The medical technology sector in India is going through a significant transition driven by government policies and initiatives like the National Medical Devices Policy (2023) and Production-Linked Incentive (PLI) scheme.

The former was introduced with the aim of helping the domestic medical devices sector become “competitive, self-reliant, resilient and innovative”. It is anticipated to push the Indian medical devices market from a value of INR 90,000 crore in 2020 to INR 4,41,365 crores by 2030, attaining a 10-12% share of the global medical devices market over the next 25 years.

Currently, India is the 4th biggest medical devices market in Asian following Japan, China and South Korea. It also stands among the top 20 global medical devices market.

Government Reforms and Initiatives

The Government of India rolled out the PLI scheme for Promoting Domestic Manufacturing of Medical Devices in 2020 to encourage domestic production of medical devices, backed by a robust capital outlay of INR 3,420 crore.

The scheme, which has a tenure of FY 2022-2023 to FY 2026-2027, is poised to bolster indigenous manufacturing of medical devices, reduce import dependency and attract substantial investments for the same. Under the scheme, a 5% incentive is offered for five years to eligible domestic manufacturers on additional sales of medical devices produced in the country and covered under the targets of the scheme. The focus areas of the policy intervention are regulatory streamlining, boosting infrastructure, enabling R&D, attracting investments and human resource developments.

As of March 2025, 21 approved projects under the PLI scheme have commenced production of 54 unique medical devices. These include MRI machines, CT scanners, dialyzers and heart valves.

In March 2025, Ahmedabad-based Zydus Lifesciences announced its plans to acquire an 85.6% stake in France’s Amplitude Surgical, with a bid to expand into the global medical devices market. While the former is primarily focused on the manufacture of generic drugs, through this acquisition it intends to diversify its product portfolio to medical devices and technology.

Let us take a detailed look at 3 Indian medical device companies reaping the benefits of the conducive reforms and policies of the central government.

#Poly Medicure

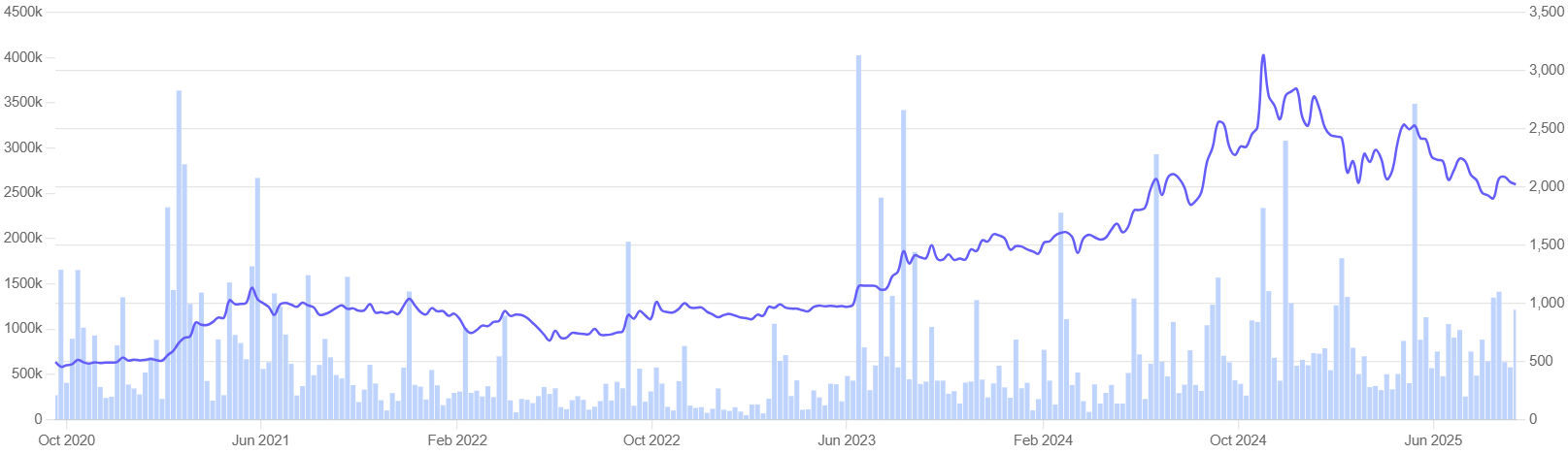

Valued at a market cap of INR 20,463 crore, Poly Medicure stock has returned approximately 308% to shareholders in the past five years.

