By Dharmesh Shah

Equity benchmarks concluded a choppy week on a positive note fueled by strong tax collections domestically and better-than-expected Chinese data boosted sentiments further. Nifty closed the week at 17594 levels up 0.7%. The broader market relatively outperformed as Nifty Midcap and Small cap indices gained 2% and 1.2%, respectively. Sectorally, financials, Metal, Realty outshone, while IT, pharma took a breather.

Technical Outlook

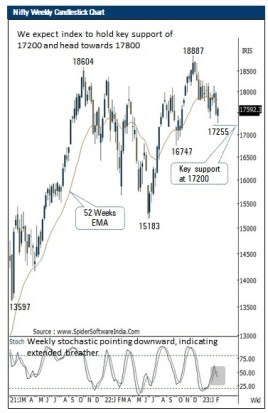

- The index started the week on a subdued note that hauled the Nifty to a fresh Feb low of 17255. However, fag end buying demand emerged from key support of 17200 on expected lines that helped the index to recoup intra-week losses and settled the week on a positive note. The weekly price action resulted in a small bull candle carrying lower high-low, indicating buying demand emerging from key support of 17200 backed by improving market breadth

- Going ahead, we expect the index to hold key support of 17200 and head towards short-term hurdle of 17800, sustainability above which would lead to an acceleration of upward momentum towards 18300 in March as it is 61.8% retracement of past three months decline (18887-17255). Thus, any dips from hereon should be capitalized to accumulate quality stocks. Our structural positive stance is further validated by the following observations:

- Historically, over the past two decades, on all ten occasions when Nifty corrected for three consecutive months, in a subsequent month, the index gained an average 6% from lows. Odds favour the market to follow this rhythm and eventually head towards 18300 in March

- Indian benchmarks are undergoing higher base formation over the past three months after reversing the CY22 decline of 18%. Within a structural bull market, secondary correction is a part of the secular bull market. The current scenario is very similar to that of CY13, CY16 and CY18. In each of these identical instances, higher base formation consumed around three to four months and retraced the preceding up move by around 50-60%, followed by new highs over the next quarter

- Despite a host of negative news, India VIX (that gauge the market sentiments) has corrected 14%, highlighting low-risk perception among market participants.

- Rupee has seen sharp appreciation last week as the DOLLAR/RUPEE pair reacted from the key hurdle of 83 and eventually breached five weeks channel, signalling a pause in upward momentum for the dollar and further appreciation for Rupee in the coming weeks

- Key sectors like BFSI, IT, Power, Infra are likely to be in the limelight

- On the large caps front Reliance, Kotak Bank, SBI, TCS, L&T, Jindal Steel and Power while Indian Bank, PFC, LTTS, Amber enterprises, National Aluminium, NCC, IEX, KNR Construction are preferred pick in midcap

- At present, the index has already retraced 44% of prior up (15183-18887) move over three month period and approaching price/time wise maturity of correction. Thus, we expect the index to hold the key support of 17200 in the coming weeks as it is a confluence of:

- 80% retracement of past September-December 2022 rally 16748-18887, placed at 17175

- price parity of December decline 18887-17774 projected from the end of January high of 18201, is placed at 17132

Bank Nifty Outlook:

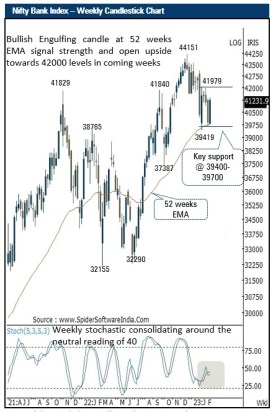

- The Bank Nifty snapped two weeks decline and closed the week higher by 3.5% at 41300 levels mainly lead by the strong gains on Friday’s session amid positive global cues. PSU Banking stocks outperformed with a gain of more than 9%. The weekly price action formed a bullish engulfing candlestick pattern as the index engulfed last week’s sizable bear candle, indicating a pause in downward momentum.

- Buying demand has emerged during last week after a base around the 200 days EMA (currently placed at 40035) signalling overall positive bias and opens upside towards 42000 levels in the coming week being the upper band of the last four weeks range.

- Structurally, since CY20 (Covid lows) intermediate corrections have lasted for 9-11 weeks in a row. In the current scenario as well, the index is seen maintaining the rhythm and resuming up move after 11 weeks of corrective decline. The index in the last 11 weeks has retraced just 65% of its preceding 10 weeks rally of October–December (37387-44151). A shallow retracement signals a base formation and a positive price structure

- The weekly stochastic is seen consolidating above the neutral reading of 40 signalling continuation of positive bias in the coming weeks

- The index has key support around 39400-39700 levels being the confluence of (a) the lower band of the last one month’s consolidation range placed around 39500 levels (b) the presence of long term 52 weeks EMA is also placed at 39430 levels

(Dharmesh Shah – Head Technical at ICICI Securities Limited. Views expressed are author’s own.)