Radico Khaitan has been a steady contributor of earnings for investors. Brokerage firm Motilal Oswal sees a further 15% upside for the company. It’s new products in the premium segment and expanding markets are among the key reasons.

The company has been one of the best alcohol stocks in the Indian markets. The company has delivered 25x return in the last 10 years and 8x in the last 5 years.

The company’s 10 year returns is best among its rivals, United Spirits, United Breweries and Allied Blenders.

10-year performance of Alcohol stocks

Source: TradingView

Here are the top 5 reasons the stock could surge 15% in time to come…

- Luxury and Premium segment

Radico has been expanding its luxury segment products. The company is one of the largest and oldest Indian Made Foreign Liquor (IMFL) makers.

The company has an 8% market share in the Prestige and Above (P&A) category in the IMFL. Vodka accounts for 50% of its P&A portfolio, and among the larger P&A Vodka industry, the company holds a more than 80% market share.

In the P&A Vodka segment, the company only holds a 3% market share. The research firm expects this area to be an opportunity for the company. It expects Radico to have double-digit volume growth in the P&A segment. This growth is expected for the medium term.

- Expanding Reach

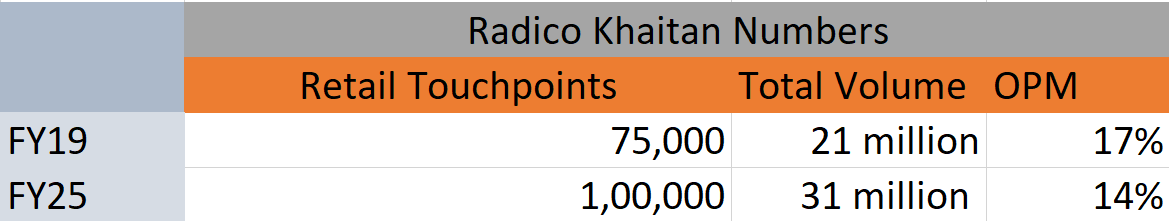

The company has increased its distribution network to 100,000 retail touchpoints. It had 75,000 retail stores in FY19. Similarly, it has increased its on-premise locations from 8,000 to 10,000 in the same period.

Radico’s has around 15 million cases in the P&A portfolio. The P&A industry, in comparison, has 200 million cases. Motilal Oswal expects the company to launch new products in the premium segment.

The company had launched brands Rampur, Ranthambore, and Jaisalmer in the luxury segment. The research firm expects more product launches, which will bring more customers from high-volume areas.

In key states like Uttar Pradesh, Andhra Pradesh, Telangana, Maharashtra and Tamil Nadu, its revenue mix has increased. It continues to penetrate deep into premium markets, the brokerage added.

- Healthy Financials

Radico has delivered a revenue growth (in Compound Annual Growth Rate) of 15% from FY19 to FY25. The IMFL segment, which makes up 70% of revenue, had a 12% CAGR. The P&A portfolio within the IMFL had a 20% revenue CAGR. It also had a 13% volume CAGR.

Radico has sold 31 million cases in FY25. In FY19, it had sold 21 million cases.

One thorn among the rosy figures is the margins. The company’s operating margin fell from 17% to 14%. The price increase of Extra Neutral Alcohol (ENA) and glass drove the margins down. Motilal said these are external factors.

It added that the company is looking to manufacture more in-house, which will increase the margins.

Motilal expects the company to have a revenue CAGR of 16% in FY25 to 28. This will be driven by growth in the P&A segment. It sees a healthy 21% CAGR for the P&A segment. It also sees a 9% volume growth overall.

Source: Motilal Oswal and Screener

- Regulatory tailwinds

Radico Khaitan has been expanding its presence across various states. Uttar Pradesh accounts for 20-25% of the company’s domestic volumes. The state recently announced a new excise policy and this is expected to be a tailwind for the company.

The company also managed to expand its market share in Andhra Pradesh from 10% in the first half of FY25 to 23% in Q4FY25. This was also a possible policy change that favoured large and national players.

Radico had moved from its in-house manufacturing to a royalty-based model. This was due to previous government rules in Andhra Pradesh. The current administration’s favourable policy could pivot the company back to manufacturing in-house. This will help its margins and offer greater operational control.

Not every state’s policies are kind to the company. Maharashtra recently announced a hike in excise duty on IMFL. This will increase prices for Radico’s products in the state. In Karnataka, the company’s value offerings are impacted by higher taxation, though it benefited from an excise duty cut.

- India-UK FTA to help

The recently announced India-UK Free Trade Agreement is also expected to benefit Radico. In the FTA, the custom duties on imports for Whisky and Gin will be cut to 75% from 150%. Further, it will be reduced to 40% over 10 years.

The lower duties will reduce taxes on the sold product and reduce raw material costs. Radico’s cost for premium products like Ranthambore, Sangam and After Dark will be reduced. These products use imported spirits for blending and hence, the cost reduction.

In FY26, Radico is expected to import spirits worth Rs 2,500 million. The import duty cut would save the company Rs 750 million.

Risks

Price inflation for glass and ENA is considered to be a major risk for the company. This will put more pressure on its margins.

Alcohol companies always act within a tricky regulatory environment. If states increase excise duty, just like Maharashtra, it will negatively affect the company. As many states’ financial health is under pressure due to freebies, this is a possibility, the brokerage said.

An increase in price competition is another risk for the company.

Radico Khaitan’s stock performance in 2025

Source: TradingView

Brokerage View

Motilal Oswal gave a buy call with a target price of Rs 7,000. This was at a valuation of 60x Price to Equity (P/E) in June 2027 Earnings Per Share (EPS). This is a 15% upside from the recent close. The brokerage valued it at 67x FY26 P/E.

According to the brokerage, a 30% EPS CAGR is good enough to sustain the company’s rich valuations.

Conclusion

Motilal Oswal’s analysts expect Radico Khaitan to continue its strong performance. There are multiple tailwinds for the company with its premium segments, increased networks, and costs expected to come down.

Readers need to remember there is always a regulatory overhang around alcohol stocks, and unexpected changes like the one in Maharashtra, which is outside the company’s control, can affect the stock.

Disclaimer:

Note: We have relied on data from Motilal Oswal throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananthu C U is an equity market journalist who has written about listed companies, equity market regulations, and economic development. He is deeply interested in increasing his knowledge about the equity market, the Indian economy and listed Indian companies. He generally tracks infrastructure, power and financial companies.

Disclosure: The writer and his dependents do not hold the stock discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.