Lab-grown diamonds are real diamonds that are created in a controlled laboratory environment rather than being mined from the earth.

They have the exact same chemical, physical, and optical properties as natural diamonds, meaning they sparkle and behave identically.

They are typically made using two main methods:

- High-Pressure, High-Temperature (HPHT): Mimics the natural conditions deep within the Earth.

- Chemical Vapor Deposition (CVD): Involves a gas mixture that allows carbon atoms to build up on a diamond seed.

India is rapidly emerging as a global leader in the lab-grown diamond (LGD) sector, blending traditional craftsmanship with cutting-edge technology.

The country currently produces 15% of the world’s LGDs and is a major hub for diamond polishing, handling over 90% of global diamond processing.

The Indian lab-grown diamond jewellery market was valued at US$ 0.5 billion (bn) in 2023 and is projected to reach US$ 1.2 bn by 2030, a compound annual growth rate (CAGR) of 14.8%.

This growth is fueled by factors such as affordability — LGDs can be up to 90% cheaper than mined diamonds — sustainability and increasing consumer demand for ethical alternatives.

Government initiatives, like the establishment of the India Centre for Lab Grown Diamond at IIT Madras with a Rs 2.4 bn research grant, are further accelerating innovation and production capabilities.

As the industry continues to expand, investors are keenly observing the market dynamics.

Hence, let’s examine 5 such stocks selected from Equitymaster’s screener for Top Lab Grown Diamond Stocks in India.

#1 Titan

First on this list is Titan.

Titan has established leadership positions in the watches, jewellery, and eyewear categories led by its trusted brands and differentiated customer experience.

In March 2022, Titan picked up a 17.5% stake in Stamford, Connecticut-based lab-grown diamond maker Great Heights Inc. for an estimated US$ 20 million (m) through its subsidiary TCL North America Inc.

The acquisition also provided Titan a presence in the branded LGD jewellery segment through the acquired company’s existing own brand “Clean Origin”.

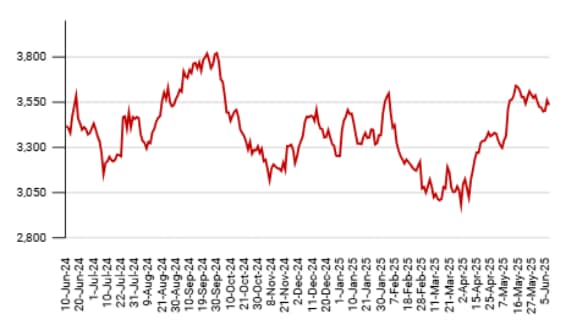

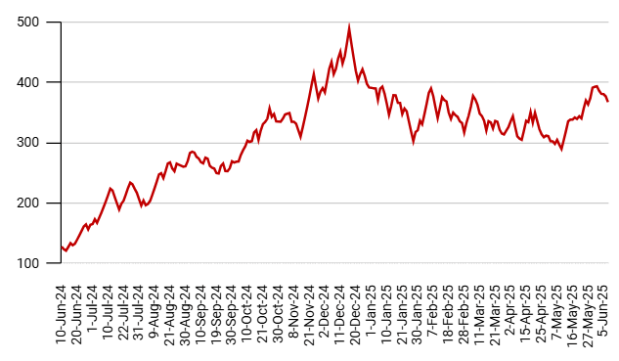

Titan Stock Price – 1 Year

Coming to the financials, the company’s revenue has grown at a CAGR of 19.8% in the last five years while its net profit has grown at a CAGR of 20.9%.

The company’s five-year average return on equity (RoE) and return on capital employed (RoCE) were 23.9% and 23%, respectively.

At the end of Q2 FY25, the company’s Managing Director acknowledged LGDs’ potential to substitute natural diamonds in India but noted a lack of concrete evidence for this shift.

For now, LGDs are a strategic consideration but aren’t significantly impacting the company’s diamond jewellery business.

The company doesn’t see LGDs as a major risk, believing their performance may not match the hype, with consumer interest still leaning towards natural diamonds.

