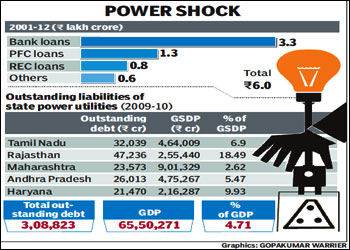

Recent grid collapses have exposed the underbelly of India?s power sector, but there is more of the story to be told. Outstanding debt of state power utilities have grown to a staggering R6 lakh crore or 6% of the GDP, according to data gathered by FE from various sources.

Roughly a third of these are loans taken to fund past losses which cannot be serviced through tariff hikes and, hence, are being considered for a benign restructuring by the Centre.

Roughly a third of these are loans taken to fund past losses which cannot be serviced through tariff hikes and, hence, are being considered for a benign restructuring by the Centre.

Needless to say, the extreme indebtedness of these utilities is attributable to state governments that don?t let regulators increase tariffs in tandem with rising costs, leading to a constantly widening revenue-expenditure gap at the utilities.

This undermines their ability to invest and thwarts India?s ambitious plan to multiply its power generation capacity and create a competitive power market.

According to Reserve Bank of India data, outstanding debt of power utilities to banks has grown by 56% in the two years to June 2012 ? from R2.1 lakh crore to R3.3 lakh crore.

Over the last one year, the increase in this debt burden was 40%, suggesting an acceleration in the addition to the liabilities, owing mainly to the relentless rise in fuel costs.

Governments pandering to the electorate have either stymied or staggered the pass-through of fuel price-driven cost increase, stifling the utilities in the process.

While these are the loans taken from banks, the utilities also owe big amounts to specialised agencies for power sector financing ? the Power Finance Corporation (R1.3 lakh crore) and Rural Electrification Corporation (R81,725 crore). That adds up to some R5.4 lakh crore. If liabilities to other institutions like LIC and IDFC and the external commercial borrowings too are included, the total burden would easily be above R6 lakh crore.

According to Crisil, unless big reforms are undertaken to stem losses and spur revenue streams, these liabilities would grow further to R7.3 lakh crore by March 2013. This looks like a reasonable estimate, given that annual losses (after receipt of subsidy) of discoms in the country were R42,415 crore in 2009-10, up 18% over the previous year.

Analysts say many states continue to follow a cautious and staggered approach on tariff hikes despite the hefty increase in electricity purchase costs in recent years. According to Icra, Rajasthan needs to hike tariff by 80%, Madhya Pradesh 65%, Tamil Nadu 55% and Punjab 24% to bridge their discoms’ revenue gaps. Such tariff shocks are, of course, not politically feasible, and carefully calibrated tariff hikes are unavoidable, analysts say.

Of course,some states have of late started assessing their discoms? annual revenue requirements (ARR) and followed these with some tariff hikes, which are, again, far below what is required. Though some states have adopted provisions for automatic recovery of increase in fuel costs, implementation remains patchy. Subsidies (meant to facilitate cheaper power to farmers and domestic consumers) account for 20% of discoms’ total revenue and delays in their payment are also a stress on their finances. There is the facility of regulatory assets ? uncovered revenue deficit proposed to be covered through future tariff hikes ? which are aimed at preventing tariff shocks, but this is not fully functional in most cases.

A recent Crisil report said that the share of bank loans in the total capital employed by state power utilities rose from 60% at the end of 2007-2008 to 72% in 2009-10. This shows the state governments’ share in capital employed has shrunk to abysmally low levels. The agency has recommended automatic pass-through of fuel price-driven cost increases and said that all unpaid utility subsidies and regulatory assets should be charged to the state government’s account by the RBI beyond a period of six months. Crisil also said that state governments could take over the portion of liabilities incurred to fund losses under a specific arrangement supervised by the RBI.