Shares of interest rate-sensitive stocks ended lower on Friday after the Reserve Bank of India (RBI) kept the benchmark repo rate unchanged at 6.50% during its fourth bi-monthly monetary policy review.

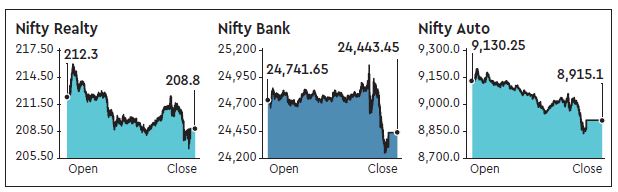

However, analysts said the RBI’s status quo stance has come against the market expectations of a 25 bps rate hike. The Nifty PSU Bank index closed 4.38% lower at 2,656 points, while the Nifty Realty index ended 2.73% down at 208.80 points. Nifty Auto closed 3.17% lower at 8,915.10 points. All the three sectoral indices recorded their respective 52-week lows on Friday.

On the other hand, BSE Bankex, BSE Realty and BSE Auto closed 1.93%, 2.70% and 3.16 % lower, respectively.

Shares of the banks in Nifty PSU Bank index fell in the range of 4.38% to 8.6%. Indian Bank was the biggest loser in the index, closing 8.6% lower at Rs 226.45. Among other prominent losers, Central Bank of India declined 6.35%, Canara Bank fell 5.81% and Oriental Bank of Commerce closed 4.89% lower. Other losers include SBI, Syndicate bank, BoB, BoI, Union Bank of India, Vijaya Bank, Punjab National Bank and IDBI Bank.

DLF, the country’s biggest real estate company, was the biggest loser in Nifty Realty index, closing 6.91% lower at Rs 147.45. Unitech was the second-largest loser, falling 5.56%, followed by IRB Real Estate, Oberoi Realty and Sunteck Reality. Other losers in the realty pack include Godrej properties, Sobha Realty, Phoenix, Brigade and Prestige.

Shares of automobile companies in the Nifty Auto index fell anywhere between 3.17% and 8.73%.

Ashok Leyland was the biggest loser in the index, falling 8.73% to end the session at Rs 107.75. Other losers include Maruti Suzuki India, Bajaj Auto, TVS Motor Company, Apollo Tyres, Eicher Motors, M&M, Tata Motor and Bharat Forge.

Prabhudas Lilladher, in its earnings preview report for July to September, has expected muted performance in the auto and banking sectors. “NBFC issue and weak auto numbers raise growth concerns,” added Lilladher.

Analysts said new rounds of rate hikes are expected in the future. “We continue to expect 25-50bps of rate hikes in the rest of FY19 to ensure financial stability amid global and domestic headwinds,” said Upasana Bhardwaj, senior economist at Kotak Mahindra Bank.