Even in areas with the company’s many LGD stores, customers are more interested in confirming they’re buying natural diamonds than purchasing LGDs.

By the end of Q4 FY25, LGD prices continued to drop significantly (typically from Rs 30,000/carat for many players from more than Rs 60,000 earlier), with management expecting further declines.

The company remains cautious, citing market instability, inconsistent customer demand for LGDs, a lack of customer clarity, and the risk of commoditization.

Citing ongoing uncertainties like gold price fluctuations, management reiterated its 11–11.5% margin guidance.

Going forward, the management is targeting high double-digit growth, estimating a fairly good rate to be between 15-20%.

#2 Trent

Second on this list is Trent.

Trent is engaged in retailing of apparels, footwear, accessories, toys, games, food, grocery & non-food products through various of its retail formats/ concepts.

In October 2024, Trent launched its new LGD brand ‘Pome’ in Westside stores.

Pome offers a range of LGD jewellery, including earrings, rings, necklaces, and bracelets, all crafted with the same expertise as natural diamonds.

The LGD jewellery is competitively priced, making it more affordable and accessible to a wider audience. Pome has set the prices for LGD jewellery to align with Trent’s typical competitive pricing. A 1-carat solitaire engagement ring is listed at Rs 24,000-29,000.

A quick estimate indicates that the implied cost of a lab-grown diamond solitaire in Pome LGD jewellery is approximately Rs 13,000-17,000 per carat.

As per this pricing framework, on average, Pome’s pricing could be (1) a 30% discount to Rs 15,000-20,000 SKUs of natural diamond studded jewellery and (2) an 80-85% discount to high value of more than Rs 500,000 natural diamond studded jewellery.

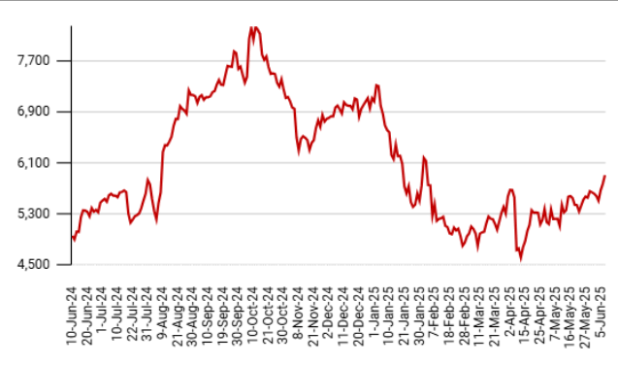

Trent Stock Price – 1 Year

Coming to the financials, the company’s revenue has grown at a CAGR of 36.3% in the last five years while its net profit has grown at a CAGR of 62.3%.

The company’s five-year average RoE and RoCE were 14.4% and 26.4%, respectively.

Trent may also expand the Pome brand with Exclusive Brand Outlets (EBOs) in the future. Trent’s entry into the LGD jewellery market is expected to drive growth and innovation in this segment.

#3 International Gemmological Institute Ltd (IGI)

Next on this list is International Gemmological Institute.

International Gemmological Institute is world’s largest independent certification and accreditation services provider in the fields of diamond, gemstone, and jewellery.

The company got listed on the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) on 20 December 2024.

The Initial Public Offer (IPO) was a significant event for IGI, especially as it consolidated its global business under the Indian entity.

The funds raised from the fresh issue portion of the IPO were primarily intended for the acquisition of IGI Belgium and IGI Netherlands from Blackstone, aiming to streamline operations and create a unified global structure.

The offer for sale allowed Blackstone to monetize a part of its existing shareholding.

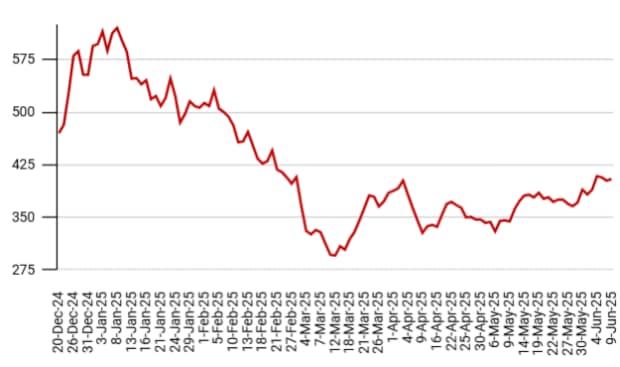

International Gemmological Institute Stock Price – Since Listing

Coming to the financials, the company’s current RoE and RoCE are 54.4% and 67.9%, respectively.