One of the leading India-based manufacturers and exporters of medical devices, Poly Medicure is aiming for major expansion of its global footprint though establishment of new manufacturing facilities, ramp-up of exports and inorganic growth through M&A. The company is on track to build three new manufacturing units in Haryana, Uttarakhand, and Rajasthan. By the end of calendar year 2026, all three facilities are expected to commence operations. The units are designed to cater to the company’s production requirements for the next five to ten years.

The company is known for manufacturing a wide range of medical devices like IV cannulas, blood bags, blood collection tubes, and infusion and transfusion sets. 2% of the company’s annual revenues go into R&D, particularly focused on cardiology, oncology, and renal care.

In September 2025, the company announced its plan to purchase 90% stake worth INR 188.5 crores in the Dutch medical device manufacturer, PendraCare Group. The acquisition deal is in line with the company’s strategy to cement its foothold within the global cardiological devices market. The remaining 10% stake is slated to be acquired in 2030, conditional on PendraCare’s performance in 2029. The acquisition is expected to benefit Poly Medicure with annual synergies estimated at INR 31.07-41.42 crore over the next few years. The gains will be reflected through the Indian firm’s expansive network, research partnerships and innovative manufacturing capabilities.

In FY25, Poly Medicure registered a 21.4% year-on-year jump in revenue to INR 1,670 crore, While EBITDA margins came in 27.1%, net profit rose by 31.1% to INR 338.6 crore.

As a part of its inorganic growth strategy, the company is planning on ramping up mergers and acquisitions in adjacent technology verticals, especially oncology (biopsy and drug delivery), cardiology, and critical care, including neonatology. In 2024, the company allocated INR 500 crore to expand its presence over the next few years in international markets like USA and Europe in the three core areas of cardiology, critical care, and renal care. It is also focusing on expanding its product portfolio by incorporating two to three new products in each of its six key therapy segments every year.

The stock is currently trading at a trailing price-to-earnings multiple of 57.3.

The stock currently has an EV/EBITDA ratio of 35.7, as compared to the industry median of 26.63.

Poly Medicure Share Price Return: 5 years

#Fischer Medical

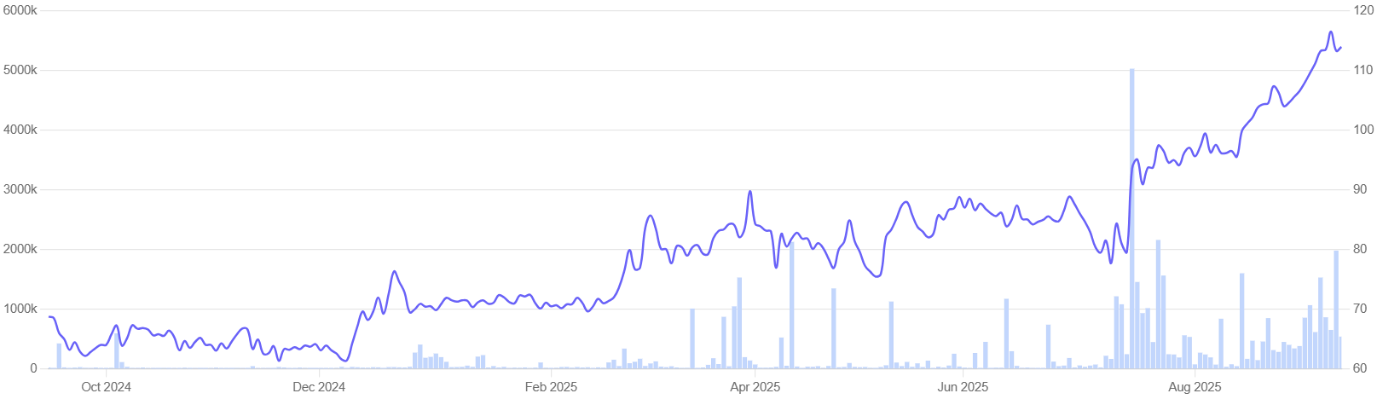

Valued at a market cap of INR 7,347 crores, the Fischer Medical Ventures stock has returned approximately 65.8% to shareholders in the past one year.

The Chennai-headquartered company specializes in manufacturing highly innovative medical imaging equipment, particularly MRI scanners. It has manufacturing facilities at the Andhra Pradesh MedTech Zone.

