansion and follow-on execution are the need of the hour for Fortis.

Medanta moves into the fast lane on new hospitals

Global Health operates Medanta hospitals in India. It has a strong brand presence in the North. For six years in a row, its Gurugram facility has been ranked the best private hospital in India by the Newsweek.

But its revenue saw a 12.7% growth in FY25, much mellower than peers. EBITDA margin contracted as well. And one-time expenses associated with the merger of MHPL (Manipal’s Lucknow entity) amounted to about Rs 50 crore, and resulted in Global Health’s consolidated PAT remaining stagnant year-on-year at Rs 480 crore in FY25.

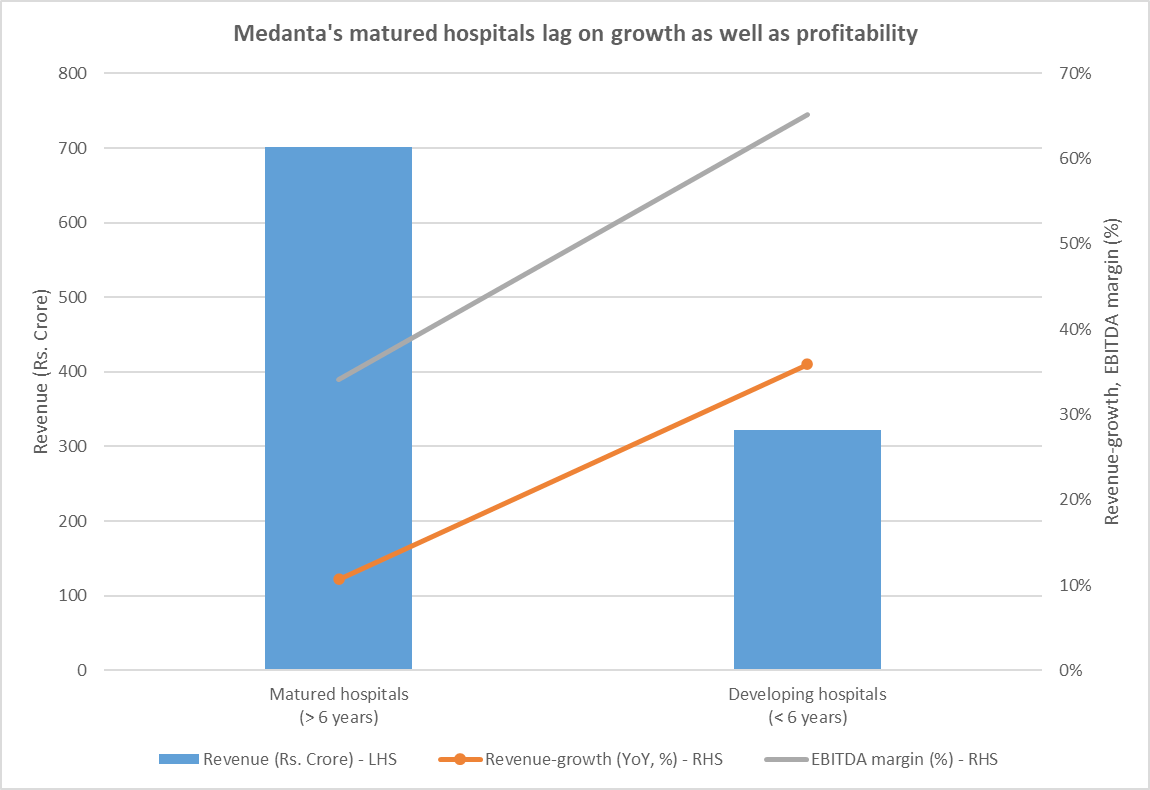

But growth picked up pace in Q1 FY26. Revenue expanded by 19% over the same quarter last year, while EBITDA margin expanded from 23.6% to 24.3%. Growth was driven by newer hospitals (age < 6 years) which witnessed 36% and 60% growth in revenues and EBITDA respectively.

Matured hospitals which contribute about 70% to its revenues, lagged behind. Their revenue and EBITDA-growth at 11% and 7% paled in comparison. Their margin-contraction from 24.3% to 23.4% is a concern as well.

That said, against the context of the recent tussle between insurers and hospitals on timeliness and quantum of payments, Medanta’s lower exposure to TPA (third party administrator) offers comfort. Medanta’s TPA exposure stands at only 27%, much lower than the 36-37% exposure for Fortis and Max.

Risks remain

The growth hereon will be driven to a large extent, by expansion. Expanding contribution of new facilities will also play a role. Even as Fortis has the highest debt-to-equity at 0.2x, all midcap hospitals hold up well on this metric. This leaves sufficient room for debt-funded expansion. But expansion plans should be taken with a pinch of salt.

If funded by debt, evolution of debt-to-equity will have to be seen. For expansions funded by internal accruals, cash-flows could get stressed. Aggressive inorganic and organic expansion can face execution risks, and also weigh on margins while the acquisitions are integrated, and as newer facilities catch up on profitability.

Medanta aims to double its bed-capacity to about 6,000 beds by FY30, with a bulk of the expansion being planned in metro cities. But considering that its brand-presence is concentrated in Gurugram, the expansions in Mumbai and Guwahati may take a while to start contributing positively. Fortis has 5,700 beds, which it reportedly plans to expand to 10,000 beds over the next 4-6 years. Delays and cost-overruns will need to be monitored. Brownfield expansion and metro-focused greenfield expansion are expected to yield benefits faster.

Max Healthcare has among the most aggressive expansion plans, with its capacity set to almost double from 5,360 beds as of August 2025 to 10,100 beds by FY29. It has already seen its return on capital employed (ROCE) contract from 32% in FY24 to 21% in the latest reported quarter. Of course, Max’s history of successful acquisitions, such as the ones with BLK, Nanavati, and Radiant, lend confidence.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article. However, clients of Credibull Capital may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.