As of March 2025, IGI reported a one-time price correction in LGD certification in Q2 2024, post which prices have stabilized for the last three quarters.

The management emphasized robust demand in both the natural and lab-grown diamond segments. Lab-grown jewellery certification is a key growth driver for the company, particularly as consumer adoption in India accelerates.

Additionally, the certification of larger LGDs (2-carat and above) is increasing, which is leading to improved realisations per report for the company.

The jewellery business mix increased from 24% in Q1CY24 to 28% in Q1CY25, primarily driven by lab-grown jewellery.

About 50% of company’s certifications cater to domestic consumption within India, with China also contributing 10% of IGI’s revenue, primarily from its domestic market. This means only around 40% of IGI’s business is potentially exposed to cross-border tariff impacts.

As a service provider, IGI faces a less direct impact from tariffs compared to product manufacturers.

The management anticipates that any tariff costs will be distributed among manufacturers, retailers, and consumers, resulting in limited pass-through to IGI.

The wholesale LGD prices have stabilized after last year’s correction. Going forward, the management does not expect further major price drops due to low ROI at current price levels (US$ 170–200/carat).

The management has forecasted 15–20% revenue growth for 2025 at both consolidated and standalone levels, benefiting from the LGD price correction being factored into the base.

Additionally, it has anticipated profit after tax (PAT) margins to improve to 57–64% in 2025 from 57% in 2024, even with continued investments in personnel and infrastructure.

With pricing being stable now, revenue growth is expected to align with volume growth for the rest of 2025.

#4 Senco Gold

Fourth is Senco Gold.

Senco Gold is a pan-India jewellery retailer, recognized as the largest organized jewellery retail player in Eastern India by store count.

The company primarily sells gold and diamond jewellery, along with items crafted from silver, platinum, and precious and semi-precious stones.

Senco Gold has launched a sub-brand called ‘Sennes’ specifically for lab-grown diamond jewellery. This brand also diversifies into luxury lifestyle products like leather bags and perfumes.

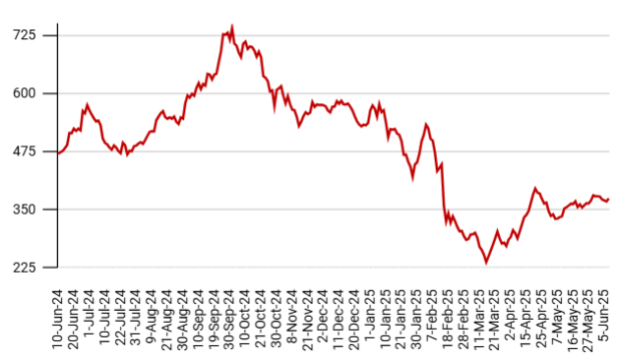

Senco Gold Stock Price – 1 Year

Coming to the financials, the company’s revenue has grown at a CAGR of 16.1% in the last five years while its net profit has grown at a CAGR of 20.4%.

The company’s five-year average RoE and RoCE were 17% and 16.6%, respectively.

Suvankar Sen, MD & CEO of Senco Gold, stated that the response from the four ‘Sennes’ stores launched in Kolkata has been very encouraging.

Further, the company plans to invest Rs 500-600 m initially in this business, followed by an annual investment of Rs 250-300 m over the next four to five years.

He also clarified that the company does not anticipate Sennes LGD jewellery to cannibalise natural diamond sales, as Senco and the new brand cater to different audiences.

Going forward, over the next four–five years, Senco Gold aims to diversify its portfolio. It is targeting an overall non-gold contribution of 20% to total sales, with diamonds at 15%, lab-grown diamonds at 1-2%, and silver and platinum at 2-3%.