In January 2025, Fischer Medical’s subsidiary Time Medical International Ventures (India) attained its license from Central Drugs Standard Control Organization (CDSCO) for the production of MRI systems. With this license, Time Medical has emerged as the first Indian company to indigenously produce FDA and CE-approved MRI systems namely EMMA – 1.5T MRI Scanner, PICA – 0.35T MRI Scanner, MICA – 1.5T MRI Scanner and QUIN – 1.5T MRI Scanner.

In 2024, Fischer Medical announced its plans to roll out domestically-manufactured CT scans in partnership with Edusoft, at half of the current market prices. This also comes on the heels of the company collaborating with Edusoft to launch indigenously produced XRAY machines in the market.

In June 2024, the company inked a partnership deal with BluSim Tech Pte Ltd to expand its medical imaging and diagnostics product portfolio. This includes the AI-powered contactless monitoring solution BlueSim Mat, used in nursing and elder home care settings.

For FY 2025, the company reported net sales of INR 110.70 crore and an operating profit of INR 3.32 crores. Net profit for the financial year amounted to INR 1.21 crore.

The stock is currently trading at a trailing price-to-earnings multiple of 1,111.60.

The stock currently has an EV/EBITDA ratio of 453.39, as compared to the industry median of 26.63.

It will be an understatement to say the valuations are expensive.

Fischer Medical Share Price Return: 1 year

#Laxmi Dental

Valued at a market cap of INR 1,682 crore, Laxmi Dental stock has declined approximately 28% to shareholders in the past one year.

Inaugurated in 2004, Laxmi Dental is the sole end-to-end integrated dental products company based in India. Its core product offerings are clear aligners, thermoforming sheets, paediatric dental products, custom-made crowns, bridges and dentures. The company’s Illusion Dental Lab comes equipped with advanced facilities for designing state-of-the-art dental appliances viz. the FDA-approved Illusion Aligners.

In January 2025, the company went public via an IPO, with an offer price of INR 428 per share. Currently the stock is trading at Rs 334.

In FY 2025, the company reported a consolidated revenue from operations amounting to INR 236.56 crore and a net profit of INR 31.83 crore. The Laboratory Business segment was the top revenue driver for the company, generating INR 154.16 crore, a jump of 18.6% YoY. The Aligners business segment saw the highest YoY growth of 42.2%, reporting revenues of INR 80.85 crore. The company’s paediatric line “Kids-e-Dental” reported a revenue of INR 2.63 crore for the fiscal.

During FY 2025, Laxmi Dental divested its Aly Dental Supply division. In August 2025, the company announced its plans to acquire a 58% stake in Gujarat-based healthcare tech company IDBG AI Dent Pvt Ltd, to strengthen its suite of AI-based dental imaging and diagnostic tools.

The company is well on track to cement its global foothold, backed by continuous innovation in dental technology and services.

With the launch of iScanPro, the company’s branded intraoral scanner, it forayed into the field of digital dentistry. As of late 2024, iScanPro was used by approximately 264 dentists. The company’s digitally-enabled dental restoration has been gaining traction in both Indian and international markets.

Laxmi Dental Share Price Return: 1 Year

The Laxmi Dental stock is currently trading at a trailing price-to-earnings multiple of 72.7.

The stock currently has an EV/EBITDA ratio of 35.8 as compared to the industry median of 26.63.

Valuation Comparison With Peers

| Company | TTM P/E | ROCE | ROE | EV/EBITDA |

| Poly Medicure | 57.3x | 20.1% | 15.8% | 35.7 |

| Fischer Medical | 1,111.6x | 1.07% | 0.7% | 453.4 |

| Laxmi Dental | 72.7x | 18.7% | 22.5% | 35.8 |

| Tarsons Products | 60.4x | 6.91% | 4.7% | 14.9 |

| Vasa Denticity | 60.6x | 23.2% | 17% | 41.2 |

| OSEL Devices | 49.2x | 31.1% | 30.1% | 30.6 |

| Industry Median | 47.2 | 18.7 | 15.8 | 27.1 |

Persistent Challenges

While the Indian MedTech sector is taking fast strides, one of the key challenges it faces is the continued reliance of foreign imports, with nearly 80% of vital devices coming in from abroad. The Indian manufacturers are also facing challenges as raw components are being used in medical devices under the Quality Control Order. However, due to time and cost restraints, most suppliers are unable to register with the Bureau of Indian Standards (BIS), threatening a potential risk of raw material supply shortage.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.