Senco plans to launch 5-7 new Sennes stores in FY26 as part of its broader expansion strategy, which includes opening 20-22 new stores overall.

The company believes LGDs will gain significant traction in the small ticket size segment for everyday wear.

The management anticipates 18-20% topline growth for FY26. The EBITDA margin guidance is 6.8-7.2% (potentially 7.5%), and the net profit margin guidance is 3.5-3.7%.

#5 Sky Gold & Diamonds

Last on this list is Sky Gold.

Sky Gold is engaged in the business of designing, manufacturing, and marketing gold jewellery.

The company follows a B2B model where the products are mainly sold to mid-range jewellers and boutique stores who sell these products through online platforms and retail stores.

Sky Gold Stock Price – 1 Year

The company’s revenue has grown at a CAGR of 16.7% in the last five years while its net profit has grown at a CAGR of 67.8%.

The company’s five-year average RoE and RoCE were 18.9% and 16.3%, respectively.

Sky Gold sees the lab-grown diamond segment as a key area for future growth. The company is planning to create samples and actively enter the segment, aiming to capitalize on the increasing acceptance of LGDs by consumers.

It also plans to boost exports, with LGDs potentially playing a role in their international expansion, particularly in the Middle East.

Additionally, Sky Gold has already secured partnerships with major players like Aditya Birla Jewellery (under its luxury brand ‘Indriya’), leading to orders in the LGD category.

It aims to strengthen and expand these relationships with leading jewellery retailers like Malabar Gold & Diamonds, Joyalukkas, and Kalyan Jewellers to broaden their distribution network for LGDs.

A significant future plan is the launch of “Sky Jewellery Park,” a massive 540,000 square feet, AI-driven jewellery manufacturing facility with a production capacity of 4.5 tonnes per month. This would position Sky Gold as India’s largest and most technologically advanced jewellery manufacturer. This enhanced capacity will be crucial for scaling up LGD jewellery production.

Currently, diamonds (including lab grown and natural) contribute 1% to Sky Gold’s total revenue, with a strategic target to increase this contribution to 4% by FY27.

The management has provided revenue guidance of Rs 54 bn for FY26 and has revised its FY27 revenue target upwards to Rs 76 bn from a previously stated Rs 72 bn.

The EBITDA margin guidance is 6.2-6.3% by FY27.

Sky Gold has projected the net profit margin to grow from 3.7% in FY25 to a long-term target of 5%. This increase includes a target of 4% in FY26 and reaching 4.5% by FY27.

The management has guided FY27 PAT to be about Rs 3.4 bn, which is implied from the 4.5% margin on Rs 76 bn revenue.

The company also aims to achieve positive operating cash flow by FY27.

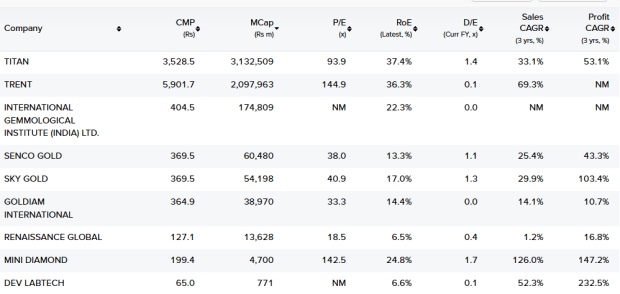

Snapshot of the Top Lab Grown Diamond Stocks on Equitymaster’s Stock Screener

Here’s a table that shows the top lab grown diamond stocks across various parameters.

Conclusion

As the lab-grown diamond industry gains momentum—both globally and in India—investors have a unique opportunity to tap into a sector that’s reshaping the future of luxury, sustainability, and advanced materials.

With India playing a pivotal role in both production and innovation, companies in this space are well-positioned for long-term growth.

Whether driven by environmental consciousness, affordability, or government support, the factors drivng this market are too big to ignore.

By keeping a close eye on these promising stocks, investors can align their portfolios with one of the most exciting trends in modern gemology and ethical investing.

Investors should evaluate these companies’ fundamentals, corporate governance, and the valuations of the stocks as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.